Borrower Affidavit - Maine State Housing Authority

Borrower Affidavit - Maine State Housing Authority

Borrower Affidavit - Maine State Housing Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

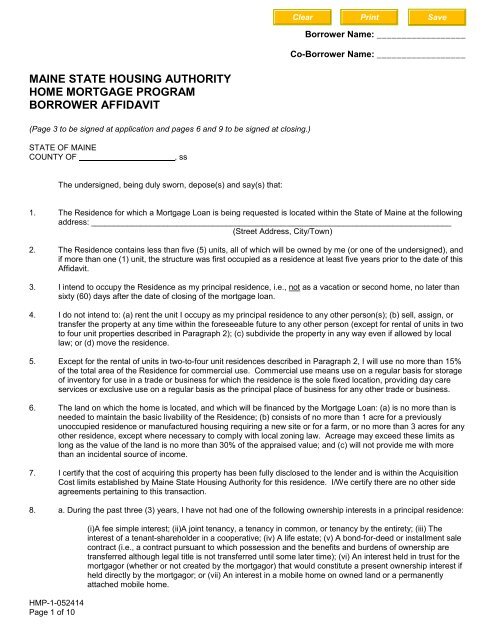

<strong>Borrower</strong> Name: __________________Co-<strong>Borrower</strong> Name: __________________MAINE STATE HOUSING AUTHORITYHOME MORTGAGE PROGRAMBORROWER AFFIDAVIT(Page 3 to be signed at application and pages 6 and 9 to be signed at closing.)STATE OF MAINECOUNTY OF, ssThe undersigned, being duly sworn, depose(s) and say(s) that:1. The Residence for which a Mortgage Loan is being requested is located within the <strong>State</strong> of <strong>Maine</strong> at the followingaddress: ________________________________________________________________________________(Street Address, City/Town)2. The Residence contains less than five (5) units, all of which will be owned by me (or one of the undersigned), andif more than one (1) unit, the structure was first occupied as a residence at least five years prior to the date of this<strong>Affidavit</strong>.3. I intend to occupy the Residence as my principal residence, i.e., not as a vacation or second home, no later thansixty (60) days after the date of closing of the mortgage loan.4. I do not intend to: (a) rent the unit I occupy as my principal residence to any other person(s); (b) sell, assign, ortransfer the property at any time within the foreseeable future to any other person (except for rental of units in twoto four unit properties described in Paragraph 2); (c) subdivide the property in any way even if allowed by locallaw; or (d) move the residence.5. Except for the rental of units in two-to-four unit residences described in Paragraph 2, I will use no more than 15%of the total area of the Residence for commercial use. Commercial use means use on a regular basis for storageof inventory for use in a trade or business for which the residence is the sole fixed location, providing day careservices or exclusive use on a regular basis as the principal place of business for any other trade or business.6. The land on which the home is located, and which will be financed by the Mortgage Loan: (a) is no more than isneeded to maintain the basic livability of the Residence; (b) consists of no more than 1 acre for a previouslyunoccupied residence or manufactured housing requiring a new site or for a farm, or no more than 3 acres for anyother residence, except where necessary to comply with local zoning law. Acreage may exceed these limits aslong as the value of the land is no more than 30% of the appraised value; and (c) will not provide me with morethan an incidental source of income.7. I certify that the cost of acquiring this property has been fully disclosed to the lender and is within the AcquisitionCost limits established by <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> for this residence. I/We certify there are no other sideagreements pertaining to this transaction.8. a. During the past three (3) years, I have not had one of the following ownership interests in a principal residence:HMP-1-052414Page 1 of 10(i)A fee simple interest; (ii)A joint tenancy, a tenancy in common, or tenancy by the entirety; (iii) Theinterest of a tenant-shareholder in a cooperative; (iv) A life estate; (v) A bond-for-deed or installment salecontract (i.e., a contract pursuant to which possession and the benefits and burdens of ownership aretransferred although legal title is not transferred until some later time); (vi) An interest held in trust for themortgagor (whether or not created by the mortgagor) that would constitute a present ownership interest ifheld directly by the mortgagor; or (vii) An interest in a mobile home on owned land or a permanentlyattached mobile home.

