Net Gearing Ratio over 500%, Reiterate 'Sell' - gtja - 国泰君安

Net Gearing Ratio over 500%, Reiterate 'Sell' - gtja - 国泰君安

Net Gearing Ratio over 500%, Reiterate 'Sell' - gtja - 国泰君安

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

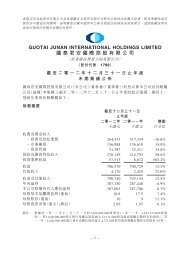

Company Report: CNBM (03323 HK)公 司 报 告 : 中 国 建 材 (03323 HK)<strong>Net</strong> <strong>Gearing</strong> <strong>Ratio</strong> <strong>over</strong> <strong>500%</strong>, <strong>Reiterate</strong> ‘Sell’净 负 债 率 超 过 <strong>500%</strong>, 重 申 ‘ 卖 出 ’Ray Zhao 赵 睿+86 755 23976755zhaorui@<strong>gtja</strong>s.com27 August 2013GTJA Research 国 泰 君 安 研 究• CNBM’s 1H13 results were slightly above expectations. Revenuereached RMB50,531mn, up 33.2% yoy; net profit reach Rmb1,352 million,down 28.9% yoy, slightly above expectations. EPS reached RMB0.25 down28.9% yoy. Excluding one off item, core EPS (incl. VAT rebates) reachedRMB0.181, down 32.3% yoy. Cement and clinker GP/t reached RMB56/t,down 13.0% yoy, and sales volume reached 125mn tonnes, up 28.9% yoy.• Key point: 1) Extremely high leverage. <strong>Net</strong> debt reached RMB164,220mn, up 54.6% yoy. <strong>Net</strong> gearing ratio (excl. minority) reached 531.5%!Finance costs reached RMB6,507 mn, up 64.6% yoy. According to themanagement, capex in FY13 might reach RMB25 bn and will reach RMB10bn in FY14-15. We expect FY13 net gearing ratio to reach 498%! 2)Goodwill doubled. Goodwill and other intangibles reached RMB39,235 mnand RMB4,223 mn, up 98.4% and 76.2% yoy, far above shareholders’equity. 3)CNBM’s NP/t will be RMB30-40/t lower than that of Conch inthe future. CNBM’s GP/t will be RMB10-20/t below that of Conch andfinance cost/t will be RMB20/t higher than that of Conch.• Cut TP to HKD5.0 and maintain ‘Sell’. CNBM’s market consolidationstrategy might fail as g<strong>over</strong>nment might approve new capacities, especiallyin Southwest China, and cement demand maintains weak as investmentdecelerates, such as in Northeast China. We cut our core EPS estimates inFY13-15 to RMB0.565, RMB0.640 and RMB0.714. Cut TP to HKD5.0,representing 6.9x 2013E Core EPS PE. <strong>Reiterate</strong> “Sell”.• 中 国 建 材 1H13 业 绩 略 高 于 预 期 。 收 入 达 到 人 民 币 50,531 百 万 ( 人 民 币 , 下 同 ), 同 比 上升 33.2%。 净 利 润 达 到 1,352 百 万 , 同 比 下 降 28.9%, 高 于 预 期 。 每 股 盈 利 将 达 到 0.250元 , 同 比 下 降 28.9%。 剔 除 一 次 性 收 益 , 包 含 增 殖 税 返 还 的 核 心 每 股 盈 利 达 到 0.181 元 ,同 比 下 降 32.3%, 远 低 于 预 期 。 水 泥 熟 料 销 售 吨 毛 利 达 到 56 元 / 吨 , 同 比 下 降 13.0%;水 泥 熟 料 销 售 量 达 125 百 万 吨 , 同 比 增 长 28.9%。• 要 点 :1) 超 高 杠 杆 。 净 负 债 164,220 百 万 , 同 比 上 升 54.6%。 净 负 债 率 ( 不 含 少 数 股 东权 益 ) 达 到 531.5%! 财 务 费 用 达 到 4,318 百 万 , 同 比 上 升 64.6%。 公 司 FY13 年 的 资 本开 支 为 250 亿 , 未 来 两 年 也 将 在 100 亿 左 右 。 我 们 预 期 FY13 年 末 净 负 债 率 达 到 498%。2) 商 誉 翻 倍 。 商 誉 及 其 它 无 形 资 产 达 到 39,235 百 万 和 4,223 百 万 , 同 比 升 98.4% 和76.2%, 远 超 过 公 司 股 本 。3) 未 来 CNBM 吨 净 利 要 比 海 螺 低 RMB30/t 至 RMB40/t 以 上 。CNBM 吨 毛 利 要 比 海 螺 低 RMB10-20/t, 同 时 吨 财 务 成 本 高 RMB20/t.