e-Platinum investment returns edges over e-Gold and e-Silver

e-Platinum investment returns edges over e-Gold and e-Silver

e-Platinum investment returns edges over e-Gold and e-Silver

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

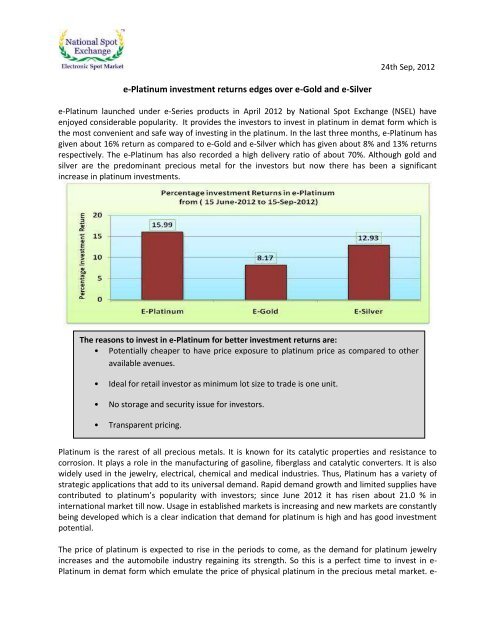

24th Sep, 2012e-<strong>Platinum</strong> <strong>investment</strong> <strong>returns</strong> <strong>edges</strong> <strong>over</strong> e-<strong>Gold</strong> <strong>and</strong> e-<strong>Silver</strong>e-<strong>Platinum</strong> launched under e-Series products in April 2012 by National Spot Exchange (NSEL) haveenjoyed considerable popularity. It provides the investors to invest in platinum in demat form which isthe most convenient <strong>and</strong> safe way of investing in the platinum. In the last three months, e-<strong>Platinum</strong> hasgiven about 16% return as compared to e-<strong>Gold</strong> <strong>and</strong> e-<strong>Silver</strong> which has given about 8% <strong>and</strong> 13% <strong>returns</strong>respectively. The e-<strong>Platinum</strong> has also recorded a high delivery ratio of about 70%. Although gold <strong>and</strong>silver are the predominant precious metal for the investors but now there has been a significantincrease in platinum <strong>investment</strong>s.The reasons to invest in e-<strong>Platinum</strong> for better <strong>investment</strong> <strong>returns</strong> are:• Potentially cheaper to have price exposure to platinum price as compared to otheravailable avenues.• Ideal for retail investor as minimum lot size to trade is one unit.• No storage <strong>and</strong> security issue for investors.• Transparent pricing.• Can be traded online on Exchange platform like buying / selling a stock.<strong>Platinum</strong> is the rarest of all precious metals. It is known for its catalytic properties <strong>and</strong> resistance tocorrosion. It plays a role in the manufacturing of gasoline, fiberglass <strong>and</strong> catalytic converters. It is alsowidely used in the jewelry, electrical, chemical <strong>and</strong> medical industries. Thus, <strong>Platinum</strong> has a variety ofstrategic applications that add to its universal dem<strong>and</strong>. Rapid dem<strong>and</strong> growth <strong>and</strong> limited supplies havecontributed to platinum’s popularity with investors; since June 2012 it has risen about 21.0 % ininternational market till now. Usage in established markets is increasing <strong>and</strong> new markets are constantlybeing developed which is a clear indication that dem<strong>and</strong> for platinum is high <strong>and</strong> has good <strong>investment</strong>potential.The price of platinum is expected to rise in the periods to come, as the dem<strong>and</strong> for platinum jewelryincreases <strong>and</strong> the automobile industry regaining its strength. So this is a perfect time to invest in e-<strong>Platinum</strong> in demat form which emulate the price of physical platinum in the precious metal market. e-

24th Sep, 2012platinum is backed by the physical platinum which is securely stored in Exchange designated vaults. Itgives the opportunity for the investors to buy units of <strong>Platinum</strong> electronically in the multiples of 1 gram<strong>and</strong> give the flexibility to sell, hold or take physical delivery through the same platform.The Exchange has made provision of physical delivery of <strong>Platinum</strong> in various denominations in the formof granules/shots imported from London platinum <strong>and</strong> palladium market (LPPM) approved suppliers. Tostart with, the physical delivery can be available at Delhi, Mumbai, Jaipur <strong>and</strong> Hyderabad. Manyinvestors are now including e-platinum in their portfolio along with e-<strong>Gold</strong> <strong>and</strong> e-silver. In the comingmonths, e-platinum is considered an excellent <strong>investment</strong> medium; it can act as a hedge againstinflation as well as provide long or short term profit.