lugano small & mid cap investor day - IR Top

lugano small & mid cap investor day - IR Top

lugano small & mid cap investor day - IR Top

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

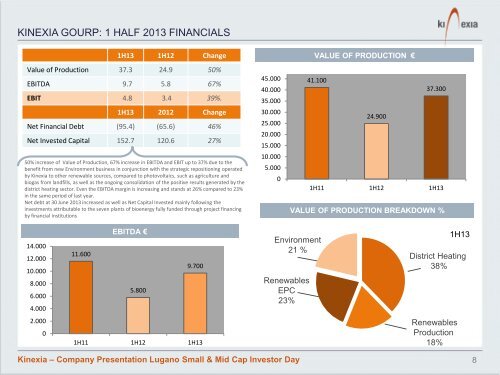

KINEXIA GOURP: 1 HALF 2013 FINANCIALS1H13 1H12 ChangeValue of Production 37.3 24.9 50%EBITDA 9.7 5.8 67%EBIT 4.8 3.4 39%.1H13 2012 ChangeNet Financial Debt (95.4) (65.6) 46%Net Invested Capital 152.7 120.6 27%50% increase of Value of Production, 67% increase in EBITDA and EBIT up to 37% due to thebenefit from new Environment business in conjunction with the strategic repositioning operatedby Kinexia to other renewable sources, compared to photovoltaics, such as agriculture andbiogas from landfills, as well as the ongoing consolidation of the positive results generated by thedistrict heating sector. Even the EBITDA margin is increasing and stands at 26% compared to 23%in the same period of last year.Net debt at 30 June 2013 increased as well as Net Capital Invested mainly following theinvestments attributable to the seven plants of bioenergy fully funded through project financingby financial institutions45.00040.00035.00030.00025.00020.00015.00010.0005.0000VALUE OF PRODUCTION €41.10037.30024.9001H11 1H12 1H13VALUE OF PRODUCTION BREAKDOWN %14.00012.00010.0008.0006.0004.00011.600EBITDA €5.8009.700Environment21 %RenewablesEPC23%1H13District Heating38%2.00001H11 1H12 1H13RenewablesProduction18%Kinexia – Company Presentation Lugano Small & Mid Cap Investor Day8