• 下 调 目 标 价 至 5.0 港 元 和 维 持 投 资 评 级 ‘ 卖 出 ’。 公 司 市 场 整 合 的 策 略 可 能 完 全 失 败 , 因 为国 家 可 能 放 开 部 分 地 区 生 产 线 审 批 , 特 别 是 西 南 , 同 时 投 资 减 速 导 致 需 求 疲 弱 , 例 如 东北 。 我 们 下 调 FY13-15 年 核 心 盈 利 预 测 至 RMB0.565,RMB0.640 和 RMB0.714。 降 低目 标 价 至 5.0 港 元 , 相 当 于 6.9 倍 2013 年 预 测 核 心 盈 利 。 重 申 “ 卖 出 ”。Rating:SellMaintained评 级 : 卖 出 ( 维 持 )6-18m TP 目 标 价 : HK$5.00Revised from 原 目 标 价 :HK$5.50Share price 股 价 :Stock performance股 价 表 现65.045.025.05.0(15.0)(35.0)(55.0)% returnHK$7.190Aug-12 Oct-12 Nov-12 Jan-13 Feb-13 Apr-13 May-13 Jul-13 Aug-13Change in Share Price股 价 变 动HSI CNBM1 M1 个 月3 M3 个 月1 Y1 年Abs. %绝 对 变 动 % (3.10) (17.83) (4.52)Rel. % to HS index相 对 恒 指 变 动 % (3.27) (14.83) (15.66)Avg. share price(HK$)平 均 股 价 ( 港 元 ) 7.43 7.30Source: Bloomberg, Guotai Junan International9.25CNBM 中 国 建 材 (03323HK)Year End年 结Turn<strong>over</strong>收 入<strong>Net</strong> Profit股 东 净 利EPS每 股 净 利EPS每 股 净 利 变 动PER市 盈 率BPS每 股 净 资 产PBR市 净 率DPS每 股 股 息Yield股 息 率ROE净 资 产 收 益 率12/31 (RMB m) (RMB m) (RMB) (△%) (x) (RMB) (x) (RMB) (%) (%)2011A 80,058 8,015 1.485 12.0 3.9 4.877 1.2 0.215 3.7 35.22012A 87,218 5,580 1.033 (30.4) 5.6 5.648 1.0 0.155 2.7 19.62013F 113,220 3,955 0.732 (29.1) 7.7 6.226 0.9 0.110 2.0 12.32014F 127,611 4,520 0.837 14.3 6.7 6.953 0.8 0.126 2.2 12.72015F 141,747 5,076 0.940 12.3 6.0 7.768 0.7 0.141 2.5 12.8Shares in issue (m) 总 股 数 (m) 5,399.0 Major shareholder 大 股 东 CNBM Group 36.3%Market cap. (HK$ m) 市 值 (HK$ m) 38,656.8 FY13 Free float (%) FY13 自 由 流 通 比 率 (%) 61.53 month average vol. 3 个 月 平 均 成 交 股 数 (‘000) 49,142.0 FY13 <strong>Net</strong> gearing FY13 净 负 债 / 股 东 资 金 (%) 49852 Weeks high/low (HK$) 52 周 高 / 低 12.800/6.0700Source..the Company, Guotai Junan International.See the last page for disclaimer Page 1 of 7Company Report

CNBM’s 1H13 results slightly above expectations. Revenue reached RMB50,531mn, up 33.2% yoy; net profit reachRmb1,352 million, down 28.9% yoy, slightly above expectations. EPS reached RMB0.25 down 28.9% yoy. Excluding one offitem, its core EPS (incl. VAT rebates) reached RMB0.181, down 32.3% yoy, far below expectations. Cement and clinker GP/treached RMB56/t, down 13.0% yoy, and sales volume reached 125mn tonnes, up 28.9% yoy.Extremely high leverage. <strong>Net</strong> debt reached RMB164,220mn, up 54.6% yoy. <strong>Net</strong> gearing ratio (excl. minority) reached531.5%! Finance costs reached RMB6,507mn, up 64.6% yoy. Although the management admitted that CNBM’s leverage istoo high and will peak at the year end of FY13 but its capex in FY13-15 still might reach RMB45bn in total. According to themanagement, its capex in FY13 might reach RMB25bn and will reach RMB10bn in FY14-15. We expect its FY13 net gearingratio to reach 497%! In 1H13, g<strong>over</strong>nment grant reached RMB619mn, up 14.7% yoy, and we think its g<strong>over</strong>nment grant ishighly associated with its capex, which might reduce with its capex gradually