IPCA Labs - Motilal Oswal

IPCA Labs - Motilal Oswal

IPCA Labs - Motilal Oswal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

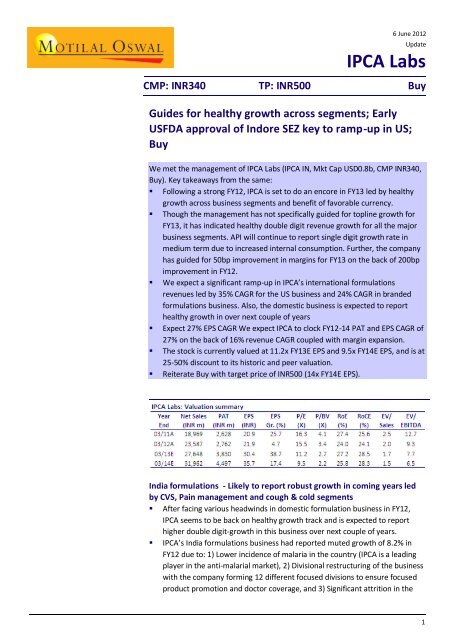

6 June 2012Update<strong>IPCA</strong> <strong>Labs</strong>CMP: INR340 TP: INR500 BuyGuides for healthy growth across segments; EarlyUSFDA approval of Indore SEZ key to ramp-up in US;BuyWe met the management of <strong>IPCA</strong> <strong>Labs</strong> (<strong>IPCA</strong> IN, Mkt Cap USD0.8b, CMP INR340,Buy). Key takeaways from the same:• Following a strong FY12, <strong>IPCA</strong> is set to do an encore in FY13 led by healthygrowth across business segments and benefit of favorable currency.• Though the management has not specifically guided for topline growth forFY13, it has indicated healthy double digit revenue growth for all the majorbusiness segments. API will continue to report single digit growth rate inmedium term due to increased internal consumption. Further, the companyhas guided for 50bp improvement in margins for FY13 on the back of 200bpimprovement in FY12.• We expect a significant ramp-up in <strong>IPCA</strong>’s international formulationsrevenues led by 35% CAGR for the US business and 24% CAGR in brandedformulations business. Also, the domestic business is expected to reporthealthy growth in over next couple of years• Expect 27% EPS CAGR We expect <strong>IPCA</strong> to clock FY12-14 PAT and EPS CAGR of27% on the back of 16% revenue CAGR coupled with margin expansion.• The stock is currently valued at 11.2x FY13E EPS and 9.5x FY14E EPS, and is at25-50% discount to its historic and peer valuation.• Reiterate Buy with target price of INR500 (14x FY14E EPS).India formulations - Likely to report robust growth in coming years ledby CVS, Pain management and cough & cold segments• After facing various headwinds in domestic formulation business in FY12,<strong>IPCA</strong> seems to be back on healthy growth track and is expected to reporthigher double digit-growth in this business over next couple of years.• <strong>IPCA</strong>’s India formulations business had reported muted growth of 8.2% inFY12 due to: 1) Lower incidence of malaria in the country (<strong>IPCA</strong> is a leadingplayer in the anti-malarial market), 2) Divisional restructuring of the businesswith the company forming 12 different focused divisions to ensure focusedproduct promotion and doctor coverage, and 3) Significant attrition in the1

