Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

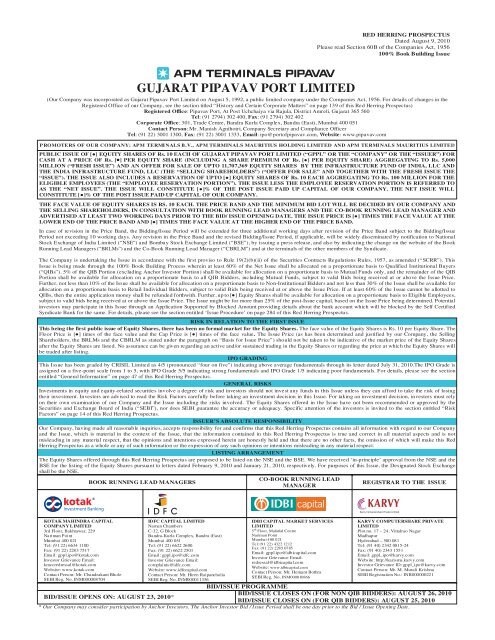

TABLE OF CONTENTSSECTION I: GENERAL .............................................................................................................................. 1DEFINITIONS AND ABBREVIATIONS .................................................................................................. 1PRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATA ............................................ 12FORWARD-LOOKING STATEMENTS ................................................................................................. 13SECTION II: RISK FACTORS ................................................................................................................. 14SECTION III – INTRODUCTION ............................................................................................................ 35SUMMARY OF BUSINESS, STRENGTHS AND STRATEGY ............................................................. 35SUMMARY OF FINANCIAL INFORMATION ..................................................................................... 41THE ISSUE ............................................................................................................................................... 46GENERAL INFORMATION ................................................................................................................... 47CAPITAL STRUCTURE .......................................................................................................................... 59OBJECTS OF THE ISSUE ....................................................................................................................... 75BASIS FOR ISSUE PRICE ....................................................................................................................... 84STATEMENT OF TAX BENEFITS ......................................................................................................... 87SECTION IV: ABOUT OUR COMPANY ................................................................................................ 99INDUSTRY .............................................................................................................................................. 99BUSINESS .............................................................................................................................................. 117REGULATIONS AND POLICIES IN INDIA ........................................................................................ 133HISTORY AND CERTAIN CORPORATE MATTERS ........................................................................ 139MANAGEMENT .................................................................................................................................... 147PROMOTERS AND PROMOTER GROUP ........................................................................................... 161GROUP COMPANIES ........................................................................................................................... 170RELATED PARTY TRANSACTIONS.................................................................................................. 176DIVIDEND POLICY .............................................................................................................................. 182INDEBTEDNESS ................................................................................................................................... 183SECTION V – FINANCIAL INFORMATION ...................................................................................... 188MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTSOF OPERATIONS .................................................................................................................................. 225SECTION VI – LEGAL AND OTHER INFORMATION ................................................................... 245OUTSTANDING LITIGATION AND MATERIAL DEVELOPMENTS ............................................. 245GOVERNMENT AND OTHER APPROVALS ..................................................................................... 260OTHER REGULATORY AND STATUTORY DISCLOSURES .......................................................... 266SECTION VII – ISSUE RELATED INFORMATION .......................................................................... 276TERMS OF THE ISSUE ......................................................................................................................... 276ISSUE STRUCTURE ............................................................................................................................. 279ISSUE PROCEDURE ............................................................................................................................. 284RESTRICTION ON FOREIGN OWNERSHIP OF INDIAN SECURITIES .......................................... 314SECTION VIII - MAIN PROVISIONS OF ARTICLES OF ASSOCIATION OF OUR COMPANY..................................................................................................................................................................... 315SECTION IX – OTHER INFORMATION ............................................................................................. 334MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION ................................................ 334DECLARATION .................................................................................................................................... 337

SECTION I: GENERALDEFINITIONS AND ABBREVIATIONSTerm“Our”, “We”, “us”, “theCompany”, , the Issuer”,“Gujarat Pipavav PortLimited” or “GPPL”DescriptionUnless the context otherwise requires, refers to Gujarat Pipavav PortLimited, a <strong>com</strong>pany incorporated under the Companies Act and having itsregistered office at Pipavav Port, At Post Uchchaiya via Rajula, DistrictAmreli, Gujarat 365 560Company Related TermsTermAPMM Group or A.P.Møller Mærsk GroupAPM TerminalsArticles or Articles ofAssociationAuditorsBoard/ Board ofDirectorsConcession AgreementCorporate OfficeDescriptionIncludes A.P. Møller Mærsk A/S together with such entities in which A.P.Møller Mærsk A/S has business and financial interestUnless the context otherwise requires refers to APM Terminals B.V., a<strong>com</strong>pany incorporated in the Netherlands together with two of itssubsidiaries, namely APM Terminals Mauritius Holding Limited andAPM Terminals Mauritius LimitedThe articles of association of our Company, as amendedThe statutory auditors of our Company, namely, B S R & Associates,Chartered AccountantsThe board of directors of our Company or <strong>com</strong>mittees constituted thereofThe concession agreement dated September 30, 1998 with GMB and theGoG (acting as a confirming party) together with the supplementaryagreement to the concession agreement dated June 2, 2006The corporate office of our Company, located at 301, Trade Centre,Bandra Kurla Complex, Bandra (East), Mumbai 400 051CDR Scheme The restructuring package for restructuring the debt of Rs. 2,985.30million as was availed by our Company and approved by the CDREmpowered Group at its meeting held on October 30, 2003Director(s)Group CompaniesMemorandum /Memorandum ofAssociationPromotersPromoter GroupThe Port, APMTerminals PipavavDirector(s) of our Company unless otherwise specifiedThe <strong>com</strong>panies, firms and ventures enumerated in “Group Companies” onpage 170 of this Red Herring ProspectusThe memorandum of association of our CompanyThe promoters of our Company, namely, APM Terminals B.V., APMTerminals Mauritius Holding Limited and APM Terminals MauritiusLimitedThe <strong>com</strong>panies enumerated in “Promoters and Promoter Group” on page161 of this Red Herring ProspectusThe APM Terminals Pipavav Port located at Post Ucchaiya Via Rajula,District Amreli, Gujarat 365 5601

TermRegistered OfficeDescriptionThe registered office of our Company, located at Port Pipavav, PostUcchaiya Via Rajula, District Amreli, Gujarat 365 560Issue Related TermsTermAllotment/ Allot/AllottedAllotteeAnchor InvestorAnchor InvestorAllocation NoticeAnchor InvestorBid/Issue PeriodAnchor Investor IssuePriceAnchor Investor PortionApplication Supported byBlocked Amount/ ASBAASBA AccountASBA Bid cumApplication FormASBA BidderASBA Revision FormBanker(s) to theIssue/Escrow CollectionBank(s)DescriptionUnless the context otherwise requires, means the allotment of EquityShares pursuant to the Issue to the successful BidderA successful Bidder to whom the Equity Shares are AllottedA Qualified Institutional Buyer, applying under the Anchor InvestorPortion, with a minimum Bid of Rs. 100 millionNotice or intimation of allocation of Equity Shares sent to AnchorInvestors who have been allocated Equity Shares after discovery of theIssue Price if the Issue Price is higher than the Anchor Investor IssuePriceThe day, one working day prior to the Bid/Issue Opening Date, on whichBids by Anchor Investors shall be submitted and allocation to AnchorInvestors shall be <strong>com</strong>pletedThe final price at which Equity Shares will be issued and Allotted toAnchor Investors in terms of the Red Herring Prospectus and theProspectus, which price will be equal to or higher than the Issue Price butnot higher than the Cap Price. The Anchor Investor Issue Price will bedecided by our Company and the Selling Shareholders in consultationwith the BRLMs and the CBRLMUp to 30% of the QIB Portion which may be allocated by our Companyand the Selling Shareholders to Anchor Investors on a discretionary basis.One-third of the Anchor Investor Portion shall be reserved for domesticMutual Funds, subject to valid Bids being received from domestic MutualFunds at or above the price at which allocation is being done to AnchorInvestorsAn application, whether physical or electronic, used by all Bidders otherthan Anchor Investors to make a Bid authorizing an SCSB to block theBid Amount in their ASBA Account maintained with the SCSBAn account maintained by the ASBA Bidders with the SCSB andspecified in the ASBA Bid cum Application Form for blocking an amountmentioned in the ASBA Bid cum Application FormThe form, whether physical or electronic, used by a Bidder (other thanAnchor Investor) to make a Bid through ASBA process, which containsan authorisation to block the Bid Amount in an ASBA Account and willbe considered as the application for Allotment for the purposes of the RedHerring Prospectus and the ProspectusProspective investors in this Issue who intend to Bid/apply through ASBAThe form used by the ASBA Bidders to modify the quantity of EquityShares or the Bid Amount in any of their ASBA Bid cum ApplicationForm or any previous ASBA revision form(s)The banks which are clearing members and registered with SEBI asBankers to the Issue with whom the Escrow Account will be opened andin this case being Hongkong and Shanghai Banking Corporation Limited,Standard Chartered Bank, Kotak Mahindra Bank Limited, HDFC Bank2

