ANNUAL REPORT (PDF Version) - Moravian College

ANNUAL REPORT (PDF Version) - Moravian College

ANNUAL REPORT (PDF Version) - Moravian College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

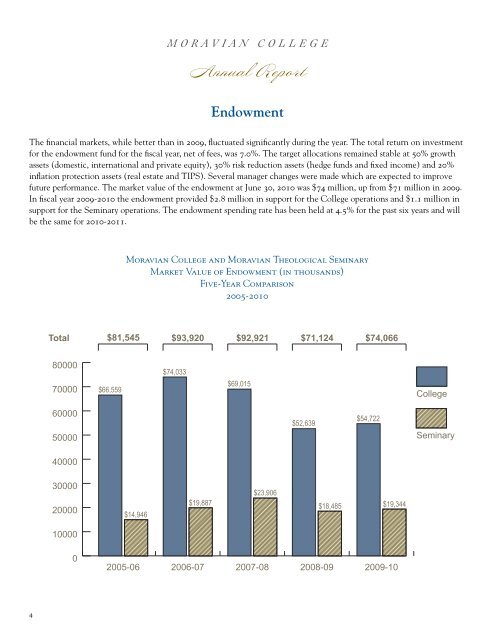

Endowment<br />

The fi nancial markets, while better than in 2009, fl uctuated signifi cantly during the year. The total return on investment<br />

for the endowment fund for the fi scal year, net of fees, was 7.0%. The target allocations remained stable at 50% growth<br />

assets (domestic, international and private equity), 30% risk reduction assets (hedge funds and fi xed income) and 20%<br />

infl ation protection assets (real estate and TIPS). Several manager changes were made which are expected to improve<br />

future performance. The market value of the endowment at June 30, 2010 was $74 million, up from $71 million in 2009.<br />

In fi scal year 2009-2010 the endowment provided $2.8 million in support for the <strong>College</strong> operations and $1.1 million in<br />

support for the Seminary operations. The endowment spending rate has been held at 4.5% for the past six years and will<br />

be the same for 2010-2011.<br />

Total $81,545 $93,920 $92,921 $71,124 $74,066<br />

80000<br />

70000<br />

60000<br />

50000<br />

40000<br />

30000<br />

20000<br />

10000<br />

0<br />

$66,559<br />

2005-06<br />

<strong>Moravian</strong> <strong>College</strong> and <strong>Moravian</strong> Theological Seminary<br />

Market Value of Endowment (in thousands)<br />

Five-Year Comparison<br />

2005-2010<br />

$14,946<br />

$74,033<br />

$19,887<br />

2006-07<br />

$69,015<br />

$23,906<br />

2007-08<br />

$52,639<br />

$18,485<br />

2008-09<br />

$54,722<br />

$19,344<br />

2009-10<br />

<strong>College</strong><br />

Seminary