Investor presentation - National Bank of Abu Dhabi

Investor presentation - National Bank of Abu Dhabi

Investor presentation - National Bank of Abu Dhabi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

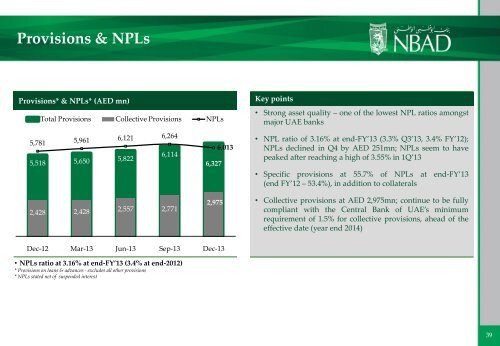

Provisions & NPLsProvisions* & NPLs* (AED mn)Total Provisions Collective Provisions NPLsKey points• Strong asset quality – one <strong>of</strong> the lowest NPL ratios amongstmajor UAE banks5,781 5,961 6,121 6,2646,1145,518 5,650 5,8222,428 2,428 2,557 2,7716,3272,9756,013• NPL ratio <strong>of</strong> 3.16% at end-FY’13 (3.3% Q3’13, 3.4% FY’12);NPLs declined in Q4 by AED 251mn; NPLs seem to havepeaked after reaching a high <strong>of</strong> 3.55% in 1Q’13• Specific provisions at 55.7% <strong>of</strong> NPLs at end-FY’13(end FY’12 – 53.4%), in addition to collaterals• Collective provisions at AED 2,975mn; continue to be fullycompliant with the Central <strong>Bank</strong> <strong>of</strong> UAE’s minimumrequirement <strong>of</strong> 1.5% for collective provisions, ahead <strong>of</strong> theeffective date (year end 2014)Dec-12 Mar-13 Jun-13 Sep-13 Dec-13• NPLs ratio at 3.16% at end-FY’13 (3.4% at end-2012)* Provisions on loans & advances - excludes all other provisions* NPLs stated net <strong>of</strong> suspended interest39