Tokyo Morning Meeting Comment - Mizuho

Tokyo Morning Meeting Comment - Mizuho

Tokyo Morning Meeting Comment - Mizuho

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

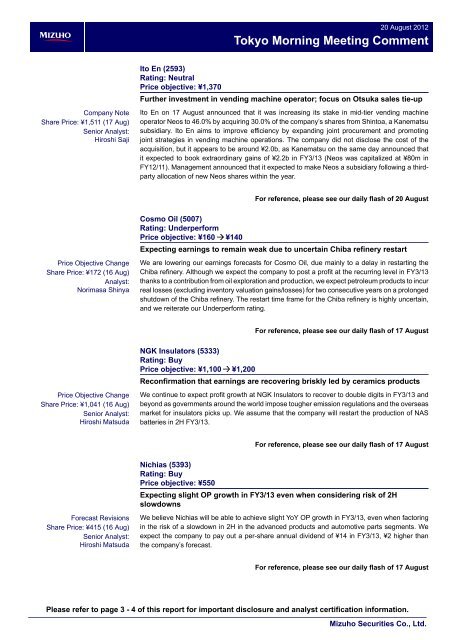

....20 August 2012<strong>Tokyo</strong> <strong>Morning</strong> <strong>Meeting</strong> <strong>Comment</strong>Company NoteShare Price: ¥1,511 (17 Aug)Senior Analyst:Hiroshi SajiIto En (2593)Rating: NeutralPrice objective: ¥1,370Further investment in vending machine operator; focus on Otsuka sales tie-upIto En on 17 August announced that it was increasing its stake in mid-tier vending machineoperator Neos to 46.0% by acquiring 30.0% of the company’s shares from Shintoa, a Kanematsusubsidiary. Ito En aims to improve efficiency by expanding joint procurement and promotingjoint strategies in vending machine operations. The company did not disclose the cost of theacquisition, but it appears to be around ¥2.0b, as Kanematsu on the same day announced thatit expected to book extraordinary gains of ¥2.2b in FY3/13 (Neos was capitalized at ¥80m inFY12/11). Management announced that it expected to make Neos a subsidiary following a thirdpartyallocation of new Neos shares within the year.For reference, please see our daily flash of 20 AugustPrice Objective ChangeShare Price: ¥172 (16 Aug)Analyst:Norimasa ShinyaCosmo Oil (5007)Rating: UnderperformPrice objective: ¥160 ¥140Expecting earnings to remain weak due to uncertain Chiba refinery restartWe are lowering our earnings forecasts for Cosmo Oil, due mainly to a delay in restarting theChiba refinery. Although we expect the company to post a profit at the recurring level in FY3/13thanks to a contribution from oil exploration and production, we expect petroleum products to incurreal losses (excluding inventory valuation gains/losses) for two consecutive years on a prolongedshutdown of the Chiba refinery. The restart time frame for the Chiba refinery is highly uncertain,and we reiterate our Underperform rating.For reference, please see our daily flash of 17 AugustPrice Objective ChangeShare Price: ¥1,041 (16 Aug)Senior Analyst:Hiroshi MatsudaNGK Insulators (5333)Rating: BuyPrice objective: ¥1,100 ¥1,200Reconfirmation that earnings are recovering briskly led by ceramics productsWe continue to expect profit growth at NGK Insulators to recover to double digits in FY3/13 andbeyond as governments around the world impose tougher emission regulations and the overseasmarket for insulators picks up. We assume that the company will restart the production of NASbatteries in 2H FY3/13.For reference, please see our daily flash of 17 AugustForecast RevisionsShare Price: ¥415 (16 Aug)Senior Analyst:Hiroshi MatsudaNichias (5393)Rating: BuyPrice objective: ¥550Expecting slight OP growth in FY3/13 even when considering risk of 2HslowdownsWe believe Nichias will be able to achieve slight YoY OP growth in FY3/13, even when factoringin the risk of a slowdown in 2H in the advanced products and automotive parts segments. Weexpect the company to pay out a per-share annual dividend of ¥14 in FY3/13, ¥2 higher thanthe company’s forecast.For reference, please see our daily flash of 17 AugustPlease refer to page 3 - 4 of this report for important disclosure and analyst certification information.<strong>Mizuho</strong> Securities Co., Ltd.

