Ultima 300 - Fedhealth

Ultima 300 - Fedhealth

Ultima 300 - Fedhealth

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

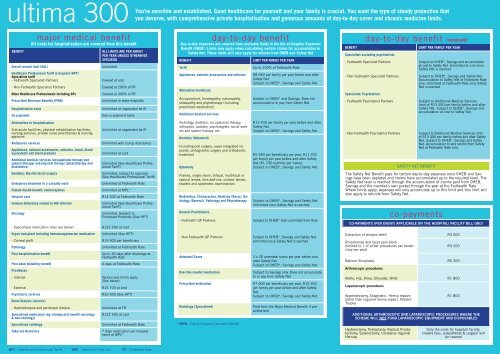

ultima <strong>300</strong> youYou’re sensible and established. Good healthcare for yourself and your family is crucial. You want the type of steady protection thatdeserve, with comprehensive private hospitalisation and generous amounts of day-to-day cover and chronic medicine limits.BENEFITmajor medical benefitAll costs for hospitalisation are covered from this benefitOverall annual limit (OAL)Healthcare Professional Tariff in hospital (HPT)Specialists tariff- <strong>Fedhealth</strong> Specialist Partners- Non-<strong>Fedhealth</strong> Specialist PartnersOther Healthcare Professionals including GPsPrescribed Minimum Benefits (PMB)Hospitalisation costsCo-paymentsAlternatives to hospitalisationSub-acute facilities, physical rehabilitation facilities,nursing services, private nurse practitioners & nursingagenciesAmbulance servicesAppliances, external accessories, orthotics, blood, bloodequivalents and blood productsAdditional medical services (occupational therapy andspeech therapy) and physical therapy (physiotherapy andbiokinetics)Dentistry: Maxillo-facial surgeryEmergency treatment in a casualty wardFemale health benefit: contraceptivesHospice careImmune deficiency related to HIV infectionOncology- Specialised medication (also see below)Organ transplant including immunosuppression medication- Corneal graftPathologyPost-hospitalisation benefitPost-natal midwifery benefitProstheses- InternalALL LIMITS ARE PER FAMILYPER YEAR UNLESS OTHERWISESPECIFIEDUnlimitedCovered at costCovered at 200% of FRCovered at <strong>300</strong>% of FRUnlimited in state hospitalsUnlimited at negotiated tariffSee co-payment tableUnlimited at negotiated tariffUnlimited with Europ AssistanceUnlimited at costUnlimited (See Healthcare ProfessionalTariff)Unlimited, subject to approval(See Healthcare Professional Tariff)Unlimited at <strong>Fedhealth</strong> RateUnlimited at MPL*R14 500 at <strong>Fedhealth</strong> RateUnlimited (See Healthcare ProfessionalTariff)Unlimited. Subject toEnhanced Protocols (See HPT)R132 500 at costUnlimited (See HPT)R15 900 per beneficiaryUnlimited at <strong>Fedhealth</strong> RateUp to 30 days after discharge at<strong>Fedhealth</strong> Rate4 days at <strong>Fedhealth</strong> RateVarious sub-limits apply(See below)- ExternalR16 700 at costPsychiatric servicesR32 600 (See HPT)Renal Dialysis (chronic)- Haemodialysis and peritoneal dialysis Unlimited at FRSpecialised medication (eg. biologicals) benefit (oncology R132 500 at cost& non-oncology)Specialised radiologyTake-out medicinesUnlimited at <strong>Fedhealth</strong> Rate7 days medication per hospitalevent at MPL*day-to-day benefitDay-to-day expenses are covered from available funds in the Out-of-Hospital ExpensesBenefit (OHEB). Limits may apply when calculating certain claims for accumulation toSafety Net. These limits will also apply for refunds from OHEB and Safety NetBENEFITTariffAppliances, external accessories and orthoticsAlternative healthcareAccupuncture, homeopathy, naturopathy,osteopathy and phytotherapy (includingprescribed medication)Additional medical servicesAudiology, dietetics, occupational therapy,orthoptics, podiatry, psychologists, social workersand speech therapy, etcDentistry (Advanced)Including oral surgery, osseo-integrated implants,orthognathic surgery and orthodontictreatmentOptometryFrames, single vision, bifocal, multifocal orspecial lenses, lens add-ons, contact lenses,readers and optometric