Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

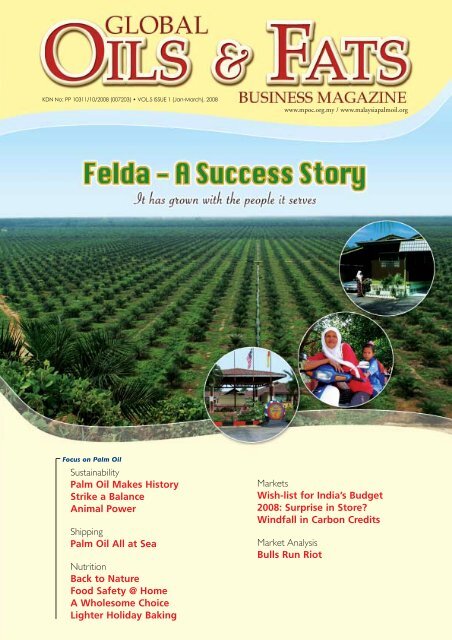

Cover Story6GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Just 51 years ago, the Federal LandDevelopment Authority (Felda) ofMalaysia was seen as a developmentagency for land settlers.Today, it savours anew image as one of the world’s largestplantation conglomerates.Established with the objective of carryingout land development and resettlement ofthe landless, it has to date developed853,313ha of land and resettled 112,635families.Felda has since diversified into many sectorswith palm oil as the core business. In the processof development, it has given special attention tosustainable palm oil production, coveringeconomic, social and environmental factors.In implementing its original goals, it devised a‘Package Deal’ strategy covering:• Economic utilisation and development of sizableareas of unused or undeveloped land, thus ensuringminimum cost and maximum returns;• Settling of deserving and qualified landless families on theland;• Infrastructure service such as transport and communicationfacilities in the settlement schemes;• Social and public amenities such as schools, clinics, water andelectricity supplies to settlers;• Processing and marketing facilities to ensure efficientproduction and fair prices for the settlers; and• Training and extension services for the promotion of goodagricultural husbandry and social development.The selection of settlers (Table 1) was based on ‘suitability criteria’and ‘needs criteria’. The ‘suitability criteria’ limited intake to thosebetween 18 and 35 years of age, and considered skills in agriculture.Other criteria included marital status, basic education, physical fitnessand absence of a criminal record.The ‘needs criteria’ covered largerfamily size and land to the landless or land with less than 2 acres.When settlers have repaid their loans, over a period of about 15years, they are eligible for a land title. In 1985, the governmentdecided on a land-share ownership system, under which settlerswould be allocated shares rather than individual plots.They were to be paid wages for working the land and, at the endof the year, receive a share of the profits. However, the settlerswere not receptive and the system was abandoned.By the end of 2006, some 73,262 settlers had received landtitles. To protect the interests of their spouses, the GroupSettlement Act 1960 was amended to allow for joint ownershipby the settler and his wife.Felda developed 720,076ha of oil palm and 86,183ha of rubberby 2005. The balance of 4,881ha is under sugarcane and othercrops. Total planted area stood at 811,140ha (Table 2). Landunder settlers’ ownership was recorded at 504,172ha (or 59.1%of the total). The balance of 349,141ha (40.9%) has no settlersbut is managed by Felda Plantation Sdn Bhd (FPSB).GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 20087

contributing further employment opportunities and reduction ofunder-employment in the rural farm sector.Land development has been instrumental in the growth oftownships like Serting, Jengka and Muadzam Shah in addition tostimulating the expansion of many towns in rural areas.Poverty eradicationIn lifting families out of poverty, Felda has made an importantcontribution to one of the main goals of the New EconomicPolicy. The settlers’ current monthly income of RM1,386(US$355) for oil palm and RM3,485 (US$893) for rubber is farabove the national poverty line of RM529 (US$139).Social stabilityWith the opening of inaccessible areas of the interior in Grik(Perak), Gua Musang (Kelantan) and Raub and Triang (Pahang) –previously hotbeds of communist activity – the influence ofsubversive elements on the rural population has been containedand a measure of stability and peace achieved. Currently, all theseplaces are thriving with social and business activities that benefita significant section of the population.The emphasis of the Entrepreneur Development Programme ison entrepreneur development, agro-based industries, the ‘OneRegion, One Industry’ model and the Modern Malaysian Project.Financial assistance is given in the form of soft loans of up toRM150,000 per settler to build production infrastructure and forbusiness-related training. The goal is to increase the number ofsettlers in non-farm activities with an earning capacity of RM600for workers and RM3,000 for the entrepreneur. Currently, about38% of the settlers are involved in such activities.The Felda Investment Co-operative (FIC) was created in 1980to encourage savings among settlers. With more than RM750million in the members’ fund and RM120 million in revenue, theFIC has grown into an avenue for alternative investment. Morethan 90% of its capital is subscribed by settlers and the rest byemployees of the Felda Group.Since its inception, the FIC has been highly successful insupplementing settlers’ income by paying out an annual dividendof between 12-15%. The New Income Model is envisaged toboost monthly income to RM2,500 comprising farm, non-farmand investment earnings.Human capitalThere is an increasing awareness of the importance of humancapital as a key factor for sustainable economic developmentand successful social transformation. In this respect, Felda hasconducted many programmes to expand the pool of educatedand skilled workers – it has trained settlers’ dependents invarious educational and technical fields at certificate and diplomalevels, while the Felda Foundation has provided educationalgrants and scholarships, as well as adopted schools.Non-farm strategySince prices of commodities fluctuate with market conditions,settlers cannot depend solely on farm income. As a cushion,Felda introduced non-farm activities to transform the settlersinto an entrepreneurial community.Challenges aheadAlmost half of the settlers are now above the age of 60. In thenext decade, almost 60% will be above 61 years old. At issue,therefore, are problems relating to aging and succession.As they age, it becomes necessary for settlers to hire farmworkers, which reduces their own income. There is also theproblem of identifying successors as not many of their childrenare interested in taking over the holdings. Many educated youthshave left for jobs and better prospects in urban centres. Incertain areas, Felda manages these holdings when thesettlers are no longer able to work.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 20089

Cover StoryProductivityUnder such circumstances, it hasbecome an increasing challenge forFelda to maintain the productivityof schemes.The implications of lowproductivity have a bearing on thesettler’s income. With lowincome, it will be difficult tocollect loans and otherdeductions. Therefore, Feldahas to ensure that the land isutilised effectively to maintain productivity andgenerate stable income.To overcome labour shortage and reduce thedependence on human resources,mechanisation of harvesting and fertiliserapplications has been widely implemented.Mechanical harvesters and fertiliserspreaders are used in many schemesmanaged by Felda co-operativeswhose members are settlers. Aerialmanuring was introduced toovercome shortage of labourin some schemes, althoughthis was discontinueddue to high costs.The realities brought about by the aging settlers necessitate anew income model that addresses declining productivity.ReplantingReplanting is a major current activity. It began in 1983 at FeldaChalok, Terengganu. To date, the total replanted area stands at236,820ha involving 68,751 settlers (Table 4). Over the years,various strategies and programmes have been implemented toensure replanting is carried out effectively as part of thesustainability initiative.To encourage settlers’ participation, Felda Technoplant Sdn Bhd(FTPSB) was established. Based on total replanted area involving82,444 settlers, almost 80% have chose to replant with Felda,indicating the success of the strategy.For the 13,693 settlers, who have replanted on their own – andare facing problems with their holdings – Felda has offered itsservices to manage the land by providing a monthly advance ofRM50/acre. A sum of RM50 million has been allocated torehabilitate these poorly-managed farms. Since the yield issustainable over a longer period of time, the settler’sincome can be maintained or higher in thecoming years.10GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Lessons learntFelda’s success can be attributed to many factors, especially theclose co-operation between the federal government, stategovernments, settlers, contractors, staff and management.In land development programmes, the people factor is critical.Therefore, social development programmes were instituted fromthe beginning to ensure harmony and peace in the schemes.In the management of funds, prudence and frugality have beenthe hallmark of financial management. Funding from variousbodies like federal government and the World Bank has beencrucial to developing the schemes.The ‘Package Deal’ strategy was successful in eliminatingmiddlemen and getting best value for the settlers.2. The settlers’ community must be turned into a middle-classgroup earning an average monthly income of RM2,500.3. Felda must become a global leader in the palm oil industry.4. It must develop second- and third-generation settlers into aprogressive community.5. Felda itself must be moulded into a strong institution.Programmes and activities have been drawn up to achieve theseobjectives. Some have been implemented and others are in theprocess of implementation.Felda is also assessing its position by benchmarking against thebest private plantation players in Malaysia and revisiting itsstrategies for settlers’ growth. The focus is on increasingproductivity of the smallholdings on par with, or better than, thebest private plantations.The ultimate test will be in creating a self-sufficient society thatis able to take care of the needs of the second and thirdgenerations on its own.The Felda model is being adapted elsewhere in terms ofconcept and structure. We have shared our experiences withmany developing countries and are now providing technicalassistance to Sierra Leone.Good Agriculture Practices and Good Management Practiceswill be exploited to boost the productivity, while striking abalance between development, environmental quality and thewell-being of settlers. Key elements such as sustainableplantation, economic and product sustainability will beincorporated.Five Thrusts for FeldaTo ensure Felda remains relevant in the next 50 years, thegovernment has outlined Five Thrusts that will help theorganisation to diversify, improve its technology, venture intocreating a ‘One Region, One Product’ concept, create moresmall- and medium-scale industries and tap the full potential ofthe younger generation:Dato’ Ahmad Tarmizi AliasDirector-GeneralFederal Land Development Authority, Malaysia1. Felda schemes must become a role model for traditionalvillages, equipped with modern infrastructure and a newstyle of living.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008 11

