STATE TAXATION OF MULTISTATE BUSINESS - Alston & Bird, LLP

STATE TAXATION OF MULTISTATE BUSINESS - Alston & Bird, LLP

STATE TAXATION OF MULTISTATE BUSINESS - Alston & Bird, LLP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

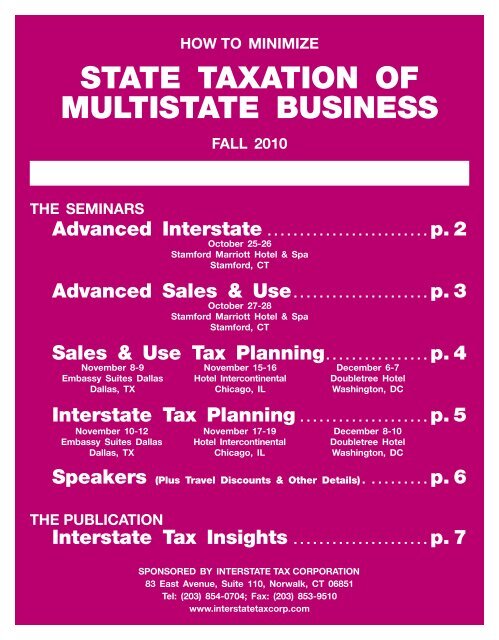

HOW TO MINIMIZE<strong>STATE</strong> <strong>TAXATION</strong> <strong>OF</strong>MULTI<strong>STATE</strong> <strong>BUSINESS</strong>FALL 2010THE SEMINARSAdvanced Interstate . . . . . . . . . . . . . . . . . . . . . . . . . p. 2Advanced Sales & Use . . . . . . . . . . . . . . . . . . . . . p. 3Sales & Use Tax Planning . . . . . . . . . . . . . . . . p. 4November 8-9Embassy Suites DallasDallas, TXInterstate Tax Planning . . . . . . . . . . . . . . . . . . . . p. 5November 10-12Embassy Suites DallasDallas, TXOctober 25-26Stamford Marriott Hotel & SpaStamford, CTOctober 27-28Stamford Marriott Hotel & SpaStamford, CTNovember 15-16Hotel IntercontinentalChicago, ILNovember 17-19Hotel IntercontinentalChicago, ILDecember 6-7Doubletree HotelWashington, DCDecember 8-10Doubletree HotelWashington, DCSpeakers (Plus Travel Discounts & Other Details). . . . . . . . . . p. 6THE PUBLICATIONInterstate Tax Insights . . . . . . . . . . . . . . . . . . . . . p. 7SPONSORED BY INTER<strong>STATE</strong> TAX CORPORATION83 East Avenue, Suite 110, Norwalk, CT 06851Tel: (203) 854-0704; Fax: (203) 853-9510www.interstatetaxcorp.com

ADVANCED INTER<strong>STATE</strong>October 25-26Stamford Marriott Hotel & SpaStamford, CTn State and local practitioners, including returning alumni, will obtain up-to-date analyses of current developments in state income taxation ofmultistate business and explore the planning opportunities arising therefrom. Delivery Method: Group-Live. No advance preparation required.However, prior attendance at a three-day Interstate Tax Planning conference, this course, or two years’ experience in the field are suggestedas prerequisites. Estimated continuing education credit: 16 based on a 50-minute hour, including 1 hour for ethics; 13.33 based on a60-minute hour, including 1 hour for ethics.Jurisdiction and NexusThe latest interpretations by the states and the MultistateTax Commission of Wrigley and Quill. State tax treatment ofpassive investment companies, financial institutions, servicecompanies, credit card and Internet activities. Effect of havingsales reps working at home, officers residing in-state,deliveries in company and third-party trucks, leased or mobileproperty, in-state affiliates, and other in-state activities.Impact of voluntarily registering to do business in a state.Nexus standards under recently revised state tax systemssuch as the Ohio CAT, Texas Margin Tax and Michigan BusinessTax. Planning ideas for minimizing state income taxes.The Unitary ConceptAn analysis of current cases interpreting the extent ofa state’s authority to apply the unitary concept in its manyforms, e.g., domestic, worldwide, water’s edge combination.Unique statutory and regulatory definitions. The MTCapproach. Legislative developments. Structuring business tobest take advantage of unitary reporting. Application of theunitary concept to non-income taxes.Business and Nonbusiness IncomeRecent interpretations of the business/nonbusiness distinctionby UDITPA and non-UDITPA states before and afterMead. Determining “operational significance.” Using thefunctional, transactional, and unitary tests to minimize statetaxation of short and long-term investment income, dividends,capital gains, rents, royalties, 338(h)(10) income,and other intangibles. Effect of operating under centralizedcash management, through divisions, partnerships, S corporationsand LLCs on a business/nonbusiness determination.Treatment of complete and partial liquidations.Legislative developments; update on MTC efforts to reconsiderthe UDITPA definition of business income.Accounting for Uncertainty in State Income TaxesFIN 48: its requirements and the impact this FASB interpretationhas had on the priorities of multistate corporatetax departments and their advisors. Discussion of the majorissues in accounting for state income taxes on the financialstatement. Practical application of FIN 48 and recent developments,including the effect of IRS Statement 2010-09.Conformity and Tax Base IssuesLimitations imposed by states on the deductibility of NOLs,depreciation, taxes imposed by other states. State tax treatmentof related party dividends and fees, foreign sourceincome, federal obligations and 338(h)(10) transactions.Computation of state AMTs, such as the Kentucky “alternativeminimum calculation.”Apportionment FactorsCharacterizing business activities for purposes of apportionment.Does the company sell tangibles, intangibles, services,mixed products, or a combination? Sourcing issuesand