READY, SET, GO - SBF Download Area - Singapore Business ...

READY, SET, GO - SBF Download Area - Singapore Business ...

READY, SET, GO - SBF Download Area - Singapore Business ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

APR/MAY/JUN 2010 [ BUSINESS PEOPLE OPPORTUNITIES ]UOTIENTA publication of<strong>READY</strong>,<strong>SET</strong>, <strong>GO</strong>MICE INDUSTRY LIGHTS UPAS ECONOMY RECOVERSTIPPING POINTHELPING SMEs RAI<strong>SET</strong>HEIR PRODUCTIVITYSINGAPOREECONOMY<strong>GO</strong>ING FOR THELONG HAUL

CONTENTS]UOTIENTAPR/MAY/JUN 2010Cover story23] MICE INDUSTRY <strong>SET</strong> TO ROAR AGAINFrom aviation and maritime to medicine, <strong>Singapore</strong> hasclearly grabbed the pole position as the place in Asia tohost major conventions. After a lacklustre 2008-2009,industry experts say better times are ahead.16BIZ COMMUNITYDeveloping an innovationledeconomy in <strong>Singapore</strong>.01] <strong>SBF</strong> SAYSMessage from the <strong>SBF</strong> Chairman.04] <strong>SBF</strong> UPDATENews and happenings at <strong>SBF</strong>.08] EYE ON SMESHelping SMEs grow their businesses.12] EYE ON ECONOMYTaking stock of emerging trendsin <strong>Singapore</strong>.16] BIZ COMMUNITY<strong>Singapore</strong> companies should ride on the neweconomy with locally-made innovations.19] GLOBAL BUSINESSBiZQ looks into one of Saudi Arabia’s keysectors – healthcare – that will offer potentialopportunities to <strong>Singapore</strong> companiesventuring into the kingdom.21] COUNTRY INSIGHTSBiZQ examines the impact the China-ASEAN Free Trade Agreement has inthis region.02 [ APR/MAY/JUN 2010 BIZQ

Vibrant ASEAN-Indianregion leads to dynamiccommunityTrade fi gures expected to jump toUS$100 billion within the next fi veyears with signing of FTA.With the ASEAN-India Free Trade Agreement(AIFTA) in force this January, ASEAN-Indiatrade is expected to jump to US$100 billionfrom the current US$40 billion within the next fi ve years.To date, three ASEAN countries – Malaysia, Thailandand <strong>Singapore</strong> – have implemented phase one of theAIFTA, while a similar agreement on trade-in-services isawaiting approval.Once the agreement on trade-in-service is approved,companies in ASEAN and India will be able to tapinto each other’s expertise and opportunities in theinformation technology, business process out-sourcing,and space sciences sectors.The US$100 billion trade target within the next fi veyears is reasonable when compared to the currentcombined GDP of ASEAN and India at US$2 trillion.With this exciting economic development unfolding,the <strong>Singapore</strong> <strong>Business</strong> Federation (<strong>SBF</strong>) organiseda seminar on the AIFTA recently together withrepresentatives from IE <strong>Singapore</strong>, <strong>Singapore</strong> Customsand <strong>Singapore</strong> International Arbitration Centre.Seventy-eight participants from the logistics,manufacturing and industrial goods, commodities,automotive, infrastructure, infocomm, real estate andservices sectors were given in-depth knowledge on howto make use of the AIFTA for their specifi c India-relatedbusiness needs and interests.The AIFTA trade-in-goods agreement will createan opening for more than 4,000 duty-free items fromASEAN member countries to enter India’s market of overa billion people.These items make up almost 80 per cent of importsfrom ASEAN into India. Likewise, Indian enterprises willbe able to tap into the rich and diverse natural resourcesof Southeast Asia and export its products to ASEAN’scombined consumer market of 550 million people. +PHOTO: SPH LIBRARY<strong>SBF</strong> POST-BUDGET BRIEFINGDuring the recent Budget 2010, the Governmentannounced that it will be devoting signifi cant resources toimplement the strategies recommended by the EconomicStrategies Committee (ESC) and push ahead longer-terminfrastructural and social investments.In light of this, <strong>SBF</strong> and <strong>Singapore</strong> National EmployersFederation organised a seminar on Budget 2010 in earlyMarch, with speakers from CIMB-GK Research and RSMChio Lim, who shared with <strong>SBF</strong> members the highlightsof the budget. Some of the topics discussed include taxdeduction for angel investors, implementing various probusinessprogrammes and extending existing tax incentives.About 700 participants made up of fi nance managers,CFOs and HR practitioners attended the briefi ng.INVESTING IN EGYPTEgypt’s Minister of Investment, Dr Mahmoud Mohieldin,said <strong>Singapore</strong> companies can expect investmentopportunities in three sectors with substantial growth inEgypt – infrastructure and construction, communicationand information technology, as well as fi nancial services.More than 100 businessmen from diversifi ed sectorsheard high-level Egyptian government offi cials and elitebusiness delegates share their perspectives on Egypt’seconomic, political and social background at an <strong>SBF</strong>organisedseminar in March.The seminar also featured speakers from fourEgyptian listed companies who represented the fi nancialservices, oil and gas, and the cables and carpetsmanufacturing industries.<strong>SBF</strong> WELCOMES NEW COOMr Victor Tay joined the <strong>Singapore</strong><strong>Business</strong> Federation this January asChief Operating Offi cer (COO) reportingto Chief Executive Offi cer Teng ThengDar. As COO, Mr Tay oversees memberrelations and services, key enterprise developmentinitiatives such as <strong>Business</strong> Continuity Management andEnterpriseOne <strong>Business</strong> Information Services, publicrelations and communications, and business development.ICC ASIAN OFFICEOver 150 guests from the legal andbusiness world attended the offi cialinauguration of ICC’s regional Asia offi cein <strong>Singapore</strong> recently. The regional offi cewill be managed by ICC Regional Director for Trade andPolicy Lee Ju Song. <strong>SBF</strong> is the National Committee in<strong>Singapore</strong> of the International Chamber of Commerce.PHOTO: SPH LIBRARYBIZQ APR/MAY/JUN 2010 ] 05

<strong>SBF</strong>UPDATE]<strong>Singapore</strong> Symposium held in New DelhiComprehensive Economic Cooperation Agreement and ASEAN-India FreeTrade Agreement will strengthen <strong>Singapore</strong>-India bilateral trade.SINGAPORE SYMPOSIUM- DIALOGUE SESSION WITH MM LEE, MODERATED BY PRE-EMINENTBUSINESSMAN, MR RATAN N TATA (SEATED NEXT TO MM LEE, WITH LIGHT BLUE TIE).New Delhi, an importantepicentre for internationalpolitics and trade, is fertileground for business investment.New Delhi has a highly skilledlabour force, high proportionof English-speaking population,liberalised foreign investmentregulations and potential businessopportunities in several industrysectors, said Mr Anjay Roy,Advisor to the Federation of theIndian Chamber of Commerce andIndustry (FICCI).He said that such key sectorsinclude information technology,telecommunications, hotels, banking,media and tourism.New Delhi’s manufacturing basehas grown considerably as manyconsumer goods manufacturingenterprises have established theirfactories and headquarters in thecapital. He said that Delhi’s largeconsumer market, coupled with theeasy availability of skilled labour, hasbeen a major push factor.To help <strong>SBF</strong> members tap into thevast opportunities in this cosmopolitancity, the <strong>Singapore</strong> <strong>Business</strong>Federation organised a fi ve-daybusiness mission last December for a19-member delegation led by Mr VikasGore, Director, DP Architects Pte Ltd.<strong>SBF</strong>’s mission role<strong>SBF</strong> partnered the Confederation ofIndian Industry (CII) who organised therecent <strong>Singapore</strong> Symposium in NewDelhi, as well as the site visits duringthe business mission.The Confederation of IndianIndustry (CII) is an MOU partner of<strong>SBF</strong> and CII is India’s premier businessassociation, with a direct membershipof over 7,800 organisations from theprivate and public sectors. Theseinclude SMEs and MNCs, and anindirect membership of over 90,000companies from around 385 nationaland regional sectoral associations.The highlight of the mission wasthe <strong>Singapore</strong> Symposium held onDecember 16, attended by over 170participants. Minister Mentor LeeKuan Yew was one of the speakersat the Symposium whose aim wasto share <strong>Singapore</strong>’s experience ineducation, corporate governanceand infrastructure development.Among the attendees wereseveral industry leaders includingPhilip Yeo, Chairman of Spring<strong>Singapore</strong> and Special Advisor forEconomic Development; Sat PalKhattar, Co-Chairman <strong>Singapore</strong>India Partnership Foundation andChairman of Khattar Holdings; AnandSharma, Minister of Commerce andIndustry Government of India; RatanTata, Chairman of Tata Sons; andSunil Bharti Mittal, Chairman andGroup CEO of Bharti Enterprises.<strong>Business</strong> contacts<strong>SBF</strong> business mission leader MrGore said: “We share this historicalconnection, and the fact that wewere both former British coloniesmake it easier for us to do business.”Some of the best takeawaysfrom the <strong>SBF</strong> business missionwere the key contacts made by the<strong>Singapore</strong> companies in New Delhi.Participants felt that they nowhave excellent legal, operationaland strategic advice to venture intoIndia. Following the mission, threecompanies are now in pursuit ofbusiness leads that surfaced duringthe meetings in New Delhi.Several <strong>SBF</strong> mission participantsare in talks with Indian counterpartsfor possible collaboration as a resultof this visit.For more information, contactTeo Chi Howe, Senior Executive forSouth Asia at Tel: 6827-6855 ore-mail markets.sa@sbf.org.sg. +06 [ APR/MAY/JUN 2010 BIZQ