SustainabilityCertified sustainable palm oilis expected within monthsIndustry history was recorded on Nov 22, 2007, when theCertification Scheme for Sustainable <strong>Palm</strong> <strong>Oil</strong> was launchedin Kuala Lumpur, Malaysia.The Hon. Malaysian Minister of Plantation Industries andCommodities, Datuk Peter Chin Fah Kui, did the honours atthe fifth annual meeting (RT5) of the Roundtable onSustainable <strong>Palm</strong> <strong>Oil</strong> (RSPO), witnessed by 540 delegates from28 countries.With the certification system in place, the market is expected tosee the availability of RSPO Certified Sustainable <strong>Palm</strong> <strong>Oil</strong> in thefirst quarter of the year.The key elements of the framework are:•A certification standard which sets the requirements that mustbe met for sustainable palm oil production (Standard)• Rules and procedures for approving certifiers (Accreditation)• The certification process requirements (Certification)• Rules for claims made in the market with regard to traceabilityand labelling (Product claims)While these elements are not new or unique, RSPO presidentDr Jan-Kees Vis pointed out in his opening address that thecertification system differs from existing schemes or frameworksin that it is the first to embrace a commodity market. Othershave so far targeted at relatively small niche markets.The launch was the culmination of a concerted effort over thelast four years to develop a credible framework and mechanismfor certification that would be globally acceptable to the palm oilsupply chain and its stakeholders, including civil society. Detailscan be found at: http://www.rspo.org/RSPO_Certification_Systems.aspxThe RSPO Principles & Criteria (P&C) set the standard forsustainable palm oil production. Developed by the CriteriaWorking Group (CWG), the P&C were adopted at RT3 inNovember 2005 in Singapore. It was agreed that these shouldundergo trial implementation for two years, and 14 companiesand organisations volunteered to test the application in theirrespective operations.In the spirit of Principle 1 (Commitment to transparency), sevenvolunteers – the Agropalma Group, GOPDC/SIAT, IOI Group,PPB <strong>Palm</strong> <strong>Oil</strong> Bhd, PT Musim Mas, PT SMART and Sime DarbyBhd – shared their experiences and results at RT5.They showedthat, with commitment and conscientious effort, it is possible toimplement the P&C in most aspects of plantation and millingoperations.12GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Concurrent movesConcurrent with the trial testing, effortswere made by major oil palm processingcountries to develop appropriateguidelines and indicators for nationalinterpretation of the generic P&C andthe guidance document. Reports by theNational Interpretation Working Groups(NIWGs) showed significant progress toalign national legislation and requirementsto the generic guidance of the P&C.National draft guidance documents forIndonesia, Malaysia, Papua New Guineaand Colombia are being finalised and areexpected to be approved by the RSPOExecutive Board early this year. Theapproved guidance and indicators willprovide the basis of certification againstthe RSPO P&C in the respectivecountries.As the P&C were originally developedwith plantation agriculture in mind, theRSPO established a Smallholder TaskForce (STF) at RT3 in November 2005 toexamine the P&C and make theserelevant and practical to the smallholdersector.A national STF was also established forIndonesia to study the specific needs ofits small growers, to ensure they candirectly participate in the process. In spiteof limited funding, both STFs haveproduced a draft guidance document,which is expected to be finalised in thefirst half of the year.The generic RSPO P&C have alsoundergone comprehensive review; theCWG reconvened in Bogor, Indonesia,last October to consider feedback from apublic consultation process as well asinput from NIWGs, STF and volunteersinvolved in pilot-testing of the P&C.Most of the feedback was related toindicators: 24 new ones were accepted, 10were deleted and 24 others amended.Seven criteria were also amended. Therevised P&C were approved by the GeneralAssembly at the conclusion of RT5 and willbe used as the standard for certification.Accreditation mechanismIndependent certification bodies (CBs)will be tasked with ensuring consistentcredible assessments and results againstthe P&C requirements.The RSPO mechanism for approving CBsmatches internationally recognisedstandards namely those in ISO/IEC Guide65: 1996 General requirements for bodiesoperating product certifications systemsand/or ISO/IEC Guide 66: 1999 Generalrequirements for bodies operatingassessment and certification/registration ofenvironmental management systems.RSPO has supplemented these withspecific requirements.A stringent process is adopted toevaluate CB applications foraccreditation, including a 30-day periodfor stakeholders to submit comments onthe applicants. These will be given dueconsideration by the RSPO ExecutiveBoard when discussing approval.At RT5, RSPO gave initial approval ofaccreditation of two CBs – SGS Malaysiaand Control Union. Since RT5, two moreCBs have been found to comply withrequirements for accreditation andapproval will be considered after theperiod for public comment.Astringentprocess isadopted to evaluateCB applications foraccreditation, including a 30-day period for stakeholders tosubmit comments on the applicants.Certification processThis process sets out the role andfunctions of CBs which are to:• Evaluate competency of assessmentteams;including the minimum competencyof lead assessors and the assessment teams• Examine the assessment process –procedures, definition of the unit ofcertification, planning for time-boundcertification of organisations with manymanagement units or subsidiary companies,assessments of conformity or nonconformitieswith each indicator, etc•Gather evidence from stakeholdersduring certification assessments• Make their documentation, such asassessment reports, publicly available• Manage conflicts of interest• Set up mechanisms to respond tocomplaints and grievances.In assessing major non-conformitiesagainst the P&C, RSPO has definedcompulsory international indicators thatmust be complied with; failure to do sowill automatically trigger a finding of‘Major Non-conformity’.RSPO endorsement of nationalinterpretations requires at least onecompulsory indicator for 39 criteria,while at least 45% of all indicators atnational level must be identified ascompulsory.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200813

