Model Question Paper - Icwai

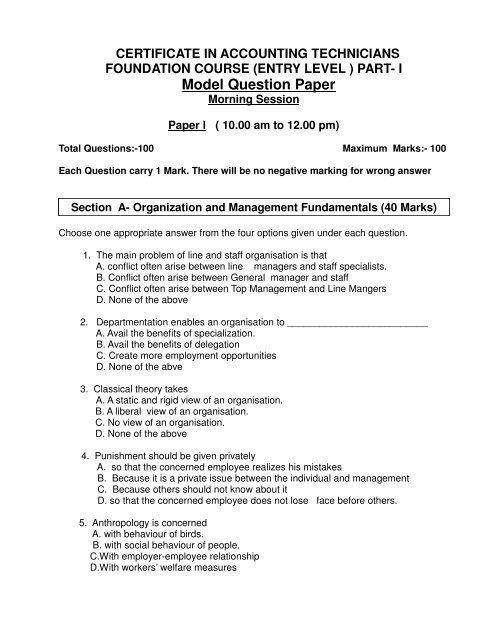

Model Question Paper - Icwai

Model Question Paper - Icwai

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

29. Planning is tooking ahead wheras control isA. exercising authorityB. Managing variablesC. Looking backD. None of the above30. Authority can be delegated but notA. ResponsibilityB. ControlC. Cheque signingD. Authorizing payments to suppliers31. Centralization implies theA. CEO vested with no authorityB. Concentration of authority at the top level of the organisation.C. Line managers having all authorityD. Central Committee having all the authority32. Leadership is the___________ which binds a group together.A. AuthoritativeB. Human FactorC. AutocraticD. Flexibility33. ________________ leadership style permits quick decision making.A. AuthoritativeB. Human FactorC. AutocraticD. Flexible34 What is vestibule TrainingA. Training in which actual jobs are stimulatedB. Training in which actual jobs are not stimulatedC. Training related to RailwaysD. It is on job training35.What does MBE stand for?A. Management by ExperienceB. Management by ExceptionC Managerial Business EconomicsD. Management by Example36. What does GD stand for?A.Group DiscussionB. Group DynamicsC. Group DecisionD. Group Documentation

37. Inter-Group conflict can be avoided byA. Incompatible goalsB. Tasks interdependenceC. Structural rearrangementsD. Absorption of uncertainty38. Which one of the following is not the statutory duties of Board of DirectorsA. Delivering share certificatesB. Attend Board MeetingC. Maintaining books and registers as required under the Companies ActD. Ensuring dividends to the shareholders regularly39. An open system meansA. Interacts with its environmentB. Offers expert adviceC. Focuses primarily on peopleD. Leads to positive outcomes40. Abraham Maslow related toA. Motivation theoryB. Theory XC. Theory YD. Payment by resultSection B :- Accounting (60 Marks )Q.41 The convention that states that the accounting practics should be followedconsistently over the years(A) Consistency(B) Conservation(C)Materiality(D) DisclosureQ.42 Reduction in the value of assets due to its continuous use is treated as(A) Loss(B) Profitability(C) Appreciation(D)DepreciationQ.43 Wages paid for installation of assets should be debited to(A) Wages A/c(B) Assets A/c(C) Trading A/c(D) P & L A/c

Q.44 Revenue Reserves are built out of(A) Recurring profit(B) Non recurring profit(C) Capital Reserves(D)None of the aboveQ.45 Del – credre commission is payable on(A) Total sales(B) Net profit(C) Credit sales(D)Cash salesQ.46 Incoming partner does not pay for goodwill but the goodwill a/c is raised andcredited in(A) Old profit sharing ratio(B) New profit sharing ratio(C) Sacrifice ratio(D) Cash salesQ.47 Amount set apart to meet loss due to bad-debts is a(A) Provision(B) Reserve(C) Appropriation(D) None of the aboveQ.48 Claims against the company not acknowledged as debts are(A) Contingent liability(B) Current liability(C) Secured loan(D) Unsecured loanQ.49 Prepaid Expenses are shown as(A) Miscellaneous expenses(B) Loans and Advances(C) Current Liabilities(D)InvestmentsQ.50 Noting charges are paid by(A) Acceptor(B) Payee(C) Drawee(D) None of the above

