Severance and TRW Heritage Retirement Overview - Benefits Online

Severance and TRW Heritage Retirement Overview - Benefits Online

Severance and TRW Heritage Retirement Overview - Benefits Online

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

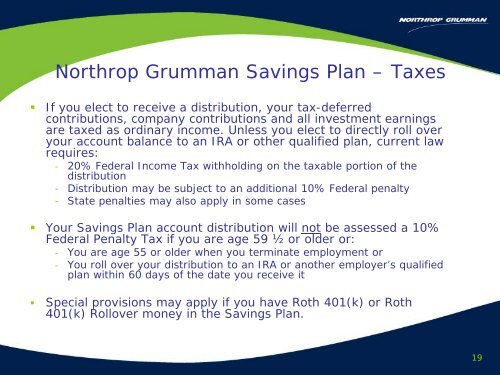

Northrop Grumman Savings Plan – Taxes• If you elect to receive a distribution, your tax-deferredcontributions, company contributions <strong>and</strong> all investment earningsare taxed as ordinary income. Unless you elect to directly roll overyour account balance to an IRA or other qualified plan, current lawrequires:- 20% Federal Income Tax withholding on the taxable portion of thedistribution- Distribution may be subject to an additional 10% Federal penalty- State penalties may also apply in some cases• Your Savings Plan account distribution will not be assessed a 10%Federal Penalty Tax if you are age 59 ½ or older or:- You are age 55 or older when you terminate employment or- You roll over your distribution to an IRA or another employer’s qualifiedplan within 60 days of the date you receive it• Special provisions may apply if you have Roth 401(k) or Roth401(k) Rollover money in the Savings Plan.19