advisormonthly - Franklin Templeton Investments

advisormonthly - Franklin Templeton Investments

advisormonthly - Franklin Templeton Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

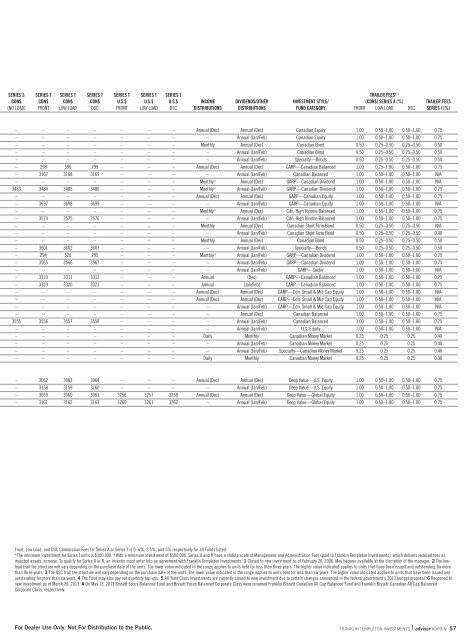

SERIES S SERIES T SERIES T SERIES T SERIES T SERIES T SERIES T TRAILER FEES 2, 3CDN$ CDN$ CDN$ CDN$ U.S.$ U.S.$ U.S.$ INCOME DIVIDENDS/OTHER INVESTMENT STYLE/ (CDN$) SERIES A (%) TRAILER FEES(NO LOAD) FRONT LOW LOAD DSC FRONT LOW LOAD DSC DISTRIBUTIONS DISTRIBUTIONS FUND CATEGORY FRONT LOW LOAD DSC SERIES I (%)– – – – – – – Annual (Dec) Annual (Dec) Canadian Equity 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – – Annual (Jan/Feb) Canadian Equity 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – Monthly Annual (Dec) Canadian Bond 0.50 0.25–0.50 0.25–0.50 0.50– – – – – – – – Annual (Jan/Feb) Canadian Bond 0.50 0.25–0.50 0.25–0.50 0.50– – – – – – – – Annual (Jan/Feb) Specialty—Bonds 0.50 0.25–0.50 0.25–0.50 0.50– 298 596 299 – – – Annual (Dec) Annual (Dec) GARP—Canadian Balanced 1.00 0.25–1.00 0.50–1.00 0.75– 3167 3168 3169 – – – – Annual (Jan/Feb) Canadian Balanced 1.00 0.50–1.00 0.50–1.00 N/A– – – – – – – Monthly 4 Annual (Dec) GARP—Canadian Dividend 1.00 0.50–1.00 0.50–1.00 N/A3483 3484 3485 3486 – – – Monthly 4 Annual (Jan/Feb) GARP—Canadian Dividend 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – Annual (Dec) Annual (Dec) GARP—Canadian Equity 1.00 0.50–1.00 0.50–1.00 0.75– 3697 3698 3699 – – – – Annual (Jan/Feb) GARP—Canadian Equity 1.00 0.50–1.00 0.50–1.00 N/A– – – – – – – Monthly 4 Annual (Dec) Cdn. High Income Balanced 1.00 0.50–1.00 0.50–1.00 0.75– 3574 3575 3576 – – – – Annual (Jan/Feb) Cdn. High Income Balanced 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – Monthly Annual (Dec) Canadian Short Term Bond 0.50 0.25–0.50 0.25–0.50 N/A– – – – – – – – Annual (Jan/Feb) Canadian Short Term Bond 0.50 0.25–0.50 0.25–0.50 0.40– – – – – – – Monthly Annual (Dec) Canadian Bond 0.50 0.25–0.50 0.25–0.50 0.50– 3601 3602 3603 – – – – Annual (Jan/Feb) Specialty—Bonds 0.50 0.25–0.50 0.25–0.50 0.50– 294 520 295 – – – Monthly 4 Annual (Jan/Feb) GARP—Canadian Dividend 1.00 0.50–1.00 0.50–1.00 0.75– 3565 3566 3567 – – – – Annual (Jan/Feb) GARP—Canadian Dividend 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – – Annual (Jan/Feb) GARP—Sector 1.00 0.50–1.00 0.50–1.00 N/A– 3310 3311 3312 – – – Annual (Dec) GARP—Canadian Balanced 1.00 0.50–1.00 0.50–1.00 0.75– 3319 3320 3321 – – – Annual (Jan/Feb) GARP—Canadian Balanced 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – Annual (Dec) Annual (Dec) GARP—Cdn. Small & Mid Cap Equity 1.00 0.50–1.00 0.50–1.00 N/A– – – – – – – Annual (Dec) Annual (Dec) GARP—Cdn. Small & Mid Cap Equity 1.00 0.50–1.00 0.50–1.00 N/A– – – – – – – – Annual (Jan/Feb) GARP—Cdn. Small & Mid Cap Equity 1.00 0.50–1.00 0.50–1.00 