instructions - Alabama Department of Revenue - Alabama.gov

instructions - Alabama Department of Revenue - Alabama.gov

instructions - Alabama Department of Revenue - Alabama.gov

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

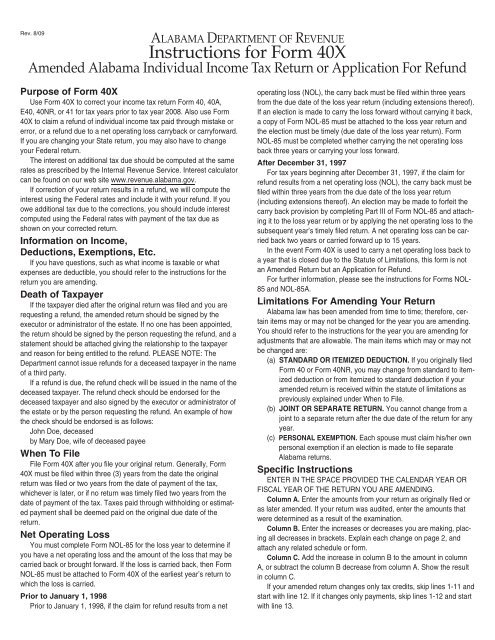

Rev. 8/09ALABAMA DEPARTMENT OF REVENUEInstructions for Form 40XAmended <strong>Alabama</strong> Individual Income Tax Return or Application For RefundPurpose <strong>of</strong> Form 40XUse Form 40X to correct your income tax return Form 40, 40A,E40, 40NR, or 41 for tax years prior to tax year 2008. Also use Form40X to claim a refund <strong>of</strong> individual income tax paid through mistake orerror, or a refund due to a net operating loss carryback or carryforward.If you are changing your State return, you may also have to changeyour Federal return.The interest on additional tax due should be computed at the samerates as prescribed by the Internal <strong>Revenue</strong> Service. Interest calculatorcan be found on our web site www.revenue.alabama.<strong>gov</strong>.If correction <strong>of</strong> your return results in a refund, we will compute theinterest using the Federal rates and include it with your refund. If youowe additional tax due to the corrections, you should include interestcomputed using the Federal rates with payment <strong>of</strong> the tax due asshown on your corrected return.Information on Income,Deductions, Exemptions, Etc.If you have questions, such as what income is taxable or whatexpenses are deductible, you should refer to the <strong>instructions</strong> for thereturn you are amending.Death <strong>of</strong> TaxpayerIf the taxpayer died after the original return was filed and you arerequesting a refund, the amended return should be signed by theexecutor or administrator <strong>of</strong> the estate. If no one has been appointed,the return should be signed by the person requesting the refund, and astatement should be attached giving the relationship to the taxpayerand reason for being entitled to the refund. PLEASE NOTE: The<strong>Department</strong> cannot issue refunds for a deceased taxpayer in the name<strong>of</strong> a third party.If a refund is due, the refund check will be issued in the name <strong>of</strong> thedeceased taxpayer. The refund check should be endorsed for thedeceased taxpayer and also signed by the executor or administrator <strong>of</strong>the estate or by the person requesting the refund. An example <strong>of</strong> howthe check should be endorsed is as follows:John Doe, deceasedby Mary Doe, wife <strong>of</strong> deceased payeeWhen To FileFile Form 40X after you file your original return. Generally, Form40X must be filed within three (3) years from the date the originalreturn was filed or two years from the date <strong>of</strong> payment <strong>of</strong> the tax,whichever is later, or if no return was timely filed two years from thedate <strong>of</strong> payment <strong>of</strong> the tax. Taxes paid through withholding or estimatedpayment shall be deemed paid on the original due date <strong>of</strong> thereturn.Net Operating LossYou must complete Form NOL-85 for the loss year to determine ifyou have a net operating loss and the amount <strong>of</strong> the loss that may becarried back or brought forward. If the loss is carried back, then