Cheif Marketing Officers-A Stu... - Zawya

Cheif Marketing Officers-A Stu... - Zawya

Cheif Marketing Officers-A Stu... - Zawya

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

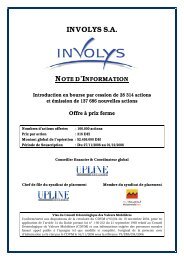

FIGURE 1A Model of Factors Associated with CMO Presence in TMTsInnovation+Strategic FactorsDifferentiationCorporate brandingDiversification++–Structural FactorsTMT marketingexperienceTMT general managementexperienceOutsider CEO+/–+/–+CMO presenceEnvironmental FactorMarket concentration–ControlsNotes: We do not present the conceptual model for the impact of CMO presence on firm performance, given the complexity of two-way interactionssuggested by the model of CMO presence and in the interest of space.ingful dialogue in this regard. Prior research efforts alongsimilar lines have been at the level of the strategic businessunit (e.g., Homburg, Workman, and Krohmer 1999; Ruekert,Walker, and Roering 1985). The current researchexpands the scope of this domain of inquiry to the corporatelevel, thus providing TMTs with an understanding of firms’central tendencies with respect to the choice of CMO presence.Evidence of practices followed and rationales used byothers in industry would help TMTs make better informeddecisions with respect to marketing at this level of the firm.To summarize the findings of our research, firms aremore likely to have a CMO in the TMT when they haverelatively high levels of innovation and differentiation,when they follow a corporate branding strategy, when thechief executive officer (CEO) is an outsider, and when TMTmarketing experience is relatively high. Furthermore, asfirms diversify, they are less likely to have a CMO whenthey are relatively small but are more likely when they arerelatively large. The presence of a CMO has no impact onfirm performance, and firms with a CMO do not performbetter or worse than those without one when faced with thepreceding factors. In the following section, we elaborate onthe conceptual model for this research illustrated in Figure1 and present hypotheses along with supporting argumentsfor both the factors associated with and the consequences ofCMO presence. In doing so, we draw on prior literature inmarketing and organization theory and on the role of theCMO. Given the scant empirical research on the CMO’srole in the firm, this research includes a qualitative stage forthis purpose, details of which we also cover in the followingsection. We test the hypotheses using secondary data. Asubsequent section presents the methodology used for thispurpose and includes descriptions of the sample and themeasures and sources of data for all the variables. This isfollowed by a section on the analysis of the data and theresults. We conclude with a discussion of the results and66 / Journal of <strong>Marketing</strong>, January 2008

elated to the marketing domain. Critical elements of themarketing domain include the firm’s market-based assetsthat are made up of relational and intellectual assets withrespect to customers and channels (Day 1994; Srivastava,Shervani, and Fahey 1998; Vorhies and Morgan 2005).Therefore, the CMO, when present, is the constituencywithin the TMT that has significant responsibility for andinformation about these assets. 5 Armed with this knowledge,the CMO is expected to reduce the complexity anduncertainty that the TMT faces in the marketing domain orin critical decision-making areas affected by the marketingdomain. Thus, the factors that are identified to explain thechoice of having/not having a CMO are those that affectsuch marketing-related complexity for the TMT.At the same time, having a CMO is also tantamount togiving up control over the marketing domain, which othertop executives in the firm may be less willing to do. Executivepower within the firm draws from control over theseresources (Pfeffer 1981). Therefore, the factors that areidentified are also those that have a bearing on the powerdynamics in the TMT with respect to control over the marketingdomain. Finally, because having a CMO has a bearingon the affiliations within the TMT, we also explore thefactors linked to homophily, the phenomenon wherebypeople prefer others who are similar to them (Lazarsfeldand Merton 1954).5It could be argued that TMT executives with marketing backgroundsmay also play this role. However, regardless of functionalbackgrounds, they are not explicitly focused on this role, givenconstraints of their own roles as CEO; COO; or heads of divisions,regions, or other functions (Gilliatt and Cuming 1986).Strategic Factors Related to CMO PresenceInnovation and differentiation. Strategies of innovationand differentiation, represented by the emphasis on researchand development (R&D) and advertising, respectively,increase the need to identify market opportunities quicklyand correctly. Top management is concerned with appropriateresource allocation across a diverse range of new productand positioning initiatives (Finkelstein and Hambrick1992). This calls for skill and experience in segmentation,targeting, and positioning at the corporate level, or whatHitt and Ireland (1985, 1986) call “corporate-level marketingcompetencies.” Varadarajan and Clark (1994) point outthat these are areas in which marketers can contribute tocorporate strategy with their experience in business-levelsegmentation, targeting, and positioning. As firms pursuenew product markets and segments, top executives are facedwith greater amounts of diverse information. Furthermore,the success of the strategies of innovation and positioningrelies heavily on successful development and deployment ofmarketing capabilities. Therefore, these conditions make itmore likely that the TMT will have a CMO to help reduceTMT complexity in the marketing domain while overseeingcritical marketing resources.In support of these arguments, we offer evidence fromthe qualitative stage of this research; we commonlyobserved the phrases of “growth,” “innovation,” and “differentiate”in the job descriptions of CMOs and press releasesof their appointments. Formally, we propose the following:H 1 : A firm’s level of innovation is positively related to thelikelihood of CMO presence in its TMT.H 2 : A firm’s level of differentiation is positively related to thelikelihood of CMO presence in its TMT.Corporate versus other branding strategies. Brandingstrategies of firms have been classified as corporate, houseof-brands,and mixed (Laforet and Saunders 1994; Rao,Agarwal, and Dahlhoff 2004). A corporate branding strategyuses the corporate brand name for all the firm’s productsand services, whereas a house-of-brands strategy doesnot use the corporate brand name at all. A mixed brandingstrategy has some of the firm’s products with the corporatebrand name and others with other names. The corporatebrand is a critical asset to all firms but more so for firmsthat rely on it for all their products and services. Therefore,firms with a corporate branding strategy are concernedabout monitoring how they build and deploy this asset (Rao,Agarwal, and Dahlhoff 2004). We argue that such a concernmakes it more likely for TMTs in firms with a corporatebranding strategy to have an executive accountable for thecorporate brand. Branding comes under the domain of marketing,and consequently, this executive is the CMO. As oneof the top executives interviewed mentioned, “The CMOhas to own the metrics area about overall brand health.” Infirms with either mixed branding or house-of-brands strategies,it is more likely that brands have distinct images.Structurally, there is a greater possibility of senior brandmanagers who monitor and filter information on theirbrands to the TMT (Aaker and Jacobson 1994). This layerof senior management makes the task of interpreting complexinformation on intangible marketing assets easier forthe TMT. This argument may suggest that the absence of aCMO in firms without a corporate branding strategy has nobearing on marketing’s influence in such firms. However,note that functional representation has been linked to functionalimportance (Chaganti and Sambharya 1987; Webster,Malter, and Ganesan 2003), and our interest is in the levelof the TMT, not the level of middle management, which iswhere senior brand managers are more likely to be. Therefore,the greater criticality and complexity associated with acorporate branding strategy makes a CMO more likely thannot.Although no prior research has linked branding strategiesto criticality and complexity for TMTs, we offer qualitativeevidence in support of the arguments. The roles ofCMOs were often linked to that of “brand management andmarketing,” “driving the firm brand,” and “brand stewardship(creating a consistent internal and external corporatebrand voice),” themes that were recurrent across firms withcorporate branding strategies. On the basis of the precedingdiscussion, we propose the following:H 3 : The likelihood of CMO presence in the TMT is higher infirms that have a corporate branding strategy than in firmsthat pursue other branding strategies.Diversification. As firms diversify into multiple businesses,marketing activities get delegated to the business68 / Journal of <strong>Marketing</strong>, January 2008