methods. Treatment of installment, intercompany, crossborder,drop shipment and dock sales; investment activities.Apportioning the income of service providers and specializedindustries. What’s new in the Joyce/Finnigan controversy?Proving distortion to obtain relief from unfair apportionment.Update on MTC proposal to revise UDITPA apportionmentrules.Flow-Through Entities and Their OwnersNexus, unitary, apportionment, tax base, conformity issuesas applied to flow-through entities and their owners. Hot topicsin this area such as how to handle non-resident ownerwithholding and coping with the various state tax reformsdesigned to reach the income of flow-through entities.Ethical and Procedural IssuesEthical and strategic dilemmas involved in conducting stateincome tax audits and running the state tax department,including application of ethical standards set by the AICPA,ABA, local state CPA societies and bar associations.Determining the availability of refunds and the associatedprocedural requirements, such as payment under protest and“pay to play.” Writing a protest; alternative dispute resolution;the right to an administrative appeal. Statute of limitationsissues, including the effect of RARs, waivers, settlingwith the IRS, and choosing the date from which the limitationsperiod should be measured. Using nonrefundable overpaymentsto offset deficiencies and interest.Problems SessionPractical application of the concepts presented.REGISTRATIONThe registration fee is $825 for the two-day conference and includes continental breakfast, refreshments, specially-prepared seminar materials,and a cocktail reception the first evening of the program. A $30 discount is available if payment accompanies the registration form and is receivedby Interstate Tax Corporation no later than September 27, 2010. See page 6 for participating speakers, hotel/airfare/car rental discounts and otherdetails, page 8 to register, or call (203) 854-0704 for further information.– 2 –

ADVANCED SALES & USEOctober 27-28Stamford Marriott Hotel & SpaStamford, CTn Sales and use tax practitioners, including returning alumni, will obtain up-to-date analyses of current developments on the most criticaltopics in the field and explore the planning opportunities arising therefrom. Delivery Method: Group-Live. No advance preparation required.However, prior attendance at a Sales & Use Tax Planning conference, this course, or two years’ experience in the field are suggested asprerequisites. Estimated continuing education credit: 16 based on a 50-minute hour, including 1 hour for ethics; 13.33 based on a 60-minutehour, including 1 hour for ethics.Jurisdiction and NexusAdvanced issues in determining “substantial nexus” for salesand use tax purposes after Quill. What current business practicescause nexus: drop shipments, advertising, delivery incompany-owned trucks, use of independent contractors, unpaidrepresentatives, maintenance of inventory, occasional visits byemployees? Affiliate nexus. Consequences of using the Internetto conduct business, voluntarily registering to collect salestaxes and establishing “temporary nexus.” The latest on stateattempts to tax Internet and mail order sales.Manufacturing ExemptionsDetermining whether a manufacturing exemption is availablein a particular state and how far it extends — to manufacturing,processing, fabricating, packaging, R&D, testing,pollution control; to machinery, materials, chemicals, electricity,natural gas, computers, transportation equipment; to theproduction of intangibles; to retail or service industries. Mustthe final product be sold? Proving substantial transformation.Manufacturing incentives.The Streamlined Sales Tax ProjectDetailed update and discussion on the current status of,and issues surrounding, the SSTP. Why the Streamlined SalesTax Project is important. Substantive state tax changes alreadymade. Which states are participating and at what level?Related federal legislation. Prospects for the future.Ethical and Procedural IssuesSufficiency of evidence and ethical issues on audit — maintainingexemption certificates and other records, includingthose kept electronically, defining good faith, using statisticalsampling. The effect of Sarbanes-Oxley on recordkeeping forsales and use taxes; how to put internal controls in place toensure that the sales and use tax department is run withethics and integrity.Leasing IssuesDistinguishing between a lease and a sale; an operatinglease and a financing lease. Applicability of the sale for resaleexemption. State tax treatment of leases involving services,tangibles, real property, intangibles, or a combination thereof.Accounting and tax issues. The Streamlined Sales Tax Projectdefinition. Available elections and exemptions. Taxability ofmobile