ABN AMRO Energy Shale Report - ABN AMRO Markets

ABN AMRO Energy Shale Report - ABN AMRO Markets

ABN AMRO Energy Shale Report - ABN AMRO Markets

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

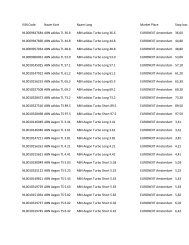

problems that the energy sector faces if shaleproduction continues to increase. Theseproblems include export restrictions,infrastructure issues, water use, qualitydifferences between shale oil and oil used by the(US) refineries, low natural gas prices andoversupply, among others.US shale oil: only limited local useDue to export restrictions, US refineries haveextra oil due to shale oil production. As a result,shale oil is stored for later use, which couldlower future imports for US refineries. Accordingto the IEA, however, many US refineries aregeared to process cheap, low-quality dense andhigh-sulphur grades of crude. Many shale oilrigs, however, produce lighter grades whichcannot be used by many US refineries.If US oil companies want to benefit from allshale findings, the US government needs toeither allow the export of lighter grades or furtherstimulate US refineries to reconfigure theirplants to handle the lighter grade crudeproduced from shale. If not, the US might as wellleave the remaining shale crude reservesuntouched.For the moment, imports of heavy grades fromother regions (mainly Canada) are still neededto meet US refinery demand, although importshave declined from a few years ago. Canadanow exports its remaining crude to Europe and,to a lesser degree, to Asia.More shale gas capacity, but many rigsclosed due to low pricesWith the success of US shale developments,many energy-related companies as well asinvestors and oil- and gas-rich states want tobenefit as well. A number of new drilling permitshave been issued and new rigs built. Especiallyfor shale gas, the number of rigs jumped higher.As a result, natural gas supplies have ballooned,leading to a huge drop in US Henry Hub naturalgasprices.The rise in the number of rigsdid increase productioncapacityWhile most commodities recovered significantlyafter the huge sell-off seen in 2008, natural-gasprices saw only two months of support beforepressure increased again in Q1 2010. Pricesremained under pressure and, even, touchedthe record low of USD 1.90 in April 2012,followed by a recovery towards the current priceof approximately USD 3.50.One reason for the price recovery is the closureof many US rigs brought about by low naturalgasprices, which made continued productionunprofitable. From a historical perspective,however, current prices are still very low, whileoversupply continues. The fact that supplies didnot decline is the result of an increase of byproduct(associated) gas from oil fields. For thecoming years, it should be understood that theincrease in the number of rigs, operational ornot, increases production capacity.Natural gas prices are now balancing athistorical low levels, responding to theimpact of moderate rising demand andan oversupply of rig-capacity. Thismeans that as soon as prices start torally based on increased demand, newproduction will come into play. Thisadditional production comes on top oflarge existing supplies.Table 2 <strong>ABN</strong> <strong>AMRO</strong> gas price forecast(in USD)Price 2013** 2014** 2015**US H.H.*Natural Gas 3.50 4.50 5.00* HH= Henry Hub 1st generic future contract** year averages,Source: <strong>ABN</strong> <strong>AMRO</strong> Sector & Commodity Research