level (Varadarajan, Jayachandran, and White 2000). Consequently,corporate strategy and its objectives get delineatedfrom business strategy and its objectives. Diversificationand the formation of a corporate strategic planning departmentare structural solutions to firm expansion (Markides1995). Therefore, we expect that complexity for the TMTdecreases as firms diversify. Furthermore, with diversification,heads of business units become independent, powerfulconstituencies themselves. For them, retaining control overkey resources becomes critical to maintaining and increasingpower or influence (Doz and Prahalad 1991; Fligstein1987). Therefore, a CMO is likely to be more valued insingle-business firms than in diversified firms. Note that itis not possible to identify which of the preceding two logicsis at play, because they both suggest the same direction ofrelationship. Formally, we propose the following:H 4 : A firm’s level of diversification is negatively related to thelikelihood of CMO presence in its TMT.Structural Factors Related to CMO PresenceTMT’s functional background in marketing. Priorresearch has viewed functional experience or expertise inthe TMT as a structural response to contingencies facingfirms (Chaganti and Sambharya 1987; Keck and Tushman1993). The type of functional experience in the TMT isviewed as relevant in addressing TMT complexity. Furthermore,it has been shown to influence power dynamicswithin the TMT (Hambrick 1981). Therefore, we explorethe role of the functional experience in the TMT as a factorrelated to CMO presence. Given that general managementexperience involves overseeing activities of multiple functions,including marketing, we offer similar hypotheses forboth these types of functional experience. For example, Dayand Nedungadi (1994) suggest that the managerial representationsof marketing managers and general managers arelikely to be somewhat similar.Two lines of reasoning suggest competing or alternativehypotheses. The first is the phenomenon of homophily,according to which people tend to like those who are similarto them (Lazarsfield and Merton 1954; McPherson andSmith-Lovin 1987). Functional experience has been shownto discriminate fairly well between people (Dearborn andSimon 1958; Hambrick and Mason 1984). Homophilywould then suggest that greater marketing or general managementexperience in the TMT would be related to agreater likelihood of a CMO. Related to the idea ofhomophily is that top executives with marketing or generalmanagement experience also recognize the importance ofthe voice of the customer in the TMT. For example, Webster,Malter, and Ganesan (2003) find this to be the case forfirms with marketing CEOs. Therefore, we propose the followinghypotheses for marketing and general managementexperience:H 5 : The proportion of a firm’s TMT with marketing experienceis positively related to the likelihood of CMO presencein its TMT.H 6 : The proportion of a firm’s TMT with general managementexperience is positively related to the likelihood of CMOpresence in its TMT.However, a second line of reasoning would suggest anopposite effect. Similar functional backgrounds are associatedwith similar mental maps (Dearborn and Simon 1958;Hambrick and Mason 1984). Greater experience in theTMT in marketing or general management could lead to anoverlap of cognitive strategies. Thus, from a contingencypoint of view, a CMO may not be required if the TMT hasexecutives with marketing or general management expertise.In addition, a CMO’s similar expertise may be viewedas a challenge to the other executives in the TMT (Pfeffer1981). Note that both rationales, one that draws on the contingencyview and the other that draws on power dependence,have the same effect. On the basis of the precedingdiscussion, we propose the following competing hypothesesfor marketing and general management experience:H 5Alt : The proportion of a firm’s TMT with marketing experienceis negatively related to the likelihood of CMOpresence in its TMT.H 6Alt : The proportion of a firm’s TMT with general managementexperience is negatively related to the likelihoodof CMO presence in its TMT.CEO’s firm-specific operational experience (outsiderversus insider CEOs). 6 Whereas the preceding discussionviewed the entire TMT’s functional experience, it is alsoimportant to focus specifically on the CEO, given his or herintegrative role within the TMT (Calori, Johnson, andSarnin 1994). The CEO has multiple responsibilities(Mintzberg 1973), and we expect that in an effort to dischargethese effectively, the CEO attempts to address his orher own limitations. A CEO limitation that has been relevantin explaining TMT staffing decisions is the CEO’sfirst-hand experience with operational activities specific tothe firm (Cannella and Lubatkin 1993). For example, Hambrickand Cannella (2004) find that CEOs who lack thisexperience, also referred to as outsider CEOs, are morelikely to have chief operating officers (COOs) than insiderCEOs, who have risen through the ranks of the firm and aremore familiar with the firm’s operations. This logic wouldbe relevant to all the functions at the operational level, andwe extend it to the marketing domain. Thus, we hypothesizethe following:H 7 : The likelihood of CMO presence in the TMT is higher infirms with an outsider CEO than in firms with an insiderCEO.Environmental Factors Related to CMO PresenceAs market concentration increases, industries tend to bedominated by fewer and larger firms. Therefore, the diversityof possible actions under the marketing domain is relativelygreater in industries with low levels of concentration.For example, Kuester, Homburg, and Robertson (1999) findthat breadth of retaliatory behavior, in terms of the numberof marketing instruments used, is greater in less concentratedindustries. Such industries also tend to be associatedwith customer-oriented managerial representations ratherthan competitor-oriented ones that are found in highly con-6We thank an anonymous reviewer for suggesting a thoroughexploration of the CEO’s role.CMOs in Top Management Teams / 69