. I may have had one of the following ownership interests and I would still qualify as a First Time Homebuyer:(i) A remainder interest; (ii) A lease with or without an option to purchase; (iii) A mere expectancy toinherit an interest in a principal residence; (iv) The interest that a purchaser of a residence acquires uponthe execution of a purchase contract; (v) An interest in other than a principal residence during theprevious three (3) years; or (vi) An interest in an unattached mobile home on leased land (includingmobile home parks and private leased land).9. I acknowledge that I must furnish the lender copies of filed Federal Income Tax Returns including allamendments signed by me for the three previous years or verification provided by the IRS as may be required.If I was not required to file a Federal Income Tax return during the past three years, the year(s)is/are_________________and the reason(s) is/are___________________________________________________________________________________________________________________________________.If any of the returns show deductions for housing expenses (mortgage interest or property taxes), the year(s)is/ are ________________and the reason(s) is/are ___________________________________________________________________________________________________________________________________.10. I have not, either jointly or individually, previously had a mortgage loan on the Residence (includes principaldwelling and land) which will be subject to the Mortgage Loan other than a construction loan having a term notsubstantially in excess of the expected construction period or a bridge loan or similar temporary financing whichhas a term of 24 months or less.11. The proceeds of the Mortgage Loan will be used solely to acquire the Residence and will not be used to refinanceany existing indebtedness on the Residence other than a construction loan having a term not substantially inexcess of the expected construction period or interim financing having a term of 24 months or less.12. The total number of persons occupying this home as their principal residence is __________(household size)and the total gross household income from each person living in the residence, as provided to the lender, is withinthe Gross Income limits established by <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong>.13. I understand that any misrepresentation or misstatement in this affidavit or any other document executed inconnection with the Mortgage Loan will constitute an EVENT OF DEFAULT under the Mortgage Loan and entitlethe holder of the Mortgage Loan to accelerate the debt and institute FORECLOSURE and other appropriateproceedings. I may be subject to CRIMINAL PENALTIES for any misrepresentation or misstatement.14. I understand that the <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong>, the financial institution, any mortgage insurer or guarantor orany of their representatives may wish to investigate or to verify the matters set forth in this <strong>Affidavit</strong> or in otherdocuments provided in connection with the application for the Mortgage Loan, and I hereby permit suchinvestigation or verification.15. In the case of Co-Applicants, Non-Applicant title holders, Co-<strong>Borrower</strong>s and title holders, statements madethroughout this <strong>Affidavit</strong> and Reaffirmation in the singular include the plural.16. Recapture/Mortgage Interest Deduction Disclosure; This loan is being financed with a mortgage madeavailable with the assistance of the <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong>. Because of this, I acknowledge that I amsubject to certain restrictions regarding my home. The Internal Revenue Code states that I may be affected by afederal tax known as recapture. The recapture tax will require some homeowners who dispose of their homeswithin nine years of loan closing to pay a portion of the profit they receive from the sale to the federal government.The maximum amount payable would be either 6.25 percent of my original mortgage amount or 50 percent of theprofit resulting from the sale of my home, whichever is less. Several factors may affect my potential tax liability,including:Length of Ownership. If I sell within one year, my maximum liability is 1.25 percent of the original mortgageamount. Each year thereafter the liability increases 1.25 percent until it reaches 6.25 percent in the fifth year.Starting in the sixth year, the liability decreases 1.25 percent per year until it is eliminated completely after nineyears.Income/Family Size. My tax liability may be reduced or eliminated if my income does not exceed limits set by thefederal government. These limits are based on a formula which takes into account my family size at the time ofthe sale.HMP-1-052414Page 2 of 10