Setting up business in the Czech RepublicAttractive business perks including reduced corporate tax rate and highlyskilled workforce.Prague and Kunovice arethe two major cities whereCzech Republic’s dynamicaerospace manufacturing clustersare located. For decades, thecountry’s aerospace industry wasranked among the most competitivein the world.This vibrant industry is nowundergoing privatisation andthis sector presents ampleopportunities for foreign investors.Czech manufacturers and investorsare currently participating innumerous multinational jointprojectswhere an increasingnumber of Czech-madecomponents and solutions, forexample, are featured in the A380and B787 programmes.ICT is another key sector whichhas been growing steadily overthe years in the European region.The republic has a competitiveadvantage in providing skilledand well-educated IT workersat a fraction of the cost of othercountries in the region, explainedMr Ondrej Votruba, ExecutiveDirector (Japan Operations)of CzechInvest, the country’sinvestment and businessdevelopment agency.He was speaking at a recentseminar on “<strong>Business</strong> Opportunitiesin Czech Republic & NetworkingSession 2010” jointly organised bythe <strong>Singapore</strong> <strong>Business</strong> Federation(<strong>SBF</strong>) and CzechInvest.The seminar, attended by some50 local business representativesfrom various sectors, provideduseful information on the country’sbusiness opportunities in theaerospace, ICT and high-tech(FROM LEFT) MARTIN FELENDA, MANAGING PARTNER, SCHAFFER & PARTNER; ONDREJ VOTRUBA,EXECUTIVE DIRECTOR (JAPAN OPERATIONS), CZECHINVEST; MARTIN YUOON, ASSISTANTEXECUTIVE DIRECTOR, <strong>SBF</strong>; THEO SPEELMANS, MANAGING DIRECTOR, KBC N.V. BANK.manufacturing sectors, as well as thelegal and fi nancial aspect of doingbusiness in Czech Republic.Mr Martin Yuoon, <strong>SBF</strong>’s AssistantExecutive Director, noted that theCzech Republic and <strong>Singapore</strong>both share common ground – bothcountries are geographically smallwith open economies strategicallylocated in their respective regions.Attendees were also updated onthe geographical and sectoral incentiveschemes in the country, and thefi nancial support available from theEuropean Structured Funds.THE CZECH REPUBLICNew incentive schemeswere made known recently andmarket information is accessiblethrough the CzechInvest websitewww.czechinvest.org/en.Based on the positive feedbackfrom the participants about thedevelopments in the country, <strong>SBF</strong>will look to increasing its engagementof the market in the coming years.For more information on suchevents, contact Cindy Chua,Executive for GBD Europe & CentralAsia, at Tel: 6827-6887 or e-mailmarkets.amea@sbf.org.sg. +The country is considered one of the most dynamic and industralisedcountries in Central Europe, thanks to its advantageous geographicalposition, liberal regime for foreign capital and highly skilled workforce.Czech Republic is ranked as <strong>Singapore</strong>’s 58th largest trading partnerin 2008 with the balance of trade in <strong>Singapore</strong>’s favour.Infl ows of foreign direct investment were roughly US$10.73 billion in2008. Trade between both countries continue to soar, reaching S$963.2million in 2008, a 44.8 per cent increase in trade value from 2007.Some of the companies who have successfully established theirpresence there are Flextronics International Ltd, System Access Ltd andAmtek Engineering Ltd.BIZQ APR/MAY/JUN 2010 ] 07

EYEONSMEs]SME NEWSFinancial help for growing SMEsThe Economic Strategies Committee report recentlyproposed a S$1.5 billion funding boost and anexport-import bank to assist SMEs.<strong>Singapore</strong> is widely regardedas one of the best placesin the world for doingbusiness. With a deep pool oftalent and expertise, strong globalconnectivity, and a reputation asa trusted hub, <strong>Singapore</strong>-basedcompanies are well-positioned toseize global opportunities.However, <strong>Singapore</strong>’s smalldomestic market makes itnecessary for local enterprises tointernationalise, often at a relativelyearly stage of their growth. Inparticular, emerging markets,especially in Asia, represent a majoropportunity for local enterprises inthe next decade and beyond.To this end, the EconomicStrategies Committee (ESC)recommended that the <strong>Singapore</strong>government should do much moreto help SMEs access capital, buildcapabilities, establish networksand nurture talent.In a multi-pronged approach,the ESC Sub-Committee reportrecommended fi ve proposals whichwere featured in the recent Budget2010 announcements. These are:a. Develop an Export-Importbank-like institution:As overseas businessopportunities for <strong>Singapore</strong>companies expand, the needfor cross-border fi nancingwill increase. The proposalrecommended that the governmentdevelops EXIM (Export-Import)banks for cross-border fi nancing,including a commercially-managedspecialist institution.The government is studyingvarious models and evaluating howbest to realise the development of amarket-based institution to supportand catalyse the growth of crossborderfi nancing for <strong>Singapore</strong>-basedcompanies.b. Catalyse supply ofgrowth capital:The ESC report said that feedbackfrom both local companies and thefi nancial sector suggests that there isroom to develop and catalyse marketfi nancing of SMEs.The government announcedduring the Budget that it will set uppartnerships with the private sectorthat will see S$1.5 billion, over 10years, directed to helping smaller fi rmsexpand overseas. Half the funds willcome from the government, with therest from private fund managers withexpertise in the venture capital fi eld.More details to be announced by May.c. Empower local tradeorganisations to drive growthand internationalisation:The report recommended thatthe government strengthenstrade organisations’ institutionalcapabilities and empowers tradeassociations and chambers like the<strong>Singapore</strong> <strong>Business</strong> Federation toserve as industry champions andmarket facilitators.The government will commit S$100million over fi ve years to scale upsupport for business associationsthrough initiatives such as theLocal Enterprise and AssociationDevelopment programme, and theEnterprise Development Centers.More details to be announced by June.d. Establish track recordwith significant consumers:The <strong>Singapore</strong> domestic market,though small, has signifi cantconsumers with sophisticateddemand and large purchasingpower.One major source of signifi cantconsumers are multinationalcompanies (MNCs). Theproposal recommended that thegovernment provides incentivesto facilitate partnerships in whichMNCs, including large localcompanies, assist local companiesto develop new partnershipsand capabilities.e. Enhance access tohuman capital:Enterprises need talentto drive their growth. TheESC recommended that thegovernment broadens the scopeof internship programmes at thepolytechnic and undergraduatelevels and facilitates a network ofadvisors and mentors to providestrategic expertise to SMEs.The government will commitS$45 million over fi ve years toenhance SPRING’s <strong>Business</strong>Leaders Initiative – an umbrellaprogramme to attract young talentinto SMEs, and groom a futuregeneration of SME managers andentrepreneurs.By implementing the followingstrategies, it is possible todouble the number of localenterprises with revenues ofover S$100 million to 1,000 overthe next 10 years, said the ESCSub-Committee. +08 [ APR/MAY/JUN 2010 BIZQ

SME HELPDESK<strong>SBF</strong> links up <strong>Singapore</strong> business communitywith high-level Japanese trade missionThe global economiclandscape haschanged over thepast 12 months and manycompanies are concerned thatthe debt crisis in Dubai mayhamper economic recovery.As such, <strong>Singapore</strong>recognises the importance oflinking business communitiesacross Asia to help this regionbecome a driving force for a strongand sustainable economic growth.At a recent high level dialoguesession between 19 <strong>Singapore</strong>business representativesand a 26-member delegationfrom the Nippon Keidanren(Japan Federation of EconomicOrganisations), <strong>SBF</strong> Chairman,Mr Tony Chew, said that both<strong>Singapore</strong> and Japan shared acommon vision for a strong andvibrant Asia.The Nippon Keidanrendelegation was led by its Chairman,Mr Fujio Mitarai last December.The <strong>Singapore</strong> businessrepresentatives were led by several<strong>SBF</strong> council members and captainsof various industries.As the leading business andeconomic organisation in Japan,Nippon Keidanren keenly promotescloser cooperation between thebusiness communities in Asiaas well as regional economicintegration.The objective of this economicmission to Asia – which includedThailand and Vietnam – was tounderstand how countries in theregion responded to the currentglobal economic crisis, as wellto explore ideas on achievingsustainable future growth inAsia. Nippon Keidanren believesthat it is paramount for Japanand the rest of Asia to developclose economic ties amongstthemselves through the expansionof trade and investment, as wellas the promotion of technical andfi na nci a l c o o p e r atio n.For more information onforthcoming events, contact MsJuliana Seah, Senior Executive forGBD China & North Asia or emailmarkets.china@sbf.org.sg.NEW EDITIONCOMMENTARYON UCP 600Members of theDrafting Group thatproduced the newUCP 600 have produced thisCommentary guide explaining therationale behind the changes inthe new rules on documentarycredits. This guide contains ananalysis of each article and subarticleof the new UCP, as well ascross-references to the changesfrom UCP 500.INTERNATIONALSTANDARD BANKINGPRACTICE (ISBP) 2007This publication, an update of thesuccessful ICC Publication 645,refl ects international standardbanking practice for all partiesto a documentarycredit under UCP600. Users will fi ndguidance on how todeal with documentscovering at least twodifferent modes oftransport, insurance documentsand coverage, transferable creditsand other issues covered in thenew documentary credit rules.BiZQ readers can order thesevaluable and informativepublications direct from <strong>SBF</strong>.For more information, refer towww.sbf.org.sg.EVENTSFOOD & HOTEL ASIA 2010April 20-23 • <strong>Singapore</strong> ExpoThis event provides SMEs with the opportunitiesfor forging new partnerships and strengtheningexisting business relationships. FHA2010encompasses specialised events – FoodAsia,HotelAsia, Bakery&Pastry, HospitalityStyleAsia andHospitalityTechnology all under one roof.INTERACTIVE DME 2010June 15-18 • <strong>Singapore</strong> ExpoInteractiveDME is the event where one gains insightsinto future interactive digital media and entertainmentindustry and see how the market continues to evolvein ways where information, content and entertainmentare obtained, accessed and shared.BIZQ APR/MAY/JUN 2010 ] 09

