Application for Grant/Renewal of Exemption Certifictae Under Rule 24

Application for Grant/Renewal of Exemption Certifictae Under Rule 24

Application for Grant/Renewal of Exemption Certifictae Under Rule 24

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

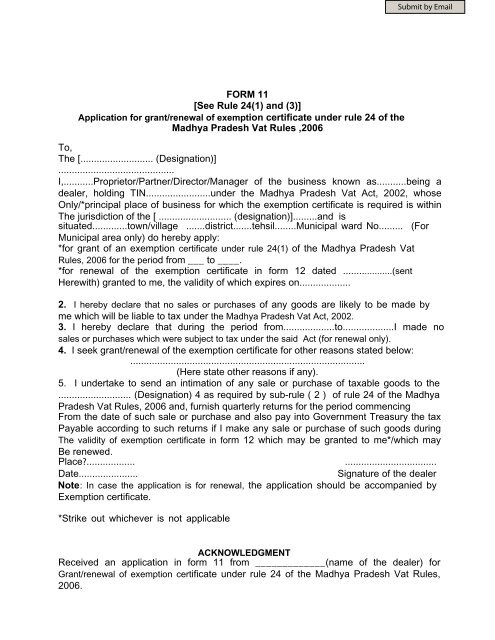

FORM 11[See <strong>Rule</strong> <strong>24</strong>(1) and (3)]<strong>Application</strong> <strong>for</strong> grant/renewal <strong>of</strong> exemption certificate under rule <strong>24</strong> <strong>of</strong> theMadhya Pradesh Vat <strong>Rule</strong>s ,2006To,The [........................... (Designation)]...........................................I,...........Proprietor/Partner/Director/Manager <strong>of</strong> the business known as...........being adealer, holding TIN........................under the Madhya Pradesh Vat Act, 2002, whoseOnly/*principal place <strong>of</strong> business <strong>for</strong> which the exemption certificate is required is withinThe jurisdiction <strong>of</strong> the [ ........................... (designation)].........and issituated.............town/village .......district.......tehsil........Municipal ward No......... (ForMunicipal area only) do hereby apply:*<strong>for</strong> grant <strong>of</strong> an exemption certificate under rule <strong>24</strong>(1) <strong>of</strong> the Madhya Pradesh Vat<strong>Rule</strong>s, 2006 <strong>for</strong> the period from ___ to ____.*<strong>for</strong> renewal <strong>of</strong> the exemption certificate in <strong>for</strong>m 12 dated ...................(sentHerewith) granted to me, the validity <strong>of</strong> which expires on...................2. I hereby declare that no sales or purchases <strong>of</strong> any goods are likely to be made byme which will be liable to tax under the Madhya Pradesh Vat Act, 2002.3. I hereby declare that during the period from...................to...................I made nosales or purchases which were subject to tax under the said Act (<strong>for</strong> renewal only).4. I seek grant/renewal <strong>of</strong> the exemption certificate <strong>for</strong> other reasons stated below:.......................................................................................(Here state other reasons if any).5. I undertake to send an intimation <strong>of</strong> any sale or purchase <strong>of</strong> taxable goods to the........................... (Designation) 4 as required by sub-rule ( 2 ) <strong>of</strong> rule <strong>24</strong> <strong>of</strong> the MadhyaPradesh Vat <strong>Rule</strong>s, 2006 and, furnish quarterly returns <strong>for</strong> the period commencingFrom the date <strong>of</strong> such sale or purchase and also pay into Government Treasury the taxPayable according to such returns if I make any sale or purchase <strong>of</strong> such goods duringThe validity <strong>of</strong> exemption certificate in <strong>for</strong>m 12 which may be granted to me*/which mayBe renewed.Place?.................. ..................................Date......................Signature <strong>of</strong> the dealerNote: In case the application is <strong>for</strong> renewal, the application should be accompanied by<strong>Exemption</strong> certificate.*Strike out whichever is not applicableACKNOWLEDGMENTReceived an application in <strong>for</strong>m 11 from _____________(name <strong>of</strong> the dealer) <strong>for</strong><strong>Grant</strong>/renewal <strong>of</strong> exemption certificate under rule <strong>24</strong> <strong>of</strong> the Madhya Pradesh Vat <strong>Rule</strong>s,2006.

Date...................... ..............................Signature <strong>of</strong> the <strong>of</strong>ficial receivingThe applicationVisit : rsgoyal.com

![levy of tax under vat 9b an stamp duty simultaneously[1] - RS Goyal ...](https://img.yumpu.com/45559052/1/158x260/levy-of-tax-under-vat-9b-an-stamp-duty-simultaneously1-rs-goyal-.jpg?quality=85)

![[2012] 54 VST 26 (P and H) - RS Goyal & Associates](https://img.yumpu.com/38348208/1/190x245/2012-54-vst-26-p-and-h-rs-goyal-associates.jpg?quality=85)

![[2012] 47 vst 116 (cestat) - RS Goyal & Associates](https://img.yumpu.com/38348091/1/190x245/2012-47-vst-116-cestat-rs-goyal-associates.jpg?quality=85)

![[2012] 47 VST 379 (Ker) - RS Goyal & Associates](https://img.yumpu.com/38348087/1/190x245/2012-47-vst-379-ker-rs-goyal-associates.jpg?quality=85)