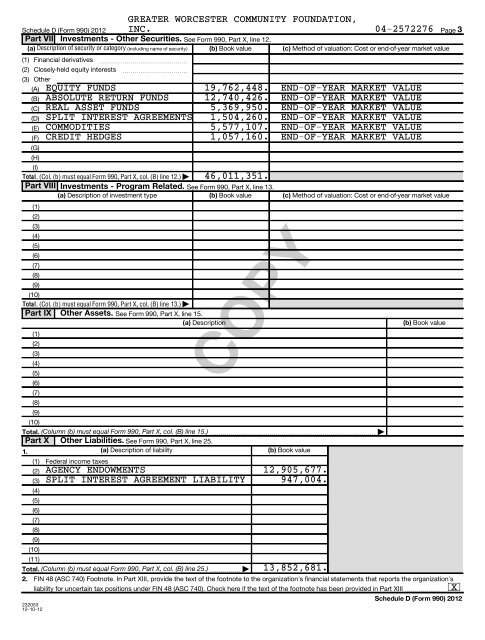

Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2012</strong>PagePart VII Investments - Other Securities. See <strong>Form</strong> <strong>990</strong>, Part X, line 12.(a) Description of security or category (including name of security) (b) Book value (c) Method of valuation: Cost or end-of-year market value(1)(2)(I)Total. (Col. (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 12.) | 46,011,351.Part VIII Investments - Program Related. See <strong>Form</strong> <strong>990</strong>, Part X, line 13.(a) Description of investment type(b) Book value (c) Method of valuation: Cost or end-of-year market value(10)Total. (Col. (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 13.) |Part IX Other Assets. See <strong>Form</strong> <strong>990</strong>, Part X, line 15.(a) Description23205312-10-12COPY(10)Total. (Column (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 15.) |Part X Other Liabilities. See <strong>Form</strong> <strong>990</strong>, Part X, line 25.1.(a) Description of liability(b) Book value(11)Total. (Column (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 25.) |2.Financial derivativesClosely-held equity interests~~~~~~~~~~~~~~~~~~~~~~~~~~(3) Other(A) EQUITY FUNDS 19,762,448. END-OF-YEAR MARKET VALUE(B) ABSOLUTE RETURN FUNDS 12,740,426. END-OF-YEAR MARKET VALUE(C) REAL ASSET FUNDS 5,369,950. END-OF-YEAR MARKET VALUE(D) SPLIT INTEREST AGREEMENTS 1,504,260. END-OF-YEAR MARKET VALUE(E) COMMODITIES 5,577,107. END-OF-YEAR MARKET VALUE(F) CREDIT HEDGES 1,057,160. END-OF-YEAR MARKET VALUE(G)(H)(1)(2)(3)(4)(5)(6)(7)(8)(9)(1)(2)(3)(4)(5)(6)(7)(8)(9)(1)(2)(3)(4)(5)(6)(7)(8)(9)(10)GREATER WORCESTER COMMUNITY FOUNDATION,INC. 04-2572276Federal income taxesAGENCY ENDOWMENTS 12,905,677.SPLIT INTEREST AGREEMENT LIABILITY 947,004.13,852,681.(b) Book valueFIN 48 (ASC 740) Footnote. In Part XIII, provide the text of the footnote to the organization’s financial statements that reports the organization’sliability for uncertain tax positions under FIN 48 (ASC 740). Check here if the text of the footnote has been provided in Part XIII X3Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2012</strong>

GREATER WORCESTER COMMUNITY FOUNDATION,Schedule D (<strong>Form</strong> <strong>990</strong>) <strong>2012</strong> INC. 04-2572276 Page 4Part XI Reconciliation of Revenue per Audited Financial Statements With Revenue per Return1 Total revenue, gains, and other support per audited financial statements ~~~~~~~~~~~~~~~~~~~ 1 14,244,966.234abcdeAdd lines 2a through 2d ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 2eSubtract line 2e from line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Amounts included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 12, but not on line 1:a Investment expenses not included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 7b ~~~~~~~~ 4ab Other (Describe in Part XIII.) ~~~~~~~~~~~~~~~~~~~~~~~~~~ 4b 1,634,684.c Add lines 4a and 4b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 4c 1,634,684.5 Total revenue. Add lines 3 and 4c. (This must equal <strong>Form</strong> <strong>990</strong>, Part I, line 12.) 5 10,086,558.Part XII Reconciliation of Expenses per Audited Financial Statements With Expenses per Return1 Total expenses and losses per audited financial statements ~~~~~~~~~~~~~~~~~~~~~~~~~~ 1 6,374,759.234abcdeabAmounts included on line 1 but not on <strong>Form</strong> <strong>990</strong>, Part VIII, line 12:Net unrealized gains on investmentsDonated services and use of facilities ~~~~~~~~~~~~~~~~~~~~~~Recoveries of prior year grantsOther (Describe in Part XIII.)Add lines 2a through 2d~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Amounts included on line 1 but not on <strong>Form</strong> <strong>990</strong>, Part IX, line 25:Donated services and use of facilities ~~~~~~~~~~~~~~~~~~~~~~Prior year adjustments~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other losses ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other (Describe in Part XIII.) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Subtract line 2e from line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Amounts included on <strong>Form</strong> <strong>990</strong>, Part IX, line 25, but not on line 1:Investment expenses not included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 7bOther (Describe in Part XIII.)~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~c Add lines 4a and 4b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~5 Total expenses. Add lines 3 and 4c. (This must equal <strong>Form</strong> <strong>990</strong>, Part I, line 18.) Part XIII Supplemental InformationComplete this part to provide the descriptions required for Part II, lines 3, 5, and 9; Part III, lines 1a and 4; Part IV, lines 1b and 2b; Part V, line 4; PartX, line 2; Part XI, lines 2d and 4b; and Part XII, lines 2d and 4b. Also complete this part to provide any additional information.PART X, LINE 2: THE FOUNDATION FOLLOWS THE ACCOUNTING FOR UNCERTAINTY2a2b2c2d2a2b2c2d4a4bCOPY6,738,318.1,086.-946,312.1,069,<strong>990</strong>.239,304.32e34c55,793,092.8,451,874.0.6,374,759.1,309,294.7,684,053.IN INCOME TAXES STANDARD WHICH REQUIRES THE FOUNDATION TO REPORT UNCERTAINTAX POSITIONS, RELATED INTEREST AND PENALTIES, AND TO ADJUST ITS ASSETSAND LIABILITIES RELATED TO UNRECOGNIZED TAX BENEFITS AND ACCRUED INTERESTAND PENALTIES ACCORDINGLY. AS OF DECEMBER 31, <strong>2012</strong>, THE FOUNDATIONDETERMINED THAT THERE ARE NO MATERIAL UNRECOGNIZED TAX BENEFITS TO REPORT.THE FOUNDATION FILES INFORMATION RETURNS IN THE UNITED STATES FEDERAL ANDSchedule D (<strong>Form</strong> <strong>990</strong>) <strong>2012</strong>23205412-10-12