Sparinvest SICAV Annual Report 2009 R.C.S. Luxembourg B 83.976

Sparinvest SICAV Annual Report 2009 R.C.S. Luxembourg B 83.976

Sparinvest SICAV Annual Report 2009 R.C.S. Luxembourg B 83.976

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Sparinvest</strong> <strong>SICAV</strong><br />

<strong>Report</strong> of the Investment Manager<br />

Economic Background<br />

In early <strong>2009</strong>, it became apparent that global governments – and in particular those of the G20 industrialised nations - would have to<br />

take extraordinary measures to re-liquify the markets. Over the course of <strong>2009</strong> they did this with direct stimulus measures valued at<br />

around 3% of global GDP.<br />

By reducing interest rates and printing money, funded by the large-scale issuance of treasuries and bonds, governments have<br />

effectively removed the toxicity from the private sector but brought it into the government sector. This has created huge deficits in<br />

some nations (notably the US and UK), thereby limiting the scope for ‘last resort’ intervention by these governments in any future<br />

crises.<br />

The question for the future is whether the markets are now strong enough to survive without further stimulus and whether other<br />

economies of the world will decouple from the US to fuel the next round of recovery. In any event, the argument both for global<br />

diversification and for asset class diversification remains strong.<br />

Market Background<br />

Kick-started by government money, <strong>2009</strong> will be remembered as a year of historic market movements across many asset classes.<br />

Beginning in early March and continuing to the year-end, global equity and credit markets have picked up significantly. Credit bonds<br />

in particular have had a spectacular year, recovering from a near total collapse in prices in 2008 to outperform the majority of world<br />

equity markets over the course of <strong>2009</strong>. As it became apparent that corporate default levels were not going to be anywhere near as<br />

catastrophic as anticipated, the Merrill Lynch Global High Yield (EUR Hedged) Index advanced 60.7%. In the equity markets, the<br />

rebound has been strongest for the segments that suffered most during 2008 - among them Far East and European Small-caps. The<br />

MSCI World equity index ended the year up by 25.9%.<br />

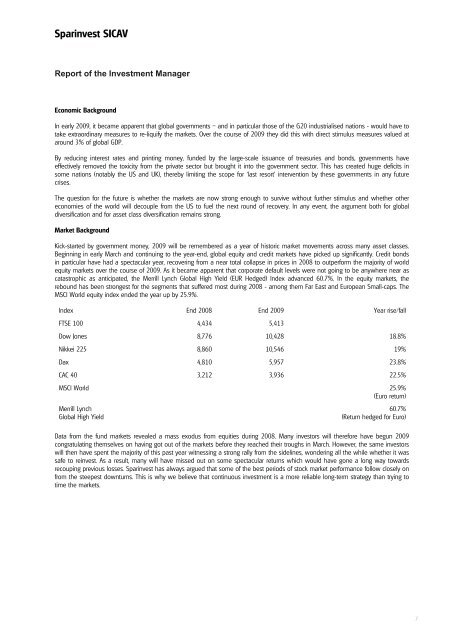

Index End 2008 End <strong>2009</strong> Year rise/fall<br />

FTSE 100 4,434 5,413<br />

Dow Jones 8,776 10,428 18.8%<br />

Nikkei 225 8,860 10,546 19%<br />

Dax 4,810 5,957 23.8%<br />

CAC 40 3,212 3,936 22.5%<br />

MSCI World 25.9%<br />

(Euro return)<br />

Merrill Lynch<br />

Global High Yield<br />

60.7%<br />

(Return hedged for Euro)<br />

Data from the fund markets revealed a mass exodus from equities during 2008. Many investors will therefore have begun <strong>2009</strong><br />

congratulating themselves on having got out of the markets before they reached their troughs in March. However, the same investors<br />

will then have spent the majority of this past year witnessing a strong rally from the sidelines, wondering all the while whether it was<br />

safe to reinvest. As a result, many will have missed out on some spectacular returns which would have gone a long way towards<br />

recouping previous losses. <strong>Sparinvest</strong> has always argued that some of the best periods of stock market performance follow closely on<br />

from the steepest downturns. This is why we believe that continuous investment is a more reliable long-term strategy than trying to<br />

time the markets.<br />

7