INSIDE JOB

INSIDE JOB

INSIDE JOB

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

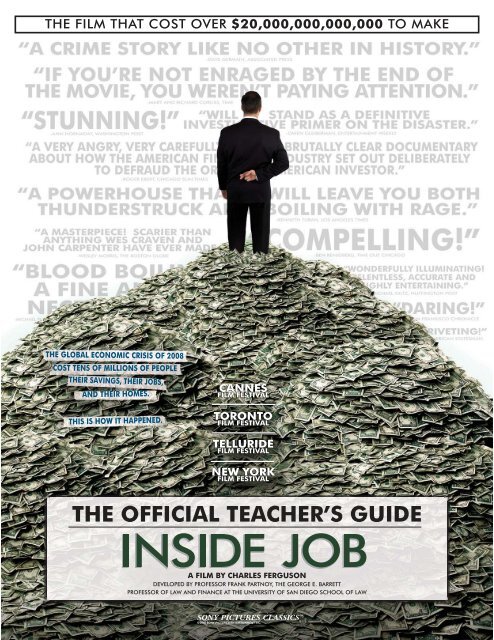

THE FILM THAT COST OVER $20,000,000,000,000 TO MAKETHE GLOBAL ECONOMIC CRISIS OF 2008COST TENS OF MILLIONS OF PEOPLETHEIR SAVINGS, THEIR <strong>JOB</strong>S,AND THEIR HOMES.THIS IS HOW IT HAPPENED.CANNESFILM FESTIVALTORONTOFILM FESTIVAL<strong>INSIDE</strong> TELLURIDE<strong>JOB</strong>FILM FESTIVALNEW YORKFILM FESTIVALTHE OFFICIAL TEACHER’S GUIDEA FILM BY CHARLES FERGUSONDEVELOPED BY PROFESSOR FRANK PARTNOY, THE GEORGE E. BARRETTPROFESSOR OF LAW AND FINANCE AT THE UNIVERSITY OF SAN DIEGO SCHOOL OF LAW

Note to TeachersInside Job, the critically acclaimed movieby Academy Award nominated filmmaker,Charles Ferguson, is the definitive filmabout the economic crisis of 2008 and therole of Wall Street in modern society.It is a substantive and entertaining film thatis ideal for educational purposes. I have shownit to my class, and I encourage you to showit to yours. The film is sweeping andnon-partisan in its critique, and coversboth the historical roots of the crisis andthe central flaws of global financial regulation.It includes comprehensive coverageof the major financial players at the center ofthe recent boom and bust. The film drawsheavily on interviews with a “Who’s Who”of financial markets, including major financialinsiders, politicians, journalists, and academics.(I have a very small part as well). Theseinterviews, and the film’s engaging andprovocative narrative by Matt Damon, willintroduce your students to key financial issues,economic history, and current debates andnews about the markets. Inside Job is colorfuland comprehensive, and is guaranteed to generatelively discussion among your students. As Time magazineput it, “If you’re not enraged by the end of this movie,you weren’t paying attention.” The people at SonyPictures Classics asked me to write this teacher’s guideto help provide some content and lesson plans forteachers interested in showing Inside Job as part of theirclasses. I have included four lesson plans to be used inconjunction with the film. These lessons will help yourstudents to connect the film to importantfinancial issues that touch their lives. Theyare designed to assess several importantquestions that your students inevitably willconfront in the future. The material isdesigned to be flexible. The topics aremodular, and the lesson plans can buildon each other, or be used alone. They canbe used with the entire film, or just selections.You should feel free to print and duplicatethese materials for your students andcolleagues. They are available for free onthis website: [INSERT WEBSITE]. Each lessonis designed for about 50 minutes of class time,though you easily could devote more orless time. I hope you and your students enjoywatching Inside Job and that you find the materialsin this guide to be a provocative and usefulway to engage your students in a conversation about thepast, present, and future of our economy.About Frank PartnoyProfessor Frank Partnoy is the George E. Barrett Professorof Law and Finance and the founding director of the Centerfor Corporate and Securities Law at the University of SanDiego. He is one of the world’s leading experts on thecomplexities of modern finance and financial market regulation.He worked as a derivatives structurer at MorganStanley and CS First Boston during the mid-1990s andwrote F.I.A.S.C.O.: Blood in the Water on Wall Street, abest-selling book about his experiences there.Since 1997, he has been a law professor at the Universityof San Diego, and an expert writing and speakingabout markets to Congress, regulators, academics, and investors.He has written numerous opinion pieces for TheNew York Times and the Financial Times, and more thantwo dozen scholarly articles published in academic journalsincluding The University of Pennsylvania Law Review,The University of Chicago Law Review, and The Journalof Finance. His recent books include Infectious Greed:How Deceit and Risk Corrupted the Financial Markets, aleading corporate law casebook, and The Match King: IvarKreuger, The Financial Genius Behind a Century of WallStreet Scandals, about the 1920s markets and Ivar Kreuger,who many consider the father of modern financialschemes. Professor Partnoy also has been a consultant tomany major corporations, banks, pension funds, andhedge funds regarding various aspects of financial marketsand regulation.You can find out more about Professor Partnoy at his website,www.frankpartnoy.com, where there are descriptionsof his books and links to some of his recent articles andmedia appearances (including his interviews with Jon Stewarton The Daily Show and Terry Gross on NPR’s Fresh Air).1