.20 August 2012Forecast RevisionsShare Price: ¥2,856 (16 Aug)Senior Analyst:Hidekatsu WatanabeForecast RevisionsShare Price: ¥2,740 (17 Aug)Senior Analyst:Toshio TakahashiHamamatsu Photonics (6965)Rating: NeutralPrice objective: ¥2,800No strong recovery, little slowdown risk; expect shares to stay at current levelWe are making slight adjustments to our forecasts for Hamamatsu Photonics, but our views onthe company remain more or less unchanged. While the earnings outlook remains unclear, weexpect the shares to trend around the current level in the near term..Don Quijote (7532)Rating: BuyPrice objective: ¥4,100For reference, please see our daily flash of 17 AugustStrong earnings in FY6/12, mainly in core business; focusing on more openingsof New Mega Don Quijote formatDon Quijote announced FY6/12 results on 17 August. OP rose 15.7% YoY to a level slightlyexceeding our forecast. We note that the company upwardly revised its earnings targets on 15August. We are making no substantial changes to our earnings estimates, and remain focusedon the potential for an improvement in profit margins and an expansion in earnings as a resultof the company accelerating store openings in the New Mega Don Quijote format. We reiterateour Buy rating.For reference, please see our daily flash of 20 August<strong>Tokyo</strong> <strong>Morning</strong> <strong>Meeting</strong> <strong>Comment</strong> 2<strong>Mizuho</strong> Securities Co., Ltd.

20 August 2012| Companies Mentioned in this ReportCode Company Name Rating Price 8/172593 Ito En Neutral ¥1,5115007 Cosmo Oil Underperform ¥1725333 NGK Insulators Buy ¥1,0425393 Nichias Buy ¥4126965 Hamamatsu Photonics Neutral ¥2,8477532 Don Quijote Buy ¥2,740Note: NR = Not RatedSource: <strong>Mizuho</strong> Securities Equity ResearchImportant Disclosure Information■■Within the past 12 months, <strong>Mizuho</strong> Securities Co., Ltd. and / or its affiliate(s) managed or co-managed a public offering of securities of Ito En.<strong>Mizuho</strong> Securities Co., Ltd. and / or its affiliate(s) received compensation in the past 12 months, or expects to receive or intends toseek compensation in the next 3 months for investment banking services from: Ito En, Cosmo Oil, NGK Insulators, Nichias, HamamatsuPhotonics, Don Quijote.<strong>Tokyo</strong> <strong>Morning</strong> <strong>Meeting</strong> <strong>Comment</strong> 3<strong>Mizuho</strong> Securities Co., Ltd.