SustainabilityProduct claimsAfter the palm oil is certified at plantations and mills, the productusually undergoes many production and logistical steps beforereaching the buyer.smallholders. The mass balance approach based on the‘volume credit system’ is considered the practical andmost credible option for mainstream trade in sustainablepalm oil as a commodity.To allow manufacturers of end-products to make appropriateclaims on use of certified palm oil, the RSPO has approved thefollowing supply chain mechanisms:• Full Segregation – palm oil from certified plantations and mills isphysically segregated from palm oil from non-certified sources atevery stage of the supply chain.•Mass Balance or controlled mixing – certified and noncertifiedpalm oil are allowed to be mixed with mechanismsin place to trace the proportion of certified palm oil used.• Book and Claim – certified palm oil is represented by tradablecertificates which are traded separately from the physical oil.Although the three options have been discussed at previous RTmeetings, real-time experiences in implementation werepresented at RT5.The Daabon Group from Colombia shared its experiences withorganic palm oil that requires full traceability from production ofoil palm fruit bunches through to milling, refining and export toEurope, the US and the Caribbean. It concluded that fullsegregation is feasible and profitable, and recommended thattrade in certified sustainable palm oil follows the approach fororganic palm oil which is well established and accepted byconsumers.Full segregation was also evaluated on a commercial scale,along with the mass balance option, by Golden Hope andUnilever. Results of a Sustainable <strong>Palm</strong> <strong>Oil</strong> Traceability project– with 3,000 tonnes of sustainable palm oil produced inSabah, Malaysia, for manufacture into margarine at a Unileverfactory in the Netherlands – showed that completetraceability and tracking of sustainability is feasible andcredible.However, implementation of the full segregation optionwas not seen as the best approach at this stage as itcould exclude production from independentThe Book and Claim option conceived at RT1 in 2003 is now upand running through Green<strong>Palm</strong> Ltd which operates a webbasedbrokerage service system for trading in certificates onsustainable palm oil.There is no physical segregation or deliveryof sustainable palm oil. Instead, the producer receives acertificate that can be sold separately to a consumer goodsmanufacturer who intends to support such production and use.This approach is innovative and simple and can beimplemented immediately for trade in mainstream palm oil ata lower cost than the other options, but the maindisadvantage is that there no traceability of the product in thesupply chain.The ultimate goal in all these approaches is full segregation thatwill allow traceability of certified palm oil throughout the supplychain. However, it is recognised that the mainstream market isnot yet ready for this.Feedback at RT5Through a facilitated process using The World Cafémethodology, delegates had the opportunity to examine themerits and challenges of the RSPO certification system. Thesewere the salient points made.Strengths1. The RSPO certification system is a complete multi-stakeholderprocess, without equal among other commodities.2. RSPO has one credible global standard for sustainable palmthat is externally verified; practicality of the criteria has beenproven on the ground.3. RSPO has delivered on time and against all targets, anunprecedented achievement for a multi-stakeholder initiative.4. The certification scheme is time-bound with provisions forannual surveillance.5. The process is transparent and incorporates a formalmechanism for handling complaints and grievances.14GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Constraints and challenges1. The availability of qualified auditors aswell as their independence is an issue.2. There are apparently too many indicatorswhich may make the certification systemunduly complex, but any effort to reducethese could be at the expense ofcredibility of the system. Hence, apractical balance is required.3. The cost of certification is a concern toproducers, particularly if there are noincentives such as price premiums tocompensate them for the additionaleffort to comply with the P&C requirements.4. The risk of non-involvement of thesmallholder sector, especially theindependent smallholder, is a key concern.There is an urgent need for capacitybuilding and to make the certificationsystem relevant to them.5. A critical challenge is to deal with breachesof the P&C by producers who are notRSPO members; misbehaviour wouldtaint the reputation and credibility ofmembers.6. Lack of greenhouse gas criteria is amajor concern, particularly for the bio-fuelindustry, as the P&C were developedfor the food sector. As a response, aWorking Group will be established toaddress the issue of emissions.With the certification system now areality, the market can expect to trade incertified sustainable palm oil withinmonths.The progress to date is indeedunprecedented. In the words of Dr Vis:“The world is watching us.We are underscrutiny because what we are about todo has never been done before – never!”The RSPO’s success will next be judgedby how well it performs in implementingthe certification system to delivercertified sustainable palm oil to theworld.Teoh Cheng HaiChairman, RT5 Organising CommitteeGLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200815

Sustainability…to get the best out ofsustainable palm oilThe palm oil industry has been a significant driver of Malaysia’s economicdevelopment ever since its cultivation was expanded as a means to eradicatepoverty in the 1970s.The industry has come a long way to establish itself. In 2006, Malaysia exported some14.4 million tonnes of palm oil, or slightly more than 50% of the global oils and fatstrade.But it has to be said that this long road towards success has been littered with trials andtribulations. For example, the industry faced a negative campaign based on dubioushealth claims by competing oils.Research has proven that palm oil is the better oil from the health point of view, as itdoes not need hydrogenation for margarine production that results in the productionof harmful trans fatty acids.The challenge is now focused on the environment based on such unsubstantiatedclaims as destruction of forests, displacement of the orang utan and other wildlife, lossof diversity as well as indiscriminate development of peatlands, resulting in carbonemissions and thereby contributing to global warming.16GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Large-scale commercial agriculture is being carried out inmany temperate and tropical countries without beingsubjected to such allegations and accusations. I find itincomprehensible that the palm oil industry is beingscrutinised to a microscopic degree.It is my duty to flag this point on behalf of hundreds ofthousands of smallholders in Malaysia.They will find it almostimpossible to meet the standards required by the P&C. I amworried for them; their contribution to domestic output issignificant both politically and economically.I am now told that palm oil may be barred from enteringcertain countries unless there is compliance with strictconditions. Whatever has happened to the World TradeOrganisation and the noble precept of free trade to bridgethe gap between rich and poor nations?The Roundtable for Sustainable <strong>Palm</strong> <strong>Oil</strong> (RSPO), whichstarted as a business-to-business initiative, has evolved intoa multi-stakeholder platform from 2004. I am glad to note itsprogress towards the development of sustainable palm oil.The government will continue to encourage the industry torespond to emerging requirements of the market place andits stakeholders with regard to sustainability.I am also glad to note that, by and large, the industry hasresponded well, since many have participated actively in thepilot project on the implementation of the RSPO Principlesand Criteria (P&C). The industry is developing suitableguidelines for implementation of the P&C through theNational Interpretation Working Groups.Those aware of the history of the oil palm industry willknow that it had its beginnings with these farmers beingpersuaded to participate in it. My ministry has been lookingafter their welfare and will continue to do so.They must beprovided the skills and knowledge to comply with the P&C.I will need answers from the RSPO on this point.New instituteNotwithstanding the progress made, I must say that not allthe membership sectors in the RSPO are responding in thesame spirit as the producers, in particular the NGOs.Whileresponsible NGOs such as the WWF are working within theRSPO framework, their counterparts continue to protestagainst the industry and to demand a moratorium on oilpalm development.I would like to point out a fundamental fact which may attimes be clouded by various arguments – it is the need toprovide a balance between taking care of the planet and itsinhabitants on the one hand, and the need for economicsustainability among palm oil producers on the other hand.The cost of doing business under the ‘new order’ asenvisaged by the P&C must be taken into consideration atall times and I do not think you can escape from this reality.What is deemed to be necessary costs by some producersmay be too burdensome for others.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200817

SustainabilityUnfortunately, many of their arguments are driven by emotionrather than facts.They often manage to pressure the supply chaininto adopting policies [against palm oil], as is the case with somemajor retailers in the United Kingdom. Such actions are not onlyunreasonable but lack the very element of compassion whichought to be shown by consumers in countries such as the UK.In response to concerns over the development of oil palm inpeatlands, Malaysia is now establishing the Tropical PeatInstitute which will co-ordinate work on developing peat areasfor possible planting of palm oil. The Institute will also carryout R&D as very little scientific investigations have beenconducted in tropical peat areas up to now.In view of thecontinued campaigns byNGOs, my ministry hasadopted a two-prongapproach to addressthis situation. We aremoving to correctmisperceptions of thesustainability of palm oilby disseminatinginformation throughmajor channels inEurope, publications onpalm oil and websites.I also recognise a greater need for direct engagement withlawmakers in Europe – in June, I led a mission to discuss withthe European Ministers and Parliamentarians our effortstowards sustainable production of palm oil. I must say theywere most appreciative of the effort and informationprovided.Everywhere I went, I took it upon myself to invite decisionmakers to visit Malaysia and its plantations to satisfythemselves that palm oil is already being produced insustainable manner.I am particularly happy that the Netherlands and Malaysiahave agreed to establish a Joint Committee to address carbonrelease in peat areas. It is hoped this collaboration will alsohelp to establish ‘best practice’ with regard to peat areas inMalaysia.I would like to urge all growers to implement the RSPO P&Cdiligently. As for the rest of the supply chain, it has aresponsibility to support growers in their efforts to producesustainable palm oil.I would also like to urge NGOs to play a constructive role insustainable production of palm oil. They need to work intandem with the industry and to support practices that arepractical, to ensure unfettered supply of sustainable palm oil tosatisfy growing demand.Datuk Peter Chin Fah KuiMinister of Plantation Industries and Commodities, MalaysiaThis is an edited version of the closing speech at the 5th meeting of theRoundtable on Sustainable <strong>Palm</strong> <strong>Oil</strong>,held in Kuala Lumpur in November 2007.Malaysia is committed to supporting further work, inparticular in the areas of conservation and addressingconcerns on greenhouse gas emissions in the developmentof the palm oil industry. Our commitment is underscored bythe fact that we have established the Malaysian <strong>Palm</strong> <strong>Oil</strong>Wildlife Conservation Fund, with an initial allocation ofRM20 million.18GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