N/A– – – – – – – – Annual (Dec) Canadian Balanced 1.00 0.50–1.00 0.50–1.00 0.753555 3556 3557 3558 – – – – Annual (Jan/Feb) Canadian Balanced 1.00 0.50–1.00 0.50–1.00 0.75– – – – – – – – Annual (Jan/Feb) U.S. Equity 1.00 0.50–1.00 0.50–1.00 N/A– – – – – – – Daily Monthly Canadian Money Market 0.25 0.25 0.25 0.40– – – – – – – – Annual (Jan/Feb) Canadian Money Market 0.25 0.25 0.25 0.40– – – – – – – – Annual (Jan/Feb) Specialty—Canadian Money Market 0.25 0.25 0.25 0.40– – – – – – – Daily Monthly Canadian Money Market 0.25 0.25 0.25 0.30– 3062 3063 3064 – – – Annual (Dec) Annual (Dec) Deep Value—U.S. Equity 1.00 0.50–1.00 0.50–1.00 0.75– 3158 3159 3160 – – – – Annual (Jan/Feb) Deep Value—U.S. Equity 1.00 0.50–1.00 0.50–1.00 0.75– 3059 3060 3061 3256 3257 3258 Annual (Dec) Annual (Dec) Deep Value—Global Equity 1.00 0.50–1.00 0.50–1.00 0.75– 3161 3162 3163 3260 3261 3262 – Annual (Jan/Feb) Deep Value—Global Equity 1.00 0.50–1.00 0.50–1.00 0.75Front, Low Load, and DSC Commission Fees for Series A or Series T is 0–6%, 2.5%, and 5% respectively for all Funds listed.*The minimum investment for Series I units is $100,000. †With a minimum investment of $500,000, Series O and R have a sliding scale of Management and Administration Fees (paid to <strong>Franklin</strong> <strong>Templeton</strong> <strong>Investments</strong>), which delivers reduced fees asinvested assets increase. To qualify for Series O or R, an investor must enter into an agreement with <strong>Franklin</strong> <strong>Templeton</strong> <strong>Investments</strong>. 1 Closed to new investment as of February 20, 2006. May become available at the discretion of the manager. 2 The lowloadtrail fee structure will vary depending on the purchase date of the units. The lower value indicated in the range applies to units held for less than three years. The higher value indicated applies to units that have been issued and outstanding for morethan three years. 3 The DSC trail fee structure will vary depending on the purchase date of the units. The lower value indicated in the range applies to units held for less than six years. The higher value indicated applies to units that have been issued andoutstanding for more than six years. 4 The Fund may also pay out quarterly top-ups. 5 All Yield Class investments are currently closed to new investment due to certain changes announced in the federal government’s 2013 budget proposal. 6 Reopened tonew investment as of March 26, 2013. A On May 13, 2013 Bissett Focus Balanced Fund and Bissett Focus Balanced Corporate Class were renamed <strong>Franklin</strong> Bissett Canadian All Cap Balanced Fund and <strong>Franklin</strong> Bissett Canadian All Cap BalancedCorporate Class, respectively.For Dealer Use Only. Not For Distribution to the Public. FRANKLIN TEMPLETON INVESTMENTS <strong>advisormonthly</strong> 57