IFRS: What should boards and audit committees be ... - IAS Plus

IFRS: What should boards and audit committees be ... - IAS Plus

IFRS: What should boards and audit committees be ... - IAS Plus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

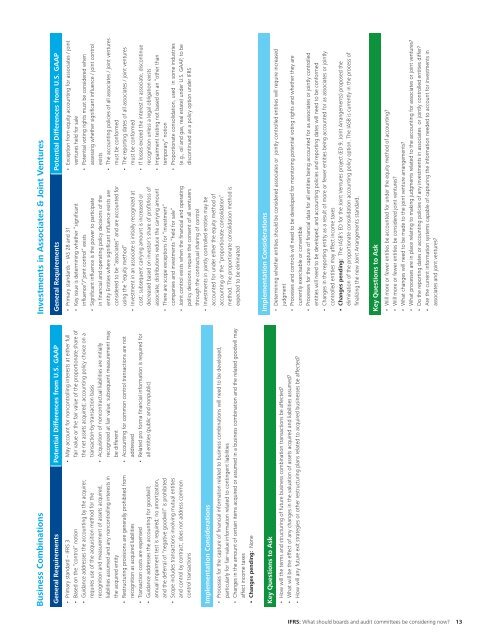

Business CombinationsGeneral Requirements Potential Differences from U.S. GAAP•••••••Primary st<strong>and</strong>ard – <strong>IFRS</strong> 3Based on the “control” notionGuidance addresses the accounting by the acquirer;requires use of the acquisition method for therecognition <strong>and</strong> measurement of assets acquired,liabilities assumed <strong>and</strong> any noncontrolling interests inthe acquired entityRestructuring provisions are generally prohibited fromrecognition as acquired liabilitiesTransaction costs are expensedGuidance addresses the accounting for goodwill;annual impairment test is required; no amortization,<strong>and</strong> the deferral of “negative goodwill” is prohibitedScope includes transactions involving mutual entities<strong>and</strong> control by contract; does not address commoncontrol transactions••••May account for noncontrolling interests at either fullfair value or the fair value of the proportionate share ofthe net assets acquired; accounting policy choice on atransaction-by-transaction basisAcquisition of noncontractual liabilities are initiallyrecognized at fair value; subsequent measurement may<strong>be</strong> differentAccounting for common control transactions are notaddressedRelated pro forma financial information is required forall entities (public <strong>and</strong> nonpublic)Implementation Considerations••Processes for the capture of financial information related to business combinations will need to <strong>be</strong> developed,particularly for fair-value information related to contingent liabilitiesChanges in the amount of certain items acquired or assumed in a business combination <strong>and</strong> the related goodwill mayaffect income taxes• Changes pending: NoneKey Questions to Ask•••How will the terms <strong>and</strong> structuring of future business combination transactions <strong>be</strong> affected?<strong>What</strong> will <strong>be</strong> the effect of any changes in the valuation of assets acquired <strong>and</strong> liabilities assumed?How will any future exit strategies or other restructuring plans related to acquired businesses <strong>be</strong> affected?Investments in Associates & Joint VenturesGeneral Requirements Potential Differences from U.S. GAAP•••••••Primary st<strong>and</strong>ards – <strong>IAS</strong> 28 <strong>and</strong> 31Key issue is determining whether “significantinfluence”/“joint control” existsSignificant influence is the power to participatein financial <strong>and</strong> operating policy decisions of theentity Entities where significant influence exists areconsidered to <strong>be</strong> “associates” <strong>and</strong> are accounted forusing the “equity method”Investment in an associate is initially recognized atcost; subsequent carrying amount is increased ordecreased based on investor’s share of profit/loss ofassociate; distributions reduce the carrying amountThere are scope exceptions for “investment”companies <strong>and</strong> investments “held for sale”Joint control exists when the financial <strong>and</strong> operatingpolicy decisions require the consent of all venturersthrough the contractual sharing of controlInvestments in jointly controlled entities may <strong>be</strong>accounted for under either the equity method ofaccounting or the “proportionate consolidation”method. The proportionate consolidation method isexpected to <strong>be</strong> eliminated•••••••Exception from equity accounting for associates / jointventures held for salePotential voting rights must <strong>be</strong> considered whenassessing whether significant influence / joint controlexistsThe accounting policies of all associates / joint venturesmust <strong>be</strong> conformedThe reporting dates of all associates / joint venturesmust <strong>be</strong> conformedIf losses exceed the interest in associate, discontinuerecognition unless a legal obligation existsImpairment testing not based on an “other thantemporary” notionProportionate consolidation, used in some industries(e.g., oil <strong>and</strong> gas, real estate) under U.S. GAAP, to <strong>be</strong>discontinued as a policy option under <strong>IFRS</strong>Implementation Considerations••••Determining whether entities <strong>should</strong> <strong>be</strong> considered associates or jointly controlled entities will require increasedjudgmentProcesses <strong>and</strong> controls will need to <strong>be</strong> developed for monitoring potential voting rights <strong>and</strong> whether they arecurrently exercisable or convertibleProcesses for the capture of financial data for all entities <strong>be</strong>ing accounted for as associates or jointly controlledentities will need to <strong>be</strong> developed, <strong>and</strong> accounting policies <strong>and</strong> reporting dates will need to <strong>be</strong> conformedChanges in the reporting entity as a result of more or fewer entities <strong>be</strong>ing accounted for as associates or jointlycontrolled entities may affect income taxes• Changes pending: The <strong>IAS</strong>B’s ED for the Joint Ventures project (ED 9, Joint Arrangements) proposed theelimination of the proportionate consolidation accounting policy option. The <strong>IAS</strong>B is currently in the process offinalizing the new Joint Arrangements st<strong>and</strong>ard.Key Questions to Ask••••••Will more or fewer entities <strong>be</strong> accounted for under the equity method of accounting?Will more or fewer entities <strong>be</strong> considered joint ventures?<strong>What</strong> changes will need to <strong>be</strong> made to the joint venture arrangements?<strong>What</strong> processes are in place relating to making judgments related to the accounting for associates or joint ventures?Do the reporting dates or accounting policies of any investments in associates or jointly controlled entities differ?Are the current information systems capable of capturing the information needed to account for investments inassociates <strong>and</strong> joint ventures?<strong>IFRS</strong>: <strong>What</strong> <strong>should</strong> <strong>boards</strong> <strong>and</strong> <strong>audit</strong> <strong>committees</strong> <strong>be</strong> considering now? 13