SustainabilityThe Malaysian plantation crop system has great potentialfor integration with livestock, particularly with cattle,sheep and goats, but use of land has not beenoptimised. Integration of animals – particularly beef cattle –provides an economically and ecologically useful strategy onseveral fronts.The number of cattle reared under oil palm in Malaysia grewfrom 46,789 in 1994 to 56,178 in 1997, so plantations still haveplenty of suitable land for this purpose.animals for ticks and wounds. Serious treatment can be left to avisiting officer from the Veterinary Department, who wouldmake regular checks on the animals and ensure that they arefree of disease.Vaccination for foot-and-mouth disease is carriedout once a year, while deworming is done twice a year.Nature’s resourcesNature provides much of the resources required for cattlerearingon oil palm plantations, which are perfectly positioned interms of synergy.Research shows that that one hectare of grazing area in aplantation can accommodate one head of cattle. A moderatelysizedplantation with sufficient grazing grounds could thereforeaccommodate 500-1,000 head of cattle. Only plantations in hillyareas would find it difficult to rear cattle, because the grazinggrounds would be limited.The animals would also have difficultyin accessing, and grazing on, steep slopes.It is estimated that the vegetation under oil palm treescontributes up to 80% of the country’s forage resources. Thetrees are grown in rows, leaving a space of 5-7m between rows.These inter-rows are covered with vegetation such asleguminous cover crops, grasses, broad leaf species and fernsthat form a naturalised pasture and can be utilised as forage forlivestock production (Wahab, 2002).There are certain basic needs in rearing cattle on plantations.Paddocks must be designated. These are usually separated byelectrical fencing, constructed with insulated steel rods and threelengths of electrical wire.Workers then drive the cattle from onepaddock to another depending on the availability of feed.The estate supervisor has to make a daily check on the animals,but actual care can be left to the workers. Normally, one workercan look after 150-200 head of cattle, including treating theThere are about 60-79 plant species, of which about 70% arepalatable grasses like Axonopus compressus, Brachiaria mutica,Chysopogon aciculatus, Cyrtococcum oxyphyllum, Digitariaascendens, Eleusine indica, Ichaemum muticum, Ottochloa nodosa,Panicum repens and Paspalum conjugatum.The legumes consist ofCalapogonium mucunoides, Centrosoma pubescen, Desmodiumovalifolium, Desmodium triflorum and Pueraria phaseloides. Fernsinclude Lygodium flexuosum, Nephrolepis biserrata and Pteridiumesculentum. Some of the native pasture species are deemed toGLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200819

Sustainabilityhave high nutritional value. Leguminouscover crops such as C. mucunoides, C.Pubescens and P. Phaseoloides, Assassinintrusa and Mikania cordata have highlevels of crude protein.The botanical composition of the foragechanges as the oil palm trees grow. In thefirst five years, grasses, legumes and broadleaf species dominate the undergrowth.The legumes become reduced after thefifth year, with ferns and non-edible broadleaf plants taking over. As the trees growand the canopy becomes thicker, it reducesthe amount of light that reaches theground.This results in the establishment ofmore shade-tolerant species.In terms of animal nutritionalrequirements, the edible resources aremore than adequate for cattle-grazing.During the first three years of the oilpalm tree crop, the undergrowth couldprovide a feed biomass of between2,000-3,000kg DM/ha/yr. This declines toabout 400-800kg DM/ha by the seventhyear and remains at this level untilapproximately the 20 th year. The feedvalue of the ground vegetation iscomparable to improved pasture grasses(Jalaludin, 1998).<strong>Oil</strong> palm biomass is another source of feed.A nine-year-old tree produces more than7,300kg of fronds per ha/yr. One-third ofthis could go into nutritious cattle feed,comprising 50% of fronds and 50% of palmkernel cake (Latif et al 2002). <strong>Palm</strong> oil millwaste can also be converted as feed. Thisfurther helps the recycling process, therebyremoving hazards to the environment fromindiscriminate disposal of waste.Economic usesLivestock-rearing would help curb thegrowth of weeds and grasses in the interrows,and overcome inherent problemsassociated with methods currently in use.One method is the planting of shorttermcash crops like bananas andvegetables, especially in smallerplantations.A main drawback of planting cash cropsis that some compete with, and stunt, thegrowth of oil palm trees. Another is thatthese crops take the place of usefulleguminous cover-crops that providenitrates and nitrogenous compounds tothe soil – in fact, intermediate cropsdeplete soil nutrients, which deprivessupply to the oil palm trees.The resultantpoor soil would pose a problem intoreplanting 20-25 years later. After shorttermcrops are harvested or removed,there is a possibility that the inter-rowswill remain barren, leading to extensiveerosion and depletion of the top layer ofthe soil.Another method is the application ofweedicides, which has adverse effects onplants and the soil. Immature oil palmplants could be accidentally sprayed withchemicals, which could result in damageor the trees being killed. Chemicals whichseep into the soil after rain could kill thenumerous micro-organisms that help inregenerating and enriching the soil.Livestock animals would eat palatableweeds and grasses in inter-rows.Plantations could save up to 40% of thecost of weedkillers and herbicides, as wellas on field maintenance.In addition, there is money to be madefrom rearing of cattle through breeding,providing young calves for replacement,and slaughtering. Cattle could be sold inbulk during festive seasons whenconsumer demand is higher or throughauctions to the highest bidder. An animalweighing 300kg could bring in RM900-1,000. After deducting RM750 to coverthe cost of feed, care and shelter, theplantation would make a profit of aboutRM200 per head.MPOC20GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

ShippingWhen economics did not work in freight ratesThe past year was a complex one for the vegetable oiltrade. Who expected crude palm oil price to riseabove US$1,000/tonne CIF Europe, partly pushed upby demand for all commodities? Who expected the price ofbunker fuel to reach US$500/tonne, purely driven by risingcrude mineral oil prices?Who expected that, by the end of 2007, freight rates to Europewould be the same or even lower than at the end of 2006? Afteran initial jump in the first quarter of last year, the rates droppedoff and ended the year below those at the end of 2006 but justabove the January rates.This was totally unexpected. Basic economics indicate that, whenthe value of a commodity increases, the costs of the hardwareneeded to transport it increases.And if the cost of fuel increases,then the cost of transport to the market place increases.These economics do not work in the shipping industry, or atleast in the tanker industry. Certainly, these did not work in palmoil trade last year.Many years ago, there was a quotation, probably apocryphal, bya professor of transportation logistics. He maintained:“It is a wellknown fact that ship owners have very short memories, but it isa proven fact that tanker owners have no memorieswhatsoever.”This has been proven to be the case once again. Admittedly thechemical tanker market has been rather high for longer thannormal. This has not been due to the owners; they have beenordering new ships as fast as possible.The difference has been that all sectors of the shipping marketwere up at the same time, which has not happened before.Shipyards prefer to build bulk carriers; these are quicker to buildthan tankers and are much less complex.The owners, innovative as always, decided to meet lateexemptions to the new rules for carriage of vegetable oils byconverting older ships to double hull.China saw an opportunity and snapped up this business,converting about 100 ships in a relatively short time. It alsoexpanded the number of shipyards building simpler tankers, thusrelieving the pressure, and freight rates stayed at lower-thanexpectedlevels.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200821