TermBasis of AllotmentBidBid AmountBid/Issue Closing DateBid/Issue Opening DateBid cum ApplicationFormBidderBid/Issue PeriodBook Building ProcessBRLMs/Book RunningLead ManagersCAN/ Confirmation ofAllotment NoteCap PriceCo-Book Running LeadManager or CBRLMCut-off PriceDesignated BranchesDescriptionLimited and IDBI Bank LimitedThe basis on which Equity Shares will be Allotted to successful Biddersunder the Issue and which is described in “Issue Procedure – Basis ofAllotment” on page 307 of the Red Herring ProspectusAn indication to make an offer during the Bid/Issue Period by a Bidderpursuant to submission of the Bid cum Application Form, or during theAnchor Investor Bid/ Issue Period by the Anchor Investors, to subscribeto the Equity Shares of our Company at a price within the Price Band,including all revisions and modifications thereto.The highest value of the optional Bids indicated in the Bid cumApplication FormExcept in relation to any Bids received from Anchor Investors, the dateafter which the the Syndicate and the Designated Branches of the SCSBswill not accept any Bids for the Issue, which shall be notified in anEnglish national newspaper, a Hindi national newspaper and a Gujaratinewspaper, each with wide circulationExcept in relation to any Bids received from Anchor Investors, the dateon which the Syndicate and the Designated Branches of the SCSBs shallstart accepting Bids for the Issue, which shall be notified in an Englishnational newspaper, a Hindi national newspaper and a Gujaratinewspaper, each with wide circulationThe form used by a Bidder (which, unless expressly provided, includesthe ABSA Bid cum Application Form by an ABSA Bidder, as applicable)to make a Bid and which will be considered as the application forAllotment for the purposes of the Red Herring Prospectus and theProspectusAny prospective investor who makes a Bid pursuant to the terms of theRed Herring Prospectus and the Bid cum Application FormThe period between the Bid/Issue Opening Date and the Bid/IssueClosing Date inclusive of both days, during which prospective Bidderscan submit their Bids, including any revisions thereofBook building process as provided in Schedule XI of the SEBIRegulations, in terms of which the Issue is being madeBook Running Lead Managers to the Issue, in this case being KMCC andIDFC CapitalNote or advice or intimation of Allotment sent to the Bidders who havebeen Allotted Equity Shares after Basis of Allotment has been approvedby the Designated Stock ExchangeThe higher end of the Price Band, above which the Issue Price will not befinalised and above which no Bids will be acceptedIDBI CapitalIssue Price, finalised by our Company and the Selling Shareholders, inconsultation with the BRLMs and CBRLM. Only Retail IndividualBidders and Eligible Employees, whose Bid Amount does not exceed Rs.100,000 are entitled to Bid at the Cut-off Price. . QIBs and Non-Institutional Bidders are not entitled to Bid at the Cut-off PriceSuch branches of the SCSBs which shall collect the ASBA Bid cumApplication Forms used by ASBA Bidders and a list of which is available3

TermDesignated DateDesignated StockExchangeDraft Red HerringProspectus or D<strong>RHP</strong>Eligible EmployeesEligible NRIEmployee ReservationPortionEscrow AccountEscrow AgreementEquity SharesFinancial Year/ fiscal/FYFirst BidderFloor PriceFresh IssueGIR NumberDescriptionon http://www.sebi.gov.inThe date on which funds are transferred from the Escrow Account or theamount blocked by the SCSB is transferred from the ASBA Account, asthe case may be, to the Public Issue Account or the Refund Account, asappropriate, after the Prospectus is filed with the RoC, following whichthe Board of Directors shall Allot Equity Shares to successful BiddersNSEThe draft red herring prospectus dated December 21, 2009 issued inaccordance with Section 60B of the Companies Act and the SEBIRegulations, which does not contain <strong>com</strong>plete particulars of the price atwhich the Equity Shares will be issued and the number of Equity Sharesbeing offered in the IssuePermanent and full-time employees, working in India or abroad, of theCompany or of the holding <strong>com</strong>pany or subsidiaries or a director of theCompany, whether whole time or part time excluding Promoters and theirimmediate relatives who are Indian nationals and are present in India onthe date of submission of the Bid cum Application Form or the ASBA Bidcum Application Form and who continues to be in the employment of theCompany until submission of the Bid cum Application Form or theASBA Bid cum Application FormNRIs from jurisdictions outside India where it is not unlawful to make anissue or invitation under the Issue and in relation to whom the RedHerring Prospectus constitutes an invitation to subscribe to the EquityShares Allotted hereinThe portion of the Issue being up to [●] Equity Shares aggregation uptoRs. 100 million available for allocation to Eligible EmployeesAccount opened with the Escrow Collection Bank(s) for the Issue and inwhose favour the Bidder (excluding the ASBA Bidders) will issuecheques or drafts in respect of the Bid Amount when submitting a BidAgreement dated [●] entered into by our Company, the Registrar to theIssue, the BRLMs, CBRLMs, the Selling Shareholders, the SyndicateMembers and the Escrow Collection Bank(s) for collection of the BidAmounts and where applicable, refunds of the amounts collected to theBidders (excluding the ASBA Bidders) on the terms and conditionsthereofEquity shares of our Company of Rs. 10 each unless otherwise specifiedPeriod of twelve months ended March 31 of that particular year, unlessotherwise specifiedThe Bidder whose name appears first in the Bid cum Application Form orRevision Form or the ASBA Bid cum Application Form or ASBARevision FormThe lower end of the Price Band, at or above which the Issue Price will befinalised and below which no Bids will be acceptedThe issue of [●] Equity Shares by our Company at Issue Price aggregatingto Rs. 5,000 millionGeneral Index Registry Number4

TermIDBI CapitalIDFC CapitalIDFC Infrastructure FundIDFC Infrastructure Fund2IDFC Private EquityGroupIssueIssue PriceIssue ProceedsKMCCLeverage India FundDescriptionIDBI Capital Market Services Limited, a <strong>com</strong>pany incorporated under theCompanies Act, having its registered office at 5th Floor, Mafatlal Centre,Nariman Point, Mumbai 400 021IDFC Capital Limited, a <strong>com</strong>pany incorporated under the Companies Act,having its registered office at Naman Chambers, C-32, G Block, Bandra-Kurla Complex, Bandra (East), Mumbai 400 051IDFC Infrastructure Fund is a trust created under the Indian Trust Act,1882 and registered as a venture capital fund with SEBI under the SEBI(Venture Capital Fund) Regulations, 1996 of which the IndiaDevelopment Fund is a unit schemeIDFC Infrastructure Fund 2 is a trust created under the Indian Trust Act,1882 and registered as a venture capital fund with SEBI under the SEBI(Venture Capital Fund) Regulations, 1996 of which the IDFC PrivateEquity Fund Fund II is a unit schemeIDFC Infrastructure Fund being a trust created under the Indian Trust Act,1882 and registered as a venture capital fund with SEBI under the SEBI(Venture Capital Fund) Regulations, 1996 of which the IndiaDevelopment Fund is a unit scheme and having its principal office at 201,Naman Chambers, C-32, G Block, Bandra Kurla Complex, Bandra (East),Mumbai 400 051, India, and acting through IDFC Private EquityCompany Limited, a limited liability <strong>com</strong>pany incorporated under theCompanies Act, 1956 and having its registered office at 201, NamanChambers, C-32, G Block, Bandra Kurla Complex, Bandra (East),Mumbai 400 051, India and separately, IDFC Infrastructure Fund 2 beinga trust created under the Indian Trust Act, 1882 and registered as aventure capital fund with SEBI under the SEBI (Venture Capital FundRegulations), 1996 of which IDFC Private Equity Fund II is a unitscheme and having its principal office at 201, Naman Chambers, C-32, GBlock, Bandra Kurla Complex, Bandra (East), Mumbai 400 051, Indiaand also acting through IDFC Private Equity Company Limited, a limitedliability <strong>com</strong>pany incorporated under the Companies Act, 1956 andhaving its registered office at 201, Naman Chambers, C-32, G Block,Bandra Kurla Complex, Bandra (East), Mumbai 400 051, India(collectively “IDFC Private Equity Group”)Public Issue of [●] Equity Shares of Rs. 10 each of our Company for cashat a price of Rs. [●] per Equity Share (including a share premium of Rs.[●] per Equity Share) aggregating to Rs. 5,000 million and an Offer forSale of upto 11,707,369 Equity Shares by The Infrastructure Fund ofIndia, LLC and The India Infrastructure Fund, LLC. The Issue also<strong>com</strong>prises a Net Issue to the public aggregating to Rs. [●] million and areservation for Eligible Employees aggregating Rs. 100 million.The final price at which Equity Shares will be issued and Allotted interms of the Red Herring Prospectus. The Issue Price will be decided byour Company and the Selling Shareholders in consultation with theBRLMs and CBRLM on the Pricing DateThe proceeds of the IssueKotak Mahindra Capital Company Limited, a <strong>com</strong>pany incorporatedunder the Companies Act, having its office at 3 rd floor, Bakhtawar, 229Nariman Point, Mumbai 400 021Leverage India Fund of the IL&FS Private Equity Trust represented by itstrustee IL&FS Trust Company Limited5