centrated industries (Day and Nedungadi 1994) becausethere are many bases of differentiation in the former, leadingto a greater need to focus on customer needs, whereas afew large players drive the market in the latter (Porter1980). Thus, it is more likely that there is greater complexityfor the TMT in the marketing domain in less concentratedindustries. This would suggest a greater likelihood ofCMO presence in such industries. Note that some empiricalevidence also suggests that CMOs are less likely in marketswith relatively low concentration. Anderson, Fornell, andMazvancheryl (2004) find that customer satisfaction’s positiveimpact on shareholder value is weaker in less concentratedindustries. Their rationale is that given the intenserivalry in such industries, customer satisfaction is notenough to hold back consumers (Kohli and Jaworski 1990).It is possible to stretch this rationale and argue that CMOsare less valued in less concentrated industries, given that akey marketing asset is relatively less critical. However, forthis rationale to affect CMO presence, firms must makeCMO-related choices in response to the stock market’sreaction, for which there is no evidence. Overall, the argumentsdiscussed in this section seem to suggest that low,rather than high, levels of market concentration are associatedwith the likelihood of CMO presence. Formally, wepropose the following:H 8 : The degree of market concentration in a firm’s primaryindustry is negatively related to the likelihood of CMOpresence in its TMT.Consequences of CMO PresenceThe preceding sections argue that CMO presence/absence iscontingent on the level of the strategic, structural, and environmentalfactors facing firms. The logic of contingencytheory suggests that the impact of CMO presence on firmperformance depends on the levels of these factors(Lawrence and Lorsch 1967; Zeithaml, Varadarajan, andZeithaml 1988). To the extent that firms face conditions thatargue for CMO presence/absence, we expect that CMOpresence/absence helps such firms improve performance.Conversely, when firms make this choice in opposition tothe logic of the conditions they face, we expect that CMOpresence/absence hampers firm performance. We hypothesizethese interaction effects for all but two of the factorsassociated with CMO presence. It is not possible to offersimilar hypotheses for TMT marketing and general managementexperience, because alternative logics suggestedcompeting hypotheses for the effects of these factors onCMO presence. Therefore, we propose the following:H 9 : Firm performance is improved by CMO presence in theTMT for firms pursuing (a) relatively high levels of innovation,(b) relatively high levels of differentiation, (c) acorporate branding strategy, and (d) relatively low levelsof diversification, as well as for firms (e) with an outsiderCEO and (f) in industries that are relatively lessconcentrated.Our conceptual framework for the explanation of CMOpresence does not offer any guidance regarding the maineffect of the presence or absence of a CMO on firm performance.Recent advocates of CMO presence suggest thathaving such an executive raises the importance of marketingissues at the corporate level and can only benefit firmperformance (Kerin 2005; McGovern et al. 2004). At thesame time, the presence of such an executive also addsadministrative and bureaucratic costs (Taylor 2004). Theonly evidence we found in this regard was an inferred indirectassociation of TMT marketing experience with firmperformance through sales growth (Weinzimmer et al.2003). Therefore, we do not offer a hypothesis for the maineffect of CMO presence on performance. However, weexplore whether firms that have CMOs perform better orworse than firms that do not.MethodologySampleWe chose to observe firms over a considerable durationrather than at any one point in time so that the results didnot reflect conditions or reporting idiosyncrasies of a particularyear. At the time this research was initiated, the mostrecent year with secondary data available on TMTs of firmswas 2004. Consequently, we chose to observe firms over thefive-year period from 2000 to 2004. All firms in the COM-PUSTAT database with sales of at least $250 million in2002, the midpoint of our period of observation, were identified.We believed that limiting the research to larger firmswas an empirical necessity given the low prevalence ofCMOs even in the Fortune 1000, as observed in the BoozAllen Hamilton study (Hyde, Landry, and Tipping 2004).Furthermore, Hambrick and Cannella (2004) use a similarcutoff. From this set, we retained only firms without missingdata on the various factors. To test the hypothesis oninnovation, we dropped firms in industries that did notreport R&D expenditures (e.g., retailing). As a result ofthese filters, the final sample had 167 firms that representeda cross-section of industries. 7The percentage of firms with a CMO was approximately40% each year⎯specifically, 41%, 42%, 44%, 41%,and 39% in 2000, 2001, 2002, 2003, and 2004, respectively.These proportions were not significantly different from oneanother. Approximately 25% of the firms had a CMO,whereas 41.32% did not in all the years of observation. Anadditional 17.37% of the firms had a CMO, whereas16.17% did not for more than half of the period of observation.We also note that 19.6% of the CMOs across all theyears in the sample had the actual title of CMO, and thetrend for the title increased over time. As an aside, 97.2% ofthe firms’ TMTs had a finance executive (of these, 96.8%had the title of CFO) across all the years of observation.7The break-up of the sample by industry (two-digit StandardIndustrial Classification [SIC]) was 38 firms in Business Services(SIC 73), 37 in Industrial Machinery and Equipment (SIC 35), 29in Electrical and Electronic Equipment (SIC 36), 21 in Chemicalsand Allied Products (SIC 28), 19 in Instruments and Related Products(SIC 38), 7 in Rubber and Miscellaneous Plastic Products(SIC 30), 6 in Fabricated Metal Products (SIC 34), 4 in Furnitureand Fixtures (SIC 25), 3 in Paper and Allied Products (SIC 26),and 3 in Primary Metal Industries (SIC 33).70 / Journal of <strong>Marketing</strong>, January 2008

Data Sources and MeasuresWe collected data using secondary sources. Unless specificallymentioned, we collected most measures annually overthe 2000–2004 period. We now describe the measures andsources of data for the various dependent and independentvariables.Operationalization of the TMT. Prior researchers haveoperationalized the TMT in various ways, depending on theresearch purpose, methodology used, and data availability(for a list of these operationalizations, see Table 1 in Carpenter,Geletkanycz, and Sanders 2004, pp. 754–58). Theseoperationalizations include vice president or senior vicepresident and above (Chaganti and Sambharya 1987; Keckand Tushman 1993; Michel and Hambrick 1992; Weinzimmeret al. 2003), the top two levels (Wiersema and Bantel1992), and inside directors (Finkelstein 1992). A fewresearchers have also used key informants such as the CEOto identify the TMT (e.g., Bantel and Jackson 1989). Weuse the most inclusive of operationalizations that allow forconsistency across firms and with more recent research(e.g., Hambrick and Cannella 2004). Specifically, in thisresearch, the TMT is the list of executive officers specifiedby a firm in the 10-K or proxy, its annual filings with theSecurities Exchange Commission. The mean size of theTMT in the sample of firms was 9.65, and the standarddeviation was 3.71, which is consistent with prior researchusing broader or more inclusive operationalizations.Dependent variable: CMO presence. We used 10-Ks orproxy statements to identify the dependent variable of interest⎯thepresence or absence of a CMO in the firm’s TMT,coded as 1 or 0, respectively. An executive in the TMT withthe term “marketing” in his or her title constitutes CMOpresence; a TMT without such an executive representsCMO absence. The actual titles included vice presidentmarketing, senior vice president marketing, or executivevice president marketing. We encountered a few cases inwhich the title had the terms “branding” or “corporate marketing.”The title of CMO was typically in addition to theseother titles (McGovern and Quelch 2004). We also checkedCMO presence coded from the 10-K/proxy against the listof officers provided in annual reports.Independent variables: strategic, structural, and environmentalfactors. All measures and data sources have beenused in prior research. Innovation and differentiation werecaptured by the ratios of R&D to sales and advertising tosales, or R&D intensity and advertising intensity, respectively(Bettis and Mahajan 1985). These data are availablethrough Standard & Poor’s COMPUSTAT. A graduateresearch assistant and one of the researchers separatelycoded the branding strategies of firms, drawing on Rao,Agarwal, and Dahlhoff’s (2004) definitions. If the firm hada corporate branding strategy, this variable was coded as 1;otherwise, the variable was coded as 0. Four sources ofinformation⎯Competitive Media Reports, DatamonitorReports, 10-Ks, and company Web sites⎯were used for thispurpose. The degree of agreement between the two coderswas 80.5%. After discussion, the degree of agreementimproved to 93.4%, with the remaining cases of disagreementbeing assigned codes by the researcher. In line withRao, Agarwal, and Dahlhoff, we assumed that the firm’sbranding strategy was constant over the observation period.We computed diversification using the entropy measurebased on four- and two-digit-level segment sales availablethrough COMPUSTAT (Palepu 1985). We calculated measuresof total, related, and unrelated diversification andtested the hypotheses on diversification using each separately.A large proportion of the sample had diversificationmeasures of zero by this method. Consequently, we alsoused a dummy variable coded as 0 or 1 to indicate nondiversifiedversus diversified firms, respectively, for eachmeasure of diversification.To determine the proportion of the TMT with marketingand general management experience and whether a CEOwas an outsider or an insider, we collected biographicalinformation on the executives using multiple sources. Theseincluded the 10-Ks, Bloomberg, Dun & Bradstreet’s Registerof Corporations, and company Web sites. The method ofclassification of functional experience is fairly well establishedin prior research (for a review, see Finkelstein andHambrick 1996). Functional experience in marketing and/ormarketing-related functions that included sales, advertising,brand management, and customer service was coded asmarketing functional experience. Experience as a head of adivision or region or as a top management executive withoutany specific functional responsibilities was coded asgeneral management experience. The coding was fairlystraightforward and was carried out by graduate researchassistants, who we trained. Some information was publiclyavailable on approximately 95% of the executives in theTMTs of the firms in the sample. The mean and median ofyears of available biographical information on these executiveswas 13.88 and 12, respectively. When no informationwas available on an executive, we dropped the executivefrom the TMT for the purpose of analysis. Consequently,75% of the firms had some biographical information on allexecutives in the TMT, and 95% of the firms had some biographicalinformation on at least 75% of the executives inthe TMT. The measures we used were either the proportionof the executives in the TMT with experience in marketingor general management or the proportion of the total yearsof experience in the TMT in marketing or general management,after we excluded the CMO from the TMT. 8 As analternative to using the entire TMT for determining marketingexperience, we used a dummy measure that equaled 1when the CEO of the firm had marketing experience.Recent research by Webster, Malter, and Ganesan (2003)suggests that CMOs are more likely and marketing is morevalued in firms in which CEOs have a marketing background.A dummy variable for outsider (insider) CEO wascoded as 1 (0) if the executive had spent zero (more thanzero) years in the firm before being appointed as a CEO. Weused other cutoffs in line with prior research on outsider8We thank an anonymous reviewer for pointing out the importanceof excluding the CMO while calculating the TMT’s experiencein marketing and general management.CMOs in Top Management Teams / 71

