6Oct•Nov•Dec 2011Economy WatchFrom Bullsto BearsWhile local firms can do little to change the macroeconomicoutlook, most are looking to contain costsand deliver new products to ride out the slowdown.What a difference nineto 12 months can makefor an economy. WhenBiZQ published the first issue of2011, the prognosis by economistswas unanimous: “The <strong>Singapore</strong>economy is currently buzzing on allfronts. The overall outlook for 2011remains upbeat.”Then, the consensus was fora 4% to 5% growth in <strong>Singapore</strong>’sGDP for 2011. As the local economycruised towards mid 2011, theofficial forecast was for an upbeatgrowth of between 5% and 7%.Since then, the escalatingcontagion in the euro zone, coupledwith the political stalemate in debtfunding in the US, has made it seemthat all have gone to pot. Now, thebears are out of the woods and infull force.PhotolibraryRisks to global growthRoyal Bank of Scotland’s <strong>Singapore</strong>basedRegional Economist EmilWolter told BiZQ the bank expectsa global recession (including Asia)in 2012. This is one of the mostbearish views.“We believe the world is headingfor recession, but this view doesnot seem to be shared by regionalinvestors in general. Anecdotalevidence suggests investors arecomplacent about risks to globalgrowth and, especially, the realdanger of Europe creating a globalliquidity crisis,” said Mr Wolter.While the downbeat mood isshared by many, some like DeutscheBank (DB) err with a bit moreoptimism. DB’s Mr Gregory Luisaid: “While we do not forecasta recession in the US or Europe,our economists do see a relativelysluggish growth picture. In theUS, growth is projected to be atabout trend (level) over the next18 months, with unemploymentpersistently high.”He explained that growth inEurope is expected to drop tosignificantly below trend levels dueto increasing fiscal drag, greaterpolicy uncertainty and systemic riskin the financial sector.

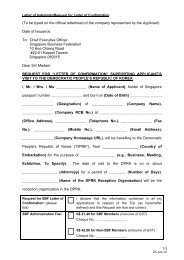

7Deutsche Bank’sVIEW OF THE WORLDEconomy New Forecast (% YOY) Previous Forecast (% YOY)2011 2012 2011 2012US 1.7 2.6 2.6 3.7Euro zone 1.7 0.8 1.9 1.5<strong>Singapore</strong> 6.2 4.4 7.0 5.0Decrease in regional tradeIn sharing the Ministry of Tradeand Industry’s analysis of the<strong>Singapore</strong> economy, DeputySecretary (Industry) Kwek MeanLuck recently summed up thechanged prognosis: “The weaknessin final demand in the advancedeconomies has affected Asia’sexports and industrial production.Supply chain disruptions in theaftermath of Japan’s Tohokuearthquake have weighed down onregional trade and manufacturingactivities.“The slowdown was furtherexacerbated by monetary tighteningand inventory adjustments in keyeconomies such as China,” he said.On the immediate horizon for<strong>Singapore</strong> is the high possibilityof a technical recession – twoconsecutive quarters of contraction.A <strong>Singapore</strong>-based Standard &Poor’s (S&P) analyst told BiZQ thatgiven the weak second- and thirdquartereconomic activity indicators,particularly the “disappointing”non-oil domestic exports, it appearsthat <strong>Singapore</strong> may be headed for atechnical recession.GDP growth projectionFor 2011, S&P forecasts GDPgrowth to be between 4.3% and 4.8%– marginally lower than its originalprojection of 4.5% to 5%.“Barring any negative globalshocks, this implies the recessionis expected to be shallow and shortwith a fourth-quarter rebound. Asa result, the government is mostprobably going to ride out therecession, given that the economy isdriven by external demand factorsand inflation remains stubborn.Domestic demand appears resilient,but is unable to offset the externalslowdown,” the analyst added.Fuelling the overall bearishsentiment, IE <strong>Singapore</strong> releasedMr Gregory Lui, Deutsche BankSeptember 2011“While US andeuro zone growthin 2012 has beenmarked down bynearly a percentagepoint, growth in theemerging marketeconomies has beenlowered by abouthalf as much. Low– often negative – realinterest rates andstable commodityprices offer unusualsupport to emergingmarkets compared topast downturns.”<strong>Singapore</strong>’s non-oil domestic exportdata for August just before thisissue of BiZQ was published. Forthat month, though such exportsrose 5.1% on a year-on-year basis(which was a better than expectedperformance), shipments ofelectronic products still continuedtheir downward trajectory.Impact of global outlookThe reversal of the global outlookis starting to trickle down to<strong>Singapore</strong> firms. However, theseverity of the impact will varyfrom sector to sector and betweencompanies within each industry.Among those who will bear thefull brunt of the slowdown willbe firms exposed to world trade.Home-grown global containeroperator Neptune Orient Lines hasexperienced a decline in its shippingvolumes, as its second-quarterresults (to end July 2011) show.Adding to the company’swoes are higher operating costs.“Conditions are challengingthroughout the shipping industry,”CEO Ronald D. Widdows told themedia recently.Another flag-bearer firm, homegrowncontract manufacturerAmtek Engineering, managed toexpand its revenue and profits forthe full year (July 2010 to end June2011), but said the outlook may notbe as promising as the previous year.While the global economicoutlook remains uncertain andchallenging as a result of recentdevelopments in some Europeaneconomies and the US, it believesthe current financial year’sperformance would be satisfactory,barring unforeseen circumstances.As the saying goes: When oneis smaller, one tends to be morenimble. Such is the case with midsized,<strong>Singapore</strong>-based contractmanufacturer Armstrong Industrial.Despite facing the same challengeslike volatile exchange rates, risingraw material costs and, mostrecently, the impact from exposureto firms hit by the earthquake inp.8