FormNOL-85 must be attached to Form 40X <strong>of</strong> the earliest year’s return towhich the loss is carried.Prior to January 1, 1998Prior to January 1, 1998, if the claim for refund results from a netoperating loss (NOL), the carry back must be filed within three yearsfrom the due date <strong>of</strong> the loss year return (including extensions there<strong>of</strong>).If an election is made to carry the loss forward without carrying it back,a copy <strong>of</strong> Form NOL-85 must be attached to the loss year return andthe election must be timely (due date <strong>of</strong> the loss year return). FormNOL-85 must be completed whether carrying the net operating lossback three years or carrying your loss forward.After December 31, 1997For tax years beginning after December 31, 1997, if the claim forrefund results from a net operating loss (NOL), the carry back must befiled within three years from the due date <strong>of</strong> the loss year return(including extensions there<strong>of</strong>). An election may be made to forfeit thecarry back provision by completing Part III <strong>of</strong> Form NOL-85 and attachingit to the loss year return or by applying the net operating loss to thesubsequent year’s timely filed return. A net operating loss can be carriedback two years or carried forward up to 15 years.In the event Form 40X is used to carry a net operating loss back toa year that is closed due to the Statute <strong>of</strong> Limitations, this form is notan Amended Return but an Application for Refund.For further information, please see the <strong>instructions</strong> for Forms NOL-85 and NOL-85A.Limitations For Amending Your Return<strong>Alabama</strong> law has been amended from time to time; therefore, certainitems may or may not be changed for the year you are amending.You should refer to the <strong>instructions</strong> for the year you are amending foradjustments that are allowable. The main items which may or may notbe changed are:(a) STANDARD OR ITEMIZED DEDUCTION. If you originally filedForm 40 or Form 40NR, you may change from standard to itemizeddeduction or from itemized to standard deduction if youramended return is received within the statute <strong>of</strong> limitations aspreviously explained under When to File.(b) JOINT OR SEPARATE RETURN. You cannot change from ajoint to a separate return after the due date <strong>of</strong> the return for anyyear.(c) PERSONAL EXEMPTION. Each spouse must claim his/her ownpersonal exemption if an election is made to file separate<strong>Alabama</strong> returns.Specific InstructionsENTER IN THE SPACE PROVIDED THE CALENDAR YEAR ORFISCAL YEAR OF THE RETURN YOU ARE AMENDING.Column A. Enter the amounts from your return as originally filed oras later amended. If your return was audited, enter the amounts thatwere determined as a result <strong>of</strong> the examination.Column B. Enter the increases or decreases you are making, placingall decreases in brackets. Explain each change on page 2, andattach any related schedule or form.Column C. Add the increase in column B to the amount in columnA, or subtract the column B decrease from column A. Show the resultin column C.If your amended return changes only tax credits, skip lines 1-11 andstart with line 12. If it changes only payments, skip lines 1-12 and startwith line 13.