My mortgage will also be subject to an Internal Revenue Code restriction if I fail or cease to occupy the home asmy principal residence. This restriction provides that the deduction for mortgage interest on my Federal IncomeTax Return will be disallowed if I stop using my home as my principal residence for a continuous period of at leastone year. This provision applies regardless of whether I am subject to the recapture tax referred to above.17. Recapture Reimbursement: If my Mortgage Loan closes on or after January 1, 2013 and the loan remainsoutstanding at the time of disposition, <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> will reimburse me for any recapture tax that Ipay to the IRS. To be reimbursed, I must submit the <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> Request for Recapture TaxReimbursement form, a copy of my tax return including IRS Form 8828, proof the federal taxes were paid and acopy of the HUD-1 Settlement <strong>State</strong>ment pertaining to the disposition of the property to the <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong><strong>Authority</strong>.I understand that I am responsible for calculating, filing and paying any recapture tax that may be due the IRS. Iam also responsible for initiating and fully complying with <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong>’s Request for RecaptureTax Reimbursement procedures when seeking reimbursement.THE UNDERSIGNED ACKNOWLEDGES THAT HE/SHE HAS READ AND UNDERSTOOD THE ABOVE AFFIDAVITAND DISCLOSURE.Power of Attorney. A Power of Attorney is prohibited from signing as the Applicant, Co-Applicant, or Non-Applicant titleholder, unless the Applicant, Co-Applicant, or Non-Applicant title holder is mentally incapacitated, physically incapacitated,or on active military duty and unavailable due to military assignment.Date: _______________ Applicant: ________________________________Printed Name: ________________________________Date: _______________ Co-Applicant/Non-Applicant Title Holder: ______________________Printed Name: ________________________________Subscribed and sworn to before me on ____________, 2____.(Seal)________________________________Name: __________________________Notary Public/Attorney-at-LawCommission Expires: _______________HMP-1-052414Page 3 of 10

ATTENTION !LEAD BASED PAINT CAN POISON YOUR CHILDREN!IF YOU PURCHASE A HOME BUILT BEFORE 1978, YOU MAY EXPOSE YOURSELF ANDYOUR FAMILY TO TOXIC LEAD BASED PAINT. LEAD POISONING IN CHILDREN CANCAUSE BRAIN DAMAGE, PERMANENT LEARNING DISABILITIES, BEHAVIORALPROBLEMS, AND SEVERE DEVELOPMENTAL DELAYS. SEVERE LEAD POISONING CANCAUSE DEATH.• A homebuyer can request to have the home inspected by a licensed lead hazard Risk Assessorbefore purchase.• Remodeling and rehabilitation work can greatly increase lead hazards by spreading lead dust,paint chips and contaminating soil. Children playing in contaminated areas can inhale the dustor ingest by putting their hands in their mouth.• <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> recommends that you have your home tested by a licensed leadhazard Risk Assessor and use only a certified Lead-Smart Renovator to work on your home.• If you purchase a multifamily home, Federal law requires that you disclose lead hazards to alltenants and prospective tenants. Contact the Regional Office of the Environmental ProtectionAgency at 888 372-7341 for more information.• I have received information about the health risks caused by lead based paint and I am aware of <strong>Maine</strong> <strong>State</strong><strong>Housing</strong> <strong>Authority</strong>’s recommendation to have the property tested and to use safe work practices to avoid leadcontamination caused by renovation. I will not hold <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> responsible for any harmsuffered by myself or my family due to the presence of lead based paint in the home I chose to purchase.For additional information, contact:The <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong><strong>Authority</strong> Energy and <strong>Housing</strong>Services Division at 800 452-4668for information about the LeadHazard Control Program thatprovides funds to reduce leadhazards in income eligiblehouseholds.www.mainehousing.orgThe <strong>Maine</strong> Department ofEnvironmental Protection LeadLicensing and Enforcement Programfor home lead testing information,ways to reduce lead hazards,renovation and remodeling safetypractices, and a list of licensed leadinspectors; at 800-452-1942www.state.me.us/depThe Department of Human ServicesChildhood Lead Poisoning PreventionProgram for health questions, bloodtesting for lead, education and casemanagement; at207 287-4311email: dianna.l.saunders@state.me.usPLEASE INITIAL: Applicant: ______________________ Date: __________Co-Applicant/Title Holder: ___________Date: __________HMP-1-052414Page 4 of 10