After Viewing the Film1. Ask your students how angry they are about the eventsdepicted in the film. What in the film made them angry?Which person depicted in the film offended them the most?2. Ask for views about who is most to blame for the eventsdepicted in the film. Republicans or Democrats? Governmentor financial services companies? Regulators whostuck by their free market beliefs or investors who carelesslytook on too much risk? When a student mentions a personor institution they blame, askwhat they should have donedifferently.3. Go back through theterms you discussed beforeviewing the film, to makesure your students understandthem. Remind them ofthe discussion you had abouthow subprime mortgageloans were “pooled.” Dothey think events would haveunfolded differently if the financialinstitutions that made subprime loans had keptthem instead of selling them?4. Ask students if they think someone should go to jail forthe behavior depicted in the film. Who? Inside Job discussesevidence that senior bankers onWall Street used prostitutes and illegaldrugs, sometimes paying withcompany credit cards. If bringing acriminal fraud case related to subprimeloans and CDOs would be toodifficult, should prosecutors go afterthis other behavior?5. Discuss whether your educationalinstitution should have a policy regardingconflicts of interest. Ask whatthe students thought of the professorsfrom Columbia and Harvard. What ifSony Pictures Classics paid you (the instructor)money to show the film inclass? Would that be ok? Should youhave to disclose all of the money youmake from outside activities? (Disclosure: Sony PicturesClassics paid me to write thisteacher’s guide, though onlya small fraction of what theprofessors in the film madefor their Iceland reports.)6. If your class has coveredthe 1920s-30s, compare theevents depicted in Inside Jobto the roaring ‘20s, the GreatCrash of 1929, and the Depressionthat followed. Whatis different about today?What is similar?7. Choose one or more of the activities and accompanyinghandouts in this lesson plan to connect the film to specifictopics, including topics you might be covering in your class.For each of the four activities, I have included both (1) ateacher’s lesson plan page with some advice and informationabout teaching the topic, and (2) a student handoutpage that you can distribute to students. For each activity,you might want to look at (2) before you look at (1), to givethe advice some context.8. Refer your students to the resources at [WEBSITE].3