in FY13-15.Goodwill doubled. Goodwill and other intangibles reached RMB39,235mn and RMB4,223mn, up 98.4% and 76.2% yoy,exceeding its shareholders’ equity. We think goodwill has reached an unacceptable level and if some of the acquired targetsmade loss we think CNBM should make impairment loss provision.High profit zone in Northeast China vanished. From its segment results, its GP/t and NP/t in North cement reachedRMB91/t and RMB13/t, down 32% and 91% yoy, partly because of bad construction demand in Northeast China as localg<strong>over</strong>nments need more cashes to invest and partly because of more supply from Hebei. Currently, CNBM’s GP/t inSouthwest China maintained very high, with GP/t and NP/t of RMB70/t and RMB21/t in 1H13 respectively. However, asGuizhou local g<strong>over</strong>nment approved many new clinker lines, we think its GP/t in Southwest China might peak in FY13 andmight fall in FY14-15. We think CNBM’s high profit zones though market consolidation might be an illusion as investment willdecelerate in the long run and small new capacities will come out.CNBM’s cement segment actually made loss in 1H13. According to the management, CNBM’s cement NP/t reached onlyRMB7/t but if we take into account of headquarter finance costs and exclude g<strong>over</strong>nment grant, its cement business in 1H13was actually in loss. Total GP/t, OP/t and NP/t in cement reached RMB56/t, RMB38/t and RMB7/t. CNBM’s finance cost/t incement reached RMB22/t in FY13 while Conch’s finance cost/t only reached RMB7/t. However, if we take into account fromheadquarter finance costs, or RMB5/t, its cement finance cost reached RMB27/t. If we consider CNBM’s headquarter wasfinancing to help its cement segment, its NP/t in cement in 1H13 was actually RMB2.3/t. If we exclude g<strong>over</strong>nment grant, orRMB5/t, its cement segment actually made net loss of RMB-2.7/t.Conch’s NP/t will be RMB30/t-RMB40/t above that of CNBM’s. In 1H13, in total, CNBM’s GP/t is RMB8/t below Conch’s.And CNBM’s finance costs reached RMB27/t, RMB20/t above that of Conch. If Conch’s NP/t reached around RMB30/t CNBMwill make loss. In East China and Central China, in 1H13, Conch’s GP/t in East China and Central China reached RMB60/tand RMB69/t respectively, while CNBM’s China United and South Cement’s GP/t reached RMB48/t and RMB48/t respectively.Cut TP to HKD5.0 and maintain ‘Sell’. CNBM’s market consolidation strategy might fail as g<strong>over</strong>nment might approve newcapacities, especially in Southwest China, and more new small capacities will come out in high profit zone, such as NortheastChina. We cut our core EPS estimates in FY13-15 to RMB0.565, RMB0.565 and RMB0.714. Cut TP to HKD5.0, representing6.9x 2013E Core EPS PE. <strong>Reiterate</strong> “Sell”.Table 1: CNBM’s 1H13 Results1H12 1H13 YoyLight weight bldg matl mn RMB 2,998 3,236 8.0%Cement mn RMB 26,295 32,068 