REAFFIRMATION AT LOAN CLOSINGBeing duly sworn, I, as borrower, co-borrower or title holder in connection with the property indicated herein,depose and say that I have reviewed all of the foregoing representations and warranties previously made by me and dohereby reaffirm all the foregoing representations and warranties including without limitation that:1. I intend to use the residence as my principal residence.2. Other than the rental of units in two-to-four unit residences, I do not intend to rent the residence.3. Other than the rental of units in two-to-four unit residences, I will not use more than 15% of the residence for abusiness.4. I will not transfer the property, or any part of the property in any way.5. The land on which the residence is located is only what is necessary for basic livability.6. I have not owned a principal residence in the last three years.7. I have not had a prior mortgage on the residence at any time, other than a construction or temporary mortgage asdefined above.8. I will not move the residence until the loan is paid.9. I certify that my gross household income is within the program income limits. If this loan did not close within fourmonths from the date of application, I hereby certify that my income is now $_________________ (yearly grosshousehold income).10. I certify that the total cost of the residence is within the program acquisition costs limits..11. I acknowledge that there is no way to predict my exact tax liability since it is based on when I sell my home, myincome and family size at the time of the sale and the amount of profit, if any, that I realize from the sale.However, the maximum tax I may be subject to will be 6.25% of my mortgage loan amount. I acknowledge that Ihave received the Method to Compute Recapture Tax on Sale of Home which is attached as Appendix A to this<strong>Affidavit</strong>.12. MORTGAGOR CERTIFICATION: I have read the above and acknowledge that I have received information as tothe Federally Subsidized Amount of my loan and the income limits by family size for each region of the <strong>State</strong> andfor each year the recapture tax may apply. I acknowledge that I am responsible for filing IRS Form 8828 and forcomputing and paying any recapture tax which I may owe. I acknowledge that I will not receive any additionalinformation regarding recapture and that I should retain with my records all the information which has beenprovided.13. Recapture Reimbursement: If my mortgage loan closed on or after January 1, 2013 and the loan remainsoutstanding at the time of disposition, <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> will reimburse me for any recapture tax that Ipay to the IRS. To be reimbursed, I must submit the <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> Request for Recapture TaxReimbursement form, a copy of my tax return including IRS Form 8828, proof the federal taxes were paid, and acopy of the HUD-1 Settlement <strong>State</strong>ment pertaining to the disposition of the property to the <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong><strong>Authority</strong>.I understand that I am responsible for calculating, filing and paying any recapture tax that may be due the IRS. Iam also responsible for initiating and fully complying with <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong>’s Request for RecaptureTax Reimbursement procedures when seeking reimbursement.14. In the case of Co-Applicants, Non-Applicant title holders, Co-<strong>Borrower</strong>s and title holders, statements madethroughout this <strong>Affidavit</strong> and Reaffirmation in the singular includes the plural.HMP-1-052414Page 5 of 10

THE UNDERSIGNED ACKNOWLEDGES THAT HE/SHE HAS READ AND UNDERSTOOD THE ABOVE AFFIDAVITAND DISCLOSURE.Power of Attorney. A Power of Attorney is prohibited from signing as the <strong>Borrower</strong>, Co-<strong>Borrower</strong> or Title Holder, unlessthe <strong>Borrower</strong>, Co-<strong>Borrower</strong> or Title Holder is mentally incapacitated, physically incapacitated, or on active military dutyand unavailable due to military assignment.Date:_________________<strong>Borrower</strong>:Printed Name:Date:_________________Co-<strong>Borrower</strong>/Title Holder:Printed Name:Subscribed and sworn to before me on _______________, 2____.(Seal)Name:__________________________________Notary Public/Attorney-at-LawCommission Expires:HMP-1-052414Page 6 of 10