YOU WANT AN EMBATO PUT YOU AHEAD.Get one that is a cut above the rest.NANYANG EXECUTIVE MBAGlobal Leadership for the Asian CenturyThe <strong>Business</strong> School’s flagship MBA programme is#27 in the Financial Times 2010 MBA rankingsThe Nanyang Executive MBA (EMBA) prepares you to meet the challenges andopportunities of the new marketplace giving you powerful insights into theworld’s most dynamic markets in Asia.The programme also offers specialisations in:• Entrepreneurship• Shipping, Offshore & Finance• EnergySo empower yourself with leadership and strategic capabilities to outperformyour competition and become the defining player in your industry.• Enjoy affiliation with the Berkeley-Nanyang Advanced ManagementProgramme• Experience international immersion in USA, Europe and Asia• Benefit from faculty who are leaders in Asian Management thought• Get the edge in management in a multicultural environment• Modular format, 6 segments of 2-week every quarterMore about our specialised tracks:Shipping, Offshore & Financeis a joint collaboration between NTU andBI Norwegian School of Management,NorwayEnergyis a joint collaboration between NTU,BI Norwegian School of Management,Norway and IFP School, FranceFor qualifying candidates, funding support of the tuition fee is availablefrom SPRING <strong>Singapore</strong> and MPA.www.execed.ntu.edu.sg

To AcquireThe <strong>Business</strong>Wisdom Of TheEast And West –You Need To ExperienceThem Both.BERKELEY-NANYANG ADVANCEDMANAGEMENT PROGRAMMEINTERNATIONAL IMMERSION. ASIAN RELEVANCE.20 Sep –– 1 Oct 2010 <strong>Singapore</strong>7 Mar –– 18 Mar 2011 Berkeley, USATo acquire the business wisdom of the East and West, you have to experienceit firsthand. The Berkeley-Nanyang Advanced Management Programme lets youdo just that. Offering unique leadership modules that integrate the best of theEast and West, the programme gets you in touch with the pulse of these dynamicand distinctive business communities, cultures and environments.So, what you get is simply the best of both worlds:• Gain insights into leadership styles and distinctions of the East and West• Capitalise on our unique Leadership module• Get the edge on our Innovation and Entrepreneurship focus• Network with the world's best in faculty and cohorts• Credits can be attributed towards the Nanyang EMBA degreeThe best programme of its kind —but don't just hear it from us..."Very informative and intriguing. Lecturers and materialsare of the highest quality and probably the best in the fieldscovered."- Mr Koh Tuan YewProgramme ManagerDefence Science & Technology Agency"The overall value of the programme is very good. It givesus a structured approach towards communication. I learnthow to communicate more effectively."- Mr Kelvin Yoo (Nanyang EMBA Student)CEO, <strong>Singapore</strong> Asian Publications (S) Pte Ltd"AMP is very good. I would like to have programmes likethis in Vietnam."- Dr Nguyen Tien DzungCEO & Chairman of Management BoardGami Group, Vietnam"Excellent out-of-the-box learning across multiple industries.Benefited from the exchange of ideas with differentparticipants. Quality of presentation by the faculty was of avery high standard. Insights to our work, lessons andapplications, is significant. Faculty was always present toprovide formal and informal learning."- Dr Thomas WK LewAsst Chairman Medical Board(Clinical Development)Tan Tock Seng HospitalFor qualifying candidates, funding support of the tuition fee is availablefrom SPRING <strong>Singapore</strong>.For further information, please contact: Louis +65 6790 4042 orAnnie +65 6514 8376 or email: execmba@ntu.edu.sg

(However) the full impact from theIRs is likely to be felt only in 2011,”he said.Equally bullish isCIMB-GK Researchhead Song SengWun. “The clearand modest globalrecovery (in recentmonths) currently underwaysuggests <strong>Singapore</strong> may enjoy twoto three quarters of strong growth inthe coming year. The government’sexpansionary bias in 2009 and thefi rst half of 2010 will continue tosupport private consumption growthof 2 to 4 per cent,” he said.<strong>Business</strong> climateOne of the early indications of theupside momentum in the <strong>Singapore</strong>economy was recently captured inthe BT-UniSIM <strong>Business</strong> ClimateSurvey, which was just completed inJanuary. The survey, a copy of whichwas shared with BiZQ, shows that149 fi rms surveyed expect to witnessgrowth of between 7.3 and 8.4 percent in 2010.The survey also shows thatbusinesses have turned upbeatfrom the preceding survey. In thelatest polls, the business prospectsindicator leapt 40 percentagepoints, indicating a sharply improvedsentiment. The 45 per cent netbalance (the difference between theproportion of optimistic fi rms andthose who were not) amounts to adramatic turnaround from a year ago.But <strong>Singapore</strong> has startedplanning and preparing for theroad ahead. Amid the economiccontraction arising from theglobal fi nancial crisis, <strong>Singapore</strong>conceptualised the EconomicStrategies Committee (ESC) tomap out growth for the next fi ve to10 years.Spearheaded by Ministerof Finance Mr TharmanShanmugaratnam, the EconomicStrategies Committee aims toachieve productivity growth of 2 to 3per cent a year, supporting a 3 to 5per cent GDP growth a year over thenext 10 years.The 25-member ESC tookabout eight months to come upwith its comprehensive report.The government reviewed therecommendations during the Budgetdebate in late February.Key growth strategyIn his assessment of the <strong>Singapore</strong>economy at the start of Year of the• FOCUS ON PRODUCTIVITYTO SUSTAIN LONG-TERMECONOMIC GROWTHTo achieve GDP growth of 3% to5% a year over the next decade,<strong>Singapore</strong> needs to targetproductivity growth of 2% to 3%a year. The report says that a keystrategy to attain this target is toensure continuous upgrading ofskills through retraining, encourageinnovation and investment intechnology. The quantity andquality of foreign workers haveto be managed through phasedincreases in foreign worker levies.• REITERATING EXISTINGSTRATEGIES OF MAKINGSINGAPORE A GLOBAL ASIAHUBThe ESC reiterated the need toanchor <strong>Singapore</strong> as a GlobalAsia hub and build a vibrant anddiverse corporate eco-system.One encouraging recommendationwas the growing of up to 1,000<strong>Singapore</strong> companies withrevenues over S$100m by 2020.Tiger, Prime Minister Lee HsienLoong, emphasised that productivityis a key growth strategy for<strong>Singapore</strong>’s economy.On the back of the ESCannouncements, Nomura economistLim Jit Soon told BiZQ that thecurrent planning will enable therepublic to make “2010 a year ofrebalancing as <strong>Singapore</strong> readjustsits economic policies and model toaddress its over-reliance on developedmarkets and declining productivity”.From an industry perspective, therecommendations contained in the >SINGAPORE’S ESC REPORT:KEY THRUSTSIn the February report released by the Economic Strategies Committee,the thrust of the recommendations are as follows:Another suggestion is to establishthe likes of an Export-Import Bank.• SEIZING GROWTHOPPORTUNITIESThe report identifi ed fi ve strategicthrusts for <strong>Singapore</strong> to becomea pioneer for “future-ready” greenurban solutions; a leading consumer<strong>Business</strong> Centre; a global base forcomplex manufacturing services;a fi nancial and business hub; and aglobal node for innovation.• DRIVE INNOVATIONTo increase overall R&Dexpenditures of 3% to 5% ofGDP and build the foundations fortranslational R&D and downstreamopportunities and strengthenemphasis on business innovation.• ENERGY RESOURCESTo enhance energy security, theESC recommended looking atthe feasibility of nuclear energy,importing electricity and how toprice energy to refl ect the real costsin a carbon-constrained world.PHOTOS: SPH LIBRARYBIZQ APR/MAY/JUN 2010 ] 13