<strong>IPCA</strong> <strong>Labs</strong>sales force.• However, the business has seen revival in growth in 4QFY12 with businessgrowing 14.7% led by key therapeutic segments of CVS and Painmanagement. Management has indicated that, the domestic formulationbusiness is likely to report 18-20% YoY growth in FY13 partially due to lowbase. Going forward, the management does not expect any significantaddition to existing field force of ~3,600MRs as the focus will be onproductivity improvement.• We are estimating slightly conservative growth of 16% in FY13 to take intoaccount rising competition in acute therapeutic segments and uncertaintyrelated to anti-malaria segment. We note that the company has recorded22.5% CAGR in this business for the FY05-11 period and we view the lowergrowth in FY12 as a temporary blip.Indore SEZ – Early US FDA approval will lead to strong scale-up• <strong>IPCA</strong> has set up its Indore SEZ at a cost of INR2b and has been awaiting USFDA inspection/approval for the past 2 years. This SEZ is an importantdeterminant of <strong>IPCA</strong>’s revenue growth in the US market as this SEZ is likely toaddress to key issues for <strong>IPCA</strong>, viz., new product approvals and availability ofincreased capacities (<strong>IPCA</strong>’s US business is currently facing capacityconstraints).• The US FDA has recently inspected this SEZ. While the final US FDA approvalis still awaited, <strong>IPCA</strong> management does not expect any major hurdles ingetting the approval.• US FDA approval for this facility will be a positive trigger for <strong>IPCA</strong> as (1) it willbe able to launch new products in the US, and (2) undertake a site transferfor already commercialized products to the new facility to take advantage ofthe expanded capacity, thus driving strong growth and profitability of the USbusiness. The company has filed 25 ANDAs with USFDA and has receivedapproval for 12. It plans to file 8-10 ANDAs every year going forward.• We estimate this SEZ to contribute ~USD5m to <strong>IPCA</strong>’s topline for FY13.6 June 2012 2

<strong>IPCA</strong> <strong>Labs</strong>Management has indicated that at peak capacity utilization (likely in the next3 years), the SEZ can generate sales of USD80-100m.Institutional supplies: Anti-malarial formulation business attains criticalmass; expect 20% growth in FY13• In FY10, <strong>IPCA</strong> received WHO pre-qualification to supply Artemether-Lumefantrine (an anti-malaria formulation) to the African continent. This is aUSD250m market with only 3 other players. Further, the company recentlyreceived WHO pre-qualification for Artesunate-Amodiaquine and is the onlycompany apart from innovator, to get the approval. This is a USD50m marketfor <strong>IPCA</strong>. These are lucrative product opportunities for the company withsignificantly high EBITDA margins at ~30%.• We note that <strong>IPCA</strong> is the only fully integrated player in this product, andhence enjoys significant advantage over other players in terms of ramping upthe business. Currently Novartis has the largest share in the institutionaltender business for the product.• <strong>IPCA</strong>'s revenue from this product has increased from INR1.2b in FY11 toINR3b in FY12. The management has guided for 20% revenue growth for thisbusiness in FY13. The company has confirmed order book for next 7-8months.• Our revenue estimates at INR3.6b for FY13 and INR4b for FY14 effectivelyfactor in this expected ramp-up.International formulations business (ex-institutional) to record 22%CAGR for FY12-14• We expect a significant ramp-up in <strong>IPCA</strong>’s international formulationsrevenues led by 35% CAGR for the US business and 23.7% CAGR in brandedformulations business led by strong growth in all three main geographies, viz,CIS, Asia & Africa.• Pure generic supplies (regulated market formulations) are expected torecord 22% CAGR for FY12-14 led by two main factors in US: 1) Newapprovals and launches, and 2) Availability of expanded capacities post theUS FDA approval for the SEZ.• European generic revenues are expected to record a more modest 13%CAGR for FY12-14 due to pricing pressure. We note that the revenue fromEurope were impacted due to implementation of new packaging system.However, the management indicated that the productivity is coming back ontrack.• Overall the international formulation revenues are expected to record 20.4%CAGR for FY12-14.6 June 2012 3

