NBAD Global Multi-Strategy Fund - National Bank of Abu Dhabi

NBAD Global Multi-Strategy Fund - National Bank of Abu Dhabi

NBAD Global Multi-Strategy Fund - National Bank of Abu Dhabi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

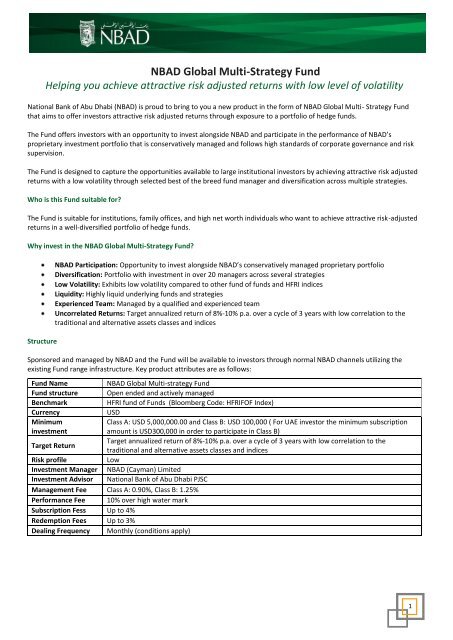

<strong>NBAD</strong> <strong>Global</strong> <strong>Multi</strong>-<strong>Strategy</strong> <strong>Fund</strong>Helping you achieve attractive risk adjusted returns with low level <strong>of</strong> volatility<strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Abu</strong> <strong>Dhabi</strong> (<strong>NBAD</strong>) is proud to bring to you a new product in the form <strong>of</strong> <strong>NBAD</strong> <strong>Global</strong> <strong>Multi</strong>- <strong>Strategy</strong> <strong>Fund</strong>that aims to <strong>of</strong>fer investors attractive risk adjusted returns through exposure to a portfolio <strong>of</strong> hedge funds.The <strong>Fund</strong> <strong>of</strong>fers investors with an opportunity to invest alongside <strong>NBAD</strong> and participate in the performance <strong>of</strong> <strong>NBAD</strong>’sproprietary investment portfolio that is conservatively managed and follows high standards <strong>of</strong> corporate governance and risksupervision.The <strong>Fund</strong> is designed to capture the opportunities available to large institutional investors by achieving attractive risk adjustedreturns with a low volatility through selected best <strong>of</strong> the breed fund manager and diversification across multiple strategies.Who is this <strong>Fund</strong> suitable for?The <strong>Fund</strong> is suitable for institutions, family <strong>of</strong>fices, and high net worth individuals who want to achieve attractive risk-adjustedreturns in a well-diversified portfolio <strong>of</strong> hedge funds.Why invest in the <strong>NBAD</strong> <strong>Global</strong> <strong>Multi</strong>-<strong>Strategy</strong> <strong>Fund</strong>?Structure<strong>NBAD</strong> Participation: Opportunity to invest alongside <strong>NBAD</strong>’s conservatively managed proprietary portfolioDiversification: Portfolio with investment in over 20 managers across several strategiesLow Volatility: Exhibits low volatility compared to other fund <strong>of</strong> funds and HFRI indicesLiquidity: Highly liquid underlying funds and strategiesExperienced Team: Managed by a qualified and experienced teamUncorrelated Returns: Target annualized return <strong>of</strong> 8%-10% p.a. over a cycle <strong>of</strong> 3 years with low correlation to thetraditional and alternative assets classes and indicesSponsored and managed by <strong>NBAD</strong> and the <strong>Fund</strong> will be available to investors through normal <strong>NBAD</strong> channels utilizing theexisting <strong>Fund</strong> range infrastructure. Key product attributes are as follows:<strong>Fund</strong> Name<strong>NBAD</strong> <strong>Global</strong> <strong>Multi</strong>-strategy <strong>Fund</strong><strong>Fund</strong> structure Open ended and actively managedBenchmarkHFRI fund <strong>of</strong> <strong>Fund</strong>s (Bloomberg Code: HFRIFOF Index)CurrencyUSDMinimuminvestmentClass A: USD 5,000,000.00 and Class B: USD 100,000 ( For UAE investor the minimum subscriptionamount is USD300,000 in order to participate in Class B)Target ReturnTarget annualized return <strong>of</strong> 8%-10% p.a. over a cycle <strong>of</strong> 3 years with low correlation to thetraditional and alternative assets classes and indicesRisk pr<strong>of</strong>ileLowInvestment Manager <strong>NBAD</strong> (Cayman) LimitedInvestment Advisor <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Abu</strong> <strong>Dhabi</strong> PJSCManagement Fee Class A: 0.90%, Class B: 1.25%Performance Fee 10% over high water markSubscription Fess Up to 4%Redemption Fees Up to 3%Dealing Frequency Monthly (conditions apply)1