EYEONECONOMY]ESC report were welcomed byVP Bank <strong>Singapore</strong>’s ManagingDirector, Reto Isenring, who saidthat the proposed plan to boostskills at every level resonates withall <strong>Singapore</strong>ans.“Human resource plays a vitalrole in <strong>Singapore</strong>'s economy, andit is therefore not surprising thatthe government has been activelyencouraging <strong>Singapore</strong>ans toconstantly improve themselves byupgrading their education and skilllevels,” he said.FedEx Express South Pacifi c’sRegional Vice President, DavidRoss, said that he fully agreedwith the ESC recommendationthat “<strong>Singapore</strong> companiesmust go beyond what they havealready developed, and differentiatethemselves by extending theirexpertise and reaching new markets.”“We also support the ESC’s callfor local companies to innovate more,and for companies to do more to raisethe productivity and effi ciency of theiremployees,” he added.Budget deficit<strong>Singapore</strong> expects a smaller budgetdefi cit for the fi scal year starting April1, 2010. The government will, however,increase spending to raise productivity.The government expects a basicbudget defi cit of $7.2 billion, or 2.6per cent of GDP, for the fi scal yearbeginning April 2010, down from anestimated $8.5 billion, or 3.3 percent of GDP, last fi scal year.The basic budget defi cit excludestransfers by the government toendowment funds as well as netinvestment returns from the country’sreserves.The overall budget balance forFY2010/11 is an estimated defi cit of$3 billion, or 1.1 per cent of GDP, the<strong>Singapore</strong> fi nance ministry said.Consensus among economistsis that the 2010 Budget will becomethe main tool to drive <strong>Singapore</strong>’slonger term ambitions, as outlinedin the ESC report. DMG & Partnerseconomist Leng Seng Choon expectsthe <strong>Singapore</strong> government to continueits budget defi cit stance from 2009. +Budget 2010 at a glanceFinance Minister Mr Tharman Shanmugaratnam recently reaffi rmed the government’s commitment to helpgrowing companies expand their businesses and announced several measures to help them raise their levelof productivity. The following are highlights of the Budget:• $5.5 BILLION TO RAISEPRODUCTIVITY<strong>Singapore</strong> will commit S$1.1billion a year over the next fi veyears in the form of tax benefi ts,grants and training subsidies tosupport the national effort toraise productivity. The incentivesinclude allowing fi rms to claim taxdeductions of 250 per cent of theirexpenditure on activities such asdesign, training and automation,subject to a maximum of $300,000for each activity.• $1.5 BILLION TO HELPGROWING COMPANIESThe government will mobilise upto $1.5 billion of growth capital byseeding a range of funds over 10years. Up to half the money willcome from government coffers.• FOREIGN WORKER LEVYThe government will increase thelevy on low-skilled foreign workersover three years. The levy on workpermit holders will be raised by $10to $30 per worker per month onJuly 1, 2010, and will average aboutS$100 over three years.• PROGRESSIVE PROPERTY TAXThe government will introducea ‘progressive’ property tax onowner-occupied homes witha top rate of 6 per cent of theproperty’s annual value. Owners ofgovernment-built HDB apartmentsand owners of most private homeswill pay lower taxes under thenew formula.• WAGE SUBSIDY<strong>Singapore</strong>’s ‘Workfare IncomeSupplement’ scheme will also beextended to workers earning up to$1,700 a month from the current$1,500 a month. The enhancedworkfare scheme will cost thegovernment $100 million annuallyand benefi t around 400,000 lowwageworkers.• INDUSTRY INCENTIVESThe government renewedtax incentives for real estateinvestment trusts and aviationmaintenance, repair and overhaulto promote these industries.• NO TAX REBATES<strong>Singapore</strong> did not extend propertyand income tax rebates.• JOB CREDITSThe government will cut andeventually phase out a subsidypaid to employers to encouragethem to hire or retain <strong>Singapore</strong>citizens or permanent residents.The job credit applies only toregular staff who make monthlycontributions to the CentralProvident Fund, the pension fund.14 [ APR/MAY/JUN 2010 BIZQ

Jointly organised by:INTERNATIONAL BUSINESS FELLOWSHIPExecutive Programme on Vietnam6 - 12 May 2010Vietnam is a promising emerging economy in Southeast Asia. Bilateral trade was $13 billionlast year and <strong>Singapore</strong> is Vietnam’s fifth-largest investor with investments of $24 billion in766 projects. With Vietnam aiming to become an industrialized nation by 2020, there areopportunities for businesses to leverage the country’s development as it works towards itsgoal. Learn first-hand about the country’s latest developments and the key challenges to lookout for, in order to thrive in this emerging market.International Enterprise (IE) <strong>Singapore</strong> and the <strong>Singapore</strong> <strong>Business</strong> Federation (<strong>SBF</strong>), together withVietnam National University, Hanoi School of <strong>Business</strong> (HSB) and University of Economics in Ho Chi MinhCity (UEH), invite you to attend the International <strong>Business</strong>Fellowship (iBF) Executive Programme on Vietnam.SEMINAR DETAILSDate 6 – 12 May 2010To be conducted in Hanoi and Ho Chi Minh City, Vietnam, the programme isdesigned to provide participants with a comprehensive overview of Vietnam’sbusiness systems, practices and varied possibilities. Topics covered include:• Vietnam’s economic and business scenario• Government and politics in Vietnam• Vietnamese culture• Human resource issues in a competitive Vietnamese market• <strong>Business</strong> experiences in Vietnam• Opportunities in various industriesParticipants can look forward to company visits to gain practical insights onbusiness operations in Vietnam as well as networking opportunities with thespeakers, business experts and industry practitioners.THE PROGRAMME IS SUITABLE FOR:• Senior management from <strong>Singapore</strong>-based companies that have businessor seek to explore business opportunities in Vietnam• Senior offi cers from public sector organizations who support businessinitiatives that add value to <strong>Singapore</strong> and VietnamOnly 25 participants will be accepted for each programme and classplacements will be decided by IE <strong>Singapore</strong> / <strong>SBF</strong>.ABOUT THE INTERNATIONAL BUSINESS FELLOWSHIP PROGRAMMEIE <strong>Singapore</strong>’s International <strong>Business</strong> Fellowship Programme supports<strong>Singapore</strong>-based companies in the training of company executives to acquirebusiness knowledge and build networks in the supported markets of CentralAsia, China, India, Latin America, the Middle East, Russia and Vietnam.Duration 6 daysVenue Vietnam National University,Hanoi School of <strong>Business</strong> (HSB),Hanoi, VietnamUniversity of Economics in Ho ChiMinh City (UEH), Ho Chi Minh City,VietnamEstimated S$1,050 per participant (after 70%Course FeeiBF Course fee support)* includeslecturers’ fees, Course Fee, coursematerials, daily lunch and over-landlocal transfers.Other Costs Airfare, accommodation, subsistenceallowance and other incidentalexpenses will be borne by participantsDress CodeLanguage<strong>Business</strong> casuals during lectures<strong>Business</strong> attire (suit and tie forgentlemen) during site visitsCourse will be conducted in EnglishREGISTRATIONIf you are interested to attend the iBF ExecutiveProgramme on Vietnam, please contact the belowand submit your registration by Friday, 16 April 2010.For more information, please contact:Mr Alan TanMs Loong Lai YongTel: 65 6827 6894 Tel: 65 6827 6819alan.tan@sbf.org.sg laiyong.loong@sbf.org.sgPAYMENTPayment will be collected upon confi rmation ofplacement in the programme.TERMS AND CONDITIONSProgramme date, fees and details are correct attime of printing but are subject to change withoutprior notice.*Terms and conditions apply.DOUBLE TAX DEDUCTION SCHEME (DTD)*Eligible companies can apply to IE <strong>Singapore</strong> for doubletax deduction for travel and accommodation costs for upto 2 employees per participating company.For details, please refer to www.iesingapore.gov.sg/dtd.BIZQ APR/MAY/JUN 2010 ] 15

BIZCOMMUNITY]Developing an innovation-led economy<strong>Singapore</strong> companies should ride on the new economy with <strong>Singapore</strong>madeinnovations. <strong>SBF</strong>’s recent seminar looks into how successfulcompanies brand their innovative products and services.PHOTO: SPH LIBRARYTHE HDB’S SOLAR TEST-BEDDING SITE IN SERAN<strong>GO</strong>ON IS AN INITIATIVE THAT IS PART OF SINGAPORE’S SUSTAINABLE-DEVELOPMENTBLUEPRINT. A $680 MILLION FUND HAS BEEN <strong>SET</strong> ASIDE FOR R&D AND MANPOWER TRAINING TO GROW THE CLEANTECH SECTOR.Research and developmentactivities in <strong>Singapore</strong>need to increasesignifi cantly, following the likes ofJapan and Sweden, according toa recent report by the EconomicStrategies Committee (ESC).The report revealed thatgreater R&D spending is neededto boost innovation and help<strong>Singapore</strong> become an Asian hubfor innovation and enterprise. TheESC recommendation calls foran increase in expenditure fromabout 3 per cent of GDP this yearto 3.5 per cent by 2015.In addition, the reportrecommended that the <strong>Singapore</strong>government remains fi rmlycommitted to public sector R&Dand helps to develop a pool ofresearch talent in the country.Emphasising the need for morepublic-private R&D initiatives, MrLim Chuan Poh, Chairman of theAgency for Science, Technology& Research (A*Star), said that<strong>Singapore</strong> has already established astrong base through signifi cant R&Dinvestments such as Biopolis andFusionpolis, while local universitiesand polytechnics have their ownresearch centres.He said that it is important for<strong>Singapore</strong> companies to know thatinnovation through R&D investmentsand the commercialisation of locallymade products and services willhelp create new technologies andsuccessful start-ups.Promoting commercialisationrequires different partners such asSUCCESSFUL START-UPS DEPENDON COMMERCIALISING INNOVATIVEPRODUCTS AND SERVICES.innovators, patent agents andstart-up mentors for small andmedium companies. One proposalis to help the public sectoraccess intellectual propertyknowledge and provide facilitiesfor testing innovative solutions.In addition, various platformscan be created to allow researchPHOTO: SPH LIBRARY16 [ APR/MAY/JUN 2010 BIZQ

