PRODUCT KEY FACTS - Aia.com.hk

PRODUCT KEY FACTS - Aia.com.hk

PRODUCT KEY FACTS - Aia.com.hk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

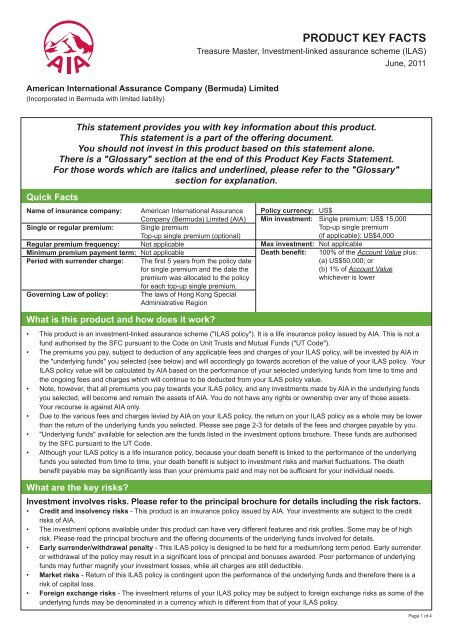

<strong>PRODUCT</strong> <strong>KEY</strong> <strong>FACTS</strong>Treasure Master, Investment-linked assurance scheme (ILAS)June, 2011American International Assurance Company (Bermuda) Limited(Incorporated in Bermuda with limited liability)This statement provides you with key information about this product.This statement is a part of the offering document.You should not invest in this product based on this statement alone.There is a "Glossary" section at the end of this Product Key Facts Statement.For those words which are italics and underlined, please refer to the "Glossary"section for explanation.Quick FactsName of insurance <strong>com</strong>pany: American International AssuranceCompany (Bermuda) Limited (AIA)Single or regular premium: Single premiumTop-up single premium (optional)Regular premium frequency: Not applicableMinimum premium payment term: Not applicablePeriod with surrender charge: The first 5 years from the policy datefor single premium and the date thepremium was allocated to the policyfor each top-up single premium.Governing Law of policy: The laws of Hong Kong SpecialAdministrative RegionPolicy currency: US$Min investment: Single premium: US$ 15,000Top-up single premium(if applicable): US$4,000Max investment: Not applicableDeath benefit: 100% of the Account Value plus:(a) US$50,000; or(b) 1% of Account Valuewhichever is lowerWhat is this product and how does it work?• This product is an investment-linked assurance scheme ("ILAS policy"). It is a life insurance policy issued by AIA. This is not afund authorised by the SFC pursuant to the Code on Unit Trusts and Mutual Funds ("UT Code").• The premiums you pay, subject to deduction of any applicable fees and charges of your ILAS policy, will be invested by AIA inthe "underlying funds" you selected (see below) and will accordingly go towards accretion of the value of your ILAS policy. YourILAS policy value will be calculated by AIA based on the performance of your selected underlying funds from time to time andthe ongoing fees and charges which will continue to be deducted from your ILAS policy value.• Note, however, that all premiums you pay towards your ILAS policy, and any investments made by AIA in the underlying fundsyou selected, will be<strong>com</strong>e and remain the assets of AIA. You do not have any rights or ownership over any of those assets.Your recourse is against AIA only.• Due to the various fees and charges levied by AIA on your ILAS policy, the return on your ILAS policy as a whole may be lowerthan the return of the underlying funds you selected. Please see page 2-3 for details of the fees and charges payable by you.• "Underlying funds" available for selection are the funds listed in the investment options brochure. These funds are authorisedby the SFC pursuant to the UT Code.• Although your ILAS policy is a life insurance policy, because your death benefit is linked to the performance of the underlyingfunds you selected from time to time, your death benefit is subject to investment risks and market fluctuations. The deathbenefit payable may be significantly less than your premiums paid and may not be sufficient for your individual needs.What are the key risks?Investment involves risks. Please refer to the principal brochure for details including the risk factors.• Credit and insolvency risks - This product is an insurance policy issued by AIA. Your investments are subject to the creditrisks of AIA.• The investment options available under this product can have very different features and risk profiles. Some may be of highrisk. Please read the principal brochure and the offering documents of the underlying funds involved for details.• Early surrender/withdrawal penalty - This ILAS policy is designed to be held for a medium/long term period. Early surrenderor withdrawal of the policy may result in a significant loss of principal and bonuses awarded. Poor performance of underlyingfunds may further magnify your investment losses, while all charges are still deductible.• Market risks - Return of this ILAS policy is contingent upon the performance of the underlying funds and therefore there is arisk of capital loss.• Foreign exchange risks - The investment returns of your ILAS policy may be subject to foreign exchange risks as some of theunderlying funds may be denominated in a currency which is different from that of your ILAS policy.Page 1 of 4

Treasure Master, ILASGlossaryThe following terms have the meanings set out below.TermAccount ValueFree PartialWithdrawal AmountMonthly AnniversaryMeaningThe total value of all investment options under the ILAS policy. The value of each investment optionequals the number of units of the investment option multiplied by the policy bid price of the investmentoption on the relevant valuation day.The free partial withdrawal amount is the:i) The potential free partial withdrawal amount; orii) The transacted free partial withdrawal amount,whichever is higher.The potential free partial withdrawal amount is the Account Value determined on the date we accept andprocess your request for partial withdrawal minus the total premium paid. The total premium paid will beadjusted by deducting the amount of partial withdrawal that had been subject to surrender charges.The transacted free partial withdrawal amount is the Account Value minus the total premium paid. TheAccount Value is the sum of the following:(1) For units selected in the partial withdrawal, the value of the units at the policy bid price in thecancellation; and(2) For units that are not selected in the partial withdrawal, the value of the units as if they werecancelled on the next valuation day immediately following the approval for partial withdrawal,provided that this valuation day is on or before at least one of the valuation day of the unitcancellations. Otherwise, the value of the units based on the latest policy bid price available on thevaluation day of the last unit cancellation.The same day in each subsequent month as the policy date.Page 4 of 4