property, sale/leasebacks, leases between related parties.Planning opportunities.Services and Mixed TransactionsIdentifying the type of transaction involved — pure service,mixed or bundled? Sourcing issues. Sales and use tax treatmentof computer software and data processing, telecommunications,engineering services, delivery charges, maintenance,access to information and the Internet, and other services.Using the separately stated rule and other planningmethods to minimize sales and use taxes on mixed transactions.Attempts to clarify this area, including the StreamlinedSales Tax Project and Internet Tax Freedom Act.Contractors and Tax Exempt EntitiesDistinguishing between exempt sales to the federal governmentand taxable sales to government employees.Treatment of purchases made with GSA-Smart Pay and othertypes of government cards. Sales to state, county, city governments,branches and agencies; religious, charitable, educationaland not-for-profit organizations. Critical differencesin tax treatment between the states. Structuring the transactionto produce the best result.Problems SessionPractical application of the concepts presented.REGISTRATIONThe registration fee is $825 for the two-day conference and includes continental breakfast, refreshments, specially-prepared seminar materials, anda cocktail reception the first evening of the program. A $30 discount is available if payment accompanies the registration form and is received byInterstate Tax Corporation no later than September 29, 2010. An additional discount of $50 may be taken only by those practitioners who attendboth Advanced Interstate and Advanced Sales & Use (all four days). See page 6 for participating speakers, hotel/airfare/car rental discounts andother details, page 8 to register, or call (203) 854-0704 for further information.– 3 –

SALES & USE TAX PLANNINGNovember 8-9Embassy Suites DallasDallas, TXNovember 15-16Hotel IntercontinentalChicago, ILDecember 6-7Doubletree HotelWashington, DCn An intensive two-day immersion into the concepts, problems and planning opportunities involved with sales, use and gross receipts taxes.This course is designed for the beginner to intermediate level practitioner; however, even the most experienced state tax professional willobtain practical ideas and valuable information concerning the latest administrative, judicial and legislative developments in sales and usetaxation. Delivery Method: Group-Live. No prerequisites or advance preparation required. Estimated continuing education credit: 16 basedon a 50-minute hour, including 1 hour for ethics; 13.33 based on a 60-minute hour, including 1 hour for ethics.Fundamental Concepts and theStreamlined Sales Tax ProjectSales, use, gross receipts taxes – their similarities anddifferences. Determining whether the tax is imposed on thepurchaser or seller. Taxation of services, tangible personalproperty, contractors, corporate and partnership transactions.Sales and use taxes on the local level. The administrativeaspect: licenses, permits, collection fees, exemption certificates,filing requirements. The effect of the Streamlined SalesTax Project on promoting sales and use tax compliance anduniformity between the jurisdictions. Recent developments.Jurisdiction, Nexus and the InternetCoping with increased sales tax collection and use taxremittance requirements. Impact of in-state order acceptanceversus telephone, direct mail or Internet solicitation, dropshipments, distribution from out-of-state, delivery in companytrucks, warehousing, national versus local advertising,collection, financing, other service activities. Destination andtitle passage issues. Economic, physical, electronic presenceand their tax consequences. How to respond to nexusquestionnaires. Recent administrative, court and legislativedevelopments.Taxation of Services, Software, Leasesand Other Special TransactionsApplication of sales and use taxes to the various forms ofcomputer software — canned, custom, electronic, load-andleave;pure services and mixed transactions; installation andfabrication labor; repairs and warranties; leases, short-termrentals, installment sales, sale/leasebacks, leases with anoperator; sales of assets in mergers, acquisitions, liquidationsor corporate reorganizations; sales to government, exemptand charitable organizations; construction contractors.Supporting the exemptions — problems of proof. Planningand refund opportunities.ProblemsPractical application of the concepts presented.Determining the Taxable BaseThe inclusion or exclusion of specific items in determiningthe gross proceeds or sales upon which the tax is based.Treatment of cash and trade discounts, coupons, rebates,returns and allowances, transportation expenses, trade-ins,finance charges, repossessed property, bad