APPENDIX ANOTICE OF MAXIMUM RECAPTURE TAX AND METHOD TO COMPUTE RECAPTURE TAX ON SALE OF HOME.When I sell my home I may have to pay a recapture tax as calculated below. The tax may also apply if I dispose of myhome in some other way. Any references in this notice to the "sale" of my home also includes other ways of disposing ofmy home. For instance, I may owe the recapture tax if I give my home to a relative. In the following situations, norecapture tax is due and I do not need to do the calculations:(a) My gross household income for the taxable year, as shown in my federal income tax return, fallswithin the qualified income range of the region in which my home is located for the year in which I sell myhome. The qualified income ranges are listed on page 9 of the <strong>Borrower</strong> <strong>Affidavit</strong> and must be the versionprovided at closing.(b)(c)(d)I dispose of my home later than nine years after I close my loan;I dispose of my home at a loss;My home is disposed of as a result of my death; or(e) I transfer my home either to my spouse or to my former spouse incident to divorce and I have nogain or loss included in my income under section 1041 of the Internal Revenue Code.MAXIMUM RECAPTURE TAX; The maximum recapture tax that I may be required to pay as an addition to my federalincome tax is 6.25% of the highest principal amount of my mortgage loan and is my federally subsidized amount withrespect to the loan.ACTUAL RECAPTURE TAX; The actual recapture tax, if any, can only be determined when I sell my home, and is thelesser of (1) 50% of my gain on the sale of my home, regardless of whether I have to include that gain in my income forfederal income tax purposes, or (2) my RECAPTURE AMOUNT determined by multiplying the following three numbers:(a)The maximum recapture tax (6.25% of the highest principal amount).HMP-1-052414Page 7 of 10(b) The HOLDING PERIOD PERCENTAGE, as listed in Column 1 in the Chart attached to thisnotice; and(c) The INCOME PERCENTAGE, is calculated by subtracting the applicable ADJUSTEDQUALIFYING INCOME in the taxable year in which I sell my home (as listed in Column 2 in theappropriate Table for the Region where my home is located) from my MODIFIED ADJUSTED GROSSINCOME in the taxable year in which I sell my home.My MODIFIED ADJUSTED GROSS INCOME means my adjusted gross income shown in my federalincome tax return for the taxable year in which I sell my home, with the following two adjustments: (a)my adjusted gross income must be INCREASED by the amount of any interest that I receive or accrue inthe taxable year from tax-exempt bonds that is excluded from my gross income (under section 103 of theInternal Revenue Code); and (b) my adjusted gross income must be DECREASED by the amount of anygain included in my gross income by reason of the sale of my home.If the amount calculated is zero or less, I owe no recapture tax and do not need to make any morecalculations. If it is $5,000 or more, My income percentage is 100%. If it is greater than zero but lessthan $5,000, it must be divided by $5,000. This fraction, expressed as a Percentage, represents myincome percentage. For example, if the fraction is $1,000/$5,000, my income percentage is 20%.LIMITATIONS AND SPECIAL RULES ON RECAPTURE TAX.(a) If I give away my home (other than to My spouse or ex-spouse incident to divorce), I mustdetermine my actual recapture tax as if I had sold my home for its fair market value.(b) If my home is destroyed by fire, storm, flood, or other casualty, there generally is no recapture taxif, within two years, I purchase additional property for use as my principal residence on the site of thehome financed with my original subsidized mortgage loan.

(c) In general, except as provided in future regulations, if two or more persons own a home and arejointly liable for the subsidized mortgage loan, the actual recapture tax is determined separately for thembased on their interests in the home.(d) If I repay my loan in full during the nine year recapture period and I sell my home during thisperiod, my holding period percentage may be reduced under the special rule in section 143(m)(4)(C)(ii) ofthe Internal Revenue Code.(e) Other special rules may apply in particular circumstances. I may wish to consult with a taxadvisor or the local office of the Internal Revenue Service when I sell or otherwise dispose of My home todetermine the amount, if any, of my actual recapture tax. See section 143(m) of the Internal RevenueCode generally.IRS FORM 8828; I understand that the Internal Revenue Service (IRS) has created Form 8828 for purposes ofcalculating the recapture tax. This form will be updated each tax year and must be filed with my tax return for theyear in which I sell or otherwise dispose of my home (if the nine year recapture period has not yet expired)regardless of whether any tax is actually due. Copies of Form 8828 and instructions can be obtained through mylocal IRS office.INFORMATION CONCERNING ATTACHED CHARTTHE HOLDING PERIOD PERCENTAGE AND ADJUSTED QUALIFYING INCOME CHART FOR REGIONS OF THESTATE ARE ATTACHED.USE ONLY THE SECTION WHICH COVERS THE REGION WHERE YOUR HOME IS LOCATED. THE INDIVIDUALTOWNS AND CITIES OR ENTIRE COUNTIES COVERED BY THE REGION ARE LISTED AT THE BOTTOM OF THECHART.NOT EVERY TOWN, CITY, AND COUNTY HAS ITS OWN REGION. IF YOU DO NOT FIND YOUR CITY OR TOWNLISTED, EITHER INDIVIDUALLY OR BY REFERENCE TO THE ENTIRE COUNTY, YOUR CORRECT REGION IS THELAST REGION. THIS IS THE CATCH-ALL REGION FOR ALL CITIES AND TOWNS IN THE STATE WHICH ARE NOTOTHERWISE LISTED.HMP-1-052414Page 8 of 10