TermMutual FundsMutual Fund PortionNet IssueNet ProceedsNon-Institutional BiddersNon-Institutional PortionNon-ResidentOCB/Overseas CorporateBodyOffer for SalePreference SharesPrice BandPricing DateProspectusPublic Issue AccountQIB PortionQualified InstitutionalDescriptionA mutual fund registered with SEBI under the SEBI (Mutual Funds)Regulations, 1996, as amended5% of the QIB Portion (excluding the Anchor Investor Portion), or [●]Equity Shares available for allocation to Mutual Funds only, out of theQIB Portion (excluding the Anchor Investor Portion)The Issue less the Employee Reservation PortionThe Issue Proceeds less the proceeds from the Offer for Sale and the Issueexpenses. For further information about use of the Issue Proceeds and theIssue expenses, please see the section entitled “Objects of the Issue” onpage 75 of this Red Herring ProspectusAll Bidders that are not QIBs or Retail Individual Bidders and who haveBid for Equity Shares for an amount more than Rs. 100,000 (but notincluding NRIs other than eligible NRIs)The portion of the Issue being not less than [●] Equity Shares availablefor allocation to Non-Institutional BiddersA person resident outside India, as defined under FEMA and includes aNon Resident IndianA <strong>com</strong>pany, partnership, society or other corporate body owned directlyor indirectly to the extent of up to 60% by NRIs including overseas trustsin which not less than 60% of beneficial interest is irrevocably held byNRIs directly or indirectly and which was in existence on October 3, 2003and immediately before such date was eligible to undertake transactionspursuant to the general permission granted to OCBs under the FEMA.OCBs are not allowed to invest in this IssueThe offer for sale of upto 11,707,369 Equity Shares by the SellingShareholders, pursuant to the terms of the Red Herring Prospectus1% Optionally Convertible Non-Cumulative Redeemable PreferenceShares of our Company of Rs. 10 eachPrice band of a minimum price of Rs. [●] (Floor Price) and the maximumprice of Rs. [●] (Cap Price) and includes revisions thereof. The PriceBand and the minimum Bid Lot size for the Issue will be decided by ourCompany and the Selling Shareholders in consultation with the BookRunning Lead Managers and Co-Book Running Lead Manager andadvertised at least two working days prior to the Bid/Issue Opening Date,in all editions of Financial Express in English language, all editions ofJansatta in Hindi language, and all editions of Avadh Times in GujaratilanguageThe date on which our Company and the Selling Shareholders, inconsultation with the BRLMs and the CBRLM finalizes the Issue PriceThe Prospectus to be filed with the RoC in accordance with Section 60 ofthe Companies Act, containing, inter alia, the Issue Price that isdetermined at the end of the Book Building Process, the number of EquityShares and certain other informationAccount opened with the Bankers to the Issue to receive monies from theEscrow Account and from the SCSBs on the Designated DateThe portion of the Issue being at least [●] Equity Shares of Rs. 10 each tobe Allotted to QIBsPublic financial institutions as specified in Section 4A of the Companies6

TermBuyers or QIBsRed Herring Prospectus or<strong>RHP</strong>Refund AccountRefund bankersRefunds throughelectronic transfer of fundsRegistrar to the IssueDescriptionAct, scheduled <strong>com</strong>mercial banks, mutual fund registered with SEBI, FIIand sub-account registered with SEBI, other than a sub-account which is aforeign corporate or foreign individual, multilateral and bilateraldevelopment financial institution, venture capital fund registered withSEBI, foreign venture capital investor registered with SEBI, stateindustrial development corporation, insurance <strong>com</strong>pany registered withIRDA, provident fund with minimum corpus of Rs. 250 million, pensionfund with minimum corpus of Rs. 250 million, National Investment Fundset up by Government of India and insurance funds set up and managedby army, navy or airforce of the union of IndiaThis red herring prospectus to be issued in accordance with Section 60Bof the Companies Act, which will not have <strong>com</strong>plete particulars of theprice at which the Equity Shares are offered and the number of EquityShares offered in the Issue. The Red Herring Prospectus will be filed withthe RoC at least three days before the Bid/Issue Opening Date and willbe<strong>com</strong>e a Prospectus upon filing with the RoC after the Pricing DateThe account opened with Escrow Collection Bank(s), from whichrefunds, if any, of the whole or part of the Bid Amount (excluding to theASBA Bidder) shall be madeHDFC Bank LimitedRefunds through NECS, Direct Credit, NEFT, RTGS, as applicableKarvy Computershare Private LimitedRetail Individual Bidder(s) Individual Bidders who have Bid for Equity Shares for an amount notmore than Rs. 100,000 in any of the bidding options in the Issue(including HUFs applying through their Karta and eligible NRIs and doesnot include NRIs other than Eligible NRIs)Retail PortionRevision FormRoCSelf Certified SyndicateBank/ SCSBSelling ShareholdersStock ExchangesSyndicate or members ofthe SyndicateSyndicate AgreementThe portion of the Net Issue to the public being not less than [●] EquityShares of Rs. 10 each available for allocation to Retail IndividualBidder(s).The form used by the Bidders, (which, unless expressly provided,includes the ASBA revision form) to modify the quantity of EquityShares or the Bid Amount in any of their Bid cum Application Forms orany previous Revision Form(s)The Registrar of Companies, Gujarat, Dadra and Nagar Haveli located atROC Bhavan, CGO Complex, Opposite Rupal Park Society, Near AnkurBus Stand, Naranpura, Ahmedabad 380 013A banker to the Issue registered with SEBI, which offers the facility ofASBA and a list of which is available on http://www.sebi.gov.inThe Infrastructure Fund of India, LLC and The India Infrastructure Fund,LLCBSE and NSEThe BRLMs, CBRLM and the Syndicate MembersThe agreement dated [●] entered into between the Syndicate, the SellingShareholders and the Company in relation to the collection of Bids in theIssue (excluding the Bidders applying through the ASBA process)7