debts and taxespaid to other jurisdictions. Impact of the sep arately statedrule on the taxability of gross receipts and how transactionsmay be structured to minimize the im position of tax.Hot Topics in Sales and Use TaxationThe latest administrative, court and legislative developmentson various hot topics in sales and use taxation suchas: qualifying for the manufacturing and sale for resaleexemptions; how states are taxing intercompany, Internet,telecommunication, advertising and other services; sourcingissues in multijurisdictional transactions on the state andlocal level; procedural limitations on refunds and assessments;and more, with a focus on the planning and refundopportunities arising therefrom.Ethics and Managing the Sales and Use Tax FunctionStructuring the sales and use tax function to maximizeeffectiveness while complying with personal ethical standardsand those set by the AICPA, ABA, local state CPA societiesand bar associations. Organizing and maintaining electronicrecords that can be trusted. Motivating and training staff toapply sales and use tax laws correctly to both purchases andsales. Cost saving strategies. Using computer software programsto manage exemption certificates and file sales anduse tax returns.Preparing for Audits and LitigationHow to handle a sales or use tax audit, from the arrivalof the audit notice to the post-audit review. Ethical considerations.Statistical samplings – their benefits and burdens.Analyzing whether to protest an assessment to the administrative,trial and appellate levels. Working effectively withoutside counsel.REGISTRATIONThe registration fee is $825 for the two-day conference and includes continental breakfast, refreshments, specially-prepared seminar materials,and a cocktail reception the first evening of the program. A $30 discount is available if payment accompanies the registration form and is receivedby Interstate Tax Corporation no later than four weeks before a conference date (October 11-TX, October 18-IL, November 8-DC). See page 6for participating speakers, hotel/airfare/car rental discounts and other details, page 8 to register, or call (203) 854-0704 for further information.– 4 –

INTER<strong>STATE</strong> TAX PLANNINGNovember 10-12Embassy Suites DallasDallas, TXNovember 17-19Hotel IntercontinentalChicago, ILDecember 8-10Doubletree HotelWashington, DCn An intensive three-day immersion into the concepts, problems and planning opportunities involved primarily with state income taxation ofmultistate business. This course is designed for the beginner to intermediate level practitioner; however, even the most experienced state taxprofessional will obtain practical ideas and valuable information concerning the latest administrative, judicial and legislative developments ininterstate taxation. Delivery Method: Group-Live. No advance preparation required. Estimated continuing education credit: 24.5 based on a50 minute hour, including 1 hour for ethics; 20.58 based on a 60 minute hour, including 1 hour for ethics.Jurisdiction and NexusConstitutional limitations on state powers to tax interstatebusiness. Protected solicitation and de minimis activities underPublic Law 86-272. Attributional nexus. Consequences of sellingover the Internet, through employees or independent contractors,advertising, delivering, owning or leasing property ina state, other issues. Dealing effectively with nexus questionnaires.The applicable standard for franchise, privilege,other non-income taxes and service companies.Unitary and Separate AccountingUnitary, combined, consolidated and separate returns: Whendoes the state or the taxpayer have the right to choose?Limitations on forced combination. Tests for determining whena business is unitary after Container and how they may be turnedinto planning opportunities for the astute tax practitioner.Business and Nonbusiness IncomeThe business/nonbusiness distinction as interpreted byUDITPA, Multistate Tax Compact and other states. The lateston the transactional versus functional tests. State taxationof capital gains, dividends, interest, rents and royalties afterASARCO/Woolworth, Allied-Signal and Mead. Factor representationand adjustment opportunities.The Tax Base and Conformity IssuesState tax treatment of income from federal obligations,taxes paid to other jurisdictions, depreciation, net operatinglosses, 338(h)(10) transactions, passive investment companies,corporate distributions, foreign source income. Stateimposition of alternative minimum taxes and the use of otheralternative tax bases. Planning and refund opportunities.Flow-Through EntitiesState taxation of flow-through entities and their owners.Types of entities used. Conformity, nexus, unitary, apportionmentand tax base issues. Planning opportunities.Ethics