Chris Johnson, Manager Consulting Services - J.W. Terrill

Chris Johnson, Manager Consulting Services - J.W. Terrill

Chris Johnson, Manager Consulting Services - J.W. Terrill

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Healthcare ReformCompliance Requirementsfor 2010 - 2011The direct call in number is877-850-8942conference code:7207877390

Healthcare Reform: Current Events• 2011 W-2 Reporting Requirement Delayed– PPACA required reporting of aggregate plan value on W-2’s– IRS Notice 2010-69 provides interim relief to employers.• Requirements will be postponed for one (1) year.• Reporting will be optional during 2011– IRS determined that employers needed additional time to make changes to payrollsystems and procedures in order to comply.– IRS will be releasing further guidance “…later this year…”

Healthcare Reform: Notice Requirements• Summary List of Potential PPACA Notice Requirements for 2011– Grandfathered Health Plan Notice• Must include statement in plan materials indicating that the plan “believes” it is a grandfathered plan andmust provide contact information for questions & complaints.• Health plan must maintain records documenting policy & plan terms in effect on March 23, 2010.– Age 26 Notice• Must provide notice in writing of the opportunity to enroll. Enrollment period must be open at least 30 days.– Lifetime Limit Re-enrollment Option• Must provide notice in writing of the opportunity to enroll. Enrollment period must be open at least 30 days.– OB/GYN PCP Notice• Language must be included in the SPD (Summary Plan Document) or Insurance Certificate of Coverageinforming members that any participating primary provider who is available may be selected as PCP.Additionally, your plan must allow pediatricians to be designated as PCP for children and female participantsmust be permitted to seek care from an in-network OB/GYN without prior authorization or referral.

Healthcare Reform: Grandfathering• Determine Grandfathered Status– Regulations Designed to Allow Groups to be “Grandfathered” Relative to CertainRequirements of PPACA (Final Interim Guidance provided June 14th)• All Plans (grandfathered or otherwise) must provide certain benefits:– No lifetime limits on coverage– No rescissions of coverage– Extension of parents coverage to young adults under 26 years of age– No coverage exclusions for children with pre-existing conditions (subject to additional regulations)– No “restricted” annual limits (subject to future regulation)• To qualify for “grandfathered” protections – based on plan design in effect March 23, 2010– Cannot significantly cut or reduce benefits (i.e. cannot eliminate coverages)– Cannot raise co-insurance charges (i.e. 20% to 25%)– Cannot significantly raise copayment charges (no more than $5 or 15% + inflation)– Cannot significantly raise deductibles (no more than 15% + inflation)– Cannot significantly lower employer contributions (no more than 5% as % of premium)– Cannot add or tighten an annual limit on what the insurer pays– Cannot change insurance companies

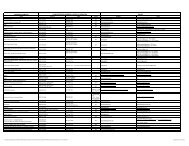

Health Care Reform Legislation: PPACAChangeApplies toGrandfathered PlansApplies to Non-Grandfathered PlansEffectiveNo Lifetime/Annual Limits Yes Yes First Renewal Post 9/23/10Age 26 Dependent Coverage Yes Yes First Renewal Post 9/23/10Rescissions Prohibited Yes Yes First Renewal Post 9/23/10No pre-existing for enrollees under 19 Yes Yes First Renewal Post 9/23/10Coverage for preventive health benefits No Yes First Renewal Post 9/23/10Mandated Patient Protections No Yes First Renewal Post 9/23/10Discrimination rules No Yes First Renewal Post 9/23/10Required Claims Procedures (External Review) No Yes First Renewal Post 9/23/10FSA/HSA/HRA OTC Drugs Non-Reimbursable Yes Yes 1/1/11Provided Uniform Coverage Documentation Yes Yes No Later than 3/23/201260-day notice of modifications of health plan Yes Yes No Later than 3/23/2012$2,500 cap on annual FSA contributions Yes Yes 1/1/2013No pre-existing condition exclusions (ALL) Yes Yes 1/1/2014No waiting period over 90 days Yes Yes 1/1/2014Employer Mandate Yes Yes 1/1/2014Required coverage for clinical trials No Yes 1/1/2014Auto-enroll FTE’s into health plans (>200 EE’s) Yes Yes TBD

