Integrity-Driven Performance. New Strategy for ... - GRC Resource

Integrity-Driven Performance. New Strategy for ... - GRC Resource

Integrity-Driven Performance. New Strategy for ... - GRC Resource

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

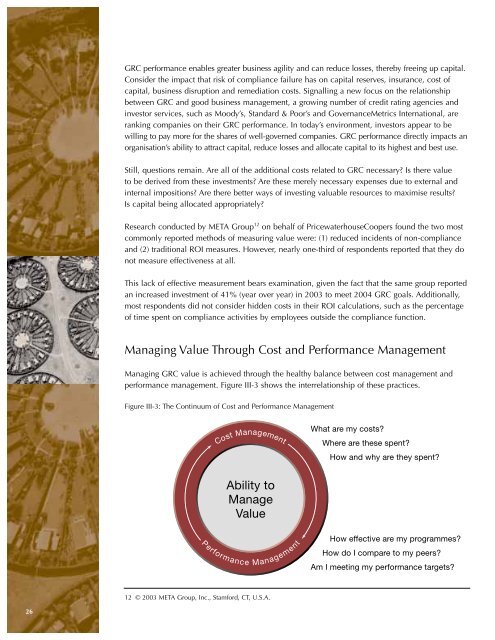

<strong>GRC</strong> per<strong>for</strong>mance enables greater business agility and can reduce losses, thereby freeing up capital.Consider the impact that risk of compliance failure has on capital reserves, insurance, cost ofcapital, business disruption and remediation costs. Signalling a new focus on the relationshipbetween <strong>GRC</strong> and good business management, a growing number of credit rating agencies andinvestor services, such as Moody’s, Standard & Poor’s and GovernanceMetrics International, areranking companies on their <strong>GRC</strong> per<strong>for</strong>mance. In today’s environment, investors appear to bewilling to pay more <strong>for</strong> the shares of well-governed companies. <strong>GRC</strong> per<strong>for</strong>mance directly impacts anorganisation’s ability to attract capital, reduce losses and allocate capital to its highest and best use.Still, questions remain. Are all of the additional costs related to <strong>GRC</strong> necessary? Is there valueto be derived from these investments? Are these merely necessary expenses due to external andinternal impositions? Are there better ways of investing valuable resources to maximise results?Is capital being allocated appropriately?Research conducted by META Group 12 on behalf of PricewaterhouseCoopers found the two mostcommonly reported methods of measuring value were: (1) reduced incidents of non-complianceand (2) traditional ROI measures. However, nearly one-third of respondents reported that they donot measure effectiveness at all.This lack of effective measurement bears examination, given the fact that the same group reportedan increased investment of 41% (year over year) in 2003 to meet 2004 <strong>GRC</strong> goals. Additionally,most respondents did not consider hidden costs in their ROI calculations, such as the percentageof time spent on compliance activities by employees outside the compliance function.Managing Value Through Cost and <strong>Per<strong>for</strong>mance</strong> ManagementManaging <strong>GRC</strong> value is achieved through the healthy balance between cost management andper<strong>for</strong>mance management. Figure III-3 shows the interrelationship of these practices.Figure III-3: The Continuum of Cost and <strong>Per<strong>for</strong>mance</strong> ManagementCost ManagementWhat are my costs?Where are these spent?How and why are they spent?Ability toManageValue<strong>Per<strong>for</strong>mance</strong>ManagementHow effective are my programmes?How do I compare to my peers?Am I meeting my per<strong>for</strong>mance targets?12 © 2003 META Group, Inc., Stam<strong>for</strong>d, CT, U.S.A.26