OVER 120 BUSINESS REPRESENTATIVES FROM VARIOUS SECTORS IN MANUFACTURING ANDSERVICES ATTENDED THE SEMINAR “EMBRACING A BRAVE, NEW ECONOMY: DEVELOPING APRODUCT-LED ECONOMY”, ORGANISED BY SINGAPORE BUSINESS FEDERATION.Innovation partnership fundThe <strong>Singapore</strong> government, as a signifi cant consumer of productsand services, will itself play a larger role to help companies turntheir research and development into marketable solutions.The government announced during Budget 2010 that itwill commit S$450 million over fi ve years to start a Public-PrivateCo-Innovation Partnership fund.Government agencies will work with private sector companiesin co-developing innovative solutions for medium- to longtermneeds. These areas include urban mobility, environmentalsustainability and energy security.<strong>Singapore</strong>’s gross expenditure on R&D stood at 1.9 per centof GDP in 1990 and grew to 2.8 per cent in 2008,and is on track to achieving 3 per cent this year.The government will sustain its commitmentto public sector basic- and mission-orientedresearch at 1 per cent of GDP.While the government will maintain publicsector support for R&D, it will encourageprivate sector R&D to grow from 2 per cent ofGDP currently to 2.5 per cent over the nextfive years.In addition, the new Productivity andInnovation Credit scheme will providesignificant incentive for companiesto engage in R&D. It will provide a taxdeduction of 250 per cent on thefirst $300,000 of R&D expenditures,and 150 per cent on the remaining R&Dcosts. For more information, refer towww.singaporebudget.gov.sg.institutions, fi rms and publicagencies to work together toprovide innovative solutions.Such proposals are already inthe works. Under the EnterpriseOneTechnology Innovation Programme,SPRING <strong>Singapore</strong> is fundingseveral “Centres of Innovation”across educational institutions suchas Nanyang Polytechnic, Ngee AnnPolytechnic, <strong>Singapore</strong> Polytechnicand SIMTech, which allow SMEs toaccess professional services at anaffordable rate.These one-stop centres provideaccess to facilities such as laboratoryequipment, professional servicessuch as technology consultancy andtraining courses, and testing anddeveloping technology projects. Formore information, refer to websitewww.business.gov.sg.Community networkAt a recent seminar, <strong>Singapore</strong><strong>Business</strong> Federation (<strong>SBF</strong>)announced that it will collaborate withSPRING <strong>Singapore</strong> and <strong>Singapore</strong>Manufacturers’ Federation (SMa) tostrengthen the product design anddevelopment community.In addition, the threeorganisations hope to encourage<strong>Singapore</strong> businesses andmanufacturers to push forwardwith product and service innovationso that they remain competitivein today’s global market to betterserve their clients.<strong>SBF</strong> CEO, Mr Teng ThengDar, said: “The evolving globaleconomy presents both challengesand opportunities. Amidst alandscape of scarce resourcesand increased volatility, as well asgrowing levels of affl uence, ageingand urbanisation, it is key forbusinesses to embrace technologylednew product development andinnovation to deliver sustainablehigh-value-add customer-centric >BIZQ APR/MAY/JUN 2010 ] 17

BIZCOMMUNITY]PHOTO: AEROMOBILES PTE LTDAIRCRAFT GROUND SUPPORT EQUIPMENTMAKER AEROMOBILES SCORED A GLOBAL FIRSTWITH ITS PROPRIETARY A380 AIRBUS HI-LIFT.products and services.”“<strong>Singapore</strong> companies needto step up and lead the change,particularly in the fast-expandingAsian market,” he added.The <strong>SBF</strong>-organised seminar –“Embracing A Brave, New Economy:Developing a Product-led Economy”– saw business leaders sharing theirproduct development experienceson how they had attained success incommercialising their products in theglobal market.Over 120 participants fromvarious sectors in manufacturing andservices learnt how these companiesleveraged on mega-trends andregulatory issues to successfullydevelop world-class products.Made in <strong>Singapore</strong>Explaining the move to embrace aproduct-led economy, Mr Victor Tay,Director for Industry DevelopmentGroup at SPRING <strong>Singapore</strong>,noted: “<strong>Singapore</strong> manufacturingsector’s value-add has doubled toS$56 billion since 1997. However,in recent years, <strong>Singapore</strong> facedgrowing competition from regionaldeveloping economies and cheapermanufacturing sites.”He explained: “<strong>Singapore</strong>SMEs, which rely heavily on MNCssubcontracting, should developtheir own intellectual properties toensure alternative revenues.”Among the speakers atthe event were panellists fromAeromobile Pte Ltd, PamarinePte Ltd, and KOOPrime Pte Ltdwho revealed their experiences inachieving <strong>Singapore</strong>-made products– highlighting the critical successfactors for the product developmentprocess that starts fromconceptualisation to marketing.Aircraft ground supportequipment maker Aeromobilesrevealed that it had scored a globalfi rst with its proprietary A380 AirbusHi-lift. It participated in the fi rsttrial run of A380 airbus workingwith EADS Airbus and <strong>Singapore</strong>Airlines. Currently, Aeromobile hasabout 80 per cent market share inthe Middle East.Another product in developmentis the Intelligent HealthcareRobotic Assistant by KOOPrime, abioinformatics company. The system,which assists patients at healthcareinstitutions, is a collaborativeproject spearheaded by KooPrime,several contract manufacturers andhealthcare institutions.One other local player who madea mark on the international sceneis Pamarine, which specialises inmarine safety solutions.The company recently launcheda regional fi rst, a <strong>Singapore</strong>-madevoyage data recorder (VDR)product which enables audio, videoand navigation data recording.It saw opportunities in theInternational Maritime Organization(IMO) regulation which called forthe mandatory installation of (VDR)to enhance safety of navigation ofpassenger and cargo ships.<strong>SBF</strong>’s Mr Teng said thatthese initiatives are encouragingin an era where multinationalmanufacturers are shifting theiroutsourcing activities to lowercostcountries.He said that theseshowcases will encourage localsubcontractors to reduce theirreliance on MNC outsourcing,and instead look to develop theirown intellectual properties togenerate revenue.Such efforts in serviceinnovation – where companies’products are boosted withtechnology and innovation – willsteer <strong>Singapore</strong> companies wellamid global competition as theyprovide good customer-centricvalue-added products. +Spending more on innovationsTo help <strong>Singapore</strong> increase its productivity levels, the EconomicStrategies Committee released its recommendations in a 46-pagereport including proposals for more research and developmentspending on innovations.At a glance:- Spend 3.5 per cent of GDP on R&D by 2015, up from 3 per cent now.- “Designed in <strong>Singapore</strong>” accreditation to emphasise designdriveninnovation.- Centres of Innovation in polytechnics to help firms enter newgrowth areas.- Recruit faculty with entrepreneurial skills in universities to helpdevelop innovation.18 [ APR/MAY/JUN 2010 BIZQ

GLOBALBUSINESS]PHOTO: PHOTOLIBRARYCITY OF RIYADH WITH AL MAMLAKAH (KINGDOM) TOWER, SAUDI ARABIA.BEYOND OIL AND GASHealthcare is one of the key sectors that will likely offer upside potential to<strong>Singapore</strong> companies venturing into Saudi Arabia. BiZQ looks into thisgrowing market segment.Healthcare and informationtechnology are not amongthe top two sectors onewould immediately recall when onediscusses market opportunities inSaudi Arabia. But this is exactlywhat happened when <strong>Singapore</strong>companies from these sectorsexplored while on a recent businessmission to Saudi Arabia.Perhaps, little known to manyhere is the fact that the Saudi Arabiangovernment is placing a majoremphasis on improving healthcareservices for its population. Hence, in2009, Saudi Arabia’s total expenditureon the healthcare sector amountedto US$16.7 billion, a signifi cant 27%increase from the previous year’sexpenditure of US$13.2 billion.The <strong>Singapore</strong> <strong>Business</strong>Federation has long been an activeproponent in building relations withSaudi Arabia when it started itsSaudi-<strong>Singapore</strong> <strong>Business</strong> Council(SSBC) in April 2006.This was when the visiting CrownPrince of the Kingdom of SaudiArabia, Sultan Bin Abdul Aziz Al-Saud and Prime Minister Lee HsienLoong witnessed the signing of aMemorandum of Understandingbetween <strong>SBF</strong> and the Council of SaudiChambers of Commerce and Industryto set up a Joint <strong>Business</strong> Council.The SSBC is the fi rst of its kind tobe formed on a business-to-businesslevel to boost bilateral trade andinvestment relations. It is underscoredby the strong and cordial relationshipbetween the leaders of <strong>Singapore</strong> andSaudi Arabia.The inaugural SSBC Meeting washeld in Riyadh in December 2006,in conjunction with a <strong>SBF</strong> businessmission to Saudi Arabia. Both sidesagreed to develop direct exchangesof business information to increaseawareness and understanding ofthe market climate and businessopportunities in each other’s countries.A non-exhaustive list of industrieswas identifi ed including infrastructuredevelopment, water and environment,oil & gas and petrochemical, infocommunicationtechnology, transportand logistics, services (fi nance,education and healthcare) and smalland medium enterprises.Growing linkagesRecognising the importance ofbilateral ties, Saudi Arabia and<strong>Singapore</strong> took steps to up theante to form an action plan for thedevelopment of bilateral trade.Coming together in January this year,members of the 3rd Saudi-<strong>Singapore</strong><strong>Business</strong> Council Meeting decided totake small steps to bolster their tradeand investment relationship. TheSSBC is jointly chaired by <strong>SBF</strong> >BIZQ APR/MAY/JUN 2010 ] 19

