Anthem CDHP - ES Represented Baltimore

Anthem CDHP - ES Represented Baltimore

Anthem CDHP - ES Represented Baltimore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

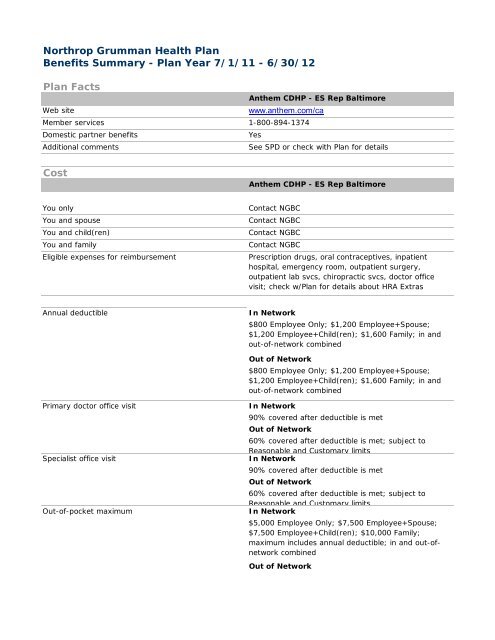

Northrop Grumman Health PlanBenefits Summary - Plan Year 7/1/11 - 6/30/12Plan Facts<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>Web sitewww.anthem.com/caMember services 1-800-894-1374Domestic partner benefitsYesAdditional commentsSee SPD or check with Plan for detailsCost<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>You onlyYou and spouseYou and child(ren)You and familyEligible expenses for reimbursementContact NGBCContact NGBCContact NGBCContact NGBCPrescription drugs, oral contraceptives, inpatienthospital, emergency room, outpatient surgery,outpatient lab svcs, chiropractic svcs, doctor officevisit; check w/Plan for details about HRA ExtrasAnnual deductibleIn Network$800 Employee Only; $1,200 Employee+Spouse;$1,200 Employee+Child(ren); $1,600 Family; in andout-of-network combinedOut of Network$800 Employee Only; $1,200 Employee+Spouse;$1,200 Employee+Child(ren); $1,600 Family; in andout-of-network combinedPrimary doctor office visitSpecialist office visitOut-of-pocket maximumIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network$5,000 Employee Only; $7,500 Employee+Spouse;$7,500 Employee+Child(ren); $10,000 Family;maximum includes annual deductible; in and out-ofnetworkcombinedOut of Network

$5,000 Employee Only; $7,500 Employee+Spouse;$7,500 Employee+Child(ren); $10,000 Family;maximum includes annual deductible; in and out-ofnetworkcombinedLifetime coverage limitIn NetworkLimit does not applyOut of NetworkLimit does not applyHospital copayHospital semi-private roomInpatient lab and X-rayInpatient surgeryInpatient physician and surgeon servicesIn Network90% covered; after deductible is metOut of Network60% covered; after deductible is metIn Network90% covered; after deductible is metOut of Network60% covered; after deductible is metIn Network90% covered; after deductible is metOut of Network60% covered; after deductible is metIn Network90% covered; after deductible is metOut of Network60% covered; after deductible is metIn Network90% covered; after deductible is metOut of Network60% covered; after deductible is metOutpatient surgeryOutpatient laboratory servicesOutpatient X-rayEmergency room (not followed by admission)In Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is met; 60% coveredafter deductible is met for non-emergencies

Out of Network90% covered after deductible is met; 60% coveredafter deductible is met for non-emergenciesUrgent care clinic visitOutpatient cardiac rehabilitationPrescription drug vendorPrescription drug Web sitePrescription drug member servicesAnnual prescription deductibleAnnual Rx out-of-pocket maximumRetail genericRetail formulary brandRetail nonformulary brandMail order genericMail order formulary brandMail order nonformulary brandOral contraceptivesFertility drugsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsSame as medical planSame as medical planSame as medical planIn NetworkNot applicableOut of NetworkNot applicableIn NetworkNot applicableOut of NetworkNot applicableIn Network90% covered after deductible is metOut of Network60% covered after deductible is metIn Network90% covered after deductible is metOut of Network60% covered after deductible is metIn Network90% covered after deductible is metOut of Network60% covered after deductible is met90% covered after deductible is met; 60% coveredafter deductible is met out-of-network90% covered after deductible is met; 60% coveredafter deductible is met out-of-network90% covered after deductible is met; 60% coveredafter deductible is met out-of-networkIn NetworkRetail and mail order availableOut of NetworkRetail and mail order availableIn NetworkCovered under Medical