CEOs (e.g., Cannella and Lubatkin 1993), but the resultsdid not differ across alternatives. We also used the numberof years instead of the preceding categorical operationalization,but we do not report the results, because they were significantlyweaker.We calculated the environmental factor of market concentrationusing the Herfindahl–Hirschmann index (HHI),which is the sum of the square of market shares at the twodigitStandard Industrial Classification (SIC) level, of allfirms listed in COMPUSTAT. As alternatives to the HHI,we also used the four-firm and eight-firm concentrationratios, which add the market shares of the four and eightfirms with the largest market shares, respectively, at thetwo-digit SIC level.Dependent variable for model of consequences: firmperformance. We used various measures of firm performancethat have been used extensively in prior research—namely, sales growth, a market-based measure of a firm’sperformance that, with adequate controls, captures thenotion of market share; return on assets (ROA) and returnon sales (ROS), which are accounting-based performancemeasures; and Tobin’s q, a market-based measure thatreflects the value of a firm as perceived by its shareholders.We calculated sales growth as the increase in sales as a proportionof the sales in the preceding year. We calculatedROA as the ratio of profits to assets and ROS as the ratio ofprofits to sales. We calculated Tobin’s q using Chung andPruitt’s (1995) approximation⎯namely, the ratio of the sumof market value of the firm and book value of its debt to itstotal assets. Researchers prefer Tobin’s q because it is forwardlooking and is not affected by accounting standardsthat may differ across industries (for details, see Anderson,Fornell, and Mazvancheryl 2004, p. 183). We obtained allrequired data for the calculation of these variables fromCOMPUSTAT.9Because the distributions were skewed, it is more appropriateto use the median, not the mean, as a measure of central tendencyor as a control (Hambrick and Cannella 2004; Rao, Agarwal, andDahlhoff 2004).ControlsBecause the sample of firms is drawn from multiple industries,we controlled for industry effects using median measuresfor the variables at the two-digit SIC level to theextent that data were available (Hambrick and Cannella2004). 9 These were subtracted from the firm’s measure onthat variable. For R&D intensity, advertising intensity, salesgrowth, ROA, ROS, and Tobin’s q, we used all firms in eachSIC with available data in Standard & Poor’s COMPUSTATfor this purpose. As an alternative to industry medians, wealso used dummy variables for industries at the two-digitSIC level. In addition, we controlled for the size of the firmmeasured through the natural log of the number of employeesreported in COMPUSTAT. Firm size controls for explanationsthat draw on the tendency of leading firms to beinitiators of structural choices, such as having a CMO; followingprior research, we also control for size in the modelof performance. We also controlled for CEO tenure; thepresence/absence of a COO, which we coded as a dummyvariable (1/0); and the extent of divisionalization in thefirm, which we measured as the proportion of executives inthe TMT who were divisional heads. We obtained thesemeasures from the 10-Ks. We included CEO tenure to controlfor the possibility of CMO presence/absence being partof a TMT shake-up that usually accompanies new CEOappointments. We needed to control for COO presencebecause it has been shown to be related to outsider CEOsfor reasons similar to those that we hypothesized for CMOpresence (Hambrick and Cannella 2004). We controlled fordivisionalization because a preponderance of such executivesmay imply CMOs at the divisional level rather than atthe corporate level. We also included prior performance,which we measured as sales growth, ROA, or ROS, as acontrol measure in the event that CMO presence/absencewas a response to either poor or superior performance.Finally, we controlled for the consumer profile of the firm,in terms of whether the firm was a pure business-toconsumerplayer, a pure business-to-business one, or onethat sold to both ultimate and organizational consumers(mixed) because the propensity to have a CMO may differacross these contexts. We coded firms as one of theseaccording to the description of the firm’s business and itscustomers as reported in the 10-K. In line with Rao, Agarwal,and Dahlhoff (2004), we assumed that the firm’s consumerprofile was constant over the observation period.Only 9% of the firms were pure business-to-consumerfirms. Therefore, we combined business-to-consumer andmixed firms and coded them as 1; we coded business-tobusinessfirms as 0. In the model of firm performance, inaddition to most of the preceding control variables, we controlledfor relevant performance variables by drawing onprior research; for example, with Tobin’s q as a measure ofperformance, we controlled for prior profitability and salesgrowth because these have been shown to affect this measureof performance.Analysis and ResultsTable 1 presents descriptive statistics and correlations for allmeasures, pooled over the period of observation. None ofthe correlations exceeded .5. For all models discussed, noneof the variation inflation factors were above 4, and none ofthe condition indexes associated with the eigenvalues of thevariable matrix exceeded 15. These tests imply the absenceof significant multicollinearity problems (Johnston 1991, p.250). Longitudinal data enabled us to perform two types ofanalyses for testing the hypotheses explaining CMO presence.In the first analysis, we assumed that the decision tohave a CMO is revisited every year. Here, we modeledCMO presence in 2001–2004 as a function of the hypothesizedvariables and controls; those that varied over timewere lagged by a year, except for firm size, outsider CEO,CEO tenure, COO presence, and divisionalization, whichwere not lagged. Empirically, lagging the time-varyingindependent variables enabled us to rule out reverse causality,especially in the case of the strategic factors. We also72 / Journal of <strong>Marketing</strong>, January 2008

TABLE 1Descriptive Statistics and Correlation CoefficientsM (SD) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 151. CMO presence t .42 (.50)2. Innovation a t– 1 –.03 (.09) .20***3. Differentiation a t– 1 .01 (.03) .16*** –.054. Corporate branding b .53 (.50) .26*** .31*** –.09**5. Total diversification c t– 1 .30 (.42) –.09 –.15*** .06* –.33***6. TMT marketing experience d t– 1 .15 (.14) .14*** .07* .15*** .03 –.15***7. TMT general managementexperience d t– 1 .53 (.18) –.14*** –.13*** .03 –.10*** .04 .048. Outsider CEO t .32 (.47) .14*** .01 .12*** .05 .04 –.05 –.019. Market concentration e t– 1 .04 (.02) –.00 .20*** .03 –.06 .16*** .01 –.01 .15***10. Log(number of employees) t 8.65 (1.37) –.06 –.15*** .07* –.32*** .43*** –.07* .17*** –.05 .08**11. Year 2002.5 (1.12) –.02 .08* .04 .00 .03 .04 –.05 –.00 .11** .0112. CEO tenure t 6.72 (7.71) –.08** –.07* –.12*** .11*** –.13*** –.04 .05 –.05 –.08** –.10** .0213. COO presence t .29 (.45) –.08** –.09** .08* .06 –.07* .03 .05 .03 –.12** .05 –.03 .13***14. TMT divisionalization t .19 (.17) –.06* .04 .02 –.08** .21*** .08** .27*** .02 .06 .19*** .03 –.08** –.09**15. Prior performance f t– 1 .06 (.35) .04 .04 .12** .07* –.13*** .10** –.12 .00 –.05 –.08** –.13*** –.02 .07* –.08**16. Business-to-consumer/mixedversus business-to-businessfirm b .43 (.49) –.07* –.24*** .43*** –.42*** .19*** .13** .04 .08** .06 .26*** .00 –.18*** .02 .05 –.03*p < .10.**p < .05.***p < .01.aRatios of R&D (innovation) and advertising (differentiation) to firm sales, respectively, less industry median ratios.bAssumed to be constant over the period of observation.cEntropy measure of total diversification.dProportion of executives in the TMT (excluding the CMO from time t if present in the TMT in time t – 1) with marketing or general management experience.eHHI.fSales growth less industry median values.Notes: Table shows correlations between measures pooled across 167 firms and four years. N = 668 firm years.CMOs in Top Management Teams / 73

