Global petrochemicals - Roland Berger Strategy Consultants

Global petrochemicals - Roland Berger Strategy Consultants

Global petrochemicals - Roland Berger Strategy Consultants

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

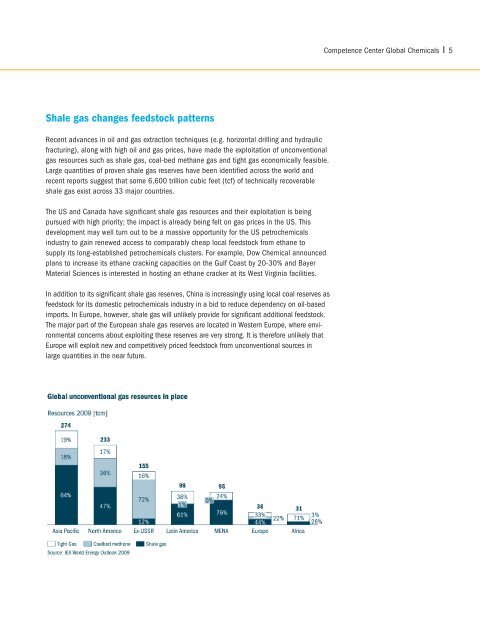

Competence Center <strong>Global</strong> Chemicals 5Shale gas changes feedstock patternsRecent advances in oil and gas extraction techniques (e.g. horizontal drilling and hydraulicfracturing), along with high oil and gas prices, have made the exploitation of unconventionalgas resources such as shale gas, coal-bed methane gas and tight gas economically feasible.Large quantities of proven shale gas reserves have been identified across the world andrecent reports suggest that some 6,600 trillion cubic feet (tcf) of technically recoverableshale gas exist across 33 major countries.The US and Canada have significant shale gas resources and their exploitation is beingpursued with high priority; the impact is already being felt on gas prices in the US. Thisdevelopment may well turn out to be a massive opportunity for the US <strong>petrochemicals</strong>industry to gain renewed access to comparably cheap local feedstock from ethane tosupply its long-established <strong>petrochemicals</strong> clusters. For example, Dow Chemical announcedplans to increase its ethane cracking capacities on the Gulf Coast by 20-30% and BayerMaterial Sciences is interested in hosting an ethane cracker at its West Virginia facilities.In addition to its significant shale gas reserves, China is increasingly using local coal reserves asfeedstock for its domestic <strong>petrochemicals</strong> industry in a bid to reduce dependency on oil-basedimports. In Europe, however, shale gas will unlikely provide for significant additional feedstock.The major part of the European shale gas reserves are located in Western Europe, where environmentalconcerns about exploiting these reserves are very strong. It is therefore unlikely thatEurope will exploit new and competitively priced feedstock from unconventional sources inlarge quantities in the near future.