TEACHER’S NOTES - Activity 1 “It’s Utterly Mad”Replay the clip of Allan Sloan, senior editor of Fortunemagazine, describing the Goldman Sachs deal in whichhome buyers borrowed 99.3% of the price of their houses,and yet two-thirds of the deal backed by those loans wasrated AAA, as safe as government securities. (The clip isavailable here [LINK].)Sloan concludes, “It’s utterly mad.” Activity 1 exploreshow something so “mad” could have happened. The basicquestion for students is this: how is it possible forrisky subprime mortgages to be pooled togetherand then, miraculously, to becomeAAA-rated CDO investments?Don’t worry: students don’t need to understand thedetails of the complicated mathematical models in order toget the basic point. The key insight is that the banks andrating agencies vastly underestimated the correlation ofsubprime mortgage defaults. Even students who hate mathmight see an incentive to learn a bit about correlation (theyalso might be enticed by the idea of a career in finance, orjust the desire to avoid losing money on their own futureinvestments).Ask students what they think of David Li(see Activity 1 handout), particularly giventhe criticism of academic researchers in InsideJob. Many of the mathematicians who built CDOmodels for banks and rating agencies understood the risksof pooling subprime loans, and explained them to others.In fact, Li warned numerous people that using his modelcould be treacherous. After you have discussed David Li,ask students what they think of this statement he made tothe Wall Street Journal in 2005, as subprime mortgagelending was skyrocketing: “The most dangerous part iswhen people believe everything coming out of it.”Here is one “hands-on” activity you mighttry in class. Ask the students to take a piece of paperand cut or tear it into 10 equally sized strips. Imagine thateach of these strips represents a subprime mortgage loan.Now suppose that your statistical model tells you that, onaverage, just 1 of those loans will default, and that thechances of 2 or 3 defaulting are extremely small. Separatethe loans into two groups, one with 7 strips (put that groupat the top) and one with 3 strips (put those at the bottom).Those two groups represent two “tranches” of investmentsin a CDO. If the group of 3 strips bears the first losses,how safe is the group with 7 strips? (Do a couple of examples:tell them there has been 1 default, so they should remove1 strip from the bottom group, and ask who loses?)But what if your model was wrong, and when housingprices decline all 10 of the loans will default? How safe isthe group with 7 strips now?You might describe defaults as being like a flood, andthe strips as being like floors of a building. As long as thereare only a few defaults, the lower level floors will be theonly ones flooded and the top floors will be safe. But ifthere are numerous defaults, even the top floors will beflooded.Here is a link to the article by Allan Sloan: Allan Sloan, Junk MortgagesUnder the Microscope, Fortune Magazine, Oct. 16, 2007,http://money.cnn.com/2007/10/15/markets/junk_mortgages.fortune/index.htm4

TEACHER’S NOTES - Activity 2 “It Was Clear He Was Stuck With His Ideology”Alan Greenspan appears throughout Inside Job. Thefilm describes how Greenspan, as Federal Reserve chairman,led the deregulation and consolidation of thefinancial sector, beginning in the 1980s. One of thequestions the film raises is about Greenspan’s ideology,and this is the focus of Activity 2. In the film, RobertGnaizda, former director of the Greenlining Institute,discusses a series of meetings in which Greenspanrecognized the complexity of subprime mortgages butrefused to change his mind about regulating them.Gnaizda concluded, “It was clear he was stuck withhis ideology.”Ask your students what they thinkof Greenspan’s ideology. What are thebenefits of free markets? To what extentwas Greenspan right? How was he wrong?In addition to discussing the substance of Greenspan’sviews, you can use his ideology as a launching point forquestions about the students’ beliefs. What are theirviews about the role of government in themarkets? How have those views changedover time? What might lead them to changein the future? Do your students think theywill become “set in their ways” as they growolder? Why or why not? You might even expand thisdiscussion beyond markets and regulation to other moregeneral beliefs.5