Healthcare Reform: Plan Provisions• Effective on first renewal following September 23, 2010• Amend appropriate plan documents regardless of Grandfathered status:– No Lifetime Limits– No “Restricted” Annual Limits– Extension of Coverage to Adult Children Under Age 26• Grandfathered plan does not have to provide coverage if child is eligible for coverage under another plan– Elimination of Pre-Existing Exclusions for Anyone Under Age 19– No Recessions of Coverage• Special Rule for Collectively Bargained Plans – (Insured Plans Only)– CBA in Place Prior to March 23, 2010 Plan Will Remain Grandfathered Until The Last ofthe Agreement (i.e. can change plans without losing protections)– Plan Does Have to Comply With Rules Above

Healthcare Reform: Plan Provisions• Effective on first renewal following September 23, 2010• Amend appropriate plan documents for non-grandfathered plans.– Include 1 st Dollar Coverage for “Preventive Care” <strong>Services</strong>• Insure coverage of US Preventive <strong>Services</strong> Task Force preventive services list with grades of A or B• Insure coverage of recommended Immunizations– Include Patient Protections• No prior authorization or increased cost sharing for OON Emergency services; no referral for access toOBGYN; and “Choice of Provider” enabling selection of PCP from and pediatrician PCP designation.– Include Internal Appeals & External Review Processes• Sponsors will need to ensure that their plan (or insurance carrier) has internal appeals & external reviewprocesses that conform with guidance created by Departments of Treasury, Labor and Health & Human<strong>Services</strong> (HHS).• Recognizing that many plans and insurers cannot meet the tight deadline for compliance DOL has announceda grace period for certain standards until July 1, 2011

Healthcare Reform: Flexible Spending Accounts• Amend plan documents to comply with PPACA requirements• Effective January 1, 2011 no over-the-counter (OTC) medicines or drugs will berecognized as eligible expenses.• Notice allows plans to retroactively amend to January 1, 2011 so long as amendmentis adopted no later than June 30, 2011• Steps to take1. Communicate new OTC (d) rule to participants prior to 2011;2. Verify with administrator* that OTC (d) will not be reimbursed effective Jan. 1 st ;3. Implement a new procedure to insure every claim for OTC (d) has a valid Rx numberor an accompanying prescription that satisfies state law;4. Adopt plan amendments

Healthcare Reform: Non-Discrimination• Non-Grandfathered Fully-Insured Plans• Effective first renewal following September 23, 2010• Prohibits discrimination based on salary;• 70% of all employees must be eligible to participate in plan (simple definition)• Classifications that favor “highly compensated” individuals prohibited• Non compliant employers subject to $100 per day / per affected participant• Rules applying to self-funded (pre-PPACA)• Prohibits discrimination based on salary;• 70% of all employees must be eligible to participate in plan (simple definition)• Classifications that favor “highly compensated” individuals prohibited• Non compliant employers – Value of benefit included in employee gross income• Exclusions from testing• Employees not having completed 3 years, under age 25, part-time, seasonal, coveredunder a Collective Bargaining Agreement, non-resident alients

Healthcare Reform: HIPAA Opt-Out• Effective first renewal following September 23, 2010 non-CBA• Formerly Self-Insured Non-federal Governmental Plans were allowed to opt out ofcompliance with certain federal benefit mandates1. HIPPA limitation on pre-existing condition exclusion periods2. HIPAA requirements for special enrollment periods3. HIPAA prohibition against discrimination based on health status (does not include GINA)4. NMHPA newborn and mother hospital-stay benefits5. MHPAEA requirements of parity in application of certain mental health and substance abuse benefits6. WHCRA required coverage for reconstructive surgery following mastectomies7. Michelle’s Law requirement to provide coverage of dependent students on medically necessary leave• Under PPACA yellow coded provisions can still be opted out of• CBA ratified pre March 23, 2010• If exempted from any of first three requirements, will not have to come intocompliance with those requirements until first day of the first plan year followingexpiration of the last plan year governed by the CBA.• HHS will not be taking enforcement actions prior to April 1, 2011

Healthcare ReformCompliance Requirementsfor 2010 - 2011Contact Information<strong>Chris</strong> <strong>Johnson</strong>, <strong>Manager</strong> <strong>Consulting</strong> <strong>Services</strong>314.594.2607cjohnson@jwterrill.com