FEDERAL INTERNATIONAL (2000) LTD

FEDERAL INTERNATIONAL (2000) LTD

FEDERAL INTERNATIONAL (2000) LTD

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

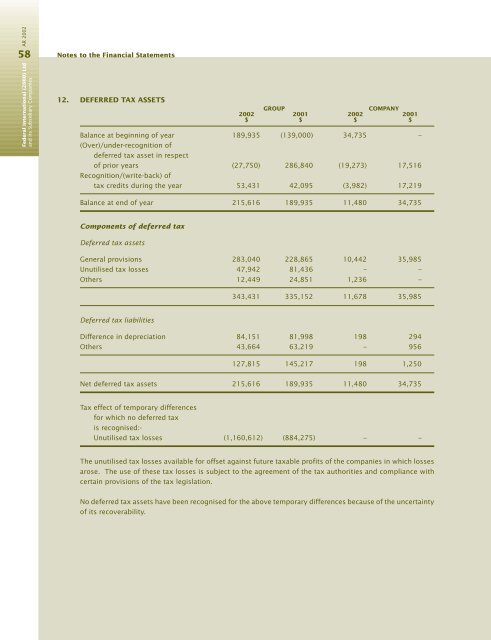

Federal International (<strong>2000</strong>) Ltd AR 2002and its Subsidiary Companies58Notes to the Financial Statements12. DEFERRED TAX ASSETSGROUPCOMPANY2002 2001 2002 2001$ $ $ $Balance at beginning of year 189,935 (139,000) 34,735 –(Over)/under-recognition ofdeferred tax asset in respectof prior years (27,750) 286,840 (19,273) 17,516Recognition/(write-back) oftax credits during the year 53,431 42,095 (3,982) 17,219Balance at end of year 215,616 189,935 11,480 34,735Components of deferred taxDeferred tax assetsGeneral provisions 283,040 228,865 10,442 35,985Unutilised tax losses 47,942 81,436 – –Others 12,449 24,851 1,236 –343,431 335,152 11,678 35,985Deferred tax liabilitiesDifference in depreciation 84,151 81,998 198 294Others 43,664 63,219 – 956127,815 145,217 198 1,250Net deferred tax assets 215,616 189,935 11,480 34,735Tax effect of temporary differencesfor which no deferred taxis recognised:-Unutilised tax losses (1,160,612) (884,275) – –The unutilised tax losses available for offset against future taxable profits of the companies in which lossesarose. The use of these tax losses is subject to the agreement of the tax authorities and compliance withcertain provisions of the tax legislation.No deferred tax assets have been recognised for the above temporary differences because of the uncertaintyof its recoverability.