TEACHER’S NOTES - Activity 3 “Sure, I’d Make That Bet”Nothing motivates students to talk like money. Ask themwhat they would be willing to do for $10 million a year.Would they make secret bets that might lead their firms tocollapse? What if they worked at a bank in 2005 or 2006,and genuinely believed the chances of a housing pricedecline were zero – would they be willing to bet billions ofdollars of the bank’s money on subprime mortgages if itwould lead to an eight-figure bonus? What did they thinkof the mansions and yachts in Inside Job?More generally, why is Wall Streetcompensation so high? Is it because WallStreet banks are creating so much value? Itcertainly is true that financial markets are important andvaluable. It is good for companies to be able toborrow money easily and at low cost, just as it isgood for us to be able to invest our money insteadof stuffing it under our mattresses (although in recentyears the mattress would have performed betterthan bank stocks). But, as the film shows, thereis a downside to Wall Street’s actions as well.Overall, how much are Wall Street bankers worth?You might ask who else makes this kind ofmoney in our society. Should professional athletes,popular actors, and rock stars be paid made more or lessthan Wall Street bankers?Ask students what they expect to happento bonuses in the future. In 2009, Wall Street firmshad revenue of approximately $433 billion, and paidrecord compensation of $139 billion. The numbers for2010 were about the same.Consider focusing on Citigroup as one example.Citigroup had more than 300,000 employees in 2008, andmuch of the $32 billion of total compensation the bankpaid was for salaries paid to lower-level employees. But,as the chart in the handout shows, Citigroup paid $5.3 billionof bonuses in 2008. A total of 738 people at Citigroupreceived bonuses of $1 million or more. 44 people receivedmore than $5 million. The “Senior Leadership Committee”got $126 million. And Citigroup paid thesebonuses even though it lost more than $27 billion that yearand had to be supported by the federal government with$45 billion of TARP funds. What grade would yourstudents give the Compensation Committeeof Citigroup’s board of directors, which setthe pay policies for the bank?Remind students that these bonuses were extrapayments, in addition to salaries. How mightthe prospect of such large bonusesaffect the behavior of employees? Intheory, people have an incentive toperform well if they make moremoney when their contribution totheir bank’s profits is greater. Butwhat happens to the employeeswhen the bank loses money or collapses? Ifthe banks still pay bonuses, and employeesknow losses will be borne by investors andtaxpayers, will they take on too much risk?Even after the financial crisis, employees got to keep theirbonuses. (Some of the bonus amounts were paid in stockinstead of cash. Employees who held stock through 2008lost money. But bonuses for 2008 that were paid in stockappreciated substantially during the following year.)6

TEACHER’S NOTES - Activity 4 “It’s a Wall Street Government”In Inside Job, Robert Gnaizda calls President BarackObama’s administration “a Wall Street government.” Thisactivity asks students to describe the key players in theadministration and to list the positions they held before andafter the 2008 election. Once your students have filled inthe positions, you can discuss whether Gnaizda’s statementwas fair.A “cheat sheet” for you is below. You alsomight encourage students to do researchon these people, to describe their backgroundsand positions in greater depth.For example, you might break studentsinto groups and assign each group oneperson to research for a few days.Alternatively, you might give studentsthe Activity 4 handout before you showInside Job and ask them to fill out the listas they watch the film.Ben Bernanke: Chair of the FederalReserve, was chair of the Federal Reserveunder President George W. BushWilliam C. Dudley: President of New York FederalReserve, was Chief Economist of Goldman SachsRahm Emanuel: Chief of Staff, was on the Boardof Directors of Freddie MacTimothy Geithner: Treasury Secretary, wasPresident of New York Federal ReserveGary Gensler: Head of the Commodity FuturesTrading Commission, was a Goldman Sachs ExecutiveMary Schapiro: Head of the Securitiesand Exchange Commission, was the CEOof FINRA, the Investment BankingIndustry’s Self-Regulation OrganizationLarry Summers: Chief EconomicAdvisor, was Treasury SecretaryInside Job also mentions some otherplayers not listed on the handout,such as Mark Patterson (WilliamDudley’s chief of staff, who was alobbyist for Goldman Sachs), LouisSachs (a senior advisor to the NY FederalReserve, who was with Tricadia, a hedge fundthat allegedly bet against CDOs), and Laura Tyson andMartin Feldstein (both of whom worked in previousadministrations and were appointed to President Obama’sEconomic Recovery Advisory Board). You might mentionthese people as well.7