<strong>IPCA</strong> <strong>Labs</strong>API business – Vadodara facility to expand capacities; expect single digitgrowth over next 2-3 years• <strong>IPCA</strong> has received environmental clearance to build API plant at Vadodara. Thecompany is expected to start work very soon. In FY13, capex on this facility istargeted at ~INR1.5b.• The facility is expected to commission only in FY14 after which the company canstart supplying APIs in domestic market and in semi-regulated markets.However, it will take another 2-3 years to start supplying APIs to regulatedmarkets as the facility will have to get approvals from regulatory agencies.• We expect the business to report single digit growth till such time.Valuation & outlook• <strong>IPCA</strong> is one of the better managed pharma companies in India with strongpositioning in domestic formulation business and growing presence abroad. Thecompany is likely to sustain its high profitability backed by backward integrationcapabilities in API manufacturing.• The performance of the company will be driven by all the major businesssegments like domestic formulations, international formulations andinstitutional supplies.• Expect 27% earning CAGR: We expect <strong>IPCA</strong> to clock FY12-14 PAT and EPS CAGRof 27% on the back of 16% revenue CAGR coupled with margin expansion.• EBITDA is expected to record 18.6% CAGR for FY12-14. EPS growth is higher thanEBITDA growth due to absence of large forex losses reported in FY12.• Further, despite INR5b capex over FY13-14 (to sustain growth), the company islikely to record healthy return ratios and low gearing.• The stock is currently valued at 11.2x FY13E EPS and 9.5x FY14E EPS. The stocktrades at 25-50% discount to its historic and peer valuation.• Reiterate Buy with target price of INR500 (14x FY14E EPS).6 June 2012 4

<strong>IPCA</strong> <strong>Labs</strong>DisclosuresThis report is for personal information of the authorized recipient and does not construe to be any investment, legal or taxa tion advice to you. This research report does not constitute an offer, invitation orinducement to invest in securities or other in vestments and <strong>Motilal</strong> <strong>Oswal</strong> Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distributionand has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form.Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The pers on accessing this information specifically agrees to exempt MOSt or any of itsaffiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agreesto hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays.The information contained herein is based on publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, MOSt and/orits affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of itsaffiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report . MOSt or anyof its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pe rtaining to this report, including without limitation the implied warranties ofmerchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations.This report is intended for distribution to institutional investors. Recipients who are not institutional investors should se ek advice of their independent financial advisor prior to taking any investment decisionbased on this report or for any necessary explanation of its contents.MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure ofInterest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report.Disclosure of Interest Statement<strong>IPCA</strong> <strong>Labs</strong> LTD1. Analyst ownership of the stock No2. Group/Directors ownership of the stock No3. Broking relationship with company covered No4. Investment Banking relationship with company covered NoAnalyst CertificationThe views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensa tion of the research analyst(s) was, is,or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principallyresponsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.Regional Disclosures (outside India)This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or an y jurisdiction, where such distribution, publication, availability or use would be contraryto law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions.For U.K.This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (FinancialPromotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by person s who are not investment professionals. Any investment or investment activityto which this document relates is only available to investment professionals and will be engaged in only with such persons.For U.S.MOSt is not a registered broker-dealer in the United States (U.S.) and, therefore, is not subject to U.S. rules. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. SecuritiesExchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commiss ion ("SEC") in order to conduct business with Institutional Investorsbased in the U.S., <strong>Motilal</strong> <strong>Oswal</strong> has entered into a chaperoning agreement with a U.S. registered broker -dealer, Marco Polo Securities Inc. ("Marco Polo").This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "majorinstitutional investors"). This document must not be acted on or relied on by persons who are not major institutional inves tors. Any investment or investment activity to which this document relates is onlyavailable to major institutional investors and will be engaged in only with major institutional investors.The Research Analysts contributing to the report may not be regis tered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered b rokerdealer,Marco Polo and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by aresearch analyst account.<strong>Motilal</strong> <strong>Oswal</strong> Securities Ltd3rd Floor, Hoechst House, Nariman Point, Mumbai 400 021Phone: (91-22) 39825500 Fax: (91-22) 22885038. E-mail: reports@motilaloswal.com6 June 2012 5

![Electronic Contract Note [ECN] â DECLARATION (VOLUNTARY) To ...](https://img.yumpu.com/48604692/1/158x260/electronic-contract-note-ecn-a-declaration-voluntary-to-.jpg?quality=85)