HHF Term Sheet Matrix

HHF Term Sheet Matrix

HHF Term Sheet Matrix

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

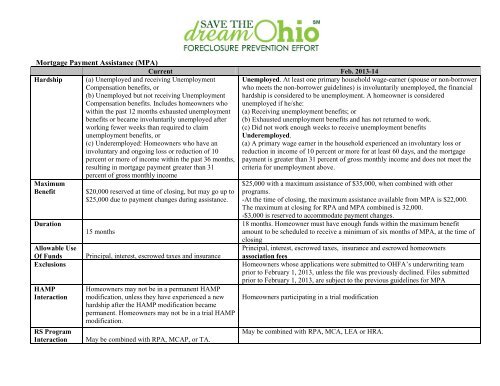

Mortgage Payment Assistance (MPA)Current Feb. 2013-14Hardship (a) Unemployed and receiving UnemploymentCompensation benefits, or(b) Unemployed but not receiving UnemploymentCompensation benefits. Includes homeowners whowithin the past 12 months exhausted unemploymentbenefits or became involuntarily unemployed afterworking fewer weeks than required to claimunemployment benefits, or(c) Underemployed: Homeowners who have aninvoluntary and ongoing loss or reduction of 10percent or more of income within the past 36 months,resulting in mortgage payment greater than 31percent of gross monthly incomeMaximumBenefitDurationAllowable UseOf FundsExclusionsHAMPInteractionRS ProgramInteraction$20,000 reserved at time of closing, but may go up to$25,000 due to payment changes during assistance.15 monthsPrincipal, interest, escrowed taxes and insuranceHomeowners may not be in a permanent HAMPmodification, unless they have experienced a newhardship after the HAMP modification becamepermanent. Homeowners may not be in a trial HAMPmodification.May be combined with RPA, MCAP, or TA.Unemployed. At least one primary household wage-earner (spouse or non-borrowerwho meets the non-borrower guidelines) is involuntarily unemployed, the financialhardship is considered to be unemployment. A homeowner is consideredunemployed if he/she:(a) Receiving unemployment benefits; or(b) Exhausted unemployment benefits and has not returned to work.(c) Did not work enough weeks to receive unemployment benefitsUnderemployed.(a) A primary wage earner in the household experienced an involuntary loss orreduction in income of 10 percent or more for at least 60 days, and the mortgagepayment is greater than 31 percent of gross monthly income and does not meet thecriteria for unemployment above.$25,000 with a maximum assistance of $35,000, when combined with otherprograms.-At the time of closing, the maximum assistance available from MPA is $22,000.The maximum at closing for RPA and MPA combined is 32,000.-$3,000 is reserved to accommodate payment changes.18 months. Homeowner must have enough funds within the maximum benefitamount to be scheduled to receive a minimum of six months of MPA, at the time ofclosingPrincipal, interest, escrowed taxes, insurance and escrowed homeownersassociation feesHomeowners whose applications were submitted to OHFA’s underwriting teamprior to February 1, 2013, unless the file was previously declined. Files submittedprior to February 1, 2013, are subject to the previous guidelines for MPAHomeowners participating in a trial modificationMay be combined with RPA, MCA, LEA or HRA.