GLOBALBUSINESS]THE SINGAPORE DELEGATION WITH THEIR SAUDI HOSTS AT THE VISIT OF SAUDI ARABIA BASICINDUSTRIES CORPORATION (SABIC).and Council of Saudi Chambers ofCommerce and Industry.Both countries agreed to promoteindividual businesses between thetwo countries in fi ve sectors includingtransport, tourism and infrastructuredevelopment.The Saudi team was led byAbdullah Al-Melehi, while the<strong>Singapore</strong>an team was headed byTang Kin Fei, <strong>SBF</strong> Council Member,who is also Group President andCEO of SembCorp Industries.Besides <strong>Singapore</strong> offi cials,representatives from 24 companiesand leading local businessmen tookpart in the discussions.SembCorp’s Mr Tang remindedmembers present that <strong>Singapore</strong>signed a free trade agreement withthe GCC (Gulf Cooperation Council)in 2008 and it is currently awaitingratifi cation by all member countries.“We are optimistic that with theanticipated ratifi cation, trade andinvestments between the two countrieswill be propelled to new heights. Ourpartnership need not restrict itselfto the two countries,” said Mr Tang.“Given our respective positions as agateway, the two countries can act asa hub for our marketable products andservices in regions in Southeast Asiaand West Asia.”Agreeing with these sentiments,Yew Sung Pei, Assistant ChiefExecutive Offi cer of IE <strong>Singapore</strong>,SAUDI ARABIA – SINGAPORE TRADE:A SNAPSHOTTRADE 2009Imports 11,751,848Exports 1,080,872Total Trade 12,832,720SOURCE: IE SINGAPORE’S STATLINKsaid: “The large market and theemphasis placed on healthcareservices make Saudi Arabia a potentialpartner for our healthcare servicesplayers across the entire value chain.”IE <strong>Singapore</strong> led a mission toSaudi Arabia this January, with theexpectation of trying to understandthe healthcare sector in SaudiArabia, including the trends andregulations, manpower issues andneeds of the population.Healthcare marketLeading healthcare groupParkwayHealth has already madeits fi rst foray into the Middle Eastby sealing a hospital managementcontract in Abu Dhabi. The group isnow exploring the growth potentialfor healthcare services markets likeSaudi Arabia.Leading IT fi rm CrimsonLogic, ahome-grown company specialisingin eGovernment services, isanother company keen to pursueopportunities in the kingdom. Thecompany was scouting for moreopportunities and had taken part ina recent business mission to SaudiArabia led by <strong>SBF</strong>.Already, the company made aforay by building SaudiEDI for theinvestment arm of the Kingdom’sMinistry of Finance. SaudiEDI is anintegrated suite of eTrade servicesresulting in an automated, transparentand collaborative trading community.There are also companieswhich continue to focus and makeinroads into the oil and gas sector.Rotary Engineering, an engineering,procurement and constructioncompany, has been on a trailblazerroute, picking up contracts in SaudiArabia. This includes a US$745million contract to build a refi nery tankfarm at Jubail.These companies are increasinglyputting Saudi Arabia on theirradar screens. Saudi Arabia was<strong>Singapore</strong>’s 17th largest tradingpartner in 2009 with total tradeamounting to S$12.8 billion. +HEALTHCARESERVICESIn an effort to improve the level ofhealthcare services in Saudi Arabia,the Kingdom is earmarking a greaterportion of its public expenditure tothis sector. For example, about 10%of the economic stimulus budgetof US$126.7 billion) announcedlast year was earmarked for healthservices and social development.The country plans to increasethe number of public and privatehospitals to 500 in 2013, up fromabout 400 currently. Anotherindicator is the growth in hospitalbeds in the private hospitals, whichrose 41% between 2003 and 2007.Saudi Arabia’s annual populationgrowth rate of 2.4% is relativelyhigh compared to the averageglobal population growth rate of1.17%, which could potentiallymean greater demand forhealthcare services.20 [ APR/MAY/JUN 2010 BIZQ

COUNTRYINSIGHTS]DEVELOPING WORLD’SBIGGEST FREE TRADE AREAThe China-ASEAN Free Trade Agreement is being billed as a welcome shotin the arm for China and six Southeast Asian countries. BiZQ examines theimpact this FTA has in the region.CHINA’S TRADE WITH ASEAN HAS JUMPED SIX-FOLD SINCE 2000 TO US$193 BILLION LAST YEAR.Apopulation of 1.9 billion.A total trade volume ofUS$4.5 trillion. A combinedGDP of about US$6 trillion. Anaverage tariff rate of 0.1%, downfrom 9.8%.These are the characteristicsof the newly formed free tradeagreement between China and theAssociation of Southeast AsianNations (ASEAN). Refl ecting thelargest FTA in the developing world,the agreement which kicked in onJan 1, 2010, was eight years in themaking.When conceptualised earlierin the last decade, policy makerswere clear that they wanted to >BIZQ APR/MAY/JUN 2010 ] 21

COUNTRYINSIGHTS]reap the following benefi ts from theChina-ASEAN FTA:• Strengthen and enhanceeconomic, trade and investmentcooperation.• Progressively liberalise andpromote trade in goods andservices as well as create atransparent, liberal and facilitativeinvestment regime.• Explore new areas and developappropriate measures for closereconomic cooperation.• Facilitate the more effectiveeconomic integration of thenewer ASEAN Member Statesand bridge the development gapamong the Parties.Reducing tariffsUnder this FTA, the six originalASEAN members, Brunei,Indonesia, Malaysia, the Philippines,<strong>Singapore</strong> and Thailand, will slashthe average tariff on Chinesegoods to 0.6%, down from 12.8%.By 2015, the policy of zero-tariffrate for 90% of Chinese goods isexpected to extend to the four newASEAN members: Cambodia, Laos,Myanmar and Vietnam.Analysts expect sectors likethe services, construction andinfrastructure, and manufacturingindustries to reap the biggestbenefi ts from this new FTA.Mr Phua KokKhoo, presidentof <strong>Singapore</strong>-China businessassociation, hailsthe FTA betweenChina and the ASEAN as a “goodevent” for both. He reckons that theFTA will make trading between the10-member regional bloc and Chinamore liberal and convenient.WHAT TARIFF SAVINGS CANBUSINESSES ENJOY?A Free Trade Agreement (FTA)is a legally binding agreementbetween two or more countriesto reduce or eliminate barriersto trade, and facilitate the crossbordermovement of goods andservices between the countriesand regions involved.Since the signing of the FTAunder the ASEAN Free Trade<strong>Area</strong> (AFTA) in 1992, <strong>Singapore</strong>’snetwork of FTAs has expandedto cover 18 regional and bilateralFTAs with 24 trading partners.<strong>Singapore</strong>’s FTAs havebeen instrumental in helping<strong>Singapore</strong>-based businessesstrengthen cross-border tradeby eliminating or reducingimport tariff rates, providingpreferential access to servicessectors, easing investment rules,improving intellectual propertyCompanies and analysts thatBiZQ spoke to as part of thisarticle said it was hard to state thequantitative and tangible benefitsthat businesses will reap becausethis FTA is in its early days. Theyadd that they can see the benefitsare obvious from a macroeconomicperspective.From a broader perspective,the benefits appear clear. China’strade with ASEAN has jumped sixfoldsince 2000 to US$193 billionlast year. During this same period,ASEAN’s trade deficit with Chinawidened by five times to US$21.6billion. This trend, with greateropen access, can only increase,say analysts.Analysts like Tan Khee Giapregulations, and openinggovernment procurementopportunities.In simple terms, when<strong>Singapore</strong> signs an FTA withanother party, <strong>Singapore</strong>businesses exporting goods tothe country in question wouldbe able to enjoy preferentialtariff rates, instead of paying thefull rates. To enjoy this benefit,the goods being exported mustoriginate from <strong>Singapore</strong>.For businesses wanting tofind out more on what tariffsavings they can enjoy from<strong>Singapore</strong>’s FTAs, governmentagency IE <strong>Singapore</strong> has a tariffcalculator located at www.fta.gov.sg/tariff_calculator.htm.<strong>Business</strong>es should visit this siteto get a better understanding ofthe tangible benefits of FTAs.postulates that the lessdeveloped countrieswithin ASEAN canexport their agriculturegoods to China whilecountries with abundantresources could sell oil, mineralsand rubber to China. In return,ASEAN countries can buy cheapermanufactured goods from China.Razeen Sally, an analyst with theEuropean Centre for InternationalPolitical Economy, says that thelatest FTA is going to make adifference at the margin to someASEAN countries but not others.Basically it takes down the tariffsbut does little on all the non-tariffbarriers where you would have muchbigger gains to trade, she says. +PHOTOS: SPH LIBRARY22 [ APR/MAY/JUN 2010 BIZQ

COVERSTORY]PHOTO: PHOTOLIBRARYMICE industryset to roar againFrom aviation and maritime to medicine, <strong>Singapore</strong> hasclearly grabbed the pole position as the place in Asiato host major conventions. After a lacklustre 2008-2009,industry experts say better times are ahead.BIZQ APR/MAY/JUN 2010 ] 23