and Managing the State Tax FunctionOrganizing state tax planning, compliance and audit activitiesin light of Sarbanes-Oxley, Fin 48 and other developments thathave made ethics a more important part of the state tax practice.Improving state tax department image. Conducting effectivestate tax research that can be relied upon. How computerizationof state tax returns helps or hinders the state tax function.REGISTRATIONThe registration fee is $1075 for the three-day conference and includes continental breakfast, refreshments, specially-prepared seminar materials, anda cocktail reception the first evening of the program. A $40 discount is available if payment accompanies the registration form and is received byInterstate Tax Corporation at least four weeks before a conference date (October 13-TX, October 20-IL, November 10-DC). An additional discount of$75 may be taken only by those practitioners who attend both Sales & Use and Interstate Tax Planning (all week). See page 6 for participatingspeakers, hotel/airfare/car rental discounts and other details, page 8 to register, or call (203) 854-0704 for further information.– 5 –The Property FactorRelevant property and the timing of its inclusion. Capitalizingleasehold interests. Using original cost, net book value, basisor fair market value to measure the property factor. Impactof depreciation strategies on, and the role of inventories in,the formula. Situs issues. Treatment of specialized industries.The Payroll FactorScope of the payroll factor — wages, salaries and otherpersonal service compensation. Treatment of managementfees, partnership reimbursements, outside contractors, leasedor shared employees, specialized industries. Ascertaining theplace where services are performed — defining “incidentalservices” and “base of operations.” Using the cash versusaccrual method.The Sales FactorType of receipts included and the proper sourcing methodto apply. Treatment of returns, allowances, installment and occasionalsales, discounts; services, rents, royalties, investmentincome, other intangibles. Throwback, throwout and dock sales.Current DevelopmentsCurrent administrative, court and legislative developments onsuch critical interstate tax topics as: whether states may denyrefunds of unconstitutional taxes or limit the applicability ofNOLs; challenges to discriminatory state tax statutes; how statesdefine the unitary concept and business/nonbusiness distinction;jurisdictional standards after Wrigley, Quill and Geoffrey;apportionment sourcing issues for services and other industries;procedural traps for the unwary; changes to state tax systemssuch as those enacted by Kentucky, Michigan, Ohio and Texas.Planning and refund opportunities.Problems SessionPractical application of the concepts presented.State and Multistate Tax AuditsThe audit process – from information requests and extensionsof the statute to the final conference. Ethical considerations.Dealing with the consequences of centralized versusdecentralized records. Handling a Multistate Tax Commissionaudit. Conducting audits in an electronic environment. Theburden of monitoring unclaimed property: reporting responsibilities,recovering funds, potential audits.

SEMINAR INFORMATIONRegistrations will be confirmed by e-mail upon receipt of the completedapplication form and payment. The e-mail will include your admissionticket, a printed copy of which must be presented at Formal Registration(see below). Please call us if you have not received your confirmation atleast one week before the seminar. All seminar fees must be paid in fullbefore entry to the meeting room.Formal Registration will take place on the first day of the conference outsidethe meeting room at 7:45 AM. Dress is business casual. Please bring aprintout of your admission ticket, as you will need it to get your badge andcourse materials. Badges should be worn to ensure admission to each sessionand to the cocktail reception given the first evening of each conference.The Meetings Start at 8:15 AM on the first day, adjourn at 5:00 PM onthe first day or days, and conclude at 4:15 PM on the last day.Cancellations, Transfers, Substitutions. Cancellation qualifies for refund,less a nonrefundable registration fee of $75, if received in writing byInterstate Tax Corporation no later than two weeks before a conferencedate. No refunds or transfers will be allowed for cancellations receivedafter this date. Refunds for timely cancellation will be given after all thecourses have concluded. Transfers are treated as cancellations and aresubject to the same fees and timing limitations. Substitutions, with noticeto Interstate Tax Corporation in writing, are permissible at any time withoutpenalty. For additional information regarding administrative policies suchas