TermSyndicate MembersTRS/ TransactionRegistration SlipUnderwritersUnderwriting AgreementUTI Unit Scheme 64Working DayDescriptionKotak Securities Limited and Sharekhan LimitedThe slip or document issued by the Syndicate or the SCSB (only ondemand), as the case may be, to the Bidder as proof of registration of theBidThe BRLMs, CBRLM and the Syndicate MembersThe agreement among the Underwriters, the Selling Shareholders and theCompany to be entered into on or after the Pricing DateUnit Scheme 64 of the Unit Trust of India represented by theAdministrator of the specified undertaking of The Unit Trust of IndiaAll days excluding Sundays and bank holidays in MumbaiTechnical and Industry TermsTermAISBPCFSCWCChart DatumEDIELLERPISPSKVLPGmphMTRTGShell GasSWLTAMPTEUsTOSDescriptionAutomatic Identification SystemBollard PullContainer Freight StationCentral Warehousing CorporationThe level of water that charted depths displayed on nautical charts aremeasured fromElectronic Data InterchangeElectric Level LuffingEnterprise Resource PlanningInternational Code for the Security of Ships and Port FacilitiesKilovoltLiquefied Petroleum GasMoves per hourMetric TonneRubber Tyred Gantry CraneShell Gas (LPG) India Private LimitedSafe Working LoadTariff Authority for Major PortsTwenty-foot Equivalent Units. In case of APM Terminals, TEUs setforth herein have been calculated by taking into account APMTerminals’ economic interest in each projectTerminal Operating System8

Conventional and General Terms/ AbbreviationsTermAct or Companies ActAGMASAYBSECAGRCDSLCINDepositoriesDepositories ActDP/ DepositoryParticipantDP IDDIPPEBITDAEGMEPSFCNR AccountFDIFEMAFEMA RegulationsFII(s)FIPBFVCIGDPDescriptionCompanies Act, 1956, as amended from time to timeAnnual General MeetingAccounting Standards issued by the Institute of Chartered Accountants ofIndiaAssessment YearBombay Stock Exchange LimitedCompounded Annual Growth RateCentral Depository Services (India) LimitedCorporate Identification NumberNSDL and CDSLDepositories Act, 1996 as amended from time to timeA depository participant as defined under the Depositories Act, 1996Depository Participant’s identificationDepartment of Industrial Policy and Promotion, Ministry of Commerce andIndustry, Government of IndiaEarnings Before Interest, Tax, Depreciation and AmortisationExtraordinary General MeetingEarnings Per Share i.e., profit after tax for a fiscal year divided by theweighted average outstanding number of equity shares at the end of thatfiscal yearForeign Currency Non-Resident Account established in accordance with theFEMAForeign Direct InvestmentForeign Exchange Management Act, 1999 read with rules and regulationsthereunder as amended from time to timeFEMA (Transfer or Issue of Security by a Person Resident Outside India)Regulations, 2000 as amended from time to timeForeign Institutional Investors as defined under SEBI (Foreign InstitutionalInvestor) Regulations, 1995 registered with SEBI under applicable laws inIndiaForeign Investment Promotion BoardForeign Venture Capital Investor registered under the Securities andExchange Board of India (Foreign Venture Capital Investor) Regulations,2000, as amended from time to timeGross Domestic Product9

TermGoI/GovernmentGoGGMBHUFIFRSITITESI.T. ActIndian GAAPIPOJNPTMICRMn / mnMoUNANAVNCRNECSNEFTNOCNR/Non ResidentsNRE AccountNRINRO AccountNSDLNSEp.a.P/E RatioPANPIOPRCLPLRRBIDescriptionGovernment of IndiaGovernment of GujaratGujarat Maritime BoardHindu Undivided FamilyInternational Financial Reporting StandardInformation TechnologyInformation Technology Enabled ServicesThe In<strong>com</strong>e Tax Act, 1961, as amended from time to timeGenerally Accepted Accounting Principles in IndiaInitial public offeringJawaharlal Nehru Port TrustMagnetic Ink Character RecognitionMillionMemorandum of UnderstandingNot ApplicableNet Asset ValueNational Capital RegionNational Electronic Clearing ServiceNational Electronic Fund TransferNo Objection CertificateNon ResidentNon Resident External AccountNon Resident Indian, is a person resident outside India, as defined underFEMA and the FEMA RegulationsNon Resident Ordinary AccountNational Securities Depository LimitedNational Stock Exchange of India Limitedper annumPrice/Earnings RatioPermanent Account Number allotted under the In<strong>com</strong>e Tax Act, 1961, asamended from time to timePersons of Indian OriginPipavav Railways Corporation LimitedPrime Lending RateReserve Bank of India10

TermRoNWRs.SCRASCRRSEBISEBI ActSEBI RegulationsSEBI TakeoverRegulationsStamp ActState GovernmentUINUS / USAUS GAAPUSD/ US$VCFsDescriptionReturn on Net WorthIndian RupeesSecurities Contracts (Regulation) Act, 1956, as amended from time to timeSecurities Contracts (Regulation) Rules, 1957, as amended from time totimeThe Securities and Exchange Board of India constituted under the SEBIActSecurities and Exchange Board of India Act 1992, as amended from time totimeSEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009, asamended from time to timeSecurities and Exchange Board of India (Substantial Acquisition of Sharesand Takeovers) Regulations, 1997, as amended from time to timeThe Indian Stamp Act, 1899, as amended from time to timeThe government of a state of IndiaUnique Identification NumberUnited States of AmericaGenerally Accepted Accounting Principles in the United States of AmericaUnited States DollarsVenture Capital Funds as defined and registered with SEBI under the SEBI(Venture Capital Fund) Regulations, 1996, as amended from time to time11

Financial DataPRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATAUnless stated otherwise, the financial data in this Red Herring Prospectus is derived from the restatedfinancial statements of our Company, prepared in accordance with Indian GAAP and which are included inthis Red Herring Prospectus.The fiscal year of our Company <strong>com</strong>mences on January 1 of each year and ends on December 31 of thesame year. However, our year ended December 31, 2005 reflects a nine month period due to a change in ourfiscal year end closing from March 31 to December 31 from fiscal 2005 onwards.There are significant differences between Indian GAAP, IFRS and US GAAP. We have not attempted toquantify their impact on the financial data included herein and we urge you to consult your own advisorsregarding such differences and their impact on the financial data. Accordingly, the degree to which theIndian GAAP financial statements included in this Red Herring Prospectus will provide meaningfulinformation is entirely dependent on the reader’s level of familiarity with Indian accounting practices. Anyreliance by persons not familiar with Indian accounting practices on the financial disclosures presented inthis Red Herring Prospectus should accordingly be limited.Any percentage amounts, as set forth in “Risk Factors”, “Business”, “Management’s Discussion andAnalysis of Financial Condition and Results of Operations” and elsewhere in this Red Herring Prospectusunless otherwise indicated, have been calculated on the basis of the audited financial statements prepared inaccordance with Indian GAAP.In this Red Herring Prospectus, any discrepancies in any table between the totals and the sum of theamounts listed are due to rounding off.Currency and Units of PresentationAll references to “Rupees” or “Rs.” are to Indian Rupees, the official currency of the Republic of India. Allreferences to “US$” or are to United States Dollars, the official currency of the United States of America.In this Red Herring Prospectus, we have presented certain numerical information in ‘million’ (or ‘mio’) and‘billion’ units. One million/mio represents 1,000,000 and one billion represents 1,000,000,000.Exchange RatesThis Red Herring Prospectus contains translations of certain U.S. Dollar and other currency amounts intoIndian Rupees that have been presented solely to <strong>com</strong>ply with the requirements of the SEBI Regulations.These convenience translations should not be construed as a representation that those U.S. Dollar or othercurrency amounts could have been, or can be converted into Indian Rupees, at any particular rate or at all.Industry and Market DataUnless stated otherwise, industry and market data used throughout this Red Herring Prospectus has beenobtained from industry publications. Industry publications generally state that the information contained inthose publications has been obtained from sources believed to be reliable but that their accuracy and<strong>com</strong>pleteness are not guaranteed and their reliability cannot be assured. Although we believe that industrydata used in this Red Herring Prospectus is reliable, it has not been independently verified.The extent to which the market and industry data used in this Red Herring Prospectus is meaningfuldepends on the reader’s familiarity with and understanding of the methodologies used in <strong>com</strong>piling suchdata.12