<strong>Tokyo</strong> <strong>Morning</strong> <strong>Meeting</strong> <strong>Comment</strong>20 August 2012<strong>Mizuho</strong> Securities Ratings<strong>Mizuho</strong> Securities investment ratings are based on the following definitions.Ratings and price objectives are based on returns expected over the next 6 -12 months.Buy: Stocks for which our price objective, as of the date it is set, exceeds the share price by 10% or more and which are not classifiedas "Underperform" under the guidelines for distribution of ratings detailed below.Neutral: Stocks for which our price objective, as of the date it is set, is within 10% of the share price (either above or below) and which arenot classified as "Underperform" under the guidelines for distribution of ratings detailed below.Underperform : Stocks for which our price objective, as of the date it is set, falls below the share price by 10% or more or stocks classified as"Underperform" under the guidelines for distribution of ratings detailed below.RS: Rating Suspended - rating and price objective temporarily suspended.NR: No rating - not covered, and therefore not assigned a rating.Guidelines for distribution of ratings: When fewer than 10% of the companies within a defined coverage universe (composed of companies withcommon attributes, covered by one or more analysts) have "Underperform" ratings, "Underperform" ratings are applied to 10% of the companies,rounded to the nearest whole number, beginning with those with the lowest implied upside. (These relative distribution guidelines apply only whenthe coverage universe is composed of six or more companies. There may be periods when the number of companies with “Underperform” ratingstemporarily does not meet these guidelines.)Information can be found on the <strong>Mizuho</strong> Securities Equity Research website (<strong>Mizuho</strong>ResearchWEB) under “Disclosure Data” as to the proportion of all research ratings published duringthe last quarter that were in rating categories “Buy”, “Neutral”, and “Underperform”, and information on the proportion of companies within each category to which <strong>Mizuho</strong> Securities providedinvestment banking services during the last 12 months.Analyst CertificationThe research analyst(s) listed on the cover page of this report certifies(y) that the views expressed in this research report accurately reflect analyst's(s') personal views about the subjectsecurity(ies) and issuer(s) and that no part of his/her/their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or views expressed in thisresearch report.DisclaimerThis report has been prepared by <strong>Mizuho</strong> Securities Co., Ltd. (‘<strong>Mizuho</strong> Securities’) solely for the purpose of supplying information to the clients of <strong>Mizuho</strong> Securities and/or its affiliates towhom it is distributed. This report is not, and should not be construed as, a recommendation, solicitation or offer to buy or sell any securities or related financial products.This report has been prepared by <strong>Mizuho</strong> Securities solely from publicly available information. The information contained herein is believed to be reliable but has not been independentlyverified. <strong>Mizuho</strong> Securities makes no guarantee, representation or warranty and accepts no responsibility or liability as to the accuracy, completeness or appropriateness of such information.Information contained herein may not be current due to, among other things, changes in the financial markets or economic environment. Opinions reflected in this report are subject tochange without notice.This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The report has been prepared without regard to the individual financialcircumstances, needs or objectives of persons who receive it. The securities and investments related to the securities discussed in this report may not be suitable for all investors. Readersshould independently evaluate particular investments and strategies, and seek the advice of a financial adviser before making any investment or entering into any transaction in relationto the securities mentioned in this report.<strong>Mizuho</strong> Securities accepts no legal responsibility from any investor who directly or indirectly receives this material. The final investment decision must be made by the investor and theresponsibility for the investment must be taken by the investor.Past performance should not be taken as an indication or guarantee of future performance. Unless otherwise attributed, forecasts of future performance represent analysts’ estimates basedon factors they consider relevant. Actual performance may vary. Consequently, no express or implied warranty can be made regarding future performance.Any references in this report to <strong>Mizuho</strong> Financial Group (‘MHFG’) and/or its affiliates are based only on publicly available information. The authors of this report are prohibited from usingor even obtaining any insider information. As a subsidiary of MHFG, <strong>Mizuho</strong> Securities does not, as a matter of corporate policy, cover MHFG for investment recommendation purposes.<strong>Mizuho</strong> Securities or other companies affiliated with MHFG may deal in securities referred to in this report, or derivatives of such securities or other securities issued by companies mentionedin this report, for its own account or the accounts of others, enter into transactions contrary to any recommendations contained herein, and may supply a wide range of financial services tothe issuers of such securities and to their affiliates. <strong>Mizuho</strong> Securities is prohibited under Article 135 of the Corporation Law from dealing in the shares of MHFG for its own account.United Kingdom/European Economic Area: This report is distributed in the United Kingdom by <strong>Mizuho</strong> International plc (MHI), Bracken House, One Friday Street, LondonEC4M 9JA, a member of MHFG. MHI is authorized and regulated by the Financial Services Authority and is a member of the London Stock Exchange. For the avoidance of doubt thisreport is not intended for retail clients. This report may be distributed in other member states of the European Economic Area. Details of organizational and administrative controls for theprevention and avoidance of conflicts of interest can be found at https://uk.mizuho-sc.com.United States: <strong>Mizuho</strong> Securities USA Inc., a member of MHFG, 320 Park Avenue, New York, NY 10022, USA, contact number +1-212-209-9300, distributes this report in the United Statesand takes responsibility for it. Any transactions by US investors resulting from the information contained in this report may be effected only through <strong>Mizuho</strong> Securities USA Inc. InterestedUS investors should contact their <strong>Mizuho</strong> Securities USA Inc. sales representative.Japan: This report is distributed in Japan by <strong>Mizuho</strong> Securities Co., Ltd., a member of MHFG, Otemachi First Square Otemachi 1-chome, Chiyoda-ku, <strong>Tokyo</strong> 100-0004, Japan. RegisteredFinancial Instruments Firm, No. 94 (Kinsho), issued by the Director, Kanto Local Finance Bureau. Member of Japan Securities Dealers Association, the Japan Investment AdvisersAssociation, Financial Futures Association of Japan, and the Type II Financial Instruments Firms Association.Asia ex-Japan: This report is being distributed in Asia ex-Japan by <strong>Mizuho</strong> Securities Asia Limited, 12th Floor, Chater House, 8 Connaught Road, Central, Hong Kong, S.A.R., The People'sRepublic of China.© <strong>Mizuho</strong> Securities Co., Ltd. All Rights Reserved 2012. This document may not be altered, reproduced or redistributed, or passed on to any other party, in whole or in part, without theprior written consent of <strong>Mizuho</strong> Securities Co., Ltd.<strong>Mizuho</strong> Securities charges a commission on equity transactions up to a maximum of 1.20750% of the contract amount, tax included. The minimum commission isJPY2,625, tax included.The value of equities may go down or up as prices fluctuate. Owners of equities may suffer losses on the original value of their purchases.Equity ResearchOtemachi First Square, 5-1 Otemachi 1-chomeChiyoda-ku, <strong>Tokyo</strong> 100-0004, Japan