complaint and refund, please contact our office at (203) 854-0704.Continuing Education Credit is required for attorneys and CPAs by manyprofessional organizations and governmental agencies. Our courses aredesigned to meet CPE, enrolled agent and CLE credit standards. Thosewho request such credit on the registration form will receive a letter bymail after the conference certifying their attendance and the amount ofcredit hours earned.NASBA. Interstate Tax Corporation is registered with the National Associationof State Boards of Accountancy (NASBA) as a sponsor of continuing professionaleducation on the National Registry of CPE Sponsors. State boardsof accountancy have final authority on the acceptance of individual coursesfor CPE credit. Complaints regarding registered sponsors may be addressedto NASBA, 150 Fourth Avenue North, Suite 700, Nashville, TN 37219-2417.Web site: www.nasba.org.Hotel Accommodations are arranged and paid for by the registrants themselves.A block of rooms at discounted rates has been reserved at eachof the hotels listed below until one month before the conference dates;thereafter, reservations will be taken on a space and rate available basis.You must call the hotel directly, not the 800 number, and mention InterstateTax Corporation in order to receive the applicable discounts and any amenitiesgiven specially to our group (see the Travel and Lodging page on ourwebsite, http://www.interstatetaxcorp.com/hotelsfall.htm, for completedetails). If you have any difficulty securing a sleeping room at the discountedrate, even after the cut-off date, please call our Meeting Coordinatorat (203) 854-0704 for assistance. We urge you to make your hotel andtravel plans early to avoid disappointment.Chicago, ILIntercontinental Chicago505 N. Michigan AvenueChicago, IL 60611(312) 944-4100Discounted Rate:$219 Single/DoubleStamford, CTStamford Marriott243 Tresser BoulevardStamford, CT 06901(203) 357-9555Discounted Rate:$152 Single/DoubleDallas, TXEmbassy Suites Dallas Galleria14021 Noel RoadDallas, TX 75240(972) 364-3640Discounted Rate:$109 Single/DoubleWashington, DCDoubletree Hotel1515 Rhode Island Avenue NWWashington, DC 20005(202) 232-7000Discounted Rate:$189 Single/DoubleAirline and Car Rental Discounts are available. A discount of 5% off thelowest quoted fares may be obtained by visiting American Airlines at AA.comre: Promotion Code 88H0AT for the October conferences, 49N0AD for theNovember conferences, and 82D0AA for the December conferences. Discountson car rentals may be obtained by visiting Avis at Avis.com re: AWD # D002760.Government Discounts are available. Please call (203) 854-0704 forfurther information.Tape or Digital Recording of Interstate Tax Corporation meetings is prohibited.Please turn off all electronic devices upon entering the meeting room.SPEAKERSListed below are the speakers scheduled to participate in the Fall 2010 conference series. Conferences (INT-income, S&U-sales & use) and locations(i.e., CT, TX, IL, DC) are indicated next to each name. Please note that some names may be added and/or changed.Mary Benton, Partner, <strong>Alston</strong> & <strong>Bird</strong> <strong>LLP</strong>,Atlanta, GA (INT-DC)J. Elaine Bialczak, Director, Compton &Associates <strong>LLP</strong>, Marietta, GA (S&U-TX)Michele Borens, Partner, Sutherland,Washington, DC (INT-DC)Ronald L. Bueing, Member, Pivotal Law Group,Seattle, WA (S&U-TX)Emily Burke, Senior Sales Tax Manager, GECapital, Danbury, CT (S&U-CT)Nicole Crighton, Principal, KPMG <strong>LLP</strong>, NewYork, NY (INT-CT)Douglas J. DeRito, Principal, Ryan, Inc.,Atlanta, GA (S&U-CT)Maryann Evans, Senior Manager, KPMG <strong>LLP</strong>,Washington, DC (INT-CT, DC)C. Eric Fader, Partner, Horwood, Marcus &Berk, Chicago, IL (INT-TX, IL; S&U-IL, DC)Lynn A. Gandhi, Partner, Honigman, Miller,Schwartz & Cohn <strong>LLP</strong>, Detroit, MI (INT-CT;S&U-DC)Jeffrey C. Glickman, Partner, <strong>Alston</strong> & <strong>Bird</strong><strong>LLP</strong>, Atlanta, GA (INT-IL)Jordan M. Goodman, Partner, Horwood,Marcus & Berk, Chicago, IL (INT, S&U-IL)Frank Guerino, Executive Director, Ernst &Young <strong>LLP</strong>, Iselin, NJ (S&U-CT)June Summers Haas, Partner, Honigman,Miller, Schwartz & Cohn <strong>LLP</strong>, Lansing, MI(S&U-DC)John B. Harper, Director, KPMG <strong>LLP</strong>, LosAngeles, CA (INT-TX)Kendall L. Houghton, Partner, Baker &McKenzie <strong>LLP</strong>, Washington, DC (INT-DC)David A. Hughes, Partner, Horwood, Marcus& Berk, Chicago, IL (INT-CT)Kathryn M. Jaques, Instructor, San Diego StateUniversity, San Diego, CA (S&U-CT; INT-TX, IL)Maryann H. Luongo, Associate, Baker &McKenzie <strong>LLP</strong>, Washington, DC (INT-DC)Fred O. Marcus, Partner, Horwood, Marcus &Berk, Chicago, IL (INT-IL)– 6 –Caryl