FORWARD-LOOKING STATEMENTSThis Red Herring Prospectus contains certain “forward-looking statements”. These forward lookingstatements can generally be identified by words or phrases such as “aim”, “anticipate”, “believe”, “expect”,“estimate”, “intend”, “objective”, “plan”, “project”, “will”, “would”, “will continue”, “will pursue”, “willlikely result”, “contemplate”, “seek to”, “future”, “goal”, “should” or other words or phrases of similarimport. Similarly, statements that describe the objectives, plans or goals of our Company are also forwardlookingstatements.All forward-looking statements are subject to risks, uncertainties, and assumptions that could cause actualresults to differ materially from those contemplated by the relevant forward-looking statement. Actualresults may differ materially from those suggested by the forward looking statements due to risks oruncertainties associated with our expectations with respect to, but not limited to, regulatory changespertaining our business and our ability to respond to them, our ability to successfully implement businessstrategy, its growth and expansion, technological changes, its exposure to market risk, general economicand political conditions in India which have an impact on its business activities or investments, themonetary and fiscal policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreignexchange rates, the performance of the financial markets in India and globally, changes in domestic laws,regulations and taxes and changes in <strong>com</strong>petition in our industry. Important factors that could cause actualresults to differ materially from our expectations include, among others:Our failure to meet our traffic volume obligations under the Traffic Guarantee Agreement;Decline in our business and growth in the event we cannot benefit from our relationship with ourPromoter, APM Terminals in the future;Risk relating to reliance on concessions and licenses from government and quasi-governmentalorganisations;Our inability to effectively manage our growth or successfully implement our business plan andgrowth strategy; andIf we are required to contribute additional capital for maintaining our equity interest in PRCL.For a further discussion of factors that could cause the actual results of our Company to differ, see “RiskFactors” on page 14 of this Red Herring Prospectus. By their nature, certain market risk disclosures areonly estimates and could be materially different from what actually occurs in the future. As a result, actualfuture gains or losses could materially differ from those that have been estimated.Neither our Company, our Directors, the Selling Shareholders, the Underwriters nor any of their respectiveaffiliates have any obligation to update or otherwise revise any statements reflecting circumstances arisingafter the date hereof or to reflect the occurrence of underlying events, even if the underlying assumptionsdo not <strong>com</strong>e to fruition. In accordance with SEBI requirements, we, the Selling Shareholders (in relation tothe Equity Shares offered by them under the Offer for Sale), the BRLMs and the CBRLM will ensure thatinvestors in India are informed of material developments until such time as the grant of listing and tradingpermission by the Stock Exchanges.13

SECTION II: RISK FACTORSThe risks and uncertainties described below, together with the other information contained in this RedHerring Prospectus, should be carefully considered before making an investment decision in our EquityShares. These risks are not the only ones relevant to our Company and our business, the industry andgeographic regions in which we operate, or the Equity Shares. Additional risks, not presently known to usor that we currently deem immaterial may also impair our business and operations. To obtain a <strong>com</strong>pleteunderstanding of our Company and prior to making an investment decision, prospective investors shouldread this section in conjunction with the sections titled “Business” and “Management’s Discussion andAnalysis of Financial Condition and Results of Operations” beginning on pages 117 and 225, respectively,as well as the other financial and statistical information contained in this Red Herring Prospectus. If any ofthe risks described below actually occur, our business, prospects, financial condition and results ofoperations could be seriously harmed, the trading price of our Equity Shares could decline, and investorscould lose all or part of their investment.Prospective investors should pay particular attention to the fact that we are incorporated under the laws ofIndia and are subject to a legal and regulatory environment that differs in certain respects from that ofother countries.Unless specified or quantified in the relevant risk factors below, we are not in a position to quantify thefinancial or other implication of any of the risks described in this section.Risks Related To Our Business1. Failure to meet our traffic volume obligations under the Traffic Guarantee Agreement could materiallyaffect our business, cash flows and results of operation.We have entered into a Traffic Guarantee Agreement dated January 10, 2003 with the Ministry ofRailways/Western Railways and PRCL. Pursuant to the terms of the Traffic Guarantee Agreement, we haveguaranteed to provide rail freight traffic of one million tonnes in the first year of operations, two milliontonnes in the second year of operations and three million tonnes from the third year of operations onwards(“Minimum Guaranteed Quantity”) to PRCL until June 2034. As of March 31, 2008, 2009 and 2010, wehad been unable to meet the Minimum Guaranteed Quantity and as per the terms of the Traffic GuaranteeAgreement total <strong>com</strong>pensation of Rs. 1,076.9 million, Rs. 306.4 million and Rs. 54.0 million, respectively,was payable to PRCL. Further to our negotiations with PRCL, we have made payments of Rs. 1,076.9million (including TDS) in relation to liability arising as of March 31, 2008 and Rs. 187.2 million(including TDS) in relation to liability arising as of March 31, 2009. In addition, <strong>com</strong>pensation of Rs.172.2. million (net of TDS) is still payable to PRCL and adequate provisions in relation to such<strong>com</strong>pensation payable to PRCL have been made in our books of accounts. There can be no assurance thatwe will achieve the Minimum Guaranteed Quantity freight arrangements with PRCL in the future. Failureto meet these standards could have an adverse effect on our cash flows, business, financial condition andresults of operations.Further, the term of the Traffic Guarantee Agreement extends beyond the term of the ConcessionAgreement for the Port, which expires on September 30, 2028. If we are unable to extend the term of theConcession Agreement or renegotiate the terms of the Traffic Guarantee Agreement, we will be obligated to<strong>com</strong>pensate PRCL the Minimum Guaranteed Quantity up to June 2034, even if we cease to operate thePort, which could have an adverse effect on our business, financial condition and results of operations.2. We benefit from our relationship with our Promoter, APM Terminals, which is part of the APMMGroup. We derived 34.2%, 22.5%, 26.2% and 28.6% of our operating revenues from the APMM Groupfor the years ended December 31, 2007, 2008 and 2009 and the three month period ended March 31,2010, respectively. Our business and growth prospects may decline if we cannot benefit from thisrelationship in the future.Our Promoter, APM Terminals, currently owns a 57.9% equity interest in us. APM Terminals is one of thelargest container terminal operators in the world with a global network of 50 terminals in 34 countries andfive continents. In the year ended December 31, 2009, APM Terminals handled 31.0 million TEUs and hadrevenues of over US$ 3.00 billion. APM Terminals is part of the APMM Group, which has significantexperience in development of ports and terminals, container and related activities, oil and gas activities,14

tankers, offshore and other shipping activities, and logistics activities. For the years ended December 31,2007, 2008 and 2009 and the three month period ended March 31, 2010, APMM Group accounted forapproximately 34.2%, 22.5%, 26.2% and 28.6% of our operating revenues, respectively. In addition, wereceive benefits such as access to modern technology, operational know-how, best industry practices,increased bargaining power and <strong>com</strong>petitive rates for purchase of port equipment, and access to experiencedpersonnel resources from APM Terminals and benefits such as developing business with shipping lines andassistance in developing relationships with third parties in the shipping industry from APMM Group.Any reduction in our business with APMM Group <strong>com</strong>panies, or decrease in the direct or indirect benefitwe receive from such <strong>com</strong>panies could adversely affect our financial condition and results of operations.3. We face various risks relating to our reliance on concessions and licences from government and quasigovernmentalorganisations. Further, we may be adversely affected by increases and/or changes inroyalties and fees payable by us.We rely on concessions, licenses and key contracts in the operation of our business. We operate and manageour business at APM Terminals Pipavav under concessions and licences granted by the relevant governmentagencies. On September 30, 1998, GMB and the GoG entered into the Concession Agreement with us,which grants us the right during the term of the Concession Agreement to develop, finance, construct,operate and maintain our Port for 30 years, which is extendable by a maximum period of two years or bysuch period until the transport infrastructure linkages as provided under certain approved detailed projectreports are in place. Pursuant to the Concession Agreement, we have leased approximately 1,056 acres ofland located at APM Terminals Pipavav.Cancellation, early termination or non-renewal of the Concession Agreement or any such concessions, subconcessionsor land lease agreements or licences or imposition of any restrictive regulatory controls couldhave an adverse effect on our ability to operate and manage our business at APM Terminals Pipavav andmay have an adverse effect on our business, financial condition and results of operations. There can be noassurance that if the concessions, leases or licences are renewed, the terms of such concessions, leases orlicences would be on similar terms or on terms favourable to us. See “History and Certain CorporateMatters – Concession Agreement with GMB and the GoG” on page 142 of this Red Herring Prospectus.The Concession Agreement requires us to pay GMB a royalty calculated based on the tonnage of cargohandled at the leased land and waterfront. For the years ended December 31, 2007, 2008 and 2009, and thethree month period ended March 31, 2010, we paid royalties of Rs. 23.24 million, or 1.5% of our operatingrevenue, Rs. 26.62 million, or 1.6% of our operating revenue, Rs. 50.96 million, or 2.3% of our operatingrevenue and Rs. 13.01 million, or 2.4% of our operating revenue, respectively. The royalty fees willincrease by 20.0% every three years. Pursuant to the terms of the Concession Agreement, we are required toobtain GMB’s prior approval for any expansion at our Port which is outside the scope of the approvedlayout plan or the approved detailed project report, and any disallowance in the capital cost already incurredwill not be available for set-off from our royalty payments. See “History and Certain Corporate Matters –Concession Agreement with GMB and the GoG” on page 142 of this Red Herring Prospectus. In the eventwe do not obtain such approval from GMB, we will not be able to undertake our proposed expansion asplanned, which could have an adverse effect on our business, financial condition and results of operations.In addition, we are required under the Concession Agreement to make an aggregate investment of Rs.10,000.00 million for the development of the Port by December 31, 2009 and such investment is required tobe approved by GMB. Our ongoing expansion plan has been under implementation and since April 1, 2003,we have invested approximately Rs. 12,060.02 million up to May 31, 2010. If we fail to obtain GMB’sapproval for any expenditure incurred we may suffer financial loss which could have an adverse effect onour business, financial condition and results of operations.4. We have incurred losses in the past and we cannot assure you that we will make dividend payments.We incurred net losses for the year ended December 31, 2006, 2007, 2008 and 2009 and the three monthperiod ended March 31, 2010 of Rs. 518.34 million, Rs. 460.22 million, Rs. 676.01 million, Rs. 1,176.69million and Rs. 277.66 million, respectively. We anticipate that we may not yet operate to full capacity inthe immediate future, and as a result, our operating losses may continue. In addition, our future ability topay dividends will depend upon a number of factors, including our results of operations, earnings, capitalrequirements and surplus, general financial conditions, contractual restrictions, applicable Indian legalrestrictions and other factors considered relevant by the Board.15