examinationsBiokinetics, Chiropractics, Dentistry (Basic), Radiology(General), Pathology and PhysiotherapyGeneral Practitioners- <strong>Fedhealth</strong> GP Partners- Non-<strong>Fedhealth</strong> GP PartnersAntenatal ScansOver-the-counter medicationLIMIT PER FAMILY PER YEARUp to 100% of <strong>Fedhealth</strong> RateR8 940 per family per year before and afterSafety Net.Subject to OHEB*, Savings and Safety NetSubject to OHEB* and Savings. Does notaccumulate to or pay from Safety NetR13 400 per family per year before and afterSafety Net.Subject to OHEB*, Savings and Safety NetR5 580 per beneficiary per year, R11 200per family per year before and after SafetyNet (R1 230 sublimit per frame).Subject to OHEB*, Savings and Safety NetSubject to OHEB*, Savings and Safety Net.Unlimited once Safety Net is reachedSubject to OHEB* then unlimited from RiskSubject to OHEB*, Savings and Safety Net.Unlimited once Safety Net is reached2 x 2D antenatal scans per year before andafter Safety NetSubject to OHEB*, Savings and Safety NetSubject to Savings only. Does not accumulateto or pay from Safety NetPrescribed medication R7 600 per beneficiary per year, R15 200per family per year before and after SafetyNet.Subject to OHEB*, Savings and Safety Net.Radiology (Specialised)* OHEB - Out-of-Hospital Expenses BenefitPaid from the Major Medical Benefit if preauthorisedBENEFITday-to-day benefit (continued)Specialists excluding psychiatrists- <strong>Fedhealth</strong> Specialist Partners- Non-<strong>Fedhealth</strong> Specialist PartnersSpecialists: Psychiatrists- <strong>Fedhealth</strong> Psychiatrist Partners- Non-<strong>Fedhealth</strong> Psychiatrist PartnersSAFETY NET BENEFITLIMIT PER FAMILY PER YEARThe Safety Net Benefit pays for certain day-to-day expenses once OHEB and Savingshave been depleted and claims have accumulated up to the required level. TheSafety Net level is reached through the accumulation of claims paid from OHEB,Savings and the member’s own pocket through the year at the <strong>Fedhealth</strong> Rate.Where limits apply, expenses will only accumulate up to this limit and this limit willalso apply to refunds from Safety Net.co-paymentsSubject to OHEB*, Savings and accumulationat cost to Safety Net. Unlimited at cost onceSafety Net is reachedSubject to OHEB*, Savings and Safety Net.Accumulation to Safety Net at <strong>Fedhealth</strong> Rateonly. Unlimited at <strong>Fedhealth</strong> Rate once SafetyNet is reachedSubject to Additional Medical Serviceslimit of R13 400 per family before and afterSafety Net. Subject to OHEB*, Savings andaccumulation at cost to Safety NetSubject to Additional Medical Services limitof R13 400 per family before and after SafetyNet. Subject to OHEB*, Savings and SafetyNet. Accumulation to and refund from SafetyNet at <strong>Fedhealth</strong> Rate onlyCO-PAYMENTS (PER EVENT) APPLICABLE ON THE HOSPITAL/ FACILITY BILL ONLYExtraction of wisdom teeth R3 000Rhizotomies and facet pain block(limited to 1 of either procedures per beneficiaryper year)R3 200Balloon Sinuplasty R5 <strong>300</strong>Arthroscopic proceduresAnkle, Hip, Knee, Shoulder, Wrist R1 800Laparoscopic proceduresAppendectomy, Diagnostic, Hernia repairs(other than inguinal hernia repair), Nissen/ToupeyR1 800ADDITIONAL ARTHROSCOPIC AND LAPAROSCOPIC PROCEDURES WHERE THESCHEME WILL NOT FUND LAPAROSCOPIC EQUIPMENT AND DISPOSABLESHysterectomy, Pyeloplasty, Radical Prostatectomy,Splenectomy, Unilateral InguinalHerniasOnly the costs for hospital/ facility,theatre fees, anaesthetist & surgeon willbe coveredHPT - Healthcare Professional Tariff*MPL - Medicine Price ListFR - <strong>Fedhealth</strong> Rate