Frequently Asked QuestionsHow can I invest in the product?The subscription process is a general process that allows the investor to purchase the number <strong>of</strong> units with a minimum <strong>of</strong> ClassA: US$ 5,000,000, Class B: US$ 100,000. (For UAE investor the minimum subscription amount is USD300,000 in order toparticipate in Class B)The subscription to the <strong>Fund</strong> is available on a monthly basis.How can I track the performance <strong>of</strong> the <strong>Fund</strong>?Estimates will be available on weekly basis.Monthly commentary and Final NAVs will be provided on a monthly basis.What type <strong>of</strong> exposures will be in the fund?The <strong>Fund</strong> will represent an underlying portfolio over 20 hedge fund investments across a multitude <strong>of</strong> strategies. The majorstrategies are Equity Long/ Short, <strong>Global</strong> Macro, Convertible Arbitrage, Fixed Income Arbitrage and Emerging markets.What experience does <strong>NBAD</strong> have?A portfolio <strong>of</strong> hedge funds is in operation since August 2009 which is currently being managed by a team <strong>of</strong> <strong>Fund</strong> managerssupported by analysts. The team in combined has over 50 years <strong>of</strong> experience in investment management industry. The keymembers <strong>of</strong> the team are:Niraj Dhanky, the Head <strong>of</strong> the Portfolio Management Department is a seasoned Hedge <strong>Fund</strong>s investor with experience ininvestment management at various leading GCC and international banks. Over the last decade; he has been responsible inestablishing and managing Alternative Investments business at various GCC banks like Emirates <strong>Bank</strong> International, Dubai andArab <strong>National</strong> <strong>Bank</strong>, Riyadh (Saudi Arabia). Prior to that Niraj was an Investment Analyst at ING Barings International in India.Niraj is a CFA Charter holder as well as FRM (Financial Risk Management) and holds a BA in Business Management from S PUniversity in India.Omeir Jilani is presently the Portfolio Manager and oversees the research and due diligence process. He has been with <strong>NBAD</strong>since May 2008 and has been an integral part is establishing the hedge funds desk. He has been involved in AlternativeInvestments since 2001. Prior to <strong>NBAD</strong>, Omeir worked as a member <strong>of</strong> the proprietary investments team for Union <strong>National</strong><strong>Bank</strong> as the Portfolio Manager, where he was responsible for the Alternative Investments portfolio and Fixed Income portfolio.Before that he was an Investment Analyst at the Private Office <strong>of</strong> Dr. Sheikh Sultan Bin Khalifa Al Nahyan. Omeir is a graduate<strong>of</strong> McMaster University, Canada and holds a Hons B.Comm with a major in Finance and Accounting. He was awarded theChartered Alternative Investment Analyst (CAIA) designation in March 2010.Niraj and Omeir are supported by two dedicated analysts and risk managers. Independent Risk Management is an integral part<strong>of</strong> the investment and monitoring process for the portfolio.How do I get my money back?You can redeem your units on a monthly basis with 95 days notice using a simple redemption form; redemptions within 12months will be subject to 2% redemption feeCan I use this <strong>Fund</strong> as a short term home for my money?We do not recommend the <strong>Fund</strong> if you intend to hold it for a period <strong>of</strong> less than 12 months, hence this investment productshould be seen as a medium term proposition.2