5. A portion of the shareholding of our Promoter, AMP Terminals Mauritius Limited, constituting 20.9%of current paid-up share capital of the Company, has been pledged with banks/ financial institutions.65,786,999 Equity Shares held by our Promoter, APM Terminals Mauritius Limited, constituting 20.9% ofcurrent paid-up share capital of the Company, have been pledged with Infrastructure Development FinanceCompany Limited as collateral security in its capacity as a security trustee for loans granted byInfrastructure Development Finance Company Limited, IDBI Bank Limited, Syndicate Bank, Bank ofIndia, Punjab National Bank, Export-Import Bank of India, Housing Development Finance CorporationLimited and Union Bank of India to our Company in terms of loan agreement dated May 19, 2009 enteredinto by us with these lenders. In the event the pledge is enforced, the shareholding of APM TerminalsMauritius Limited in our Company shall reduce to that extent.6. We may be required to contribute additional capital for maintaining our equity interest in PRCL and maynot control PRCL’s dividend payment decisions.We own a 38.8% equity interest in PRCL and may be required to contribute additional capital formaintaining our equity interest in PRCL. Certain aspects of PRCL’s operations have been delegated to thecontrol of other parties. For example, rail haulage and freight rates payable for using the PRCL network aredetermined by the Ministry of Railways. If these rates are increased, our customers may not use the PRCLnetwork for evacuation of cargo from APM Terminals Pipavav, which may adversely affect our results ofoperations.Our ability to receive dividends from PRCL is constrained by corporate laws and regulations governing thepayment of dividends to shareholders. Also, we do not control dividend decisions by PRCL as decisionsregarding dividend payment require majority consent. If dividend payments do not materialise in theamounts that we expect, we may not be able to recover our investment in PRCL, which could have anadverse effect on our financial condition and results of operations.7. We have in the past entered into related party transactions with entities forming part of APMM Group,and are likely to continue to do so in the future which could result in conflict of interests.We have entered into transactions with entities forming part of APMM Group for container cargo andrelated marine services. We also derived 34.2%, 22.5%, 26.8% and 28.6% of our operating revenue for theyear ended December 31, 2007, 2008 and 2009 and the three month period ended March 31, 2010,respectively, from Maersk Line and Safmarine Container Lines, each of which is part of APMM Group.While we believe that all such transactions have been conducted on, and have <strong>com</strong>mercial terms consistentwith, an arm’s length basis, there can be no assurance that we could not have achieved more favourableterms had such transactions not been entered into with related parties. Further, it is likely that we will enterinto related party transactions in the future. There can be no assurance that such transactions, individually orin the aggregate, will always be in the best interests of our minority shareholders. Commercial transactionsin the future between us and related parties could result in conflicting interests. See “Related PartyTransactions” on page 176 of this Red Herring Prospectus.8. A venture promoted by our Promoter, APM Terminals, is engaged in a line of business similar to ours.Our Promoter, APM Terminals, also operates Gateway Terminals India Private Limited, a containerterminal at Mumbai engaged in a line of business similar to ours. We cannot assure you that our Promoterwill not favour the interests of Gateway Terminals India Private Limited over our interests or that APMTerminals may not in the future invest in other ports in India, which may increase our <strong>com</strong>petition.9. Our inability to effectively manage our growth or successfully implement our business plan and growthstrategy could have an adverse effect on our business, results of operations and financial condition.We have experienced considerable growth in operating revenue over the past five years. Our operatingrevenue for the years ended December 31, 2007, 2008 and 2009 and for the three month period endedMarch 31, 2010 was Rs. 1,516.04 million, Rs. 1,673.23 million, Rs. 2,191.16 million and Rs. 540.67million, respectively. We intend to pursue a growth strategy to explore existing and potential marketopportunities. Our future prospects will depend upon our ability to grow our business and operationsfurther.16

In order to manage growth effectively, we must implement and improve our operating systems, proceduresand internal controls on a timely basis, create additional facilities and infrastructure and make timely andadequate investments at <strong>com</strong>petitive rates. If we fail to implement these systems, procedures and controls oradd additional facilities and infrastructure on a timely basis, we may not be able to meet our customers’needs, hire and retain new employees, pursue new business, <strong>com</strong>plete future strategic agreements or operateour business effectively. Failure to manage growth effectively could have an adverse effect on our business,results of operations and financial condition.10. If EDI is not implemented at APM Terminals Pipavav or we face technical problems afterimplementation of EDI, our results of operations could be affected.The customs and excise authorities in India have <strong>com</strong>menced implementation of EDI facilities at Indianports to facilitate electronic filing of bills of entry (import goods declarations), shipping bills (export goodsdeclarations) and <strong>com</strong>munications with cargo carriers such as shipping lines. We have incurred costs forinstallation of hardware for implementation of EDI facilities at APM Terminals Pipavav, but such facilitieshave not yet been fully implemented. There can be no assurance that the Government will continue to placeemphasis on EDI implementation. If there is any change in the Government or budgetary allocations byGovernment for EDI implementation, as a result of shifts in Government policies or priorities, our financialresults and business prospects may be adversely affected. In addition, once implemented, EDI may notwork smoothly and if we face major technical problems, our results of operations could be adverselyaffected.11. The inhabitants of Shial Bet island expose us to additional risk and may themselves be exposed to risksdue to our operations.The inhabitants of the island of Shial Bet, which is located near our Port, use public transport on the roadswithin our leased property and a thoroughfare which gives them access to Port premises. Our operations atAPM Terminals Pipavav may expose the inhabitants of Shial Bet to risks such as personal injury anddamage to or destruction of property. In addition, we are required to <strong>com</strong>ply with the International Code forSecurity of Ships and Port Facilities requirements which place additional security, safety and other suchobligations on us.12. We rely on a small number of customers and partners for a large proportion of our revenue.We have derived and believe that we will continue to derive in the near term a significant portion of ourrevenue from a few major carrier customers. For the years ended December 31, 2007, 2008 and 2009 andthe three month period ended March 31, 2010, our five largest customers accounted for approximately57.5%, 45.5%, 46.3% and 47.6% of our operating revenue, respectively. The revenue from these customersmay vary from year to year. Any loss of our major customers or any significant decreases in spending bysome or all of our top five customers on our services may reduce the demand for our Port and the serviceswe offer and may adversely affect our revenue, profitability and results of operations.Further, in recent years, members of the APMM Group have accounted for substantial portions of ouroperating revenues. See “- We benefit from our relationship with our Promoter, APM Terminals, which ispart of the APMM Group. We derived 34.2%, 22.5%, 26.2% and 28.6% of our operating revenues from theAPMM Group for the years ended December 31, 2007, 2008 and 2009 and the three month period endedMarch 31, 2010, respectively. Our business and growth prospects may decline if we cannot benefit fromthis relationship in the future.”We expect that a significant portion of our in<strong>com</strong>e will continue to be attributable to a limited number ofcustomers in the foreseeable future and if any of these customers reduce their business with us, it may resultin low capacity utilization of our resources, which could adversely affect our profitability and results ofoperations.In addition, our in<strong>com</strong>e may be affected by <strong>com</strong>petition, increases in fuel prices, the cyclical nature of theshipping industry and decreasing tariffs in the port and related services industry and a number of factors,other than our performance, that could cause the loss of a customer and that may not be predictable such asfinancial difficulties, bankruptcy or insolvency affecting our customers. Our customers, some of whomhave experienced substantial <strong>com</strong>petition and other pressures on their profitability, may demand price17