22.0%Concrete mn RMB 2,337 10,604 353.8%Engineering mn RMB 2,326 2,771 19.1%Fiber glass and FRP mn RMB 1,041 833 -20.0%Others mn RMB 3,377 3,813 12.9%Intersegment mn RMB (435) (2,795) 541.9%Total revenue mn RMB 37,938 50,531 33.2%COGS mn RMB (29,684) (38,934) 31.2%Gross Profit mn RMB 8,254 11,598 40.5%Selling and distribution mn RMB (1,117) (2,472) 121.3%Admin mn RMB (2,589) (3,613) 39.5%Share of associate mn RMB 169 142 -16.0%Operating Profit mn RMB 4,717 5,655 19.9%Finance costs mn RMB (2,624) (4,318) 64.6%Other revenue and gains mn RMB 1,461 1,528 4.6%Income taxes mn RMB (840) (821) -2.3%Minorities mn RMB (813) (692) -14.9%<strong>Net</strong> profit mn RMB 1,901 1,352 -28.9%One off item mn RMB 849 789 -7.1%NP-recurring mn RMB 1,447 980 -32.3%27 August 2013CNBM 中 国 建 材 (03323HK)Company ReportSee the last page for disclaimer Page 2 of 7

effective tax rate % 23.6% 28.6% 5.0% some subsidiaries made lossMinority-actual % 30.0% 33.8% 3.9% introduce more investors in Southwest ChinaSelling/Revenue % 2.9% 4.9% 1.9%Administrative/Revenue % 6.8% 7.1% 0.3%Other gains as % of revenue % 3.9% 3.0% -0.8%VAT rebate mn RMB 612 739 20.8%27 August 2013cementsales volume mn tonnes 96.9 123.4 27.4%China United mn tonnes 28.1 30.6 8.8%South Cement mn tonnes 45.5 51.9 13.9%North Cement mn tonnes 9.0 8.1 -10.5%Southwest Cement mn tonnes 12.8 32.9 157.5%ASP RMB/t 271 247 -8.8%China United RMB/t 264 238 -10.0%South Cement RMB/t 275 240 -12.4%North Cement RMB/t 352 318 -9.6% ASP might peak.Southwest Cement RMB/t 245 249 1.3% Oversupply risk is rising.GP/t RMB/t 64 56 -13.0%China United RMB/t 64 48 -24.5% more capacity suspension costsSouth Cement RMB/t 61 48 -21.3% more capacity suspension costsNorth Cement RMB/t 107 91 -14.9% more supply from Hebei and small capacitiesSouthwest Cement RMB/t 37 70 87.7% Higher than GP/t of Conch in West China (68)!?NP/t RMB/t 14 7 -50.8%China United RMB/t 27 9 -66.7%South Cement RMB/t 22 8 -63.6%North Cement RMB/t 62 13 -79.0%Southwest Cement RMB/t 1 21 2000.0%concretesales volume mn M3 7.0 34.8 395.1% FY13 estimate 78mn M3.ASP RMB/M3 327 304 -6.9%GP/t GP/M3 117 80 -31.9% more competition, perhaps more bad debt provisionAR turn<strong>over</strong> days days 176 173 -1.6% AR increased due to concreteIN turn<strong>over</strong> days days 69 66 -4.0%AP turn<strong>over</strong> days days 162 160 -0.8%cash conversion days days 83 78 -5.2%CNBM 中 国 建 材 (03323HK)cash mn RMB 13,548 11,236 -17.1% Need to raise more cashesST mn RMB 74,260 98,918 33.2% ST debt accounted for 56% of total debt.LT mn RMB 45,535 76,538 68.1%shareholders' Equity mn RMB 27,016 30,898 14.4%total equity mn RMB 44,065 47,364 7.5%goodwill mn RMB 19,771 39,235 98.4% Goodwill doubled, <strong>over</strong> its equity.intangibles mn RMB 2,396 4,223 76.2%total debt 119,795 175,456 46.5% When will CNBM pay off its debt?