Nackenson-Sheiber, Attorney/Editor,Interstate Tax Insights, Norwalk, CT (INT,S&U-CT, TX, IL, DC)Jill Nielsen, Managing Director, KPMG <strong>LLP</strong>,Chicago, IL (S&U-IL)Brian D. Pedersen, Managing Director, Alvarez& Marsal Taxand, LLC, Seattle, WA (INT-TX)Gerard Quinlan, Principal, Ryan, Inc., Dallas,TX (S&U-TX)Donald Roveto III, Managing Director, Alvarez &Marsal Taxand, LLC, New York, NY (INT-CT)Frank Schaefer, Executive Director, GrantThornton <strong>LLP</strong>, Edison, NJ (INT-DC)Richard H. Thompson, Principal, Ryan, Inc.,Dallas, TX (S&U-TX)Joseph A. Vinatieri, Partner, Bewley, Lassleben& Miller <strong>LLP</strong>, Whittier, CA (S&U-TX)Aaron M. Young, Partner, Reed Smith <strong>LLP</strong>, NewYork, NY (INT-CT, IL)Kenneth T. Zemsky, Partner, Ernst & Young<strong>LLP</strong>, New York, NY (INT, S&U-CT)Jennifer A. Zimmerman, Partner, Horwood,Marcus & Berk, Chicago, IL (S&U-IL)

INTER<strong>STATE</strong> TAX INSIGHTSInterstate TaxI N S I G H T SCaryl Nackenson-Sheiber, Editor-in-ChiefWayne Farms: The Alabama Administrative Law DivisionOverrules Its Own State LegislatureIngredient or Component Part ExemptionOn January 14, 2008, the Alabama Administra -tive Law Division misconstrued and eviscerated 66years of Alabama sales tax law when it denied thetaxpayerʼs application for rehearing in Wayne FarmsLLC v. Alabama Department of Revenue. 1 The divisionrefused to exempt as an ingredient or componentpart carbon dioxide sprayed onto chickens tocool them during processing because the resultingpresence of the carbon dioxide was “merely incidental”to the cooling function. This never has beenthe test for allowing the ingredient exemption inAlabama. The divisionʼs action rejects its own earlierobjective analysis of Alabama Code Section 40-23-1(a)(9), which defines “wholesale sale,” andoverrules the Alabama Legislatureʼs amendments tothe statute.IN THIS ISSUEWayne Farms: The Alabama Administrative Law DivisionOverrules Its Own State Legislatureby J. Elaine Bialczak . . . . . . . . . . . . . . . . . . . . . . . . . . page 1From the Editor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . page 2J. ELAINE BIALCZAKInitial Decision in Wayne FarmsitiWayne Farms sprays carbon dioxide on chickenstwice while processing them: first, to cool the chickenafter cooking, and second, during packaging tofreeze and preserve the chicken for shipment.Wayne Farms initially paid sales tax on its purchasesof carbon dioxide, but then requested a refundbased on its claim that the carbon dioxide becamean exempt ingredient and component part of thechicken. 2 It also asserted that the second application[contʼd on p.2]J. ELAINE BIALCZAK is a Director with Compton &Associates, <strong>LLP</strong> in Marietta, GA. She received her B.A. fromThe Ohio State University and J.D. from The Ohio StateUniversity College of Law.Copyright 2008. ISSN 1092-2180. The articles con tainedherein do not necessarily represent the views of the editorialboard of Interstate Tax Insights.n Since 1990, Interstate Tax Corporation has provided its unique coverage ofdevelopments in state taxation of multistate business through its publication,first entitled Interstate Tax Report, now Interstate Tax Insights. With the helpof authors who are active practitioners in the field, Interstate Tax Insights hasexamined current interstate tax cases, legislation, incentives, trends and planningopportunities on an ongoing basis.n Earlier issues of ITI have included in-depth articles on how to comply withthe Texas “margin” and Ohio Commercial Activity taxes, Commerce Clausechallenges to Pennsylvania tax statutes, the Cuno decision and its potentialeffect on the future of state tax incentives, the Alabama manufacturing exemption,recent developments involving California’s water’s edge election, and more.n Upcoming articles will discuss South Carolina litigation concerning combinedreporting as an option under UDITPA Section 18- relief from unfair apportionment,Wisconsin developments regarding the distinction between canned andcustom software, challenges to New York’s website “linking” nexus statute andNew Jersey’s throwout rule, the latest on the Streamlined Sales Tax Project,and other hot topics in interstate taxation.Grocers Association Challenges Ohio CommercialActivity Taxby Caryl Nackenson-Sheiber . . . . . . . . . . . . . . . . . . . . page 5Pennsylvania Courts Interpret Various Tax ProvisionsUnder The Commerce Clause: Part IIIby Stewart M. WeintraubDrew Alexander Morris . . . . . . . . . . . . . . . . . . . . . . . . page 8Interstate Tax Insights (formerly Interstate Tax Report)is published by Interstate Tax Corporation. Regularsubscription rates are $150 for 6 issues. To subscribe,contact Interstate Tax Corporation at 83 East Avenue,Suite 110, Norwalk, CT 