ShippingAnother factor contributing to the number of ships for thevegetable oil trade was the adaptation of many new shipsbeing built in China and Korea as product tankers.The ownersdiscovered that it was relatively cheap to meet the cargo tankstripping tests and to install the underwater slop dischargeoption while the ships were being built. These leave theshipyard with an IMO3 Certificate, albeit limited to vegetableoils.Lastly, double hull product tankers due for regular drydockings were converted cheaply for little money and no lossof time on the ships. Some of these were very large.The M/TMariella and M/T Maritina (now M/T Theresa Mediterranean),each of 77,770 deadweight (dwt), were the first and are nowowned by Wilmar.They were followed by four ships of around84,000 dwt, two more of these for Wilmar and operated byRaffles.Charterers’ innovationThe final factor that has reduced the freight rates has been thestrength of the trading companies. Wilmar, having bought Kuok<strong>Oil</strong>s and Grains palm oil business are believed to control about12 million tonnes of exported palm oil.They own, together withRaffles Ship Management, 19 ships including one due to becompleted this year.The average age of the 18 existing ships is21.5 years; although this will drop to 20 yrs 4 months when thenew ship is delivered (Table 1).On top of these ships, Wilmar has several on both long- andshort-term charter. Cargill and Pacific Interlink both have shipson charter for various periods.The result of their activities is that the producers do not have toworry too much about the freight market. If they cannot find aship, or if the ones they find are asking for higher freights, theycan abandon the idea of selling C&F and sell FOB instead. Notonly do they avoid all the problems and responsibilitiesconnected with chartering a ship and worrying about the cargoup to the final destination, they will also often receive the same,or better, net-back from selling FOB.IOI with its refinery in Rotterdam has also secured long-termfreight coverage at reasonable rates.Kwantas has its own ships, M/T Diana (9,306 dwt), M/T Dolphina(12,900 dwt), and M/T Doris (19,960 dwt). These ships, alreadyover 20 years old, are trading for Kwantas from East Malaysia toChina.In terms of smaller ships, many Thai vessels are now convertedto double hull and are trading to the east coast of India,Bangladesh, Sri Lanka, Myanmar, Vietnam and the Philippines.There are also some single hull ships still trading to these areasbut this is expected to end, as there will be enough coverage onships that comply with the regulations.22GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Soft oils freightsThe situation has been the same in thesoft oils trade. For example, the rate for25,000-30,000 tonnes of soybean oilfrom South America to China wasUS$49/tonne at the end of 2006; itjumped to US$77/tonne last March butdropped to around US$60/tonne at theend of 2007.This pattern was followed on almost allthe other routes.The rates jumped in thefirst months of 2007 but then droppedoff, the difference for palm oil being thatthe rate remained higher than at the endof 2006.What about 2008? I would expect therates to remain fairly stable and even toease off a little, but next year will be moreinteresting.If the freights for petroleum productsincrease, there may well be a rush tocharter the double hull IMO3-classproduct tankers now carrying vegetableoils.That is what they were ordered forin the first place – to replace themultitude of single hull ships. They willtrade where the money is, but vegetableoil charterers would be well advised tosecure tonnage into 2010 when the newrules take effect.Predicting freight levels is a gamble. Themajor established chemical tankeroperators have got it right. They havefleets of both old (written down) shipsand new ships; they are constantlyrenewing their fleets and selling shipswhen these get old, but not tocompetitors. They sell and charter backuntil the ship is ready for the scrap yard.On top of this, they are chartering inships both in the short- and long-term sothey can always meet commitments andyet get rid of short-term ships if themarket turns down. Their size enablesthem to do this. For their loyal charterers,they are always there in good times andbad.Charles BartonMaritime ConsultantGLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200823

Nutrition<strong>Palm</strong> fruit grows in bunches containingas many as 3,000 fruitlets.Natural palm oil is an integralpart of a healthy tropical dietin Africa and Southeast Asia,just as olive oil is in the Mediterraneanregion.In West Africa, palm oil is still generallyconsumed in a crude state. Forgenerations, the oil has been extractedfrom the flesh surrounding the seed, bycooking, mashing, and pressing. Everyfamily makes their own. The oil is thenused in traditional foods, where itcontributes its characteristic colour todishes.In areas of the world where palm oil hasbeen used as a staple in the diet,common illnesses such as heart disease,diabetes and cancer have been relativelylow, attesting to its healthful nature.It has a history of use as a healing salve forwounds and to ease pain and as a medicineto treat a number of health problems suchas headaches, rheumatism, and cancer, andto improve reproductive health.Pregnant women went out of their wayto include ample amounts of palm oil intheir diet to ensure themselves a troublefreedelivery and a healthy baby. Forgenerations, it has been considered auseful, healthy fat.<strong>Palm</strong> oil has been a part of the humandiet all over the world for thousands ofyears. In the leading producer-countriesof Malaysia, Indonesia and Nigeria, it is themajor source of dietary fat.The Malaysiandiet has about 27% fat, of which 80%comes from palm oil.Up until the late 1980s, you could alsofind palm oil in many prepared foods soldin North America and Europe.Manufacturers preferred it over othervegetable fats because it gave foods manydesirable characteristics.24GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Fabricated issueThe entire anti-saturated fat campaignwas fabricated to appear as a healthissue. Polyunsaturated vegetable oils werepromoted as healthy alternatives becausethey don’t raise blood cholesterol.Despite a long history of safe andeffective use, palm oil came under attackin the 1980s by a commercial lobbyagainst tropical oils. Even in countrieswere such oils were produced and widelyused, people were initially frightened intobelieving these were dangerous.In June 1988, congressional hearingswere held in the United States to settlethe tropical oils issue. The domesticvegetable oil industry had their ‘experts’testify about the dangers of tropical oils.Lipid researchers not on the payrolls ofthe vegetable oil industry were alsocalled in. Dr George Blackburn, aHarvard Medical School researcher,testified that these oils do not have aharmful effect on blood cholesteroleven in situations where they serve asthe sole source of fat.It was pointed out that palm andcoconut oils have been consumed as asubstantial part of the diet of manygroups of people for thousand of yearswith absolutely no evidence of anyharmful effects.At the end of the hearings, the evidenceagainst the tropical oils didn’t stack up,and no health warning went into effect.Companies that had placed the ‘notropical oils’ claim on products were toldto remove it, because of theunsubstantiated health claim.Researchers familiar with palm and coconutoils couldn’t understand all the criticism.Studies clearly showed that the tropical oilsdo not promote heart disease. If anything,they help protect against it.To all those whoknew the facts about these oils, this was nota health issue at all, but a profit motivatedpublicity campaign.Dr C Everett Koop, then US Surgeon-General, called the tropical oil scare“Foolishness!” and added “but to get theword to commercial interests terrorisingthe public about nothing is anothermatter”.When restaurants and food producersmade the switch, the public assumed thatsaturated fats were being replaced by‘heart friendly’ vegetable oils. What thepromoters conveniently failed tomention was that these werehydrogenated vegetable oils – theunhealthiest fat in the human diet. Thepublic had been deceived.The problem with hydrogenated oils isthat, during the hydrogenation process,polyunsaturated fats are transformed intotrans fatty acids (TFA) – toxic artificialfats. By 1990 a number of studies wereemerging showing that TFA promotesheart disease, diabetes, auto-immunedisease and a host of other healthproblems.“These are probably the most toxic fatsever known. It looks like trans fatty acidsare two to three times as bad assaturated fats in terms of what they do toblood lipids,” said Walter Willett, MD,professor of nutrition at the HarvardSchool of Public Health.Dr Willett and his colleagues at HarvardUniversity estimate that the consumptionof TFA in the <strong>American</strong> diet causes up to228,000 heart attacks each year.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200825