included the year as an additional control in case CMOpresence varied over time. Given that our dependentvariable of CMO presence is binary and that we repeatedlyobserve the same firms over a period of time, we used thegeneralized estimating equations (GEE) approach (Zegerand Liang 1986). The GEE approach estimates regressioncoefficients and standard errors after weighting data withestimates of serial correlations that occur with repeatedobservations. This approach also allows for the specificationof various distributions for the dependent variable and,consequently, has been used to model binary outcomes inprior research (Hambrick and Cannella 2004; Law 2002).The results from this analysis, using StataCorp (2005), areshown as Models 1 and 2 in the first two columns of Table2; Model 2 introduces two-digit SIC dummy variablesinstead of using industry-level variables as controls.In the second analysis, we study a firm’s propensity fora CMO over the entire period of observation. Here, for aCMO to be considered present/absent in a firm, the firmshould have had/not had this executive in the TMT for a significantportion of the period of observation. In the interestof space, we report the results only for CMO presence/absence, when firms had/did not have a CMO in the TMTfor more than half the period of observation. The results arefairly similar across other specifications, except that theusable sample for analysis decreases in size; for example,the sample reduces from 167 to 106 when we include onlythose firms that have/do not have a CMO throughout theperiod of observation. We averaged time-varying independentvariables over the period of observation, and the controlof prior performance refers to the performance in theyear before the period of observation. We provided this secondanalysis as a support for the results from the longitudinalanalysis, especially in the event that the decision to havea CMO is not an annual one. The results from this analysis,which employs logistic regression, are shown as Model 3 inthe last column of Table 2. The analysis that tests thehypotheses related to consequences of CMO presence onfirm performance also uses averages to avoid the complexityof trying to interpret short-term effects of CMO presenceand separate cause and effect. The results from this analysis,which uses ordinary least squares, appear in Table 3. Inthe interest of space, we present the results using only twoof the measures of performance—Tobin’s q in Model 1 andsales growth in Model 2. The results were not significantlydifferent when we used ROA and ROS. In general, the precedinganalyses follow the work of Hambrick and Cannella(2004), who study factors associated with COO presenceand the consequences of COO presence for firmperformance.Results of the Model of Factors Associated withCMO PresenceAs Table 2 shows, we find support for the hypothesizedpositive association between innovation and CMO presence(H 1 ) (p < .05 in Models 1 and 3; p < .10 in Model 2). H 2 ,which predicted the positive association between differentiationand CMO presence, is also strongly supported (p

TABLE 2Results of Logistic Regressions with CMO Presence as the Dependent VariableHypotheses AcrossModels 1, 2, and 3Independent Variables Model 1 a Model 2 b Model 3 c Support forConstant 138.95 (125.56) 55.45 (119.98) –.14 (.74) —Innovation d (H 1 ) 2.79 (1.51)** 2.52 (1.49)* 5.97 (2.56)** YesDifferentiation d (H 2 ) 12.62 (5.12)** 13.18 (5.07)*** 15.34 (7.75)** YesCorporate branding (H 3 ) .93 (.33)*** .87 (.37)** .75 (.45)* YesDiversification (H 4 ) –.45 (.42) –.39 (.44) –.47 (.61) No (main effect)TMT marketing experience (H 5 /H 5Alt ) –.25 (.71) –.42 (.70) 3.33 (1.55)** Partial (H 5 )TMT general management experience (H 6 /H 6Alt ) –.34 (.58) –.43 (.59) –2.06 (1.24)* Partial (H 6Alt )Outsider CEO (H 7 ) .49 (.19)** .47 (.19)** 1.27 (.46)*** YesMarket concentration (H 8 ) –8.72 (6.70) — –9.90 (9.18) NoFirm size .03 (.12) .07 (.12) .24 (.17) —Diversification × firm size (H 4 : post hoc) .43 (.21)* .44 (.22)** .58 (.33)* Yes (interaction effect)Year –.07 (.06) –.03 (.06) — —CEO tenure –.01 (.01) –.01 (.01) –.02 (.03) —COO presence –.12 (.21) –.10 (.21) –.49 (.55) —TMT divisionalization .25 (.53) .20 (.53) –1.50 (1.44) —Prior performance d –.05 (.21) –.05 (.21) –.15 (.24) —Business-to-consumer/mixed versusbusiness-to-business firm –.06 (.36) –.02 (.36) –.52 (.49) —Nine industry dummies e — Included — —*p < .10.**p < .05.***p < .01.aPooled logistic regression using GEE over the 2001–2004 period. We controlled for industry effects for relevant strategic variables by subtracting the median value at the two-digit SIC level fromthe raw value of the variable. We coded CMO presence as 1 (0) for firms with (without) a CMO in time t; we measured all time-varying independent variables in time t – 1, except for outsider CEO,firm size, COO, CEO tenure, and divisionalization, which we measured in time t (N = 645 firm years; CMO presence = 42.05%; χ 2 (16) = 45.73, p < .001).bModel 2 is similar to Model 1, except that we controlled for industry effects using dummy variables at the two-digit SIC level (N = 645 firm years; CMO presence = 42.05%; χ 2 (24) = 50.22, p