<strong>Net</strong> debt mn RMB 106,247 164,220 54.6%<strong>Net</strong> gearing ratio excluding minority % 393.3% 531.5% 138.2% Leverage reached an unacceptable level.net gearing ratio including minority % 270.3% 346.7% 76.4%cement businessOperating profit mn RMB 4,978 4,786 -3.9%Finance cost from cement mn RMB (1,905) (2,738) 43.7%Finance Cost from headquarters mn RMB (436) (578) 32.5%profit before taxation mn RMB 2,637 1,470 -44.3%OP/t RMB/t 51 39 -24.6%Finance cost/t RMB/t (24) (27) 11.1%Company ReportSee the last page for disclaimer Page 3 of 7

SGA/t RMB/t 13 17 32.6%ACP/t RMB/t 207 191 -7.5%other income/t (incl.g<strong>over</strong>nment subsidy) RMB/t 15 12 -17.9%other income/t (excl. VAT rebate) RMB/t 9 6 -27.1%NP/t RMB/t 14 7 -50.8%Source: the Company, Guotai Junan International.Table 2: Conch’s 1H13 ResultsConch 1H12 1H13 Yoycement and clinkersales volume mn tonnes 80.6 103.6 28.6%East China mn tonnes 30.1 34.8 15.7%Central China mn tonnes 19.1 30.0 56.7%South China mn tonnes 15.8 17.8 12.7%West China mn tonnes 13.0 18.3 41.0%Exports mn tonnes 2.5 2.7 7.0%27 August 2013ASP RMB/t 252.0 224.7 -10.8%East China & Central China RMB/t 263.8 226.4 -14.2%South China RMB/t 249.7 231.9 -7.1%West China RMB/t 227.8 228.0 0.1%OP/t RMB/t 45.5 39.4 -13.4%East China & Central China RMB/t 54.7 40.4 -26.2%South China RMB/t 39.8 41.8 4.9%West China RMB/t 15.8 33.3 111.4%GP/t RMB/t 68.3 63.5 -6.9%East China 76 60 -21.3%Central China 76 69 -9.5%South China 66 59 -10.9%West China 39 68 73.3%Exports 74 71 -4.5%ACP/t RMB/t 183.8 161.1 -12.3%SGA/t RMB/t 23.0 22.9 -0.5%Finance Cost/t RMB/t 6.6 5.8 -12.1%Other income (incl. g<strong>over</strong>nment subsidy)/t RMB/t 7.5 5.1 -31.9%NP/t RMB/t 36.0 30.0 -16.7%Source: the Company, Guotai Junan International.CNBM 中 国 建 材 (03323HK)CNBM’s <strong>Net</strong> Debt and <strong>Net</strong> <strong>Gearing</strong> <strong>Ratio</strong>CNBM’s Finance Costs and Avg. Borrowing Rate250,000600%14,0006.20%mn RMB200,000150,000100,000267%300%451%497%469%<strong>500%</strong>450%400%300%200%mn RMB12,00010,0008,0006,0004,0005.15%5.22%6,5075.50%9,5205.8%10,9655.9%6.0% 6.00%5.80%5.60%5.40%11,9075.20%5.00%50,000100%2,0002,5793,8594.80%02010A 2011A 2012A 2013E 2014E 2015EShort Term DebtLong Term Debt<strong>Net</strong> <strong>Gearing</strong> <strong>Ratio</strong>Interest C<strong>over</strong>ageSource: the Company, Guotai Junan International.0%02010A 2011A 2012A 2013E 2014E 2015EFinannce CostsAvg. Borrowing RateSource: the Company, Guotai Junan International.4.60%Company ReportSee the last page for disclaimer Page 4 of 7