NutritionWith the removal of tropical oils,hydrogenated vegetable oils penetratedevery level of our food supply. By theearly 1990s, we were consuming 10 timesas much harmful TFA as we had a decadeearlier.Consumption of TFA ranges up toabout 15% of calories, depending on aperson’s diet. Even tiny amounts pose athreat. A mere 2% increase in energyfrom TFA increases risk for heartdisease by 25%.A report by the Danish Nutrition <strong>Council</strong>states that TFA are up to 10 times worsethan saturated fats as a risk factor forheart disease. Dr Willett said removingTFA would probably have greater impactthan anything else we can do inpreventing death from a heart attack.In 2003 the US Institute of Medicinereported the results of a three-yearinvestigation of all published studies onhydrogenated vegetable oils and TFA.Their conclusion was that no level ofTFA is safe in the diet. This is interestingbecause the institute didn’t set a limit thatcould be considered safe; it flatlystated that no amountis safe.As a result of these findings the FDApassed a law requiring the labelling ofTFA from January 2006. It said this wouldencourage people to make better foodchoices which, in turn, will preventnumerous deaths each year from heartdisease.The FDA has acknowledged thathydrogenated vegetable oils cause or atleast contribute to heart disease,something that the vegetable oil industrycouldn’t prove with tropical oils.After more than three decades of intensescrutiny by researchers attempting toprove that tropical oils are harmful, theoils have come out squeaky clean. Notonly have they been proven not topromote heart disease, but evidenceshows that they can protect against it.Source of confusionMany of the studies done in the 1960sand 1970s which implicated saturatedfats as a possible contributor to heartdisease were actually done usinghydrogenated vegetable oils, notsaturated fats. Complete hydrogenationturns unsaturated fats into saturated fats.Most researchers thought it didn’t matterwhere the saturated fats come from solong as these were saturated. At the timethey didn’t know there was a differencebetween natural saturated fats andhydrogenated fats.Hydrogenated palm and coconut oilswere often used. People reading thestudies ignored the term ‘hydrogenated’and simply associated palm and coconutoils with the negative results. It didn’tmatter if they used hydrogenated palm,coconut or soybean oil – hydrogenatedoil from any source raises bloodcholesterol.The detrimental effects of TFA weresuspected as far back as the 1950s. Someresearchers at the time even suggestedthat they may cause or contribute toheart disease.Research throughout the 1960s and1970s also showed thathydrogenated fats produced anumber of adverse health effects inlaboratory animals.One of the primary concerns wasthe effect of TFA onessential fatty acids( E F A )utilisation.After more than three decades ofintense scrutiny by researchersattempting to prove that tropical oilsare harmful, the oils have come outsqueaky clean.26GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Consuming hydrogenated oils can leadto EFA deficiency, a symptom of whichis elevated cholesterol – a risk factor forheart disease. Hydrogenated fats notonly raise total cholesterol but also LDL(the so-called bad cholesterol) andlowers HDL (the ‘good’ cholesterol).TFA block prostaglandin synthesis whichleads to hormonal imbalance, stuntstesticular development in the young, andhave been observed to cause testiculardegeneration in mature animals.In the diet, TFA are incorporated intocells and alter composition of tissuesthroughout the body. Higher levels of fataccumulate in the heart, liver and otherorgans. TFA also retard kidneydevelopment, stunt growth and interferewith blood sugar metabolism.Nursing mothers who consumehydrogenated oils pass TFA to theirchildren through breast milk. TFA arefurther found to contribute to low birthweight babies, visual abnormalities ininfants, childhood asthma, reproductivedysfunction, obesity and lowerimmunity.Simple solutionMuch of this was known and available inpublished studies by the mid-1980s, evenbefore the vegetable oil industry startedits anti-saturated fat campaign and thepush to replace tropical oils withhydrogenated oil.This explains why industryrepresentatives always alluded toreplacing saturated fats with ‘vegetable’ oilrather than ‘hydrogenated vegetable’ oil. Ifthe public knew that the industry wasplanning on using hydrogenated oils, itwould have had a bigger fight on itshands.How did they get away with it? Thevegetable oil and pharmaceuticalindustries fund a great deal of research.Concerned about unfavourablefindings that began surfacing in the1950s and 1960s, they began countermeasuresto show that hydrogenatedfats were safe.They especially didn’t want hydrogenatedoils implicated as a possible cause ofheart disease. They financed studies toshow that hydrogenated oils wereharmless to the heart and circulatorysystem. Negative findings were ignoredand even suppressed.Researchers depend on fundingorganisations to finance their work andadvance their careers. Consequently,most researchers are highly motivated toproduce good results and ignoreunfavourable information. Those whohave attempted to publicise negativeeffects are faced with denial of financialassistance and being ostracised by otherfunding organisations.For example, When Mary Enig, PhD, anoted researcher and co- founder of theWeston A Price Foundation, discoveredthe harmful effects of TFA, she ignoredthe normal protocol of suppressing theinformation and published anyway. Herfinancial backers withdrew support andall future funding dried up. She waslabelled a troublemaker and shunned bythe vegetable oil industry. She was forcedto make a shift in her career plans.The idea of a researcher searching fortruth, regardless of the consequences,apparently no longer applies. Similar tothe tobacco industry, the vegetable oilindustry suppressed studies and hidevidence. But just as evidence linking lungcancer and tobacco mounted, so too didthe evidence against hydrogenatedvegetable oils.Now that hydrogenated vegetable oilshave been exposed as health hazards,food manufacturers are removing thesefrom products.So what’s the solution to hydrogenatedfats? There is a simple answer. What didfood manufacturers and restaurants usebefore they had hydrogenated oils?Saturated fats – and one of the best forcooking is palm oil.Dr Bruce FifeAuthor, The <strong>Palm</strong> <strong>Oil</strong> MiracleThis is an edited chapter from the bookpublished in 2007.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200827

NutritionAlmost all food products are composed largely of organic material – carbohydrates, proteins and lipids.Once food is harvested or slaughtered, the organic material in it begins to break down chemically.Generally food spoils in one or two ways:- It can lose acceptability = Quality spoilage- It can produce illness = Safety spoilageFoods, even if not decomposed, may harbour certain kinds of bacteria or their toxins in numbers or amounts whichmake the products poisonous and thus unfit for human consumption.28GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Bacteria need food for energy and growth, and thrive oncertain types of food. Potentially hazardous foods arethose high in protein such as meat, poultry, fish andshellfish. Dairy products, eggs, grains and somevegetables are also sufficiently high in protein tosupport bacterial growth. These foods anditems containing these foods (for example,custard, hollandaise sauce and quiche)must be handled with great care.Food spoilage is linked to one or more of thesecauses:- Inappropriate storage temperature, like exposure to extremetemperatures- Incorrect or excessive period of storage- Unacceptable levels of ventilation in storage areas- Failure to separate items being stored- Excessive delays between receipt and storage of products- Inadequate or unacceptable sanitation standards- Physical changes, such as excessive pressure or carelesshandling that causes bruisingFoods are frequently classified on the basis of ‘stability’, whichrefers to susceptibility to microbial spoilage. Generally food isclassified into three broad categories.Non-perishableThese foods are the most resistant to spoilage unless improperlyhandled and stored.They mainly comprise dry grocery items likesugar, salt and spices.Semi-perishableFoods spoil more slowly when stored under recommended timetemperaturecombinations.They include baked goods, hard cheeses,dried fruits and vegetables, and waxed vegetables such as cucumber.PerishableSuch foods spoil readily without special processing orpreservation techniques. This category includes meats, poultry,fish, shellfish, eggs, dairy products, most fruits and vegetables, andall cooked items.Bacteria controlThree basic principles help protect food against bacteria.- Protect foodfrom bacteria in air.- Practise proper hygiene.- Clean utensils properly.Avoid conditions that promote growth of bacteria.If bacteria are present, kill them by subjecting the food to ahigh temperature (77°C) for at least 5 minutes.Temperature is the most important and most easily controlledfactor. Most micro-organisms are destroyed at hightemperatures. Freezing slows but does not stop bacterialgrowth, or destroy bacteria.Most of the bacteria that cause food-borne illnesses multiplyrapidly at temperatures from 16-49°C.Therefore, the broad rangefrom 4-60ºC is deemed the temperature danger zone.To controlthe growth of any bacteria present, it is important to maintain theinternal temperature of food at 60ºC or above, or 4ºC or below.Keep cold foods coldFoods that are to be displayed, stored or served cold must becooled rapidly. When cooling foods:- Refrigerate semi-solid foods at 4ºC or below in containers thatare less than 5cm deep (increased surface area decreasescooling time).- Avoid crowding the refrigerator; allow air to circulate around foods;- Use pre-chilled ingredients, for example, mayonnaise, toprepare cold foods.- Store cooked foods above raw foods to preventcross-contamination.Keep bacteria from spreading:- Don’t touch contaminated foods.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200829