06851 or call (203) 854-0704.n Why not subscribe today and join your colleagues who are already benefitingfrom the in-depth analyses and tax savings ideas that appear regularly inInterstate Tax Insights?EDITOR-IN-CHIEFCaryl Nackenson-SheiberEDITORIAL BOARDASSISTANT EDITORSSophia KiriakidisHarvey R. SheiberGeorge T. BellMorgan, Lewis & BockiusHarrisburg, PAAmy EisenstadtGeneral Electric CompanyAsheville, NCRichard A. LeavySidley AustinNew York, NYFrank SchaeferGrant ThorntonEdison, NJJ. Elaine BialczakCompton & AssociatesMarietta, GABrian L. BrowdyThe Browdy Law FirmChicago, ILJ. Whitney ComptonCompton & AssociatesMarietta, GAJames M. Ervin, Jr.Holland & KnightTallahassee, FLPaul H. FrankelMorrison & FoersterNew York, NYJames W. HeatheringtonHeatherington & Fields, CPAsTulsa, OKFred O. MarcusHorwood Marcus & BerkChicago, ILJ. Mark McCormickAlvarez and Marsal TaxandAtlanta, GARichard D. PompUniversity of ConnecticutSchool of LawHartford, CTPatrick R. Van TiflinHonigman MillerSchwartz & CohnLansing, MIStewart M. WeintraubChamberlain & HrdlickaWest Conshohocken, PAFrank YanoverGeneral Electric CompanyAlbany, NYFranklin G. DincesThe Dinces Law FirmGig Harbor, WAJames P. KleierReed SmithSan Francisco, CADonna RutterHartman Leito & BoltFort Worth, TXKenneth T. ZemskyErnst & YoungNew York, NYTO SUBSCRIBEA full year’s subscription to Interstate Tax Insights is currently available to new subscribers only at the rate of $100 for 6 issues (a $50 discountoff our cover price). But you must act quickly! In order to qualify for this special price, your subscription and payment must be received byInterstate Tax Corporation no later than February 19, 2011. See page 8 to subscribe or call (203) 854-0704 for further information. We lookforward to having you as an ITI subscriber.– 7 –

<strong>STATE</strong> <strong>TAXATION</strong> <strong>OF</strong> MULTI<strong>STATE</strong> <strong>BUSINESS</strong>FALL 2010 REGISTRATION FORMSponsored By:INTER<strong>STATE</strong> TAX CORPORATION83 East Avenue, Suite 110Norwalk, CT 06851(203) 854-0704www.interstatetaxcorp.comLook Inside For:n TOPICS & SPEAKERSn CPE/CLE CREDITn NETWORKING OPPORTUNITIESn COMPREHENSIVE TRAININGAND UPDATES ONINTER<strong>STATE</strong> TAX ISSUESPLEASE DO NOT DETACH–RETURN ENTIRE PAGE WITH ORIGINAL MAILING LABEL.ADVANCED INTER<strong>STATE</strong>-$825***n October 25-26, Stamford, CTn Early Payment Discount ($30)*ADVANCED SALES & USE-$825***n October 27-28, Stamford, CTn Early Payment Discount ($30)*n Discount All 4 Days (Adv.) ($50)SALES & USE TAX PLANNING-$825***n November 8-9, Dallas, TXn November 15-16, Chicago, ILn December 6-7, Washington, DCn Early Payment Discount ($30)*INTER<strong>STATE</strong> TAX PLANNING-$1075***n November 10-12, Dallas, TXn November 17-19, Chicago, ILn December 8-10, Washington, DCn Early Payment Discount ($40)*n Discount All 5 Days (S&U & INT) ($75)CONTINUING EDUCATION CREDITn Attorney n CPA n Enrolled Agentn License # ____________________________________n Accrediting Org._____________________________________________________________________________(e.g., Texas Board of Accountancy)INTER<strong>STATE</strong> TAX INSIGHTSn 6 Issues — $100***n Conn. subscribers, please add 6% sales tax***All fees must be paid in U.S. dollarsTOTALFEES___________________________________________________________TO REGISTER: Please complete this form and send the entire pagewith full payment to Interstate Tax Corporation. Use photo copies foradditional registrants (and yourself, if you wish to keep the brochureintact). You may fax credit card registrations only to (203) 853-9510,or mail your registration (with check or credit card authorization) to:Registrar, Interstate Tax Corporation, Dept. WS83 East Avenue, Suite 110, Norwalk, CT 06851Name ________________________________________________________Title __________________________________________________________Organization __________________________________________________Address ______________________________________________________City, State, Zip ________________________________________________Phone __________________________ Fax _________________________E-mail ________________________________________________________n Check enclosed (payable to Interstate Tax Corporation)I authorize you to charge my n Visa n MasterCard n AmexCard Number _____________________________________________Cardholder Name __________________________________________Signature ________________________________ Exp. Date ________*Early payment discounts will not be accepted for registrations received by InterstateTax Corporation later than four weeks before a conference date and/or unaccompaniedby payment. We will not be responsible for delays in the U.S. mail. Seepages 2, 3, 4 and 5 for the relevant cut-off dates.