eductions and/or other value-added services for no additional charge, which could reduce our profitability.Any significant reduction in or the elimination of the use of the services we provide to any of ourcustomers, or any requirement to lower our prices, could harm our business.13. Our inability to create mortgages on land leased from the GoG could have an adverse affect on ourresults of operations.In addition to the land we received pursuant to the terms of the Concession Agreement from GMB, weleased an additional approximately 395 acres of land from the GoG. However, we do not have authority tocreate mortgages on the property without the prior approval of the GoG. While we have submitted anapplication to the District Collector, Amreli, on April 1, 2009 seeking approval to create a mortgage, theapplication is still pending. Some of our lenders have granted us time until December 31, 2009 to <strong>com</strong>pletethe process of creating security, however in case the approval from the GoG is not received in time, theselenders, at their discretion, can charge penal interest of 1.0% per annum on the amount of debt drawn. Incase we are unable to create security on or before June 30, 2010 and these lenders do not waive their rightto levy penal interest, our results of operations could be adversely affected.14. Our funding requirements and deployment of the net proceeds of the Issue are based on managementestimates and have not been independently appraised.Our funding requirements and the deployment of the net proceeds of the Issue are based on managementestimates and have not been appraised by any bank or financial institution. The deployment of funds asstated in “Objects of the Issue” on page 75 of this Red Herring Prospectus is entirely at the discretion of ourBoard. All the figures included under “Objects of the Issue” are based on our own estimates. In view of thehighly <strong>com</strong>petitive nature of the industry in which we operate, we may have to revise our managementestimates from time to time and consequently our funding requirements may also change. This may result inthe rescheduling of our expenditure programmes and an increase or decrease in our proposed expenditurefor a particular matter.15. Our senior management team and other key personnel in our business units are critical to our continuedsuccess and the loss of, or the inability to attract and retain, such personnel in the future could harm ourbusiness.Our success substantially depends on the continued service and performance of the members of our seniormanagement team and other key personnel in our business for the management and running of our dailyoperations and the planning and execution of our business strategy.Our ability to implement our business strategy will depend, in large part, on our ability to attract, train,motivate and retain highly skilled personnel. There is intense <strong>com</strong>petition for experienced seniormanagement and other key personnel with technical and industry expertise in the port business and if welose the services of any of these or other key individuals to <strong>com</strong>petitors and are unable to find suitablereplacements in a timely manner, our ability to realise our strategic objectives could be impaired. Further, asour Port is located in a remote location in Gujarat, with limited access to schools, hospitals and otherfacilities, we may find it difficult to attract and retain skilled personnel. Any shortage of skilled personnel orloss of services of our senior management could adversely affect our business and results of operations.Additionally, we rely on our relationship with our Promoter for utilizing the services of certain members ofour senior management. If there is a change in our relationship with our Promoter, we may also lose theservices of some of our senior management, which could adversely affect our business and results ofoperations.16. Our performance depends on our employees, sub-contractors and contract workers and the inability toattract such persons or any shortage of labour could adversely affect our business.The port industry is capital intensive. However, it is dependent on skilled personnel to carry out portoperations. Continuous access to skilled personnel is critical to our business. However, due to the locationof our Port we find it difficult to attract such skilled personnel. As of May 31, 2010, we had 505 full-timeemployees. In addition to our full-time employees, we utilise temporary contract workers provided to us bysub-contractors. Although we maintain satisfactory relations with the sub-contractors and the contractworkers and continue to engage them at rates which are acceptable to us, there can be no assurance that we18

will be able to continue to engage them on reasonable terms in the future. Any disruption in the steady andregular supply of workers may adversely affect our business and operations. In addition, our business relieson a number of third-party <strong>com</strong>panies involved in activities such as stevedoring, power supply, hiring ofequipment and vehicles, survey of cargo, provision of information technology systems, equipmentmaintenance and repair services and transportation services. The failure or inability of certain of these<strong>com</strong>panies to provide the required services efficiently could disrupt our operations. Additionally, ouroperations may also be affected by circumstances beyond our control including work stoppages, labourdisputes, shortage of qualified skilled labour and lack of adequate infrastructure services.17. Container shipping lines generally operate under fixed schedules and any change in their vessel callingpatterns may have an adverse effect on our business, results of operations and financial condition.Container shipping lines tend to operate on fixed schedules and generally review their calling patternsperiodically and accordingly book time-slots for docking and undocking. We currently do not chargeshipping lines the agreed time-slot rate for a failure to arrive at a scheduled time-slot. The increase ordecrease in calls and the stay period depends on trade patterns and volume growth. Any decrease or changein the vessel calling patterns of these lines at our Port could result in our port berths remaining unoccupiedfor certain durations, which will have an adverse effect on our business, results of operations and financialcondition.18. Delays in the improvement of the connectivity of APM Terminals Pipavav to the Indian road and railnetwork may have an adverse effect on our future growth prospects.Our Port has an approximately 269 kilometre-long dedicated broad gauge railway link and a road link toNational Highway-8E for transporting cargo to and from the Port. Presently, we rely on and benefit fromtransportation and logistics networks, and the connectivity and conditions of the road, rail and generaltransportation infrastructure in India. However, the investment in and maintenance of transportationinfrastructure in India has been poor <strong>com</strong>pared to developed countries. There can be no assurance that wewill continue to recognize the benefits of connectivity as there is no guaranty that, in the future, suchtransportation infrastructure will be constructed in a timely manner, operated on a cost effective basis andmaintained at adequate levels, the failure to do which may adversely affect our future growth prospects.Further, disruptions of transportation services because of weather-related problems, strikes, inadequacies inthe road or rail infrastructure, or other events may have an adverse impact on our operations.We have made, and will continue to make, transportation and infrastructure investments to improve theconnectivity of APM Terminals Pipavav with the inland regions of India. In particular, we entered into anagreement with the Ministry of Railways/Western Railways to set up PRCL to undertake the construction,operation and maintenance of the broad gauge railway link, which was <strong>com</strong>pleted in 2003. We presentlyown a 38.8% equity interest in PRCL. Our efforts in improving the connectivity between APM TerminalsPipavav and the inland regions of India may not be successful or could require greater capital expenditurethan we anticipate, which could adversely affect our business, results of operations and financial condition.19. Our net in<strong>com</strong>e would decrease if the tax benefits and other incentives we currently expect to beavailable to us are reduced or withdrawn.We <strong>com</strong>menced <strong>com</strong>prehensive <strong>com</strong>mercial port operations in April 2002. Being an infrastructure <strong>com</strong>pany,we benefit from certain tax incentives under section 80-IA of the In<strong>com</strong>e Tax Act, 1961, as amended, for aperiod of 10 consecutive years in a block of 15 years starting from the <strong>com</strong>mencement of business for adeduction equivalent to 100.0% of profits derived from developing or operating APM Terminals Pipavav.This tax exemption would result in tax savings for us once APM Terminals Pipavav be<strong>com</strong>es profitable.There can be no assurance that these tax incentives will continue in the future or that such tax credits shallbe available to us for the durations mentioned above or at all. The non-availability of these tax incentivescould adversely affect our results of operations and financial condition.The EPCG scheme in India facilitates import of capital goods at a concessional rate of duty with anobligation to export an amount equal to eight times the duty saved and maintain export obligations based onthe average turnover of the last three years. Importing secondhand capital goods without any restriction onage is also allowed under the Foreign Trade Policy announced on August 31, 2004. We have importedcertain of our equipment under license pursuant to the EPCG scheme. Under this scheme we are required torefund an amount to the Government of India equivalent to the duty benefit enjoyed by us under the said19