TABLE 3Results of Ordinary Least Squares Regressions with Firm Performance as the Dependent VariableDependent Variable:Tobin’s q aDependent Variable:Sales Growth aIndependent Variables Model 1a b Model 1b b Model 2a c Model 2b cConstant .59 (.13)*** .60 (.13)*** .04 (.02)** .04 (.02)**Innovation a 5.56 (1.00)*** 5.52 (1.00)*** .11 (.13) .12 (.13)Differentiation a 10.25 (2.82)*** 10.59 (2.86)*** .56 (.37) .52 (.37)Corporate branding –.08 (.18) –.07 (.17) –.01 (.02) –.01 (.02)Diversification –.20 (.23) –.20 (.23) –.08 (.03)*** –.08 (.03)***TMT marketing experience –.48 (.65) –.53 (.66) .02 (.08) .03 (.08)TMT general management experience .33 (.46) .35 (.46) .02 (.06) .01 (.06)Outsider CEO –.59 (.18)*** –.46 (.25)* .01 (.02) –.01 (.03)Market concentration –.16 (3.27) –.13 (3.27) –.66 (.45) –.66 (.45)Firm size .23 (.07)*** .23 (.07)*** –.00 (.01) –.00 (.01)CEO tenure .02 (.01) .02 (.01) .00 (.00) .02 (.01)COO presence .26 (.22) .25 (.22) .02 (.03) .02 (.03)Prior performance a, d .02 (.01)** .02 (.01)** .09 (.01)*** .09 (.01)***Profitability (ROA) a 2.44 (.49)*** 2.46 (.50)*** –.22 (.01)*** –.22 (.06)***Sales growth a 2.85 (.61)*** 2.91 (.62)*** — —CMO Presence e .08 (.16) .07 (.16) .01 (.02) .01 (.02)Outsider CEO × CMO presence f (H 9e ) — –.26 (.36) — .04 (.05)*p < .10.**p < .05.***p < .01.aTobin’s q, sales growth, innovation, differentiation, prior performance, and profitability are the raw values less the median values at the twodigitSIC level.bN = 156. Model 1a: Adjusted R 2 = .46, F (15, 140) = 9.73, p < .001; Model 1b: Adjusted R 2 = .46, F (16, 139) = 9.13, p < .001.cN = 165. Model 2a: Adjusted R 2 = .32, F (14, 150) = 6.50, p < .001; Model 2b: Adjusted R 2 = .32, F (15, 149) = 6.12, p < .001.dPrior performance is the value of the dependent variable in the year before the period of observation.eWe coded CMO presence as 1 (0) for firms with (without) a CMO for more than half the period of observation (2000–2004).fSample interaction between factor associated with CMO presence and CMO presence. All other similar interactions were also nonsignificant.Notes: Table shows parameter estimates along with standard estimates in parentheses. We averaged all time-varying variables across theperiod of observation (2000–2004).with the choice of having a CMO (for a summary of supportedhypotheses, see Table 2). The presence of a CMO isrelated to innovation, differentiation, branding strategy, theCEOs operational experience in the firm, the diversificationstrategy and size of a firm, and, to some extent, the TMT’sfunctional experience. However, CMO presence has nodirect impact on firm performance, and having a CMO doesnot translate into higher levels of performance in the face offactors that are associated with CMO presence. In this section,we discuss implications for theory and practice, limitations,and suggestions for further research. We also presentsome illustrative examples of firms from our sample whilediscussing implications for theory.Implications for TheoryTo the best of our knowledge, we know of only one studythat has identified factors related to CMO presence, as partof a conference board report on corporate marketing (Hopkinsand Bailey 1984). Hopkins and Bailey (1984) studied aset of multibusiness firms and identified diversification as akey factor that explained CMO likelihood. Our studyexpands the scope of inquiry to include many more factors,it studies firms over time, and it updates the field on thisphenomenon by examining data that are two decades fromthe aforementioned report. We identified the gaps addressedby our study as important to the field, given the efforts tounderstand marketing’s role in the firm, especially at thelevel of corporate strategy. Notwithstanding other dimensionsthat capture marketing’s importance to a firm, theCMO-related choice represents an important facet of marketing’sinfluence in the TMT. This is evident in recentaccounts of the CMO’s role in the firm—namely, that of thecustomer advocate at the strategy table. For example,Joseph Tripodi, CMO of Allstate Insurance Company,defines his role as “the voice of the customer … particularlyat the senior management table” (Crosby and Johnson 2005,p. 12). However, not all TMTs have CMOs, which leads tothe question, Why do firms differ on this structural choice?In exploring these phenomena, this research contributesto the dialogue on the role of marketing in the firm (Anderson1982; Day 1992; Varadarajan 1992; Webster 1992;Wind and Robertson 1983; Workman, Homburg, andGruner 1998), providing evidence of rationales for differencesin marketing’s influence at the corporate level of thefirm. In the context of this research, these rationales helpedidentify specific strategic and structural factors, such asbranding, innovation, diversification, and top executiveexperience, which are related to CMO presence. The rationalefor the effect of the firm’s branding strategy was thatthe criticality and complexity associated with building andprotecting the corporate brand would make it more likelyfor firms with a corporate branding strategy to have a CMO.As an illustration of this rationale, consider the followingtwo firms from our sample that are in the same industry—in76 / Journal of <strong>Marketing</strong>, January 2008

Mean Predicted Probability of CMO PresenceFIGURE 2The Relationship Between Diversification andProbability of CMO Presence at Different Levelsof Firm Size.60.40.20.0012Firm Size (1 = Small Firms, 4 = Large Firms)3Dichotomized TotalDiversification (Entropy)MeasureNondiversifiedDiversifiedthis case, semiconductors: Advanced Micro Devices(AMD), which has a corporate branding strategy and sellsall its product under the AMD brand name, and MicronTechnology, which does not have a corporate brandingstrategy and sells products under the brand names Micron,Spectek, and Crucial. In line with the preceding rationale,we find that AMD has a CMO in all the years of observation,whereas Micron does not have a CMO in four of thefive years. To the best of our knowledge, no prior researchin the TMT literature has incorporated a firm’s brandingstrategy in a framework of TMT’s structural choices. Therefore,evidence of the effect of this variable marks a contributionof this research to organization theory.The rationale of complexity in the marketing domain forthe TMT also appears in the association between the strategicfactors of innovation and differentiation and CMO presence.As firms pursue a strategy of innovation and differentiation,the need for a CMO seems to increase because aCMO is able to allay the TMT’s resultant marketing-relateduncertainty. Again, as an illustration of this rationale withrespect to innovation, which we measure using the R&D-to-4sales ratio, consider two firms in the same two-digit SIC 73:Oracle, whose average ratio between 2000 and 2004 was.12, and PeopleSoft, whose ratio was higher at .18. Similarly,with respect to differentiation, which we measureusing the advertising-to-sales ratio, consider the followingtwo firms that belong to the pharmaceutical industry:Abbott Laboratories, whose average ratio over the observationperiod was .01, and Bristol-Myers Squibb, whose ratiowas higher at .08. In line with the rationales for these twofactors, both Oracle and Abbott did not have a CMO in allthe five years of observation, whereas PeopleSoft had aCMO throughout this period, and Bristol-Myers Squibb hadone for four of the five years. <strong>Marketing</strong> complexity alsohelps explain why outsider CEOs are more likely to haveCMOs. We expected this effect to be heightened for a newCEO, but the interaction between outsider CEO and theCEO’s tenure as a CEO was not significant. 11The presence of a CMO is also explained by the firm’slevel of diversification, contingent on the size of the firm(see Figure 2). As firms diversify, they most likely adoptstructures that reduce the TMT’s complexity of managingdiverse companies. As a result, a CMO is considered lessessential in diversified firms. It is also likely that heads ofthe diversified businesses are reluctant to cede their powerover decisions in the marketing domain to a CMO. However,this effect is more evident in firms that are relativelysmall in size. For example, if we compare Plantronics, anundiversified manufacturer of communication equipment,with Technitrol, a diversified manufacturer of electroniccomponents, both with sales not exceeding $600 million,we find that Plantronics had a CMO, whereas Technitrol didnot for the entire period of observation. Across relativelylarge firms, the effect of diversification seems to bereversed. For example, if we compare a large firm, such asPfizer, which is undiversified, with another large firm, suchas Procter & Gamble, which is highly diversified, we findthat Pfizer did not have a CMO for four of the five years ofobservation, whereas Procter & Gamble had a CMOthroughout this period. We suggest that this counterintuitiveresult is a result of size and diversity of businesses togetherconfronting the TMT with increased complexity. As aresult, the rationales of power and existing structures insmall diversified firms are overcome in larger diversifiedfirms. This counterintuitive component of our results differsfrom the finding of Hopkins and Bailey (1984), who findthat unrelated diversification decreases CMO likelihood.11We also checked other CEO-related variables, such as whetherthe CEO was also chairman, whether the CEO had been a COO ofthe firm, and whether the CEO’s dominant experience was in outputfunctions (i.e., marketing, manufacturing, and R&D) or infinance/law. None of these variables were significant. It is possiblethat the observation period of five years is a limitation in thisregard because we observed a change in CEO in only 10.6% of thefirm years in this period. Any CEO-related influence on the decisionto have a CMO may be relevant only in the year the CEO isappointed.CMOs in Top Management Teams / 77

