Point 2 - 2/11. FINAL - Bridgepoint Capital

Point 2 - 2/11. FINAL - Bridgepoint Capital

Point 2 - 2/11. FINAL - Bridgepoint Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

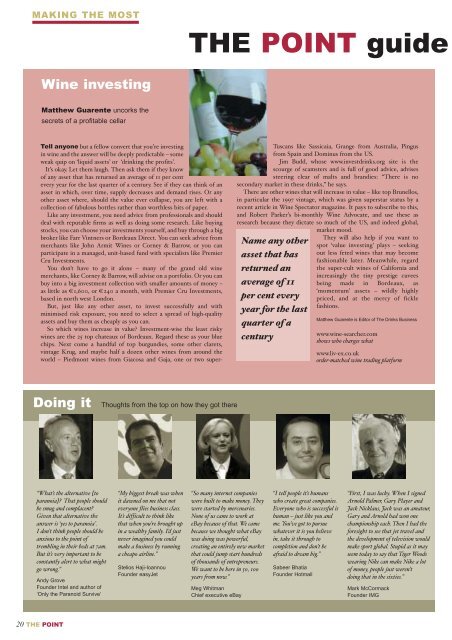

MAKING THE MOSTTHE POINT guideWine investingMatthew Guarente uncorks thesecrets of a profitable cellarTell anyone but a fellow convert that you’re investingin wine and the answer will be deeply predictable – someweak quip on ‘liquid assets’ or ‘drinking the profits’.It’s okay. Let them laugh. Then ask them if they knowof any asset that has returned an average of 11 per centevery year for the last quarter of a century. See if they can think of anasset in which, over time, supply decreases and demand rises. Or anyother asset where, should the value ever collapse, you are left with acollection of fabulous bottles rather than worthless bits of paper.Like any investment, you need advice from professionals and shoulddeal with reputable firms as well as doing some research. Like buyingstocks, you can choose your investments yourself, and buy through a bigbroker like Farr Vintners or Bordeaux Direct. You can seek advice frommerchants like John Armit Wines or Corney & Barrow, or you canparticipate in a managed, unit-based fund with specialists like PremierCru Investments.You don’t have to go it alone – many of the grand old winemerchants, like Corney & Barrow, will advise on a portfolio. Or you canbuy into a big investment collection with smaller amounts of money –as little as €1,600, or €240 a month, with Premier Cru Investments,based in north west London.But, just like any other asset, to invest successfully and withminimised risk exposure, you need to select a spread of high-qualityassets and buy them as cheaply as you can.So which wines increase in value? Investment-wise the least riskywines are the 25 top chateaux of Bordeaux. Regard these as your bluechips. Next come a handful of top burgundies, some other clarets,vintage Krug, and maybe half a dozen other wines from around theworld – Piedmont wines from Giacosa and Gaja, one or two super-Tuscans like Sassicaia, Grange from Australia, Pingusfrom Spain and Dominus from the US.Jim Budd, whose www.investdrinks.org site is thescourge of scamsters and is full of good advice, advisessteering clear of malts and brandies: “There is nosecondary market in these drinks,” he says.There are other wines that will increase in value – like top Brunellos,in particular the 1997 vintage, which was given superstar status by arecent article in Wine Spectator magazine. It pays to subscribe to this,and Robert Parker’s bi-monthly Wine Advocate, and use these asresearch because they dictate so much of the US, and indeed global,market mood.They will also help if you want toName any otherspot ‘value investing’ plays – seekingasset that hasout less feted wines that may becomefashionable later. Meanwhile, regardreturned an the super-cult wines of California andincreasingly the tiny prestige cuveesaverage of 11 being made in Bordeaux, as‘momentum’ assets – wildly highlyper cent every priced, and at the mercy of ficklefashions.year for the lastquarter of acenturyMatthew Guarente is Editor of The Drinks Businesswww.wine-searcher.comshows who charges whatwww.liv-ex.co.ukorder-matched wine trading platformDoing it Thoughts from the top on how they got there“What’s the alternative [toparanoia]? That people shouldbe smug and complacent?Given that alternative theanswer is ‘yes to paranoia’.I don’t think people should beanxious to the point oftrembling in their beds at 7am.But it’s very important to beconstantly alert to what mightgo wrong.”Andy GroveFounder Intel and author of‘Only the Paranoid Survive’“My biggest break was whenit dawned on me that noteveryone flies business class.It’s difficult to think likethat when you’re brought upin a wealthy family. I’d justnever imagined you couldmake a business by runninga cheapo airline.”Stelios Haji-IoannouFounder easyJet“So many internet companieswere built to make money. Theywere started by mercenaries.None of us came to work ateBay because of that. We camebecause we thought what eBaywas doing was powerful,creating an entirely new marketthat could jump start hundredsof thousands of entrepreneurs.We want to be here in 50, 100years from now.”Meg WhitmanChief executive eBay“I tell people it’s humanswho create great companies.Everyone who is successful ishuman – just like you andme. You’ve got to pursuewhatever it is you believein, take it through tocompletion and don’t beafraid to dream big.”Sabeer BhatiaFounder Hotmail“First, I was lucky. When I signedArnold Palmer, Gary Player andJack Nicklaus, Jack was an amateur,Gary and Arnold had won onechampionship each. Then I had theforesight to see that jet travel andthe development of television wouldmake sport global. Stupid as it mayseem today to say that Tiger Woodswearing Nike can make Nike a lotof money, people just weren’tdoing that in the sixties.”Mark McCormackFounder IMG20 THE POINT