Intangible Assets - IFRS Canadian GAAP Differences Series

Intangible Assets - IFRS Canadian GAAP Differences Series

Intangible Assets - IFRS Canadian GAAP Differences Series

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

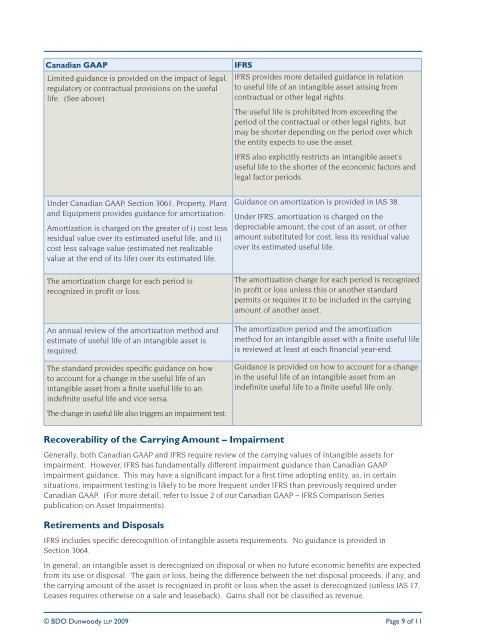

<strong>Canadian</strong> <strong>GAAP</strong>Limited guidance is provided on the impact of legal,regulatory or contractual provisions on the usefullife. (See above).<strong>IFRS</strong><strong>IFRS</strong> provides more detailed guidance in relationto useful life of an intangible asset arising fromcontractual or other legal rights.The useful life is prohibited from exceeding theperiod of the contractual or other legal rights, butmay be shorter depending on the period over whichthe entity expects to use the asset.<strong>IFRS</strong> also explicitly restricts an intangible asset’suseful life to the shorter of the economic factors andlegal factor periods.Under <strong>Canadian</strong> <strong>GAAP</strong>, Section 3061, Property, Plantand Equipment provides guidance for amortization.Amortization is charged on the greater of i) cost lessresidual value over its estimated useful life, and ii)cost less salvage value (estimated net realizablevalue at the end of its life) over its estimated life.The amortization charge for each period isrecognized in profit or loss.An annual review of the amortization method andestimate of useful life of an intangible asset isrequired.The standard provides specific guidance on howto account for a change in the useful life of anintangible asset from a finite useful life to anindefinite useful life and vice versa.Guidance on amortization is provided in IAS 38.Under <strong>IFRS</strong>, amortization is charged on thedepreciable amount, the cost of an asset, or otheramount substituted for cost, less its residual valueover its estimated useful life.The amortization charge for each period is recognizedin profit or loss unless this or another standardpermits or requires it to be included in the carryingamount of another asset.The amortization period and the amortizationmethod for an intangible asset with a finite useful lifeis reviewed at least at each financial year-end.Guidance is provided on how to account for a changein the useful life of an intangible asset from anindefinite useful life to a finite useful life only.The change in useful life also triggers an impairment test.Recoverability of the Carrying Amount – ImpairmentGenerally, both <strong>Canadian</strong> <strong>GAAP</strong> and <strong>IFRS</strong> require review of the carrying values of intangible assets forimpairment. However, <strong>IFRS</strong> has fundamentally different impairment guidance than <strong>Canadian</strong> <strong>GAAP</strong>impairment guidance. This may have a significant impact for a first time adopting entity, as, in certainsituations, impairment testing is likely to be more frequent under <strong>IFRS</strong> than previously required under<strong>Canadian</strong> <strong>GAAP</strong>. (For more detail, refer to Issue 2 of our <strong>Canadian</strong> <strong>GAAP</strong> – <strong>IFRS</strong> Comparison <strong>Series</strong>publication on Asset Impairments).Retirements and Disposals<strong>IFRS</strong> includes specific derecognition of intangible assets requirements. No guidance is provided inSection 3064.In general, an intangible asset is derecognized on disposal or when no future economic benefits are expectedfrom its use or disposal. The gain or loss, being the difference between the net disposal proceeds, if any, andthe carrying amount of the asset is recognized in profit or loss when the asset is derecognized (unless IAS 17,Leases requires otherwise on a sale and leaseback). Gains shall not be classified as revenue.© BDO Dunwoody LLP 2009 Page 9 of 11