We suggest that this could be due to the change in contextin the past two decades and the result of deconglomeration,which has reduced the number of firms diversifying intounrelated areas (Varadarajan, Jayachandran, and White2000).The amounts of marketing and general managementexperience in the TMT were both found to be associatedwith CMO presence, though we did not find consistent supportfor these relationships. The rationale of homophily wassupported, given the positive relationship found for marketingexperience. It seems that marketing experience isrequired in the TMT for a CMO’s role to be consistentlyappreciated. We also find evidence of the competing rationalesof contingency theory and/or power dependence,given the negative relationship of general managementexperience to CMO presence. As we indicated in the discussionbuilding up to this alternative hypothesis, it is not possibleto determine whether only one or both of the logics ofcontingency theory and need for power are at play. Firmsthat take a contingency view consider general managementexperience in their top executives sufficient to address thetasks of a CMO. Alternatively, it might be the case that topexecutives with this experience are reluctant to let go ofresponsibilities in the marketing domain because these arebases for their power and influence within the TMT. Tosummarize, we find evidence of the rationales of (1)marketing-related complexity for the executives in theTMT, (2) criticality in the marketing domain, (3) structuralarrangements within the TMT and the firm, (4) powerdynamics within the TMT, and (5) homophily. Thus, furtherresearch in the domain of marketing’s role in the firm and atthe level of the TMT will be better informed given thisevidence.Implications for PracticeAs firms evaluate their TMT compositions, we hope thatthis research aids them in making decisions in the contextof CMO presence. Admittedly, the results of our researchdo not provide conclusive evidence of the benefits of aCMO, given the nonsignificant effects in the model of performance.Notably, however, CMO presence shared a significant,positive correlation with the Tobin’s q measure ofperformance. Specifically, for the set of firms with/withouta CMO across all years in the period of observation (N =106), this correlation is .22 (p < .05). When this specificationis relaxed to allow CMO presence to include firms witha CMO for more than half the period of observation (N =134), this correlation is .21 (p < .05). However, these effectsare dominated by other variables in the model of performance.Regardless, it is important to note that CMOs do nothave a negative impact on performance.However, firms can still benefit from the results of themodel of CMO presence. Optimality of choices is impliedor assumed in rationales that draw on the contingency view(Zeithaml, Varadarajan, and Zeithaml 1988). Under thisassumption, CMO presence would be optimal for firms thataggressively pursue innovation and differentiation, for firmswith corporate branding strategies, for firms with outsiderCEOs, and for large diversified firms. Conversely, choicesthat are influenced by the rationale of power dependencemay lead to suboptimal choices. Either of these two precedingrationales may be operating in the case of diversificationin small firms. The power rationale implies that CMOabsence may be suboptimal for small diversified firms,though the contingency logic based on existing structuralarrangements implies that it may be optimal. Similarly,given these two rationales, it is not clear whether CMOabsence is optimal when TMTs have high levels of generalmanagement experience. In this context, note that conceptualarticles have argued that this experience is still not asubstitute for an executive in the TMT who is explicitlyfocused on the marketing domain (Gilliatt and Cuming1986). We hope that for these factors, the identification ofthe underlying rationales and their implied outcomes willstill be of value to TMTs. The decision to have a CMO iscomplex, which is probably why fewer than 50% of thefirms (in this and the Hyde, Landry, and Tipping [2004]studies) have such a role in place. In making top executivesaware of the mechanisms that drive this choice in firms, thisresearch has endeavored to take away the complexity thatmight be associated with it.Limitations and Further ResearchFirst, the nature of our sample does not allow for a systematicexploration of institutional effects, specifically those ofimitation. A logic of institutional theory is that earlyadopters of a structural adaptation or innovation in an environmentdo so using contingency rationales and thereforeare rewarded with performance gains; conversely, lateradopters seek legitimacy and, in imitating other firms intheir environment, do not achieve similar performance gains(DiMaggio and Powell 1983; Tolbert and Zucker 1983;Westphal, Gulati, and Shortell 1997). Therefore, in additionto providing evidence of imitation in CMO adoption, anexploration of institutional effects would shed light on thenonsignificance of the relationship between CMO presenceand performance that we find in our study. However, tomake any inferences about imitation, we must observe anentire population or, at the least, a substantially large set offirms that belong to a similar environment (in this case, thesame industry) over a considerable period. The sample inthis study is made up of firms drawn from multiple industries,and across the five-year period of observation in ourstudy, we do not observe significant changes in CMOprevalence, with 66.5% of the firms consistently having/nothaving a CMO. Therefore, we are unable to comment on thepresence or absence of institutional effects and suggestfocusing on one industry over a longer period as an area forfurther research.Second, our hypotheses for market concentration werenot supported. A possible explanation might lie in a suggestionwe made in the “Theory and Hypotheses” section; thatis, whereas industries with low concentration have highmarketing complexity, arguing in favor of CMO presence,marketing assets, such as customer satisfaction, may not becritical enough to warrant a CMO. We drew on Anderson,Fornell, and Mazvancheryl’s (2004) finding of customersatisfaction’s weakened impact on shareholder value in such78 / Journal of <strong>Marketing</strong>, January 2008