HANDOUT - Activity 1 “It’s Utterly Mad”For centuries, scientists have searched forways to mix different materials to creategold. In 1995, David Li, a thirty-somethingmath whiz from rural China, was doingsomething similar with loans. Li was tryingto figure out how to mix risky loans togetherto get risk-free ones.Surprisingly, his great insight came from death. Li knewabout the “broken heart” problem, in which people diemore quickly after their spouses die. Li saw an analogy toloan defaults. When one borrower defaulted, others weremore likely to default. Not everyone defaulted atthe same time, but the defaults were correlated– they moved together to some degree.Li used the same math that statisticians usedto model how people reacted when their spousesdied to model how different loans reacted whenone of them “died,” or defaulted. Li told the WallStreet Journal, “Suddenly I thought that the problemI was trying to solve was exactly like the problem theseguys were trying to solve. Default is like the death of acompany, so we should model this the same way we modelhuman life.”According to the math, huge amounts of riskdisappeared when you pooled risky assets together in aCDO. The key assumption was that although some loansmight default at the same time, not all of them would defaultsimultaneously. For example, if you assumed thechances of two-thirds of the loans defaulting at the sametime were close to zero, you could split the CDO into a riskypiece (which would bear the first losses when loans in thepool defaulted) and a safer piece (which would not loseany money unless more than one-third of the loans defaulted).Then, the safer piece would be rated AAA.The CDO that Allan Sloan describes in Inside Job wasbased on exactly this assumption. The banks and ratingagencies assumed that, although some of the mortgageloans in the pool might default at the same time, thelikelihood of more than one-third defaulting togetherwas basically zero. In other words, they assumed thecorrelation was low.Historically, this correlation had been low, especially ashousing prices rose. But what would happen if thenature of the loans changed (they were made toborrowers with bad credit who put virtually nomoney down), and then housing prices fell? Evena slight decline in housing prices would pull borrowersunderwater, meaning the amount they hadborrowed was more than the value of theirhouses. Then, the correlation would be high.Everyone would default.The experts who put together subprime CDOs vastlyunderestimated the correlation of defaults. Why might theyhave done this? Was it an innocent mistake, whichsurprised the banks and rating agencies as much as itsurprised most investors? Or was it an intentional ruse,which generated phantom profits and bonuses, even as itsowed the seeds of financial destruction?How, exactly, was it “mad”?8

HANDOUT - Activity 2 “It Was Clear He Was Stuck With His Ideology”“Regulation of derivative transactions that are privatelynegotiated by professionals is unnecessary.”-Congressional Testimony of Alan Greenspan, July 1998Until recently, Alan Greenspan was oneof the most admired government officials inthe world. He was appointed and reappointed tohigh-level positions, and served as chairman of the FederalReserve for nearly two decades. Before the financial crisis,the dominant view was that Greenspan was a kind ofmystic savior – like the diminutive Yoda of Star Wars fame– who could foretell the future and understood the forcesthat would lead to prosperity and peace.Fewer people admire Greenspan today. Muchof the criticism of him is that he formed anideology about markets and refused to budgefrom his views, even when overwhelmingevidence showed that these views were wrong.Greenspan’s ideology was an extreme version ofa widely held view about the benefits of markets.He developed these views in his 20s, when hejoined the free-market Objectivist movement, dominatedby writer Ayn Rand, and he solidified his ideology as apolitical advisor to President Richard Nixon’s presidentialcampaign in 1967. By the time he became chair of theFederal Reserve in the 1980s, his views of the marketswere fixed.Greenspan especially opposed regulationof derivatives, the side bets that were at thecore of the financial crisis. The basis of thisideology was challenged in 1994, when the FederalReserve’s decision to raise interest rates sent shock wavesthrough the financial system. The culprit was hiddenderivative side bets on interest rates placed by hundreds ofcompanies. Three years later, Long Term Capital Management,a hedge fund, collapsed under the weight of $1.25trillion of bad derivatives bets. Throughout the 1990s,there were repeated examples of fraud in the privatederivatives market. Yet Greenspan continued to lobby forderegulation of derivatives.Many people believe that unregulated marketsare frequently preferable to government involvement.But Greenspan’s ideology was that marketsare always preferable to government. For example,consider Greenspan’s view of fraud. He toldone senior regulator that rules prohibiting fraudwere unnecessary, because participants in themarkets inevitably would discover fraud. He said,“We will never agree on the issue of fraud, because I don’tthink there is a need for laws against fraud.” What areyour own views and beliefs about the factspresented in Inside Job? Do you have anideology in this area? Make a list of thebasic principles of “right and wrong” thatyou believe to be true about markets. Whatmight lead you to change your views?“Well, remember that what an ideology is, is a conceptual framework with the way peopledeal with reality. Everyone has one. You have to -- to exist, you need an ideology. Thequestion is whether it is accurate or not. And what I’m saying to you is, yes, I found a flaw.”-Congressional Testimony of Alan Greenspan, October 2008.9

