PDF (92 Kb) - MMC UK Pensions

PDF (92 Kb) - MMC UK Pensions

PDF (92 Kb) - MMC UK Pensions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

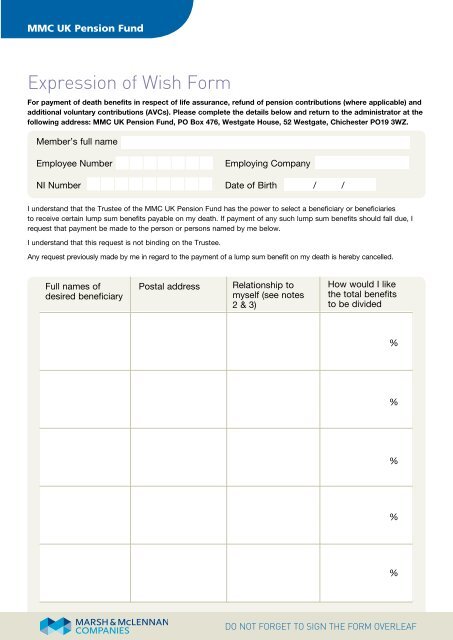

<strong>MMC</strong> <strong>UK</strong> Pension FundExpression of Wish FormFor payment of death benefits in respect of life assurance, refund of pension contributions (where applicable) andadditional voluntary contributions (AVCs). Please complete the details below and return to the administrator at thefollowing address: <strong>MMC</strong> <strong>UK</strong> Pension Fund, PO Box 476, Westgate House, 52 Westgate, Chichester PO19 3WZ.Member’s full nameEmployee NumberEmploying CompanyNI Number Date of Birth / /I understand that the Trustee of the <strong>MMC</strong> <strong>UK</strong> Pension Fund has the power to select a beneficiary or beneficiariesto receive certain lump sum benefits payable on my death. If payment of any such lump sum benefits should fall due, Irequest that payment be made to the person or persons named by me below.I understand that this request is not binding on the Trustee.Any request previously made by me in regard to the payment of a lump sum benefit on my death is hereby cancelled.Full names ofdesired beneficiaryPostal addressRelationship tomyself (see notes2 & 3)How would I likethe total benefitsto be divided%%%%%DO NOT FORGET TO SIGN THE FORM OVERLEAF

<strong>MMC</strong> <strong>UK</strong> Pension FundBefore returning this Form, please make sure that you have read the accompanying notes. The notes should be retainedfor information and should not be returned with the Form.Once you have returned your Expression of Wish Form to the administrator, it will be kept in a secure file which iscompletely confidential.Signed:Date: / /Should you require acknowledgement of receipt of the Expression of Wish Form please complete your detailsbelow and return with the Form:Name and address to be completed by the Member if an acknowledgement is required.For use by the administrator onlyWe acknowledge receipt of an Expression of Wish Form dated / /completed by the member whose name and address are shown in the box.Signed Date / /

<strong>MMC</strong> <strong>UK</strong> Pension FundNotes on the completion of the Expression of Wish Form1 Read these notes first. You are advised to keep your own copy of the Expression of Wish Form beforesending it to the administrator. If you wish to receive an acknowledgement be sure to complete the separateAcknowledgement Slip and return the Slip with the Form. The Form should be sent to the administrator at thefollowing address: <strong>MMC</strong> <strong>UK</strong> Pension Fund, PO Box 476, Westgate House, 52 Westgate, Chichester PO19 3WZ.2 The Trustee of the <strong>MMC</strong> <strong>UK</strong> Pension Fund (“the Fund”) may, at its discretion to be exercised not later than twoyears from the date of the member’s death, pay lump sum death benefits (as indicated in the Fund ExplanatoryBooklet) to one or more of the Beneficiaries (as defined below) as the Trustee decides and/or pay any part of thelump sum death benefit to the member’s estate. In exercising its discretion the Trustee will have regard to, but willnot be bound by, any Expression of Wish Form completed by the member.If the Trustee within the said period of two years does not pay or apply the whole of the said benefit under theaforesaid power, it shall pay it, or so much of it as has not been paid or applied, to the member’s estate.Beneficiaries shall mean in relation to a member:a the spouse of the member (or registered civil partner under the Civil Partnership Act 2004);b the parents and grandparents of the member and of the member’s spouse (or registered civil partner);c all other descendants (however remote) of the grandparents of the member, and of the grandparents ofthe member’s spouse (or registered civil partner) and of the spouse (or registered civil partner) of any suchdescendant (provided that a relationship acquired by process of legal adoption shall be as valid as a bloodrelationship, and a stepchild shall be deemed to be a descendant);d any individual or individuals entitled to any interest in the member’s estate under any valid testamentarydisposition or dispositions made by the member or upon the member’s intestacy;e any other person or persons, who in the opinion of the Trustee shall have been wholly or partially maintained orfinancially assisted by the member;fany person, or persons you have nominated in your Expression of Wish Form, this can be any individual orindividuals (including anyone listed under a-e above) and/or charities, societies, clubs, or trustees of a family trust.3 The Trustee is not permitted to make payment of a death benefit to any person outside of the permitted categoriesas indicated in note 2. It will therefore be very helpful if, when the Expression of Wish Form is completed, therelationship between yourself and each of the desired beneficiaries is clearly indicated in such a way as toestablish that each beneficiary is within the permitted categories.4 In completing the Expression of Wish Form you may wish to take account of the fact that you may or may not besurvived by a potential beneficiary, thus a wish may be expressed in the Form ‘A if he survives me but otherwise B’.P.T.O.

<strong>MMC</strong> <strong>UK</strong> Pension Fund5 The following general propositions concerning inheritance tax under current legislation may be relevant:(i)(ii)A transfer of assets between husband and wife (or registered civil partners) whether during their joint lifetimeor at the death of one of them is exempt from liability for tax.A transfer of assets between two persons whether during their joint lifetime or at the death of one of themmay otherwise be liable for tax.(iii) A payment of the fund at the death of a member payable under Trustee discretion is exempt.(iv) There are other exemptions too numerous to list here.If, therefore, you wish to leave at your death a monetary gift to a person other than your spouse or registeredcivil partner, it may be more tax efficient to seek to do so out of the Fund death benefit monies than out of theassets forming your estate. If you wish to take inheritance tax planning into consideration before completing yourExpression of Wish Form you must not rely on this brief note but take professional advice which will take intoaccount your own personal circumstances.6 From time to time you should consider whether the wishes expressed on the Expression of Wish Form continueto be appropriate. A new Expression of Wish Form may be obtained at any time from the administrator. A newExpression of Wish Form submitted will always be taken to cancel the wishes expressed on an earlier Expressionof Wish Form.NoteIt is recommended that you make a Will in order to ease the administration of your estate for your survivors and helpthe Trustee to meet your wishes. Assistance and advice in drawing up a Will can be obtained from a Solicitor, or froman Independent Financial Adviser.Designed & produced by Mercer Limited © <strong>92</strong>39_11