(A) Rs.20,.000(B) Rs.15,000(C) Rs10,000(D) None of theseQ.66 H's Trial Balance contains the following informationRs.Bed debts 3,000Discount allowed 3,000Provision for discount on debtors 3,200Provision for Doubtful debts 3,500Sundry Debtors 50,000At the end of the year, it is desired to maintain a provision for Doubtful debts at 10%and provision for discount on debtors at 4%. Sundry Debtors will appear in theBalance Sheet at a figure of:(A) Rs.43,200(B) Rs.39,744(C) Rs. 44,700(D) None of theseQ.67 2000 kg of apples are consigned to a wholesaler,the cost being Rs.3 per kg plusRs.400 of freight, it is known that a loss of 15% is unavoidable. The effective costper kg will be:(A) Rs.2.50(B) Rs.3.76(C) Rs.1.70(D) Rs.1.50Q.68 On 1.4.09 X drew a bill of Rs.1,00,000 after sight for 3 months on Y whoaccepted the bill on 1.5.09 On 4.6.09, the bill was discounted at 12% p.a. Atmaturity , the bill returned dishonoured ,due to Y's insolvency,noting chargesRs.500 and 40 Paisa in rupee is recovered from Y’s estate. The amount ofdeficiecy in Y's books will be:(A) Rs.60,000(B) Rs 40,000(C)Rs.60,300(D) Rs.40,200Q.69 A Transaction affects three accounts, one account is debited by Rs 7500,another account is credited by Rs. 9000. Third account will be(A) Credited by Rs. 7500(B) Credited by Rs. 9000(C) Credited by Rs. 1500(D) Debited by Rs. 1500

Q. 70 . International Accounting Standards are issued by the(A) International Accounting Board(B) International Accounting Standards Committee(C) Institute of Chartered Accountants of India(D)Accounting Standards Council of AmericaQ.71 The following is included in financial Accounts,but not in Cost Accounts:(A) Carriage & Freight(B) Excise Duty(C) Royalty(D) Dividend paidQ.72 The following items come under indirect administrative overheads:(A) Office stationery(B) Director's fees(C) Office rent and lighting(D) All of the aboveQ.73 The following factor is an avoidable cause for labour turnover:(A) Lower wages(B) Resignation(C) Retirement(D) Worker's roving natureQ.74 Cost reduction is:(A) Long -term phenomena(B) It challenges the standards(C) It is carried out without compromising the quality(D) All of the aboveQ.75 The main purpose of cost accounting is to(A) Recording Costs(B) Help in inventory valuation(C) Provide information ti management for decision making(D) All of the aboveQ.76 A company sold fans at Rs.2,000/- each. Variable cost Rs.1,200/- each andfixed cost Rs.60,000/-. The break even sales in Rupees is:(A) 1,20,000/-(B) 1,50,000/-(C) 1,80,000/-(D)2,00,000/-

Q.77 Which of the following is true at Break Even Point?(A) Total sales revenue = variable cost(B) Profit = Fixed cost(C) Sales revenue = Total Cost – variable Cost(D) Contribution = Fixed costQ.78 Within a given capacity , fixed cost per unit is(A) Variable(B) Fixed(C) Both(D) Neither variable nor fixedQ.79 Which of the following is a cost behaviour oriented approach to product costing ?(A) Absorption Costing(B) Marginal Costing(C) Process Costing(D) Job-Order CostingQ.80 Which of the following source documents in a cost accounting system designed toexercise control over the delivery and accurate recording of the receipt of goods?(A) Goods received note(B) Order to the supplier(C) Materials requisition(D) Purchase requisitionQ.81 Which of the following is a cost behaviour oriented approach to product costing?(A) Absorption Costing(B) Maginal Costing(C) Process Costing(D) Job Order CostingQ.82 Over which of the following costs,management is likely to have least control:(A) Wages Cost(B) Building Insurance Cost(C) Machinery Breakdown Cost(D) Advertisement CostQ.83 Which of the following indicates BEP?(A) Sales Revenue – Variable Cost(B) Profit = Fixed Cost + Variable Cost(C) Contribution = Fixed Cost(D) Contribution + Fixed Cost = Profit

Q.84 Payment of Royalties is:(A) Direct Expenses(B) Factory Overheads(C) Charged to P& L(D)Administration CostQ.85 Bad debts are treated as:(A) Direct Expenses(B) Cost of Production(C) Selling Overheads(D) Distribution OverheadsQ.86 In the situation of increasing prices, the valuation of closing stock is more under:(A) FIFO(B) LIFO(C) Simple average(D) Weighted averageQ.87 Re-order level indicates:(A) Level when a replenishment order is placed(B) Level beyond which stocks are not allowed to each(C) Quantity Ordered(D) Economic Order QuantityQ.88 An increase in fixed Cost will result into:(A) Decrease in PV Ratio(B) Decrease in Contribution per unit(C) Increase in Break Even level(D)Increase in PV RatioQ.89 Which of the following is not usually included in a Good Received Note?(A) Date of receipt(B) Quantity received(C) Price of goods(D) Description of goodsQ.90 Which of the following is usually prepared daily by employee for each job workedon?(A) Labour Job Ticket(B) Time Card(C) Punch Card(D) Cost Control CardQ.91 Which of the following is False?(A) Three basic objectives of Cost Accounting are to ascertain cost, to control costand to provide information for decision making.(B) In Cost Sheet net realizable value of normal scrap of direct materials isdeducted from the cost of materials.