NutritionNever thaw foods at room temperature.Instead, thaw foods gradually under refrigeration; place in a containerto prevent cross-contamination from dripping or leaking liquids.Keep hot foods hotThe high internal temperatures reached during cooking(74-100ºC) kill most of the bacteria that can cause foodborneillnesses. During reheating of foods, the internaltemperature should reach or exceed 74ºC in order to killany bacteria that may have grown during storage. Onceproperly heated, foods must be held at temperatures of atleast 60ºC.How to cook, reheat and holdpotentially hazardous foods:• Cook poultry to at least 74ºC for at least 1 minute.• Cook pork to at least 68.5ºC for at least 1 minute.• Cook roast beef to at least 63ºC for at least1 minute(medium rare); or 60ºC for at least 12 minutes.• Cook hamburger to at least 68.5ºC for at least 1 minute.• Cook fish to at least 63ºC for at least 1 minute.• Cook fresh egg products to at least 63ºC for 3.5minutes.• Reheat all foods rapidly to at least 74ºC for at least 15seconds within two hours.• Hold all hot foods at 60ºC or higher.• Prepared foods held at room temperature for two hoursor more should be destroyed.Keep frozen foods frozenFreezing at -18ºC or below essentially stops bacterialgrowth but will not kill the bacteria. Do not place hotfoods in a standard freezer – cool them first. They willnot cool any more rapidly if still hot, and the release ofheat can raise the temperature of other foods.Freeze foods in portion sizes required for future meals.When frozen foods are thawed, bacteria that arepresent will begin to grow.Therefore:- Never thaw foods at room temperature.- Instead, thaw foods gradually under refrigeration;place in a container to prevent cross-contaminationfrom dripping or leaking liquids.- Or, thaw foods under running water at a temperatureof 21ºC or lower.- Thaw foods in a microwave only if the food will beprepared and served immediately.Handling and preparing foodThese basic measures should be observed whenhandling food.When shoppingChoose meat and poultry last and go directly homefrom the market. Don’t put these items in the trunk ofthe car because the high temperature will promoterapid bacterial growth. Foods will also decline in qualityand perishable foods like meats and eggs can pose safetyproblems if left sitting in the car.30GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Meat and poultry should not be out of refrigeration more thantwo hours or an hour in warm weather above 32ºC. If they areset out for too long, bacteria can produce toxins that causeillness and remain active even during cooking.1. Refrigerate meat and poultry immediately upon arriving home.Always store raw meat and poultry below other foods toprevent possible cross-contamination from dripping. Keeprefrigerator temperature at 4ºC.2. Purchase ground meat or poultry no more than a day ortwo before you plan to grill it. Otherwise, freeze it. Grill largercuts of meat, such as steaks, within four days of purchase orfreeze them.5. Marinate meat and poultry in the refrigerator. Sauce canbe brushed on these foods while cooking, but never use thesame sauce after cooking that has touched the raw product.6. Refrigerate perishable foods so that total time at roomtemperature is less than two hours or only one hour whentemperature is above 32ºC.7. If fruits and vegetables are placed on refrigerator shelves,store meats on pans or plates below the produce to preventmeat juices – which may contain harmful bacteria – fromdripping on them.Wash hands before working with produce.Also wash produce thoroughly.8. Rinse produce even before the peel is removed, such as formelons and citrus fruits. Bacteria on the outside can betransferred to the inside when the protective skin of fruitsand vegetables is cut or peeled.9. The recommended temperature for refrigerators is 4ºC orbelow, and for freezers, -18ºC.10. Place an appliance thermometer in the refrigerator andfreezer; check temperature at least once a week.When cooking1. Use clean tongs or spatula for removing meat or poultryfrom the grill and placing on a clean plate to avoid crosscontaminationwith uncooked meat.Clean hands are the most effective way of stopping thespread of micro-organisms, so wash for about 20 secondswith soap and warm water after:• (and before) Handling food or eating• Using the bathroom or changing diapers• Sneezing, blowing your nose or coughing• Touching a cut or open sore• Playing outside or with pets2. Use different cutting boards – one for raw meat, poultry andseafood, another for cutting cooked meats and a separate onefor fresh produce. Never cut cooked foods and raw meaton the same board, to avoid cross-contamination.3. Don’t serve foods on a plate that has held raw meat, poultryor seafood unless it has been washed in hot soapy water.4. Wash your hands – this is the most effective way to stopthe spread of illness.3. As a general rule, use the refrigerated raw meats within oneor two days for best safety and quality. Freeze for longerstorage.4. Separate raw, cooked, and ready-to-eat foods whileshopping, preparing or storing foods.5. Wash cutting boards, knives, utensils and counter tops in hotsoapy water after preparing each food and before going onto the next.6. Avoid spreading bacteria; use paper towels or clean cloth towipe kitchen surfaces or spills. Wash cloth often in the hotcycle of the washing machine and dry in a hot dryer; dirtydishcloths spread bacteria.This is an edited article from Health & Nutrition, <strong>Issue</strong> 87, 2007, UAE.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200831

NutritionWhole grains are cerealgrains which retain thebran and germ as well asthe endosperm, in contrast to refinedgrains which retain only the endosperm.They are a very good source of keynutrients such as the B-group vitamins,Vitamin E, magnesium, iron and fibre, aswell as other valuable antioxidants notfound in some fruits and vegetables.Most of the antioxidants and vitamins arefound in the germ (core) and the bran(outer layer) of a grain.The bran is full offibre, B-group vitamins, 50-80% of thegrain’s minerals, and other healthpromoting plant substances calledphytochemicals.The germ is packed withB-group vitamins, Vitamin E, traceminerals, healthful unsaturated fats,phytochemicals and antioxidants.balance of nutrients that are found in theoriginal seed (Whole Grains <strong>Council</strong>).Until the last century grains werecommonly eaten whole. Advances in themilling and processing of grains allowedlarge-scale separation and removal of thebran and germ, resulting in refined flourthat consists only of the endosperm.Refined flour became popular because itproduced baked goods with a softertexture and extended freshness.Nutritional benefitsThe benefits of whole grains seem toexpand with every new scientific study –from helping to prevent diseases rangingfrom cancer to cardiovascular disease tokeeping weight down by lowering theglycemic index and providing a longlastingfeeling of satiation.Whole grains or food products made fromthese contain all the essential parts andnaturally-occurring nutrients of the entiregrain seed. If the grain has been processed(e.g. cracked, crushed, rolled, extrudedand/or cooked), the food product shoulddeliver approximately the same richColour is not anindication of a wholegrain. Brown does notnecessary mean wholewheat or whole grain –colouring is added tosome brown bread!32GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

Whole grains are believed to benutritionally superior to refined grains,richer in dietary fibre, antioxidants,protein (and in particular the amino acidlysine), dietary minerals (includingmagnesium, manganese, phosphorus andselenium), and vitamins (including niacin,Vitamin B6 and Vitamin E).Studies have consistently found thatindividuals with three or more servings ofwhole grain foods per day have a 20-30%lower risk for atherosclerotic cardiovasculardisease compared to individuals with lowerintakes of whole grains.Whole grains help the digestive tract.Thefibre promotes regularity and keeps theintestines working smoothly to helpmaintain good digestive health.Fibre and certain starches found in wholegrains ferment in the colon to helpreduce transit time and improve gastrointestinalhealth.Whole grains also contain antioxidantsthat may help protect against oxidativedamage, which may play a role in cancerdevelopment.Major epidemiological studies also showa reduced risk of 20-30% for Type 2diabetes associated with higher intake ofwhole grain or cereal fibre.Whole grains have a low GI rating. Thismeans they are converted slowly intoblood glucose and do not cause a ‘sugarspike’ (sudden rise in blood glucose levels).In contrast, refined carbohydrates, especiallywhite flour foods, typically have high GIvalues that are associated with bloodglucose problems and insulin disorders.Studies have further shown that peoplewho consume more whole grainsconsistently weigh less than those whoconsume fewer whole grain products.This is an edited article from Health & Nutrition, <strong>Issue</strong> 87, 2007, UAE.GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200833

NutritionIt makes sense to try to lighten mealsduring festive occasions, and manyare doing just that. But while it’srelatively easy to trim fats from meats orsubstitute skim milk for whole, even themost dedicated fat-cutter can beflummoxed by holiday baking.Fat is an essential ingredient in bakingeverything from pie crusts to cookies. Itcontributes flavour and facilitates thebaking process. It is added to bakedgoods in the form of butter, shortening,margarine or vegetable oil.Unfortunately, many of themanufactured fats raise cholesterollevels and contain dangerous trans fattyacids (TFA).A growing number of bakers arediscovering a healthful alternative – palmoil – which eliminates TFA and is packedwith powerful antioxidants liketocotrienols, beta-carotene, and VitaminsA and E.It also increases good cholesterol (HDL)more than any other food ingredient.Increased HDL is associated withdecreased risk of heart disease, andeliminates increased risk associated withelevated bad cholesterol (LDL).<strong>Palm</strong> oil shares or exceeds the healthbenefits of other oils like olive or canolabut, unlike these, works especially well inbaked products. Because it is naturallysemi-solid at room temperature, it can besubstituted in baking for less healthful oilsand shortenings.Anyone who has ever tried tosubstitute oil for shortening, butter ormargarine in many cookie recipe wouldknow the sad result: batter that oozesor runs, cookies that don’t formproperly and are either gummy, oily ordry, and have an ‘off’ flavour’ caused bythe strong taste of the substitute oil.Cakes, breads and other confectionscan be equally disastrous with wrongsubstitutes.<strong>Palm</strong> oil’s unique consistency andcomposition actually enhance thetexture of baked goods. These deliverthe plasticity needed to enable thebaker to repeatedly roll and kneaddough, as well as the aeration thatmakes cookies crumble perfectly, cakeslight and fluffy, and breads fresh andtasty.Being virtually without flavour of itsown, palm oil will not overpower thetaste of other ingredients. It only meltsat higher temperatures, meaning it willnot ruin the batter before this is cookedthrough.Since palm oil is very stable, it can bestored at room temperature for manymonths without going rancid.To substitute palm oil in your favouriterecipe, use a one-to-one ratio. If therecipe calls for 1 cup of shortening, use 1cup of palm oil.Be sure to purchase the original form ofpalm oil, which is white and resemblesshortening.The liquid form is better usedin other forms of cooking, like frying.Courtesy of ARA Content34GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