HANDOUT - Activity 3 “Sure, I’d Make That Bet”“You’re going to make an extra $2 million a year– or $10 million a year – for putting your financialinstitution at risk. Someone else pays the bill. Youdon’t pay the bill. Would you make that bet? Mostpeople who worked on Wall Street said, ‘Sure, I’dmake that bet.’” - Frank Partnoy, Inside JobInside Job criticizes several Wall Streetexecutives who made tens of millions – orhundreds of millions – of dollars, even astheir firms collapsed. For example, JosephCassano, an officer of AIG’s FinancialProducts division, received $315 million from1987 until he retired in March 2008, sixmonths before AIG was rescued by the federalgovernment. Robert Rubin, the former TreasurySecretary and head of Goldman Sachs, made $126million during eight years as a board member andadvisor to Citigroup through 2009.Companies often award annual bonuses toemployees after a good year. But 2008 was hardly agood year for Wall Street. Profits were down, stockprices plummeted, and many banks nearly collapsed.In 2008, the federal government implemented the“Troubled Asset Relief Program,” known asTARP, to support the banks. Some arguedTARP was unnecessary; others said majorbanks would have been forced intobankruptcy without it.Below is a table of the net income (orlosses) for 2008 for several of the majorfinancial institutions mentioned in the film,along with the total amount of bonuses those firmspaid that year, the number of employees whoreceived more than $1 million or $10 million inbonuses, and the amount of TARP support each firmreceived. The dollar amounts are in billions.WHY DID THESE BANKS PAY SUCH LARGE BONUSES IN 2008?WHAT GRADE WOULD YOU GIVE THE DECISION TO AWARD THESE BONUSES?Bank Net Income Bonuses $1 Million Bonuses $10 Million Bonuses TARPBank of America $4.0 $3.3 172 4 $45Citigroup -$27.7 $5.3 738 3 $45Goldman Sachs $2.3 $4.8 953 6 $10JPMorgan Chase $5.6 $8.7 1,626 10 $25Merrill Lynch -$27.6 $3.6 696 14 $10Morgan Stanley $1.7 $4.5 428 10 $10“I would give them about a B.”-Scott Talbott, Financial Services Roundtable, grading the compensation decisions of Wall Street banks in Inside Job“It is hard for us, without being flippant, to see a scenario within any kind of realm or reasonthat would see us losing one dollar in any of those transactions.”-Joseph Cassano, conference call with AIG investors, July 200710

HANDOUT - Activity 4 “It’s a Wall Street Government”Inside Job is critical of the major players in theadministration of President George W. Bush, includingHank Paulson, the former head of Goldman Sachs,who was Secretary of the Treasury as the financialcrisis unfolded in 2007 and 2008. But the film is bipartisan– it is just as critical of the major playersin the administration of President Barack Obama.Below is a list of seven of those players. For eachperson, write down what their previous position was,as well as their position under President Obama.Ben Bernanke _____________________________________________________________________________________________________________________________________________________________________________________________William C. Dudley _________________________________________________________________________________________________________________________________________________________________________________________Rahm Emanuel ____________________________________________________________________________________________________________________________________________________________________________________________Timothy Geithner__________________________________________________________________________________________________________________________________________________________________________________________Gary Gensler _____________________________________________________________________________________________________________________________________________________________________________________________Mary Schapiro _____________________________________________________________________________________________________________________________________________________________________________________________Larry Summers_____________________________________________________________________________________________________________________________________________________________________________________________Why do you think President Obama appointedthese people to these positions?How would you balance the need for experienceand expertise against the benefits of having afresh perspective?Who would you have appointed?Are these appointments like hiring a head sportscoach? Would you rather have an experienced coachwith a losing record or an inexperienced coach withno record at all?“When the financial crisis struck just before the 2008 election, Barack Obama pointed to Wall Streetgreed and regulatory failures as examples of the need for change in America.”-From Inside Job11