COVERSTORY]DYNAMIC DEVELOPMENTSPointing to the emerging buoyancy in theMICE sector, <strong>Singapore</strong> Tourism Board’s (STB)Assistant Chief Executive for <strong>Business</strong> Traveland MICE, Melissa Ow said: “All vital signsare pointing towards the return of businessconfidence in the <strong>Singapore</strong> business eventssector, fuelled by the dynamic developmentstaking place within the tourism landscape.“Leveraging on our sterling track record andsound business fundamentals, <strong>Singapore</strong> hassecured a robust pipeline of business events,including key international association meetings,in the coming years,” she added.<strong>Singapore</strong>’s business travel sector is a keytourism driver for <strong>Singapore</strong>. In 2008, amid aA VIEW OF THE RESORT WORLD SENTOSA (RWS) FROM THETIGER SKY TOWER.After two years of a rough-and-tumble ride,<strong>Singapore</strong>’s MICE (Meetings, Incentives,Conventions and Exhibitions) industry isset to ride out into brighter times.There is more than a glimmer of hope in thisrecovery as the MICE sector was buzzing withlots of business activity in recent weeks. For astart, the 2010 <strong>Singapore</strong> Airshow brought 800exhibitors from over 40 countries to <strong>Singapore</strong> inFebruary – numbers far exceeding expectations.Resorts World Sentosa, which opened on theback of the Airshow, gave another booster shotto the <strong>Singapore</strong> MICE sector. Resorts WorldSentosa told BIZQ that it has lined up about 30confirmed events over the next two years. Ofthese, 25 per cent are annual events that will beheld here for the first time, one-off internationalevents that rotate from country to country, andone-off regional events.In addition, <strong>Singapore</strong>’s star attraction, theMarina Bay Sands, said that it would open itsdoors on May 27, 2010. Marina Bay Sands toldBiZQ that it has secured more than 30 eventsto be held from 2010 to 2012, of which six aremaking their debut appearance. The events areexpected to attract over 150,000 visitors.ON<strong>GO</strong>ING CONTRUCTION AT THE MARINA BAY SANDSINTEGRATED RESORT.challenging global economic climate, <strong>Singapore</strong>’sbusiness travel sector set a new record withthree million business and MICE visitors andgenerated about S$6 billion in tourism receipts.As an indication of the emphasis andimportance of this sector, <strong>Singapore</strong> clinched thetitle of ‘Top International Meeting City’ last yearin the Union of International Associations 2008Global Rankings for the second consecutive year.<strong>Singapore</strong> continues to reign as Asia’s topcountry and city for meetings for the 25thconsecutive year, accounting for more than 25per cent of the meetings held in the continentin 2008.STB’s Ow added: “As we move into 2010,PHOTOS: SPH LIBRARY24 [ APR/MAY/JUN 2010 BIZQ

All vital signs are pointing towards the return of businessconfidence in the <strong>Singapore</strong> business events sector, fuelledby the dynamic developments taking place within thetourism landscape.- Melissa Ow, <strong>Singapore</strong> Tourism BoardGLOBAL INVITATIONThe <strong>Singapore</strong> Tourism Board (STB) hasbeen a prime driver for the MICE sector in<strong>Singapore</strong>. Working closely with partnersin the medical profession, the <strong>Singapore</strong>Exhibition and Convention Bureau (SECB),a group of the STB, put forth competitivebids and secured a number of majorbusiness events within the biomedicalsciences and medical cluster.These include:• International Conference on EmergencyMedicine (ICEM) in 2010,• International Congress on Aviation andSpace Medicine in 2010,• Third World Congress of the InternationalAcademy of Oral Oncology (IAOO) in 2011,• 15th World Conference on Tobacco orHealth (WCTOH) in 2012, and• World Congress on Cardiac Pacing andElectrophysiology 2015.According to STB, these target eventswill bring an estimated total attendance ofover 7,000 participants to the republic andwill entrench <strong>Singapore</strong>’s status as Asia’sleading medical and intellectual exchangehub where influential opinion leaders gather.Other significant associationconferences secured by <strong>Singapore</strong> andscheduled to take place in the next fewyears include:• The International Council forCommercial Arbitration (ICCA)Conference 2012, which will debutwith a distinguished delegate audiencecomprising top international lawyers,judges and arbitrators, providing anopportunity for <strong>Singapore</strong> to showcase itsachievements in commercial arbitration.• The 13th Conference of the AssociatedResearch Centers for Urban UndergroundSpace 2012 which provides a forum forexperts to discuss opportunities andchallenges in the use of undergroundspaces in cities.• The 15th Asian Chemical Congress 2013which will bring together establishedscientists for information exchangeand education.• The 16th Baptist Youth WorldConference 2013 which will welcome6,000 young adults to <strong>Singapore</strong>,representing the largest-ever internationalgathering of Baptist youths.BIZQ APR/MAY/JUN 2010 ] 25

COVERSTORY]<strong>Singapore</strong> has rejuvenated itselfin the past few years as an excitingcruise destination and now playsan important role as a platform forthe global and regional industry toshowcase itself.- Michael Duck, UBM Asiaand a climate of economic recovery, the STBwill continue to work closely with our industrypartners to meet business event organisers’evolving needs, explore new business leads andstrengthen our international marketing andchannel development efforts.”TOURISM COMPASS 2020Beyond the current horizon, the STB hasbigger ambitions. In the spirit of the EconomicStrategies Committee (ESC), which is tryingto drive change and growth in the <strong>Singapore</strong>landscape, the STB has its own game plan asmapped out in Tourism Compass 2020.Tourism Compass 2020 was launchedrecently and is an enhancement of Tourism2015. The Tourism 2015 master plan aimed togenerate $30 billion in tourism receipts and 17million visitor arrivals to <strong>Singapore</strong> by 2015.As part of this plan to achieve new goals,the STB put together a steering committee thatincludes members of the Tourism ConsultativeCouncil (TCC) who are leaders in the businessand tourism sector. The Tourism Compass 2020Steering Committee will provide strategic directionfor future tourism development in <strong>Singapore</strong>.Five taskforces have also been set upto map out tourism strategies specificallypertaining to business, enrichment, lifestyle,marketing, and travel and hospitality. Eachtaskforce is led jointly by STB and TourismConsultative Council (TCC) representatives,and is supported by members of variousbackgrounds from the private and publicsectors that provide valuable insightsand perspectives.SINGAPORE AIRSHOW2010 IS NOW THELARGEST IN ASIAAgainst the backdrop of a weak aviationsector, <strong>Singapore</strong> pulled a coup with Airshow2010 – it attracted 112,000 visitors and 250delegations from 80 countries when it washeld in February earlier this year.“When the economygets tough, people docome out and network, seefor themselves and buildalliances as quickly as theycan. And this has been thetrend we have seen in most of the shows,especially in Asia Pacific,” said Jimmy Lau,Managing Director of <strong>Singapore</strong> Airshow &Events, the organiser of Airshow 2010.Speaking at a media briefing, he saidthat <strong>Singapore</strong> Airshow 2010 has emergedas one of the top three aviation events in theworld and is now the largest in Asia, despitethe aviation industry’s woes. One of theindications of a strong traction is the returnrate of visitors, he said.Lau added that the Airshow was able tosecure a healthy rate of returning visitors.About 85 per cent of companies whoparticipated in the show two years earlierreturned for the 2010 show, he said.The organiser did its bid to promotethe MICE sector by setting several firsts in<strong>Singapore</strong>. Apart from being able to draw morethan 30 airline CEOs from around the world, italso launched new initiatives at the event.FRESH PERSPECTIVESExplaining the broad-based approach adoptedunder the Tourism Compass 2020 umbrella,Gerald Lee, Deputy Chief Executive Officer of TheAscott Group and also co-chair of the steeringcommittee, says: “This will provide us freshperspectives and a 360-degree vantage point fora sustainable tourism roadmap.”He explains: “Tourism is not just for visitors;<strong>Singapore</strong> tourism belongs to residents too.By bringing members of the public into this26 [ APR/MAY/JUN 2010 BIZQ

PHOTOS: SPH LIBRARYFor the first time, there were business forumson market opportunities in India, China and theMiddle East. There was also an inaugural Greenpavilion that featured environmental aspects ofthe aviation industry.Another government agency that activelypromotes this subsector under the MICEumbrella is the Economic DevelopmentBoard (EDB). “As Asia’s most importantaviation event, <strong>Singapore</strong> Airshow provides anexcellent platform for participants to reachout to their target audience, be it exploringcommercial opportunities,forging partnerships or makingannouncements for maximumimpact,” EDB Director forTransport Engineering Sia KhengYok told the media.The 2010 <strong>Singapore</strong> Airshow was spreadacross 40,000 sq m of indoor exhibition spaceand 100,000 sq m of outdoor space. “Whenyou consider what we went through in the pastyear, I think we did pretty well,” Lau quipped.Speaking of the show, Airbus Head ofMarketing for freighters Didier Lenormandsaid: “The number and quality of visitorsexceeded our expectations, as the A330-200F really created a ‘buzz’ at the show.”The company used the platform to showcaseits A330-200F, its latest freighter, which wasthe largest aircraft on exhibit.Looking ahead to 2012, the eventorganiser has already sold more than 60per cent of the exhibition space. “We arecommitted to delivering another iconic andstrategic event,” said Lau.discussion, we hope to include ideas andsuggestions close to the hearts of people living in<strong>Singapore</strong>, <strong>Singapore</strong>ans based overseas, visitorswho love <strong>Singapore</strong> – everyone. We want to evolvethe destination into one that will excite andengage people in a personal and authentic way.”The STB conducted a road show to sevencities in Europe, including London, Frankfurt andGeneva, Vienna and Paris In November 2009.Through meetings and networking sessions withover 400 business events trade partners andintermediaries, and key decision-makers frominternational associations, STB organised theroad show to raise awareness of <strong>Singapore</strong> as apremier destination for business events and aspringboard to tap on the burgeoning economicgrowth of Asia Pacific.REGIONAL BASESTB’s effort has already started to show traction.One of the key industry associations that theSTB met was the International Air Transport >BIZQ APR/MAY/JUN 2010 ] 27