Table 3 :Assumption RevisionCement segmentFY13(Old)FY13(New)Change%Revenue mn Rmb 108,608 113,220 4% 119,533 127,611 7% 132,035 141,747 7%Sales Volume mn tonnes 275 276 1% 286 290 2% 302 303 0%Avg. Selling Price Rmb/t 267 256 -4% 275 263 -4% 284 272 -4%Unit cost Rmb/t 202 192 -5% 209 196 -6% 217 202 -7%GP/T Rmb/t 65 64 -2% 67 67 0% 67 69 3%FY14(Old)FY14(New)Change%FY15(Old)FY15(New)Change%27 August 2013SG&A/Revenue % -10.60% -12.0% -1% -11% -12.0% -1% -11% -12.0% -1%Interest rate % 5.9% 5.8% -0.1% 5.9% 5.9% 0.0% 5.9% 6.0% 0.1Effective income tax % 25% 26% 1.0% 25% 26% 1.0% 25% 26% 1.0%MI ratio % 28% 34% 6% 28% 0% -28% 28% 34% 6%Dividend rate % 15% 15% 0% 15% 15% 0% 15% 15% 0%EPS Rmb 1.056 0.732 -30.6% 1.128 0.837 -25.8% 1.236 0.940 -24.0%Source: the Company, Guotai Junan International.Table 4: Financial Statements and <strong>Ratio</strong>s of CNBMP&L FY11A FY12A FY13E FY14E FY15ELight weight bldg matl mn RMB 5,959 6,635 6,967 7,316 7,681Cement mn RMB 59,673 59,784 70,593 76,294 82,285Concrete mn RMB 1,048 9,341 24,288 32,588 40,323Engineering mn RMB 6,890 6,067 5,885 5,827 5,768Fiber glass and FRP mn RMB 2,208 2,195 2,261 2,329 2,399Others mn RMB 5,396 6,486 6,551 6,617 6,683Intersegment mn RMB (1,115) (3,292) (3,325) (3,359) (3,392)Revenue mn RMB 80,058 87,218 113,220 127,611 141,747COGS mn RMB (58,742) (67,089) (86,370) (96,948) (107,783)Gross profit mn RMB 21,317 20,128 26,850 30,663 33,964SG&A mn RMB (6,597) (9,243) (13,634) (15,367) (17,069)share of associates 686 459 432 432 432Operating Profit mn RMB 15,406 11,345 13,648 15,728 17,327Finance costs mn RMB (3,859) (6,507) (9,532) (10,961) (11,920)Others mn RMB 2,768 5,086 3,963 4,466 4,961Profit before tax and MI mn RMB 14,315 9,924 8,078 9,233 10,368Income tax mn RMB (3,569) (2,187) (2,100) (2,401) (2,696)Profit before MI mn RMB 10,746 7,737 5,978 6,832 7,672Minority interests mn RMB (2,731) (2,157) (2,023) (2,313) (2,597)<strong>Net</strong> profit mn RMB 8,015 5,580 3,955 4,520 5,076CNBM 中 国 建 材 (03323HK)EPS RMB/shr 1.485 1.033 0.732 0.837 0.940Core EPS RMB/shr 1.355 0.706 0.565 0.640 0.714DPS RMB/shr 0.215 0.155 0.110 0.126 0.141Cash Flow FY11A FY12A FY13E FY14E FY15E<strong>Net</strong> Income mn RMB 8,015 5,580 3,955 4,520 5,076Working Capital Change mn RMB (3,113) (6,077) (8,109) 4,064 (4,171)Dep.&Amortization mn RMB 2,605 3,558 4,650 5,667 5,984Minority Interest mn RMB 2,731 2,157 2,023 2,313 2,597Others mn RMB 1,816 4,799 (4,274) (10,055) (9,070)CFO mn RMB 12,054 10,017 (1,867) 6,508 416CAPEX mn RMB (12,288) (11,411) (25,000) (12,000) (12,000)Others mn RMB (12,558) (25,256) (2,000) (2,000) (2,000)CFI mn RMB (24,846) (36,667) (27,000) (14,000) (14,000)New Issues mn RMB 0 0 0 0 0New Bank Loans mn RMB 29,718 50,440 33,068 9,812 15,958Dividend Paid mn RMB (502) (1,161) (837) (593) (678)Company ReportSee the last page for disclaimer Page 5 of 7

Others Mn RMB (14,687) (22,174) 0 0 0CFF mn RMB 14,529 27,106 32,231 9,219 15,280<strong>Net</strong> change in cash mn RMB 1,737 455 3,476 1,727 1,696Cash at beginning of year mn RMB 7,918 9,655 10,222 13,586 15,313Cash at end of year mn RMB 9,655 10,111 13,586 15,313 17,010Balance Sheet FY11A FY12A FY13E FY14E FY15ECash mn RMB 9,738 10,222 13,586 15,313 17,010Trade and other receivables mn RMB 22,924 45,611 53,651 55,939 62,136Inventories mn RMB 