UK TMT: Staying smart in a downturn - UK.COM

UK TMT: Staying smart in a downturn - UK.COM

UK TMT: Staying smart in a downturn - UK.COM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

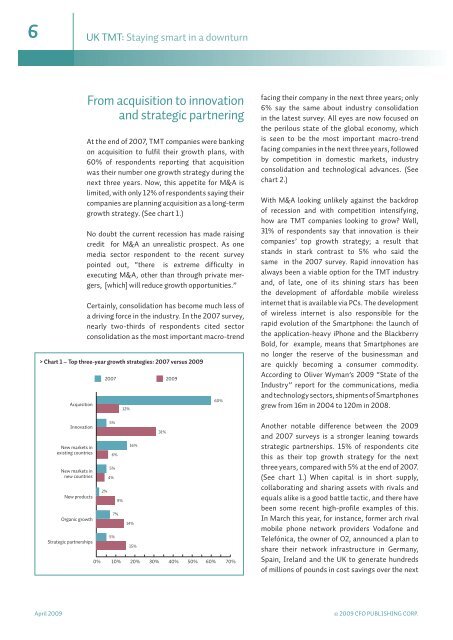

6<strong>UK</strong> <strong>TMT</strong>: <strong>Stay<strong>in</strong>g</strong> <strong>smart</strong> <strong>in</strong> a <strong>downturn</strong>From acquisition to <strong>in</strong>novationand strategic partner<strong>in</strong>gAt the end of 2007, <strong>TMT</strong> companies were bank<strong>in</strong>gon acquisition to fulfil their growth plans, with60% of respondents report<strong>in</strong>g that acquisitionwas their number one growth strategy dur<strong>in</strong>g thenext three years. Now, this appetite for M&A islimited, with only 12% of respondents say<strong>in</strong>g theircompanies are plann<strong>in</strong>g acquisition as a long-termgrowth strategy. (See chart 1.)No doubt the current recession has made rais<strong>in</strong>gcredit for M&A an unrealistic prospect. As onemedia sector respondent to the recent surveypo<strong>in</strong>ted out, “there is extreme difficulty <strong>in</strong>execut<strong>in</strong>g M&A, other than through private mergers,[which] will reduce growth opportunities.”Certa<strong>in</strong>ly, consolidation has become much less ofa driv<strong>in</strong>g force <strong>in</strong> the <strong>in</strong>dustry. In the 2007 survey,nearly two-thirds of respondents cited sectorconsolidation as the most important macro-trend> Chart 1 – Top three-year growth strategies: 2007 versus 2009Acquisition2007 200912%60%fac<strong>in</strong>g their company <strong>in</strong> the next three years; only6% say the same about <strong>in</strong>dustry consolidation<strong>in</strong> the latest survey. All eyes are now focused onthe perilous state of the global economy, whichis seen to be the most important macro-trendfac<strong>in</strong>g companies <strong>in</strong> the next three years, followedby competition <strong>in</strong> domestic markets, <strong>in</strong>dustryconsolidation and technological advances. (Seechart 2.)With M&A look<strong>in</strong>g unlikely aga<strong>in</strong>st the backdropof recession and with competition <strong>in</strong>tensify<strong>in</strong>g,how are <strong>TMT</strong> companies look<strong>in</strong>g to grow? Well,31% of respondents say that <strong>in</strong>novation is theircompanies’ top growth strategy; a result thatstands <strong>in</strong> stark contrast to 5% who said thesame <strong>in</strong> the 2007 survey. Rapid <strong>in</strong>novation hasalways been a viable option for the <strong>TMT</strong> <strong>in</strong>dustryand, of late, one of its sh<strong>in</strong><strong>in</strong>g stars has beenthe development of affordable mobile wireless<strong>in</strong>ternet that is available via PCs. The developmentof wireless <strong>in</strong>ternet is also responsible for therapid evolution of the Smartphone: the launch ofthe application-heavy iPhone and the BlackberryBold, for example, means that Smartphones areno longer the reserve of the bus<strong>in</strong>essman andare quickly becom<strong>in</strong>g a consumer commodity.Accord<strong>in</strong>g to Oliver Wyman’s 2009 “State of theIndustry” report for the communications, mediaand technology sectors, shipments of Smartphonesgrew from 16m <strong>in</strong> 2004 to 120m <strong>in</strong> 2008.InnovationNew markets <strong>in</strong>exist<strong>in</strong>g countriesNew markets <strong>in</strong>new countriesNew productsOrganic growthStrategic partnerships2%5%6%5%4%5%7%9%16%14%15%31%0% 10% 20% 30% 40%50% 60% 70%Another notable difference between the 2009and 2007 surveys is a stronger lean<strong>in</strong>g towardsstrategic partnerships. 15% of respondents citethis as their top growth strategy for the nextthree years, compared with 5% at the end of 2007.(See chart 1.) When capital is <strong>in</strong> short supply,collaborat<strong>in</strong>g and shar<strong>in</strong>g assets with rivals andequals alike is a good battle tactic, and there havebeen some recent high-profile examples of this.In March this year, for <strong>in</strong>stance, former arch rivalmobile phone network providers Vodafone andTelefónica, the owner of O2, announced a plan toshare their network <strong>in</strong>frastructure <strong>in</strong> Germany,Spa<strong>in</strong>, Ireland and the <strong>UK</strong> to generate hundredsof millions of pounds <strong>in</strong> cost sav<strong>in</strong>gs over the nextApril 2009© 2009 CFO PUBLISHING CORP.