Edelweiss ELSS One Pager_190312.cdr - Edelweiss Mutual Fund

Edelweiss ELSS One Pager_190312.cdr - Edelweiss Mutual Fund

Edelweiss ELSS One Pager_190312.cdr - Edelweiss Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

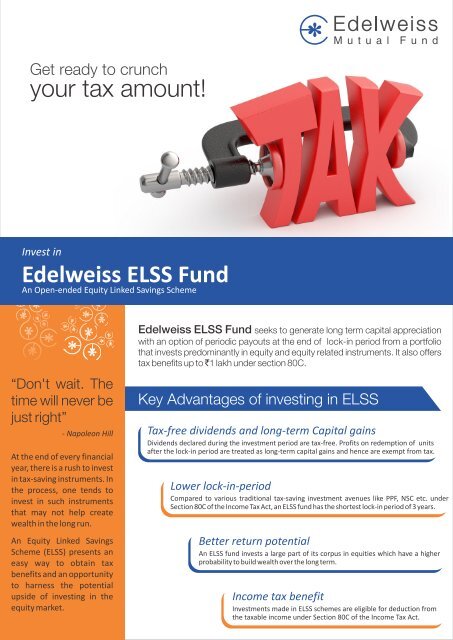

Get ready to crunch<br />

your tax amount!<br />

Invest in<br />

<strong>Edelweiss</strong> <strong>ELSS</strong> <strong>Fund</strong><br />

An Open-ended Equity Linked Savings Scheme<br />

“Don't wait. The<br />

time will never be<br />

just right”<br />

- Napoleon Hill<br />

At the end of every financial<br />

year, there is a rush to invest<br />

in tax-saving instruments. In<br />

the process, one tends to<br />

invest in such instruments<br />

that may not help create<br />

wealth in the long run.<br />

An Equity Linked Savings<br />

Scheme (<strong>ELSS</strong>) presents an<br />

easy way to obtain tax<br />

benefits and an opportunity<br />

to harness the potential<br />

upside of investing in the<br />

equity market.<br />

<strong>Edelweiss</strong> <strong>ELSS</strong> <strong>Fund</strong><br />

seeks to generate long term capital appreciation<br />

with an option of periodic payouts at the end of lock-in period from a portfolio<br />

that invests predominantly in equity and equity related instruments. It also offers<br />

tax benefits up to `1 lakh under section 80C.<br />

Key Advantages of investing in <strong>ELSS</strong><br />

Tax-free dividends and long-term Capital gains<br />

Dividends declared during the investment period are tax-free. Profits on redemption of units<br />

after the lock-in period are treated as long-term capital gains and hence are exempt from tax.<br />

Lower lock-in-period<br />

Compared to various traditional tax-saving investment avenues like PPF, NSC etc. under<br />

Section 80C of the Income Tax Act, an <strong>ELSS</strong> fund has the shortest lock-in period of 3 years.<br />

Better return potential<br />

An <strong>ELSS</strong> fund invests a large part of its corpus in equities which have a higher<br />

probability to build wealth over the long term.<br />

Income tax benefit<br />

Investments made in <strong>ELSS</strong> schemes are eligible for deduction from<br />

the taxable income under Section 80C of the Income Tax Act.

Why invest in <strong>Edelweiss</strong> <strong>ELSS</strong> <strong>Fund</strong>?<br />

1<br />

STP / SIP Options<br />

Frequency<br />

Daily<br />

2<br />

Weekly / Monthly<br />

For further information<br />

TOLL FREE<br />

1800 425 0090<br />

Distributed by:<br />

Tax saving and an ideal investment avenue for wealth creation<br />

3<br />

Regular dividend paying policy – the Scheme declared 3 dividends in 3 months in FY 2010 - 2011<br />

Scheme Details<br />

Follows a quant-based portfolio modelling process^<br />

^Quant Based Portfolio Modelling Process<br />

Systematic approach to stock picking. No dependency on emotions or gut feel while choosing stocks. Stocks are selected on the basis of<br />

Growth, Quality, Valuation and Performance.<br />

Makes the most of market opportunities available: Investment universe comprises of securities which are constituents of S&P CNX 500 Index.<br />

Who should invest in <strong>ELSS</strong> <strong>Fund</strong>?<br />

1<br />

2<br />

Investors looking for tax deductions under Section 80C<br />

3<br />

Investors having an investment horizon of 3 years or more<br />

Investors looking for wealth creation over the long period<br />

Minimum Application Amount / Minimum Additional Investment Amount<br />

Minimum of `500/- and in multiples of `500/-<br />

thereafter<br />

NON TOLL FREE<br />

+91 40 23310090<br />

WEBSITE<br />

www.edelweissmf.com<br />

Minimum Investment Amount<br />

`300/- & in multiples of `1/- thereafter<br />

`500/- & in multiples of `1/-thereafter<br />

SMS<br />

IQ to 5757590<br />

SM S<br />

o<br />

IQ t<br />

57575 90<br />

EMAIL : INVESTORS<br />

investor.amc@edelcap.com<br />

Scan QR Code with your<br />

mobile and learn more.<br />

If you don’t have the QR<br />

reader, simply download one of<br />

the many free applications<br />

available for your handset !!!<br />

<strong>Mutual</strong> <strong>Fund</strong> investments are subject to market risks, read all scheme related documents carefully.