Recapture TaxAdjusted Qualifying Incomes by Household SizeRegion I Region II Region IIISale Date of Home/ Qualified Income % Qualified Income % Qualified Income %Holding Period % 2 or less 3+ 2 or less 3+ 2 or less 3+0 - 11months / 20% $81,000 $93,150 $77,300 $88,890 $64,140 $73,76012 - 23 months / 40% $85,050 $97,807 $81,165 $93,334 $67,347 $77,44824 - 35 months / 60% $89,302 $102,697 $85,223 $98,000 $70,714 $81,32036 - 47 months / 80% $93,767 $107,831 $89,484 $102,900 $74,249 $85,38648 - 59 months /100% $98,455 $113,222 $93,958 $108,045 $77,961 $89,65560 - 71 months / 80% $103,377 $118,883 $98,655 $113,447 $81,859 $94,13772 - 83 months / 60% $108,545 $124,827 $103,587 $119,119 $85,951 $98,84384 - 95 months / 40% $113,972 $131,068 $108,766 $125,074 $90,248 $103,78596-107 months / 20% $119,670 $137,621 $114,204 $131,327 $94,760 $108,974*Region I-York-Kittery-So. Berwick Metropolitan Statistical Statistical Area: Berwick, Area: Berwick, Eliot, Kittery, Elliot, South Kittery, Berwick, South York Berwick, York*Region II-Portland Metropolitan Statistical Area: Buxton, Cape Elizabeth, Casco, Chebeaque Island, Cumberland, Falmouth, Freeport, FryeIsland, Gorham, Gray, Hollis, Limington, Long Island, North Yarmouth, Old Orchard Beach, Portland city, Raymond, Scarborough, South Portland city,Standish, Westbrook city, Windham and Yarmouth, except Qaulifited Census Tracts 0005.00 0006.00 (See Region XV below.)*Region III-Bangor Metropolitan Statistical Area: Bangor city, Brewer city, Eddington, Glenburn, Hampden, Hermon, Holden, Kenduskeag, Milford,Old Town city, Orono, Orrington, Penobscot Indian Island, and VeazieNumber of persons in family and incomes is as of date of sale or transfer of houseRegion IV Region V Region VISale Date of Home/ Qualified Income % Qualified Income % Qualified Income %Holding Period % 2 or less 3+ 2 or less 3+ 2 or less 3+0 - 11months / 20% $64,600 $74,290 $68,600 $78,890 $68,400 $78,66012 - 23 months / 40% $67,830 $78,004 $72,030 $82,834 $71,820 $82,59324 - 35 months / 60% $71,221 $81,904 $75,631 $86,975 $75,411 $86,72236 - 47 months / 80% $74,782 $85,999 $79,412 $91,323 $79,181 $91,05848 - 59 months /100% $78,521 $90,298 $83,382 $95,889 $83,140 $95,61060 - 71 months / 80% $82,447 $94,812 $87,551 $100,683 $87,297 $100,39072 - 83 months / 60% $86,569 $99,552 $91,928 $105,717 $91,661 $105,40984 - 95 months / 40% $90,897 $104,529 $96,524 $111,002 $96,244 $110,67996-107 months / 20% $95,441 $109,755 $101,350 $116,552 $101,056 $116,212*Region IV-Kennebec County: All Towns and Cities, except Qaulified Census Tract 0241.02 (See Region XIV below.)*Region V-York County Non-Metropolitan Statistical Area: Acton, Alfred, Arundel, Biddeford city, Cornish, Dayton, Kennebunk, Kennebunkport,Lebanon, Limerick, Lyman, Newfield, North Berwick, Ogunquit, Parsonsfield, Saco city, Sanford, Shapleigh, Waterboro and Wells*Region VI-Cumberland County Non-Metropolitan Statistical Area: Baldwin, Bridgton, Brunswick, Harpswell, Harrison, Naples, New Gloucester,Pownal and SebagoNumber of persons in family and incomes is as of date of sale or transfer of houseRegion VII Region VIII Region IXSale Date of Home/ Qualified Income % Qualified Income % Qualified Income %Holding Period % 2 or less 3+ 2 or less 3+ 2 or less 3+0 - 11months / 20% $64,520 $74,200 $71,300 $81,990 $65,460 $75,28012 - 23 months / 40% $67,746 $77,910 $74,865 $86,089 $68,733 $79,04424 - 35 months / 60% $71,133 $81,805 $78,608 $90,393 $72,169 $82,99636 - 47 months / 80% $74,689 $85,895 $82,538 $94,912 $75,777 $87,14548 - 59 months /100% $78,423 $90,189 $86,664 $99,657 $79,565 $91,50260 - 71 months / 80% $82,344 $94,698 $90,997 $104,639 $83,543 $96,07772 - 83 months / 60% $86,461 $99,432 $95,546 $109,870 $87,720 $100,88084 - 95 months / 40% $90,784 $104,403 $100,323 $115,363 $92,106 $105,92496-107 months / 20% $95,323 $109,623 $105,339 $121,131 $96,711 $111,220*Region VII-Lincoln County: All Towns and Cities*Region VIII-Sagadahoc County: All Towns and Cities*Region IX-Androsoggin County: All Towns and Cityes, except Qualfied Census Tracts 0101.00 0201.00 0204.00 (See Region XIV below.)Number of persons in family and incomes is as of date of sale or transfer of house<strong>Borrower</strong>: _________________________Co-<strong>Borrower</strong>/Title Holder: __________________________HMP-1-052414Page 9 of 10

