Management's Discussion and Analysis of Financial ... - Wal-Mart

Management's Discussion and Analysis of Financial ... - Wal-Mart

Management's Discussion and Analysis of Financial ... - Wal-Mart

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

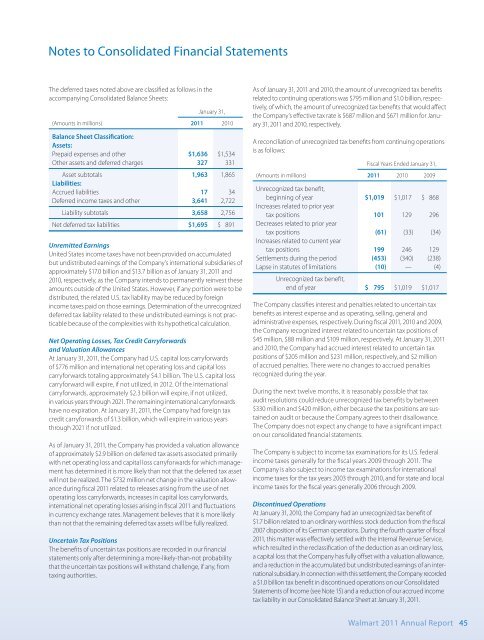

Notes to Consolidated <strong>Financial</strong> StatementsThe deferred taxes noted above are classified as follows in theaccompanying Consolidated Balance Sheets:January 31,(Amounts in millions) 2011 2010Balance Sheet Classification:Assets:Prepaid expenses <strong>and</strong> other $1,636 $1,534Other assets <strong>and</strong> deferred charges 327 331Asset subtotals 1,963 1,865Liabilities:Accrued liabilities 17 34Deferred income taxes <strong>and</strong> other 3,641 2,722Liability subtotals 3,658 2,756Net deferred tax liabilities $1,695 $ 891Unremitted EarningsUnited States income taxes have not been provided on accumulatedbut undistributed earnings <strong>of</strong> the Company’s international subsidiaries <strong>of</strong>approximately $17.0 billion <strong>and</strong> $13.7 billion as <strong>of</strong> January 31, 2011 <strong>and</strong>2010, respectively, as the Company intends to permanently reinvest theseamounts outside <strong>of</strong> the United States. However, if any portion were to bedistributed, the related U.S. tax liability may be reduced by foreignincome taxes paid on those earnings. Determination <strong>of</strong> the unrecognizeddeferred tax liability related to these undistributed earnings is not practicablebecause <strong>of</strong> the complexities with its hypothetical calculation.Net Operating Losses, Tax Credit Carryforwards<strong>and</strong> Valuation AllowancesAt January 31, 2011, the Company had U.S. capital loss carryforwards<strong>of</strong> $776 million <strong>and</strong> international net operating loss <strong>and</strong> capital losscarryforwards totaling approximately $4.1 billion. The U.S. capital losscarryforward will expire, if not utilized, in 2012. Of the internationalcarryforwards, approximately $2.3 billion will expire, if not utilized,in various years through 2021. The remaining international carryforwardshave no expiration. At January 31, 2011, the Company had foreign taxcredit carryforwards <strong>of</strong> $1.3 billion, which will expire in various yearsthrough 2021 if not utilized.As <strong>of</strong> January 31, 2011, the Company has provided a valuation allowance<strong>of</strong> approximately $2.9 billion on deferred tax assets associated primarilywith net operating loss <strong>and</strong> capital loss carryforwards for which managementhas determined it is more likely than not that the deferred tax assetwill not be realized. The $732 million net change in the valuation allowanceduring fiscal 2011 related to releases arising from the use <strong>of</strong> netoperating loss carryforwards, increases in capital loss carryforwards,international net operating losses arising in fiscal 2011 <strong>and</strong> fluctuationsin currency exchange rates. Management believes that it is more likelythan not that the remaining deferred tax assets will be fully realized.Uncertain Tax PositionsThe benefits <strong>of</strong> uncertain tax positions are recorded in our financialstatements only after determining a more-likely-than-not probabilitythat the uncertain tax positions will withst<strong>and</strong> challenge, if any, fromtaxing authorities.As <strong>of</strong> January 31, 2011 <strong>and</strong> 2010, the amount <strong>of</strong> unrecognized tax benefitsrelated to continuing operations was $795 million <strong>and</strong> $1.0 billion, respectively,<strong>of</strong> which, the amount <strong>of</strong> unrecognized tax benefits that would affectthe Company’s effective tax rate is $687 million <strong>and</strong> $671 million for January31, 2011 <strong>and</strong> 2010, respectively.A reconciliation <strong>of</strong> unrecognized tax benefits from continuing operationsis as follows:Fiscal Years Ended January 31,(Amounts in millions) 2011 2010 2009Unrecognized tax benefit,beginning <strong>of</strong> year $1,019 $1,017 $ 868Increases related to prior yeartax positions 101 129 296Decreases related to prior yeartax positions (61) (33) (34)Increases related to current yeartax positions 199 246 129Settlements during the period (453) (340) (238)Lapse in statutes <strong>of</strong> limitations (10) — (4)Unrecognized tax benefit,end <strong>of</strong> year $ 795 $1,019 $1,017The Company classifies interest <strong>and</strong> penalties related to uncertain taxbenefits as interest expense <strong>and</strong> as operating, selling, general <strong>and</strong>administrative expenses, respectively. During fiscal 2011, 2010 <strong>and</strong> 2009,the Company recognized interest related to uncertain tax positions <strong>of</strong>$45 million, $88 million <strong>and</strong> $109 million, respectively. At January 31, 2011<strong>and</strong> 2010, the Company had accrued interest related to uncertain taxpositions <strong>of</strong> $205 million <strong>and</strong> $231 million, respectively, <strong>and</strong> $2 million<strong>of</strong> accrued penalties. There were no changes to accrued penaltiesrecognized during the year.During the next twelve months, it is reasonably possible that taxaudit resolutions could reduce unrecognized tax benefits by between$330 million <strong>and</strong> $420 million, either because the tax positions are sustainedon audit or because the Company agrees to their disallowance.The Company does not expect any change to have a significant impacton our consolidated financial statements.The Company is subject to income tax examinations for its U.S. federalincome taxes generally for the fiscal years 2009 through 2011. TheCompany is also subject to income tax examinations for internationalincome taxes for the tax years 2003 through 2010, <strong>and</strong> for state <strong>and</strong> localincome taxes for the fiscal years generally 2006 through 2009.Discontinued OperationsAt January 31, 2010, the Company had an unrecognized tax benefit <strong>of</strong>$1.7 billion related to an ordinary worthless stock deduction from the fiscal2007 disposition <strong>of</strong> its German operations. During the fourth quarter <strong>of</strong> fiscal2011, this matter was effectively settled with the Internal Revenue Service,which resulted in the reclassification <strong>of</strong> the deduction as an ordinary loss,a capital loss that the Company has fully <strong>of</strong>fset with a valuation allowance,<strong>and</strong> a reduction in the accumulated but undistributed earnings <strong>of</strong> an internationalsubsidiary. In connection with this settlement, the Company recordeda $1.0 billion tax benefit in discontinued operations on our ConsolidatedStatements <strong>of</strong> Income (see Note 15) <strong>and</strong> a reduction <strong>of</strong> our accrued incometax liability in our Consolidated Balance Sheet at January 31, 2011.<strong>Wal</strong>mart 2011 Annual Report 45