COVERSTORY]Association (IATA), which has set up its regionalbase in <strong>Singapore</strong> and is looking to stage moreevents in the city-state.IATA Manager for Passenger Services, ElenaCiuperceanu said: “IATA has been operatingin <strong>Singapore</strong> since 1969. We held our AnnualGeneral Meeting in <strong>Singapore</strong> in 2004 and weare working with the <strong>Singapore</strong> Airshow, Ministryof Transport and Civil Aviation Authority of<strong>Singapore</strong> to organise the Aviation Summit inFebruary 2010.”“With our extensive experience doingbusiness in <strong>Singapore</strong>, it is our opinion that theaccommodation available is at very competitiveprices, the meeting and conference facilities areextensive and of the highest standards, and thecorporate entertainment and cuisine can cater toevery taste,” she added.GROWING MARITIME SEGMENTReed Exhibition Services, one of the main playersin the <strong>Singapore</strong> exhibition market, notes thatexhibitors are increasingly telling them thatthey see greater growth potential in Asia, and<strong>Singapore</strong> in particular, than ever before. Thecompany secured the mandate to manage theAsia Pacific Maritime 2010 (APM 2010) whichtook place in March at the <strong>Singapore</strong> Expo.The event featured 900 companies and13 country pavilions and many first-timeparticipants showcasing new technologies,equipment and systems for shipbuilding,shipping services and port operations.In 2008, when the event was last held in<strong>Singapore</strong>, the show attracted 7,100 visitorsand 841 companies from 52 countries.“APM 2010 is getting tremendous responsefrom an even bigger cross-section of themaritime industry this time, because theyanticipate the economic recovery in Asia willprecede that of other regions in the worldand they want to be here when it happens.Exhibitors are telling us they see greater growthpotential in Asia than ever before,” said MichelleLim, General Manager for Reed Exhibitions<strong>Singapore</strong>.UBM Asia is another company playing onthe maritime theme in the MICE sector. Thecompany, which organises the annual CruiseShipping Miami, the world’s largest andmost important international tradeshow andconference serving the cruise industry, toldBiZQ that it has launched a new product calledCruise Shipping Asia. The inaugural trade eventwill take place in November 2011 at the MarinaBay Sands in <strong>Singapore</strong>.“The arrival of this major cruise event in<strong>Singapore</strong> underscores the growing recognitionof this market’s strong potential, and will greatlycomplement our ongoing efforts in promotingAsia’s cruise industry development,’ saidJennifer Yap, a spokeswoman for Asia CruiseAssociation and Managing Director of RoyalCaribbean Cruises Asia.Michael Duck, Senior Vice President forUBM Asia said it was happy to bring CruiseShipping Asia back to <strong>Singapore</strong>. “It has been10 years since we last organised a cruise eventhere and today the Asian market is primed fortremendous growth. <strong>Singapore</strong> has rejuvenateditself in the past few years as an exciting cruisedestination and now plays an important role asa platform for the global and regional industryto showcase itself,” he said. +With our extensive experience doing business in <strong>Singapore</strong>, it isour opinion that the accommodation available is at very competitiveprices, the meeting and conference facilities are extensive and of thehighest standards, and the corporate entertainment and cuisine cancater to every taste.- Elena Ciuperceanu, International Air Transport Association28 [ APR/MAY/JUN 2010 BIZQ

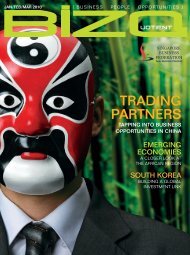

BiZQ Jan-Mar09 cover final.indd 1 12/29/08 10:04:04 AMCover BiZQ Apr.indd 1 4/14/09 2:58:51 PMBiZQ Jul-Sep09 cvroptions.indd 1 6/19/09 9:29:50 AMJAN/FEB/MAR 09 [ BUSINESS PEOPLE OPPORTUNITIES ]APR/MAY/JUN 09 [ BUSINESS PEOPLE OPPORTUNITIES ]JUL/AUG/SEP 09 [ BUSINESS PEOPLE OPPORTUNITIES ]UOTIENTUOTIENTUOTIENTWHENFUNDINGHELPSMORE FINANCIN<strong>GO</strong>PTIONS AVAILABLEFOR SMESECONOMICOUTLOOK 2009WHERE THE SINGAPOREECONOMY IS HEADEDFINANCIALMANAGEMENTMANAGING YOURBUSINESS RISKSCHANGINGSTRATEGIESMANAGING BUSINESS COSTSTO STAY COMPETITIVEPOST-BUDGET2009 FORUM<strong>SBF</strong> GATHERS FEEDBACKFROM BUSINESS COMMUNITYGREENINITIATIVESMANAGING COST SAVINGSTHROUGH ECO-FRIENDLYENVIRONMENTBRANDPOWERMAKING AN IMPACTIN THE GLOBAL MARKET<strong>SBF</strong> TURNS 7!FORGING AHEADTOWARDS BETTER TIMESSERVICE WITHA SMILEHOSPITALITY INDUSTRYGETS A $90M BOOSTadvertise inUOTIENTBiZQ READERSHIPSURVEY 2009150 DINING VOUCHERS TO BE WON!<strong>Business</strong> Quotient, (BiZQ) is an offi cial publication of the <strong>Singapore</strong> <strong>Business</strong>Federation, the country’s apex business chamber. The quarterly, published incollaboration with SPH Magazines, is your eye on Asian and global business trends.BiZQ is circulated to the federation’s members, professional associations andoverseas business chambers and aims to keep companies and businesses upto-datewith the latest economic trends, industry news and trade and investmentopportunities in <strong>Singapore</strong> and around the world.With a circulation of 20,000 copies, BiZQ reaches out to decision-makers includingCEOs, MDs, Chief Financial Offi cers, businessmen and entrepreneurs.To fi nd out more about advertising in BiZQ,please fi ll in this form with your contact detailsFull Colourand fax this page to the <strong>Singapore</strong> <strong>Business</strong>Federation at 6827-6807 or SPH MagazinesR.O.B. Full Page $3,500 Custom Publishing at 6319-3095.Double Page Spread $6,1001/2 Page Vertical $2,4001/2 Page Horizontal $2,300NameDesignationCompanyMembership No.Premium PositionsOutside Back Cover $6,300Inside Front Cover $5,700Inside Back Cover $4,700Offi ce AddressE-mailTel. No. (O)(Mobile)❒ Please send me more information on BiZQ’s advertising rates.

INDUSTRYTRENDS]UPSWING IN INDUSTRIALREAL ESTATE MARKETThe recovering economy is stimulating demand for industrial real estate. Withsupply expected to contract in 2010, rentals are expected to recover later. BiZQtakes a closer look at the market dynamics.The year 2009 would havebeen a good year forbusinesses to buy or leaseindustrial real estate for medium tolonger term use. But all is not lost in2010 because industrial rental ratesare beginning to recover althoughdemand is only showing signs of apick-up in recent months, said analysts.As history would tell, take-upof ready-built factory space fell in2009 in <strong>Singapore</strong>. Further, rentsand capital values for factories andwarehouses fell in the fi rst quarterbut held fi rm in the remaining threequarters in 2009, according torecently published data.But the market is improving onfronts, they add. While demandis starting to pick up, rental ratesstill have room to climb furtherbefore they reach their 2008highs. This will certainly give spaceto businesses looking to secureindustry real estate to ride thecurrent growth trend.“General business sentiment ison the upswing for 2010. As such,a healthy demand for industrialproperties is expected in 2010and rents are projected to begintheir upward climb in the secondhalf of the year,” CB Richard30 [ APR/MAY/JUN 2010 BIZQ

The gradual, albeitmodest, recovery instrata sales activity hasencouraged a return ofdevelopers’ interest indevelopment land.– Tan Boon Leong, ColliersInternationalAVERAGE PRIME INDUSTRIAL RENTSHIGH-TECH$2.25 PSFFACTORY (GRD FLR) $1.40 PSFFACTORY (UPP FLR)$1.15 PSF($ psf per month)4.003.50Ellis’s industrial real estate analystElizabeth Choong said.She added that the upswingwill be fuelled by GDP growthof between 3 and 5 per cent for<strong>Singapore</strong>, following the contractionin 2009.Tan Boon Leong, Director ofIndustrial at Colliers International,said that “on the back of anexpected improvement in both theeconomy and the manufacturingsector, as well as more optimisticbusiness sentiments, we expectto see a pick-up in the demand forindustrial space in 2010.”Looking backThe events of 2009 were of littlesurprise in the industrial realestate market in <strong>Singapore</strong>. Amidthe global fi nancial crisis and theresulting squeeze in credit fromthe fi nancial sector, companies hadlittle choice but to scale back theirbusiness activities. This resulted indownward pressure on industrialrents (see chart).The latest data from a majorindustrial property player in<strong>Singapore</strong> brings this to bear. JTCCorporation, one of <strong>Singapore</strong>’slargest providers of industrial realestate services, released its latestreport in late February and clearlydisplays this trend.The data showed that overallgross allocation of preparedPHOTO: SPH LIBRARY3.002.502.001.501.000.500.00Q1 04Q2 04Q3 04Q4 04Q1 05Q2 05Q3 05Q4 05Q1 06Q2 06Q3 06Q4 06Q1 07Q2 07Q3 07Q4 07Q1 08Q2 08Q3 08Q4 08Q1 09Q2 09Q3 09Q4 09SOURCE: CBRE RESEARCHANALYSTS EXPECT THE TAKE-UP RATE FOR <strong>READY</strong>-BUILT FACTORY SPACE MARKET TO INCREASEAS THE ECONOMY RECOVERS.industrial land fell 34 per cent to175.6ha in 2009 while terminationsincreased by 17 per cent to 74.7ha.Prepared industrial land refers to landthat is made ready for lessees todevelop their own industrial facilities.The industrial real estatedeveloper also showed that net >BIZQ APR/MAY/JUN 2010 ] 31