industries. Possibly, this tension is also reflected in firms’CMO-related choices. For example, CMO presence wasapproximately 21% and 56% in SICs 28 and 73, respectively,which are both industries with relatively low valuesof concentration (HHIs of .02 and .04, respectively). 12However, the lack of significant effects may also be due tothe limited range of industries and concentration values(HHI values range from .02 to .18). Therefore, expandingthe scope of this research to include additional industriesmight provide a clearer understanding of the role of marketconcentration. However, in analyses not shown here, wealso found that several other environmental factors that arelikely related to marketing complexity, such as industrysales growth, performance, and volatility, did not explainany additional variance in CMO presence at both two-digitand three-digit SIC levels. Again, one explanation may bethat imitative forces are at play, in which case it would bebeneficial to observe firms over a longer period of observation.Prior research has found that factors that influencestructural adaptations may be strong or weak, depending onthe stage of institutionalization of that adaptation (Tolbertand Zucker 1983; Zorn 2004). It might also be the case thatthe CMO position has been institutionalized in firms (Hannanand Freeman 1984); there is evidence of this, given the12The presence of a CMO in SIC industries was 56% in SIC 73,41% in SIC 35, 39% in SIC 36, 21% in SIC 28, 52% in SIC 38,34% in SIC 30, 30% in SIC 34, 30% in SIC 25, 33% in SIC 26,and 33% in SIC 33.significant, positive correlations between CMO presenceacross the years of observation. Another explanation may bethat the response to environmental marketing complexity isalready captured in the firms’ strategic and structuralchoices (Donaldson 2002).Two other limitations in our research are related to theexclusion of firms with sales less than $250 million andfirms that do not report R&D expenses. Given the lack of asignificant correlation between size and CMO presence andthe wide range of firm sizes that we included in our analysis,we suspect that the former is not a serious limitationand that our results should hold even for relatively smallerfirms. We accept the latter as a limitation of this researchand submit that our results cannot be generalized to firms inindustries, such as retailing, that do not report R&Dexpenses.We offer two final suggestions for further research. Thefirst is to explore the effect of CMO presence on domainsthat are closely linked to the role of the CMO, such as brandequity. The second is to examine the characteristics of asuccessful CMO. There has been some concern in the fieldwith respect to the phenomenon of CMO churn. Spencer<strong>Stu</strong>art, an executive recruiting firm, estimates the tenure ofa CMO at two years; in comparison, a CEO’s tenure is fiveyears (Welch 2004). Reasons offered include a gap betweenthe expectations and delivery from a CMO and the CMO’slack of strategic and/or line experience. Research that shedslight on these phenomena will be of value to top executivesand CMOs.REFERENCESAaker, David A. and Robert Jacobson (1994), “The FinancialInformation Content of Perceived Quality,” Journal of <strong>Marketing</strong>Research, 31 (May), 191–201.Anderson, Eugene W., Claes Fornell, and Sanal K. Mazvancheryl(2004), “Customer Satisfaction and Shareholder Value,” Journalof <strong>Marketing</strong>, 68 (October), 172–85.Anderson, Paul F. (1982), “<strong>Marketing</strong>, Strategic Planning and theTheory of the Firm,” Journal of <strong>Marketing</strong>, 46 (Spring), 15–26.Bantel, Karen A. and Susan E. Jackson (1989), “Top Managementand Innovations in Banking: Does the Composition of the TopTeam Make a Difference?” Strategic Management Journal, 10(Special Issue), 107–124.Bettis, Richard A. and Vijay Mahajan (1985), “Risk/Return Performanceof Diversified Firms,” Management Science, 31 (7),785–99.Calori, Roland, Gerry Johnson, and Philippe Sarnin (1994),“CEO’s Cognitive Maps and the Scope of the Organization,”Strategic Management Journal, 15 (6), 437–57.Cannella, Albert A., Jr., and Michael Lubatkin (1993), “Successionas a Sociopolitical Process: Internal Impediments to OutsiderSelection,” Academy of Management Journal, 36(August), 763–93.Carpenter, Mason A., Marta A. Geletkanycz, and Wm. GerardSanders (2004), “Upper Echelons Research Revisited:Antecedents, Elements, and Consequences of Top ManagementTeam Composition,” Journal of Management, 30 (December),749–78.Chaganti, Rajeswararao and Rakesh Sambharya (1987), “StrategicOrientation and Characteristics of Upper Management,” StrategicManagement Journal, 8 (July–August), 393–401.Chung, Kee H. and Stephen W. Pruitt (1995), “A Simple Approximationof Tobin’s q,” Financial Management, 23 (3), 70–79.Crosby, Lawrence A. and Sheree L. Johnson (2005), “ChangeAgents: Chief <strong>Marketing</strong> <strong>Officers</strong> Are Positioned to CreateCustomer-Loyalty Centered Enterprises,” <strong>Marketing</strong> Management,12 (November–December), 12–13.Cyert, Richard M. and James G. March (1963), A BehavioralTheory of the Firm. Englewood Cliffs, NJ: Prentice Hall.Day, George S. (1992), “<strong>Marketing</strong>’s Contribution to the StrategyDialogue,” Journal of the Academy of <strong>Marketing</strong> Science, 20(Fall), 323–29.——— (1994), “The Capabilities of Market-Driven Organizations,”Journal of <strong>Marketing</strong>, 58 (October), 37–52.——— and Prakash Nedungadi (1994), “Managerial Representationsof Competitive Advantage,” Journal of <strong>Marketing</strong>, 58(April), 31–44.Dearborn, DeWitt C. and Herbert A. Simon (1958), “Selective Perceptions:A Note on the Departmental Identification of Executives,”Sociometry, 21 (2), 140–44.DiMaggio, Paul J. and Walter W. Powell (1983), “The Iron CageRevisited: Institutional Isomorphism and Collective Rationalityin Organizational Fields,” American Sociological Review, 48(April), 147–60.Donaldson, Lex (2002), The Contingency Theory of Organizations.Thousand Oaks, CA: Sage Publications.Doz, Yves L. and C.K. Prahalad (1991), “Managing DMNCs: ASearch for a New Paradigm,” Strategic Management Journal,12 (Special Issue), 145–64.Finkelstein, Sydney (1992), “Power in Top Management Teams:Dimensions, Measurement, and Validation,” Academy of ManagementJournal, 35 (August), 505–538.CMOs in Top Management Teams / 79

<strong>Marketing</strong> Strategy,” Journal of <strong>Marketing</strong>, 65 (January),15–28.Vorhies, Douglas W. and Neil A. Morgan (2005), “Benchmarking<strong>Marketing</strong> Capabilities for Sustainable Competitive Advantage,”Journal of <strong>Marketing</strong>, 69 (January), 80–94.Webster, Frederick E., Jr. (1981), “Top Management’s Concernsabout <strong>Marketing</strong>: Issues for the 1980s,” Journal of <strong>Marketing</strong>,45 (Summer), 9–16.——— (1992), “The Changing Role of <strong>Marketing</strong> in the Corporation,”Journal of <strong>Marketing</strong>, 56 (October), 1–17.———, Alan J. Malter, and Shankar Ganesan (2003), “Can <strong>Marketing</strong>Regain Its Seat at the Table?” <strong>Marketing</strong> Science InstituteReport No. 03-003.Weinzimmer, Laurence G., Edward U. Bond, Mark B. Houston,and Paul C. Nystrom (2003), “Relating <strong>Marketing</strong> Expertise onthe Top Management Team and Strategic Aggressiveness toFinancial Performance and Shareholder Value,” Journal ofStrategic <strong>Marketing</strong>, 11 (June), 133–59.Welch, Greg (2004), “CMO Tenure: Slowing Down the RevolvingDoor,” (accessed May 1, 2005), [available at http://content.spencerstuart.com/sswebsite/pdf/lib/CMO_brochureU1.pdf].Westphal, James D., Ranjay Gulati, and Stephen M. Shortell(1999), “Customization or Conformity? An Institutional andNetwork Perspective on the Content and Consequences ofTQM Adoption,” Administrative Science Quarterly, 42 (June),366–94.Wiersema, Margarethe F. and Karen A. Bantel (1992), “Top ManagementTeam Demography and Corporate Strategic Change,”Academy of Management Journal, 35 (March), 91–21.Wind, Yoram and Thomas S. Robertson (1983), “<strong>Marketing</strong> Strategy:New Directions for Theory and Research,” Journal of<strong>Marketing</strong>, 47 (Spring), 12–25.Woolridge, Jeffrey M. (2003), Introductory Econometrics. MasonOH: Thomson South-Western.Workman, John P., Jr., Christian Homburg, and Kjell Gruner(1998), “<strong>Marketing</strong> Organization: An Integrative Framework ofDimensions and Determinants,” Journal of <strong>Marketing</strong>, 62(July), 21–41.Zeger, Scott L. and Kung-Yee Liang (1986), “Longitudinal DataAnalysis for Discrete and Continuous Outcomes,” Biometrics,42 (March), 121–30.Zeithaml, Valarie A., P. Rajan Varadarajan, and Carl P. Zeithaml(1988), “The Contingency Approach: Its Foundations andRelevance to Theory Building and Research in <strong>Marketing</strong>,”European Journal of <strong>Marketing</strong>, 22 (7), 37–64.Zorn, Dirk M. (2004), “Here a Chief, There a Chief: The Rise ofthe CFO in the American Firm,” American SociologicalReview, 69 (June), 345–64.CMOs in Top Management Teams / 81