MarketsFocus on the vegetable oil sectorLong before the Indian Budget is announced at theend of February each year, people from all walks oflife would have drawn up a list of what they wouldlike to see included or, in some cases, not included in theproposals.The Finance Minister will once again walk the tight rope. His ownlist would include only one wish: that the majority of the peopleand the country benefit from his proposals.The paradox is that proposals for the benefit of one group couldbe perceived to adversely affect another. Concessions for theconsumer could adversely affect the producer. Incentives givento importers could affect domestic manufacturers.Vegetable oil is only one of many categories where differentpeople – the farmer, manufacturer, trader and importer – havedifferent wishes.ConsumersThis is the broadest group that is likely to be affected by everyaspect of the budget proposals. The last 24 months have seensignificant increases in the prices of most commodities andgoods. Vegetable oil, an essential commodity, has been noexception as prices have more than doubled.So, consumers can only wish that the budget proposals willalleviate their hardship. <strong>Oil</strong> consumption in India, at 11kg percapita, is well below the world average of 18kg.The consumerdoes not care much about the form in which the budgetproposals are worded, so long as these help bring downprices.Vegetable oil manufacturersA further reduction in import duties is what they want. Dutieson all vegetable oils, particularly palm-based products, have beenreduced significantly over the last 24 months. CPO import dutiesdropped from a staggering 80% to 45%, and duty on refinedpalm oil is at 52.5%. Duty on crude soybean oil has beenreduced from 45% to 40%.The industry will want import duties harmonised on all gradesof vegetable oils. CPO duty could be brought down to the levelof crude soybean oil, while refined palm oil and refined soybeanoil could be equalised at 45%. Rationalisation of labelling lawswould be another item on the wish-list.Vanaspati industryThe industry has been reeling under the impact of duty-freeimports under the Free Trade Agreements (FTAs) with SriLanka and Nepal, although quotas have been fixed. Not beingin a position to oppose the FTAs, the industry would bepleased to see a level playing field. It would want India to insistthat Sri Lanka and Nepal comply strictly with the rules oforigin under the FTAs.Especially in view of the high price of palm oil, budget proposalsto re-examine such compliance would make the industry’s day.Alternatively, the government could allow genuine vanaspatimanufacturers to import palm oil duty free – under strictenforcement to prevent misuse by others – to enable them tocompete with imports under the FTA.The sector would welcome a review of regulations on use ofpalm stearin in vanaspati manufacture. Besides cuttingproduction costs, this would benefit the palm oil processing36GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008

industry. Currently, there is an issue with disposal of largequantities of stearin produced by the fractionation of palm oil.Wider use would expedite the development of thefractionation industry and reduce trans fatty acid (TFA)content in vanaspati.Industrial applicationsThe soap and oleochemical industries are currently permittedto import raw materials, subject to certain quality parameters,on a preferential duty basis. Such parameters impose hardshipand additional costs. A rationalisation ofthese requirements, especially inrelation to the Free Fatty Acid,would be welcome.Snack foods/FastfoodsThe hazards of TFAin cooking mediumshave beenrecognised beyond adoubt. It has also beenestablished that palm oil isthe only oil which is free ofTFA. Several multinationalcompanies are converting to use of TFAfreecooking mediums as a global policy.Their Indiancounterparts are also set to follow suit. In the face of healthconcerns, proposals to lower duties on palm-based productsbelow the levels of soft oils would bring fiscal relief to thesefood sectors.Bio-dieselIndia’s fledgling industry languishes in the absence of a clear-cutgovernment policy. Periodic assurances have been issued that itwill be implemented soon, but there seems to be no urgencyabout this. The industry needs direction by way of an earlyannouncement of the policy. Additionally, in view ofenvironmentalimplications, the industry would like tosee feedstock imports at concessionary tariff rates.AgricultureWhile most sectors would want import tariffs lowered, othergroups argue against such reductions as being counterproductiveto the interests of agricultural growth.The agriculturelobby and some trade bodies would like to see the duty ratesbeing increased instead, to improve returns tofarmers. It is argued that, in spite of highoil prices, oilseed production haslost acreage to othercommercial crops whichprovide higher returns.The agriculturallobby would like tosee import dutyrates on vegetableoils increased tolevels which makeoilseeds cultivationprofitable.There is no denying the fact thatbudget proposals are at times influenced bypolitical exigencies. Economic considerations and consumerinterests therefore have to take a back seat.Various sectors will continue to jockey for preferentialtreatment until D-Day. However, in view of rising prices andconsequent inflation, the balance may just tilt in favour ofpolicies aimed at benefiting the consumers this time around.Wishful thinking?Bhavna ShahMPOC IndiaGLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 200837

MarketsPredictions for the commodity marketThe year began with a market structure much differentand prices much higher than expected. Commoditiesoutperformed equities, bonds, mutual funds and otherforms of ‘safe’ investments last year and are (for now) theshelter of choice for vast sums of managed money.Some expectations for 2008:• If 2007 was the year of grains, 2008 is shaping up as theyear of the soybean complex. Last year, supplies were ampleenough that land could be donated to corn to help meetdemand.The situation is now reversed – the US is amplysupplied with corn, but faces a tight soybean supply situationthat demands corn acreage be switched back to soybeanin spring.• The soybean complex should lead the way until a recordSouth <strong>American</strong> crop is assured and Brazil begins to takeover world demand from March. If or when the marketfeels assured that the 2008 US acreage is sufficient to easedomestic short supply with next fall’s harvest, the soybeancomplex could become vulnerable to large-scale fundliquidation. While US supplies are rapidly shrinking, theworld is not facing a soybean shortage.• Commodities were the best investment available last year,with average gains of 30%. It seems unlikely that these canduplicate the performance this year. The upward pricepressure caused by demand for raw materials is likely to bemitigated by an economic slowdown in the US and China,which will lead to less-than-stellar growth elsewhere.• What does seem likely is more of a two-sided marketenvironment.This will still lead to erratic and highly volatilemarkets, but the price band between the highs and lowsmay be somewhat narrower than last year.• Assuming ‘normal’ worldwide growing weather, the worldwill be better supplied with wheat, oilseeds and even cornthan last year. However, world supply/demand balancesheets will still be tight enough, so it would be a mistake tobecome complacent.All it will take is another ‘bad’ growingyear to bring those S&Ds back to precarious tightness.• Weather scares are guaranteed to occur. The price impactwill be magnified by lingering supply concerns and by hugespeculative positions taken or held by managed money.• Energy prices should hit their peak in the first half of theyear. Without serious disruptions in Nigeria, Iraq and Iran,among other countries, we doubt that crude oil will getmuch higher than US$100.The results of new productionand refining investments, conservation and substitutionshould begin to show. Crude oil prices will finish the yearlower – say, in the US$70-80 range.• For bio-fuel producers, the negative impact of lowerpetroleum prices will be partially offset by lower rawmaterial costs, but bio-fuel profitability will remain undersome pressure.• Wheat prices should average sharply lower. A bigger USand world wheat crop will depress prices. Soft wheat willbecome a feed grain again, pushed by a big increase in USand EU production and supplies. US wheat will struggle tocompete in the world market.• Corn is fundamentally overpriced unless acreage fallsfurther or there is a major crop problem. Even grantingincreased demand from the feed and ethanol sectors, UScorn supplies are comfortably ample.• Promising new seed varieties of corn and soybean will beintroduced and others will be on the verge. Unfortunately,technological breakthroughs that could make celulosicethanol economically viable will remain elusive.There is a final prediction – that there will be unexpectedsurprises that will jolt markets and force us to reassess andprobably change many of our other forecasts.Bob KohlmeyerWorld Perspectives Inc38GLOBAL OILS & FATS BUSINESS MAGAZINE • VOL.5 ISSUE 1, 2008