(C) In a Cost Sheet,Selling and distribution Overheads are divided by the totalnumber of units produced to arrive at selling and distribution overheads perunit.(D) Conversion Cost is equal to direct labo cost plus production overheads.Q.92 Which of the following is Flase ?(A) Waste does not have any realizable value but scrap has small realizable value.(B) Spoilage cannot be rectified but defectives can be rectified by incurringadditional materials labour and overheads costs.(C) Scarp involves only loss of materials but spoilage involves not only the loss ofmaterials but also of labour and overheads incurred up to stage of spoilage.(D) In ABC analysis.' A' group of items consists of those materials, the value ofwhich is not high but which are used in large quantities.Q.93 Which of the following is Flase ?(A) Perpetual Inventory System is a system of recording stores balances afterevery receipt and issue to facilitate regular checking and to obviate closingdown for stock -taking but Continuous Stock Taking is regular physicalverification of materials throughout the year.(B) Bin Card shows only the quantity of materials received ,issued and in hand atany point of time but Stores Legder shows both the quantity and money valueof materials received ,issued and in hand at any point of time.(C) Closing Stock is close to current economic value under FIFO method ofpricing.(D) LIFO method of pricing results in higher profit during the period of rising prices.Q.94 Which of the following is False ?(A) Cost of normal Waste, Scrap,Spoilage, Defectives,Idle Time and FringeBenefits should be treated as part of cost of production(B) Overtime Premium due to seasonal pressure of work and Preventive LabourTurnover Costs should be treated production overheads.(C) In Production Department Idle Time Wages and Overtime Premium due tobreak down of machinery should be charged to Costing Profit & Loss Account.(D) NoneQ.95 Which of the following is False?(A) Allocation of overheads is the process of charging the full amount of overheadsto a pa rticular cost centre.(B) Apportionment of overheads is the process of charging a proportion ofcommon item of overheads to different cost centres.(C) Absorption of overheads is the process of charging overheads to production orservices.(D) Re- apportionment of overheads is the apportionment of overheads ofProduction Department over the Service Departments.

Q.96 Which of the following is Flase ?(A) Blanket Overhead Rate is a single rate of overhead absorption computed for theentire factory but Departmental Overhead Rates are the separate rates ofoverhead absorption computed for each individual department/cost centre.(B) Actual overhead rate is calculated by dividing the actual overheads by the actualbase but Predetermined overhead rate is calculated in advance by dividing thebudgeted overheads by the budgeted base.(C) Time Booking is a system of recording the arrival and departure time of eachworker but Time Keeping is a system of recording the time spent by each workeron various jobs, order or processes.(D) Job Costing is that form of specific order costing under which each job is treatedas a cost unit and costs are accumulated and ascertained separately for eachjob but Process Costing is a method of costing under which all costs areaccumulated for each stage of production (also called process of production)and the cost per unit of product is ascertained at each stage of production bydividing the total cost of each process by the normal output of that process.Q.97 Which of the following is Flase ?(A) Marginal Costing is the practice of charging all variable costs to operationsprocesses or products and writing off all fixed costs against profits in the periodin which they arise but Absorption Costing is the practice of changing allvariable manufacturing costs and fixed production overheads to operations,processes or products and writing off administration ,selling and distributionoverheads against profits in the period in which they arise.(B) While Valuing Stock of Work in Progress and Finished Goods fixed productionoverheads are included under Absorption Costing and not under MarginalCosting.(C) Relevant costs are those future costs which differ under different alternative.These can be changed by the decision of the management.(D) NoneQ.98 Cost per unit Rs.200, Cost of an order Rs.100, Semi – annual carrying cost perunit 5% Total carrying and Ordering Cost at Economic Order Quantity Rs.4,000.EOQ is:(A) 100 units(B) 200 units(C)300 units(D)None of theseQ.99 Piyush & Pranav Ltd. Provides you the following informaation:Activity level 10,000 hours 20,000 hours 30,000 hoursOverheads (Rs.) 3,00,000 4,20,000 5,40,000Activity level at which the standard overhead Rate of Rs.15 per hour has beenfixed is:

(A) 30,000 hours(B) 40,000 hours(C) 50,000 hours(D) 60,000 hoursQ.100 P/V ratio 40% Margin of Safety 60% Sales Rs.1,50,000. Fixed Costs are:(A) Rs.60,000(B) Rs. 36,000(C) Rs.24,000(D)None of these________________________________________________________________________________________________________________________________________________