Line 1. Total Income. To figure this amount, add income from allsources such as wages, interest, dividends, and net pr<strong>of</strong>it frombusiness.If you are correcting wages or other employee compensation,attach the state copy <strong>of</strong> Form W-2/W-2C that you received after youfiled your original return.Line 2. Adjustments to Income. Enter on this line all adjustments toincome such as business expense, moving expense, penalty for earlywithdrawal <strong>of</strong> savings, etc. Refer to the <strong>instructions</strong> for the year you areamending for the adjustments that are allowable since <strong>Alabama</strong> lawhas been amended several times and certain adjustments may applyonly to certain years.Line 4. Standard or Itemized Deductions (Forms 40 or 40NR only).Indicate if you are claiming the Standard Deduction or ItemizedDeductions. You may change from standard to itemized or from itemizedto standard deduction. (See Limitations For Amending YourReturn on page 1 <strong>of</strong> these <strong>instructions</strong>.) Also, refer to the <strong>instructions</strong>for the year you are amending since the items allowed as itemizeddeductions are different for certain years.Line 6. Federal Income Tax Deduction. Enter on this line the federalincome tax you claimed as a deduction in your return. If you areincreasing the amount originally claimed, explain on page 2, and attacha copy <strong>of</strong> your canceled check(s), money order(s), or other records tosubstantiate the additional amount.Line 8. Personal Exemption, Dependent Exemption, or FiduciaryExemption. Enter the total amount you claimed on your original returnfor personal exemption and dependents. See Limitations ForAmending Your Return since you cannot change the personal exemptionunder certain conditions. If you are claiming additional dependents,give the name, age, and relationship on page 2.Line 9. Taxable Income. Subtract line 8 from line 7, and enter theresult on this line.If a Net Operating Loss is available to be applied to taxable income,enter the amount from line 9, Form 40X, on line 3, Form NOL-85A, andcompute your tax per the <strong>instructions</strong> for Form NOL-85A.Line 10a. Income Tax. Enter your <strong>Alabama</strong> income tax before subtractingany credits. If you are computing your tax from Form NOL,write “NOL Form” on this line. Include any previous voluntary contributionsin the total.Line 10b. Consumer Use Tax. Enter Consumer Use Tax due thestate <strong>of</strong> <strong>Alabama</strong>.Worksheets on how to compute Consumer Use Tax are available inthe instruction booklets for Forms 40 and 40A.Line 12. Credits from Schedule CR and/or OC. Enter the total creditclaimed for taxes paid to other states, Capital Credits, and/orEnterprise Zone Credits. See Schedules CR, OC and <strong>instructions</strong> forfurther information on these credits.If you are changing the amount originally claimed on your return,show the correct computation on page 2, or attach a correctedSchedule CR, OC.Line 13. Net Tax Liability. Subtract line 12 from line 11, and enterthe result on this line. The amounts entered on this line cannot be lessthan zero.Line 14. <strong>Alabama</strong> Income Tax Withheld. If you change theseamounts, attach the state copy <strong>of</strong> all additional or corrected W-2 Formsthat you received since you filed your original return.Line 16. Amount Paid With Return. Enter the amount you paid onthe “Balance Due” reported on your original return. Do not include payments<strong>of</strong> interest or penalties.Line 17. Other Payments. Enter other payments not included onlines 14, 15, or 16. Amounts entered on this line include amounts paidwith an application for extension, additional tax due as a result <strong>of</strong> <strong>of</strong>ficeor field adjustments, and any other tax paid after your return was filed.Line 19. Overpayment as Shown on Original Return. The overpaymentshown on your original return must be considered in preparingForm 40X, since any refund you may not have received will be refundedseparately from any additional refund due on Form 40X.The amount you should list on line 19 is the overpayment on youroriginal return before any amount(s) you elected to apply to your nextyear’s estimated tax and/or elected to donate to any <strong>of</strong> the donationcheck-<strong>of</strong>f funds. If your refund was increased or decreased as a result<strong>of</strong> an examination <strong>of</strong> your original return, you should show the correctedamount on Form 40X. Do not include any interest you received onany refund.Note: You cannot decrease the amount(s) you elected to apply toyour next year’s estimated tax or donated to any <strong>of</strong> the donation check<strong>of</strong>ffunds, since these elections are irrevocable and cannot be refundedor applied to pay any additional tax due on your amended return.Line 21. Balance Due. If the amount on line 13, column C is morethan line 20, enter the difference on this line.If your amended return is filed after the due date <strong>of</strong> the return, youshould include interest from the due date to date <strong>of</strong> payment. See theinterest rates in the first part <strong>of</strong> these <strong>instructions</strong>. If you are subject toany penalties such as delinquent penalties, or estimate penalties, theyshould be included with your payment. The tax, interest, and penaltiesshould be entered in the spaces provided on line 21.Line 22. Refund to be Received. If the amount on line 13, column C,is less than the amount on line 20, enter the difference on this line.This amount will be refunded separately from the amount claimed onyour original return. If you are due interest on this amount, the<strong>Department</strong> will include the interest with your refund.Explanations For Changes To Income,Exemptions, Deductions, and CreditsExplain on page 2 any changes made in column B on page1. Enter the line reference from page 1 by each explanation. Ifnecessary, attach supporting schedules and/or forms showingthe corrected amounts.Where To FileMail your amended return to:<strong>Alabama</strong> <strong>Department</strong> <strong>of</strong> <strong>Revenue</strong>Individual and Corporate Tax DivisionP.O. Box 327464Montgomery, AL 36132-7464Mail ONLY your Amended Return to the above address. Currentreturns should be mailed separately to a different address, since thesereturns are processed separately.