9,677 12,222 16,173 15,937 17,718Other Current Assets mn RMB 6,553 9,455 10,874 12,505 14,380CURRENT ASSETS mn RMB 48,893 77,511 94,284 99,694 111,24327 August 2013Property Plant & Equipment mn RMB 71,161 105,414 113,345 119,678 125,694Intangibles mn RMB 17,048 34,423 48,881 56,213 61,834Others mn RMB 21,293 29,086 33,740 38,801 44,621NON-CURRENT ASSETS mn RMB 109,502 168,923 195,966 214,692 232,149TOTAL ASSETS mn RMB 158,395 246,434 290,250 314,386 343,393Trade and other payable mn RMB 25,800 47,251 52,134 59,423 64,601Bank borrowings-due within oneyear mn RMB 53,992 92,502 108,570 114,457 124,032Others mn RMB 3,559 4,165 4,582 5,040 5,544CURRENT LIABILITIES mn RMB 83,351 143,918 165,286 178,919 194,177Bank borrowings - amounts dueafter one year mn RMB 34,845 55,380 72,380 76,304 82,688Deferred income & others mn RMB 2,588 3,071 3,379 3,716 4,088TOTAL LIABILITIES mn RMB 120,784 202,369 241,044 258,940 280,953Minorities mn RMB 11,279 13,569 15,592 17,905 20,501NET ASSETS mn RMB 26,332 30,496 33,614 37,541 41,938Shareholders Equity mn RMB 26,332 30,496 33,614 37,541 41,938TOTAL EQUITIES mn RMB 37,611 30,496 33,614 37,541 41,938BVPS RMB/shr 4.877 5.648 6.226 6.953 7.768Key <strong>Ratio</strong>s FY11A FY12A FY13E FY14E FY15EGross Margin % 27% 23% 24% 24% 24%<strong>Net</strong> Margin % 10% 6% 3% 4% 4%ROE % 35% 20% 12% 13% 13%ROA % 6% 3% 1% 1% 2%ROIC % 9% 5% 4% 5% 5%Free CF mn RMB (12,792.3) (26,650.3) (28,866.7) (7,491.7) (13,584.1)Interest C<strong>over</strong>age 2.1 0.9 0.4 0.4 0.4<strong>Net</strong> <strong>Gearing</strong> % 300% 451% 498% 467% 452%CNBM 中 国 建 材 (03323HK)Key Assumptions FY11A FY12A FY13E FY14E FY15ECementASP RMB/t 309 258 256 263 272Sales Volume mn tonnes 184 217 276 290 303Capacity mn tonnes 260 333 356 375 400GP/t RMB/t 85 55 64 67 69- China United RMB/t 87 57 53 57 59- South Cement RMB/t 108 52 58 60 61- North Cement RMB/t 113 115 90 91 91- Southwest Cement RMB/t 41 250 258 266 276EBITDA/t RMB/t 96 87 69 72 74Source: the Company, Guotai Junan International.Company ReportSee the last page for disclaimer Page 6 of 7

Company Rating DefinitionThe Benchmark: Hong Kong Hang Seng IndexTime Horizon: 6 to 18 monthsRatingDefinitionBuy Relative Performance >15%;or the fundamental outlook of the company or sector is favorable.Accumulate Relative Performance is 5% to 15%;or the fundamental outlook of the company or sector is favorable.Neutral Relative Performance is -5% to 5%;or the fundamental outlook of the company or sector is neutral.Reduce Relative Performance is -5% to -15%;or the fundamental outlook of the company or sector is unfavorable.Sell Relative Performance 5%;or the fundamental outlook of the sector is favorable.Neutral Relative Performance is -5% to 5%;or the fundamental outlook of the sector is neutral.Underperform Relative Performance

![有關: 敏華控股有限公司[01999] - gtja](https://img.yumpu.com/41399174/1/184x260/-01999-gtja.jpg?quality=85)