scheme, plus interest, if we fail to make the required exports within the required time period. As of March31, 2010, we had outstanding export obligations of Rs. 1,616.88 million, Rs. 2,966.95 million, Rs. 2,680.80million and Rs. 40.95 million which are required to be met by December 31, 2014, 2015, 2017 and 2018,respectively, under the EPCG Scheme. The consequences for non-fulfillment of the export obligations orother conditions include a retroactive levy of import duty on items previously imported duty-free for thesefacilities. Additionally, the respective authorities have rights to levy penalties for any defaults on a case-bycasebasis. Any such levy or penalty imposed could adversely affect our financial condition and results ofoperations.20. Our operating results may experience significant variability and as a result it may be difficult for us tomake accurate financial forecasts.Our operating results may fluctuate significantly from period to period due to various factors, such ascustomer losses, the mix of cargo handled at our Port (for example, the margins for handling bulk cargosuch as fertilisers and iron-ore are generally lower as <strong>com</strong>pared to other types of cargo handled at our Port),delays or failure by us or our partners to generate the projected level of business, variations in our operatingefficiency and manpower, delays or difficulties in expanding our operations at APM Terminals Pipavav(including constructing new facilities), changes to our pricing structure or that of our <strong>com</strong>petitors, seasonalchanges and other fluctuations in the operations of our customers and other events identified under“Forward-Looking Statements” on page 13 of this Red Herring Prospectus. In addition, the timing andspeed of <strong>com</strong>mencement of revenue-generating operations from our projects and capital expenditures, suchas the expansion of our cargo handling capacity or the addition of other services, may vary considerablyfrom our expectations based upon the size and <strong>com</strong>plexity of the project being implemented. These factorsmay make it difficult to make accurate financial forecasts or replace anticipated in<strong>com</strong>e that we do notreceive as a result of delays in implementing our services or due to losses of customers. If our actual resultsdo not meet estimates or expectations, or if we under-perform market expectations as a result of suchfactors, trading prices for our Equity Shares could be adversely affected.21. Our port handling and other operations are subject to operational risks.The operation of our port handling, <strong>com</strong>prising handling of bulk cargo, LPG, container handling,warehousing, customs inspection and other operations may be adversely affected by many factors, such asthe breakdown of equipment, damage or loss of cargo, labour disputes, accidents, natural disasters, changesin government regulations, lack of qualified equipment operators and a downturn in the overall performanceof the container and shipping industry. We are currently covered by insurance policies for loss caused byaccident, fire, flood, riot, strike and malicious damage, for liability to our customers and third parties andfor anticipated loss of profit. However, such insurance may not be adequate to cover all losses or liabilitiesthat may arise.22. If we lose the operational and <strong>com</strong>mercial flexibility we enjoy <strong>com</strong>pared to the Major Ports under thepresent regulatory regime, our in<strong>com</strong>e and profitability could be adversely affected.In our port business, we <strong>com</strong>pete with both domestic and international <strong>com</strong>panies, including ports locatedon the northwest coastline of India, non-Major Ports located in Gujarat including ports managed by GMB,global port operators with a presence in India and port service providers and intermediaries that operate atexisting ports such as handling, stevedoring, clearing and forwarding agents. See “Our Business –Competition” on page 130 of this Red Herring Prospectus. Presently we are not covered within theregulatory purview of TAMP, which provides us with considerable flexibility in determining the tariff ratesat our Port. In future, if we are unable to determine the tariff rates at our Port or are required to levy ratesspecified by any regulatory authorities, our business, financial condition and results of operations could beadversely affected.23. We operate in a highly <strong>com</strong>petitive environment and if we are not able to <strong>com</strong>pete effectively, our in<strong>com</strong>eand profitability could be adversely affected.In India, some domestic <strong>com</strong>petitors may have extensive local knowledge and business relationships and alonger operational track record in selected areas of the domestic market than us. Some of these <strong>com</strong>panieshave significant financial resources, marketing and other capabilities. Some of our international <strong>com</strong>petitorsare able to capitalise on their overseas experience to <strong>com</strong>pete in the Indian market. As a result, there can beno assurance that we will be able to <strong>com</strong>pete successfully in the future against our existing or potential20

<strong>com</strong>petitors or that our business, financial condition and results of operations will not be adversely affectedby increased <strong>com</strong>petition.Competition may increase as a result of the development of new ports in India as GMB has invited bids forthe development of additional ports in Gujarat, which may force us to lower our tariffs. In addition, portoperator <strong>com</strong>panies from other countries that establish operations in India may <strong>com</strong>pete with us,particularly if they are more efficient and have lower costs such as cheaper access to skilled manpower.Current and future <strong>com</strong>petitors may also introduce new and more <strong>com</strong>petitive port services, make strategicacquisitions or establish cooperative relationships among themselves or with third parties, therebyincreasing their ability to address the needs of our target customers. If we cannot <strong>com</strong>pete in providing<strong>com</strong>petitive port services or expanding into new markets, this could have an adverse effect on our business,financial condition and results of operations. There can be no assurance that we will be able to retain ourcustomers in the face of increased <strong>com</strong>petition.24. Our operations are subject to extensive environmental and other related regulations.Our business and operations are subject to various environmental risks such as oil spills and disposal ofhazardous waste and chemicals. We, like other port operators and manufacturers in India, are subject tovarious central, state and local environmental, health and safety laws and regulations concerning issues suchas accidents, damage caused by air emissions, wastewater discharges, solid and hazardous waste handlingand disposal. These laws, rules and regulations also prescribe the punishments for any violations. While webelieve that our facilities are in <strong>com</strong>pliance in all material respects with applicable environmental laws andregulations and we have obtained the requisite permissions and clearances in this regard, we may incuradditional costs and liabilities in relation to environmental concerns and <strong>com</strong>pliance with these laws andregulations or any remedial measures in relation thereto. These additional costs and liabilities could be onaccount of penalties, fines, remedial measures and clean up liabilities or due to <strong>com</strong>pliance with moreonerous laws or regulations. Any non-<strong>com</strong>pliance with such laws and regulations may force us to close ourPort operations until such time as we are in <strong>com</strong>pliance with these laws and regulations and in that eventour business, results of operations and financial condition could be adversely affected.Generally, insurance coverage in India may be less <strong>com</strong>prehensive than that in certain developed countriessuch as the United States. Although we maintain insurance coverage against pollution and related liabilities,in such amounts and against such risks as we believe are in accordance with industry practice in India, ourinsurance may not be adequate to cover all losses or liabilities that may arise from our operations and anyadditional costs or liabilities could adversely affect our business, financial condition and results ofoperations.25. Our business and facilities may be adversely affected by severe weather conditions or natural disasters inGujarat or elsewhere.Our business and operating facilities may be adversely affected by severe weather conditions, such as heavyrains and flooding, dense fog and low visibility, climatic changes or natural disasters such as earthquakes,tsunamis and hurricanes.Severe weather conditions or climatic changes, resulting in conditions such as dense fog, low visibility,heavy rains, wind and waves, may force us to temporarily suspend operations at APM Terminals Pipavav. Insome cases, we may temporarily suspend operations based on warnings from local and nationalmeteorological departments. If weather conditions or climatic changes of any type were to force APMTerminals Pipavav to close for an extended period of time, our business could be adversely affected. Inaddition, any weather condition or climatic change, including but not limited to severe monsoons orflooding, affecting ports that serve as starting points or final destinations for shipping lines calling at APMTerminals Pipavav could harm our business.Our operating facilities may be damaged in natural disasters such as earthquakes, tsunamis, tornados,hurricanes and cyclones. Such natural disasters in India, or in Southeast Asia may lead to a disruption oftransportation networks, information systems and telephone service for sustained periods of time. Furtherprolonged spells of below normal rainfall or other natural calamities could have a negative impact on theIndian economy, adversely affecting our business. Damage or destruction that interrupts our operations maycause us to incur substantial additional expenses to repair or replace damaged facilities or equipment. Wemay also be liable to our customers for disruption in our operations resulting from such damage or21