Region X Region XI Region XIISale Date of Home/ Qualified Income % Qualified Income % Qualified Income %Holding Period % 2 or less 3+ 2 or less 3+ 2 or less 3+0 - 11months / 20% $64,220 $73,850 $67,000 $77,050 $64,680 $75,46012 - 23 months / 40% $67,431 $77,542 $70,350 $80,902 $67,914 $79,23324 - 35 months / 60% $70,802 $81,419 $73,867 $84,947 $71,309 $83,19436 - 47 months / 80% $74,342 $85,489 $77,560 $89,194 $74,874 $87,35348 - 59 months /100% $78,059 $89,763 $81,438 $93,653 $78,617 $91,72060 - 71 months / 80% $81,961 $94,251 $85,509 $98,335 $82,547 $96,30672 - 83 months / 60% $86,059 $98,963 $89,784 $103,251 $86,674 $101,12184 - 95 months / 40% $90,361 $103,911 $94,273 $108,413 $91,007 $106,17796-107 months / 20% $94,879 $109,106 $98,986 $113,833 $95,557 $111,485*Region X-Hancock County : All Towns and Cities*Region XI-Knox County: All Towns and Cities*Region XII-Waldo County: All Towns and CiteiesNumber of persons in family and incomes is as of date of sale or transfer of houseRegion XIII Region XIV Region XVSale Date of Home/ Qualified Income % Qualified Income % Qualified Income %Holding Period % 2 or less 3+ 2 or less 3+ 2 or less 3+0 - 11months / 20% $62,040 $72,380 $72,840 $84,980 $82,080 $95,76012 - 23 months / 40% $65,142 $75,999 $76,482 $89,229 $86,184 $100,54824 - 35 months / 60% $68,399 $79,798 $80,306 $93,690 $90,493 $105,57536 - 47 months / 80% $71,818 $83,787 $84,321 $98,374 $95,017 $110,85348 - 59 months /100% $75,408 $87,976 $88,537 $103,292 $99,767 $116,39560 - 71 months / 80% $79,178 $92,374 $92,963 $108,456 $104,755 $122,21472 - 83 months / 60% $83,136 $96,992 $97,611 $113,878 $109,992 $128,32484 - 95 months / 40% $87,292 $101,841 $102,491 $119,571 $115,491 $134,74096-107 months / 20% $91,656 $106,933 $107,615 $125,549 $121,265 $141,477*Region XIII-All Other Towns and Cities in the <strong>State</strong>, except Qualfied Census Tracts Penobscot County 9400.00 (See Region XIV below.)*Region XIV-Target Areas Qualified Census Tracts in Androscoggin County: 0101.00 0201.00 0204.00; Kennebec County: 0241.02; andPenobscot County: 9400.00*Region XV-Target Areas Qualified Census Tracts in Cumberland County: 0005.00 0006.00Number of persons in family and incomes is as of date of sale or transfer of houseThe above chart will be used to determine if recapture tax is due in the event I sell my home financed by <strong>Maine</strong> <strong>State</strong><strong>Housing</strong> <strong>Authority</strong> within 9 years from the date of closing.I acknowledge that I will not receive any additional information regarding recapture tax and that I should retain with myrecords this recapture tax chart and the <strong>Borrower</strong> <strong>Affidavit</strong> for nine years after I close on my <strong>Maine</strong> <strong>State</strong> <strong>Housing</strong><strong>Authority</strong> loan.<strong>Borrower</strong>: _________________________Co-<strong>Borrower</strong>/Title Holder: __________________________HMP-1-052414Page 10 of 10