Out of NetworkCovered under MedicalCoverage<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>Annual physical examIn Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsWell-woman exam (includes pap)In Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsMammogramColonoscopyIn Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; age schedules apply;check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsIn Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsCancer screeningsIn Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsCardiovascular screeningsIn Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network

100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsAllergy tests and treatmentsFertility servicesIn vitro fertilizationArtificial inseminationFemale tubal ligationMale vasectomyOffice visit: Pre/postnatalIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is met; limited to$25,000 per lifetime including prescription drugs; inand out-of-network combinedOut of Network60% covered after deductible is met; limited to$25,000 per lifetime including prescription drugs; inand out-of-network combined; subject to R&C limitsIn Network90% covered after deductible is met; limited to$25,000 per lifetime for all fertility services combinedincluding prescription drugs; in and out-of-networkcombinedOut of Network60% covered after ded is met; limited to $25,000 perlifetime for all fertility services combined includingprescription drugs; in and out-of-network combined;subject to R&C limitsIn Network90% covered after deductible is met; limited to$25,000 per lifetime for all fertility services combinedincluding prescription drugs; in and out-of-networkcombinedOut of Network60% covered after deductible is met; limited to$25,000 per lifetime for all fertility services combinedincluding prescription drugs; in and out-of-networkcombined; subject to R&C limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limits

In-hospital delivery servicesNewborn nursery servicesPediatric examsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsImmunizations (child)In Network100% covered; not deducted from HRA account; mustmeet preventive guidelines; check with Plan for detailsOut of Network100% covered; not deducted from HRA account;subject to Reasonable and Customary limits; mustmeet preventive guidelines; check with Plan for detailsMental Health: Combined with substance abuseMental Health: Outpatient coverageMental Health: Inpatient coverageBehavioral health member servicesBehavioral health vendorBehavioral health Web siteIn NetworkNot applicableOut of NetworkNot applicableIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is metSame as medical planSame as medical planSame as medical planDetox: Outpatient coverageIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limits

Detox: Inpatient coverageRehab: Outpatient coverageRehab: Inpatient coverageIn Network90% covered after deductible is metOut of Network60% covered after deductible is metIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is metOut of Network60% covered after deductible is metDental implantsAccidental injury to teethSurgical removal of tumors, cysts, and impacted teethIn NetworkNot coveredOut of NetworkNot coveredIn Network90% covered after deductible is met; limitations apply;check with Plan for detailsOut of Network60% covered after deductible is met; limitations apply;subject to Reasonable and Customary limits; checkwith Plan for detailsIn Network90% covered after deductible is met; limited tosurgical removal of tumors and cysts; removal ofimpacted teeth not coveredOut of Network60% covered after deductible is met; subject to R&Climits; limited to surgical removal of tumors and cysts;removal of impacted teeth not coveredRoutine vision examsRegular lenses and framesContact lensesIn NetworkNot coveredOut of NetworkNot coveredIn NetworkNot coveredOut of NetworkNot coveredIn NetworkNot coveredOut of NetworkNot coveredHearing evaluationsIn Network90% covered after deductible is met

Hearing aidsAcupunctureChiropracticOutpatient physical therapyOutpatient speech therapyOutpatient occupational therapyOut of Network60% covered after deductible is met; subject toReasonable and Customary limitsIn Network90% covered after deductible is met; limited to 2hearing aids per benefit plan yearOut of Network60% covered after deductible is met; subject toReasonable and Customary limits; limited to 2 hearingaids per benefit plan yearIn Network90% covered after deductible is met; limited to 20visits per benefit plan year; combined withacupressure; in and out-of-network combinedOut of Network60% covered after deductible is met; limited to 20visits per benefit plan year; combined withacupressure; in and out-of-network combined; subjectto Reasonable and Customary limitsIn Network90% covered after deductible is met; limited to 40visits per benefit plan year; in and out-of-networkcombinedOut of Network60% covered after deductible is met; limited to 40visits per benefit plan year; in and out-of-networkcombined; subject to Reasonable and Customary limitsIn Network90% covered after deductible is met; limited to 50visits per benefit plan year; in and out-of-networkcombined; not combined with any other therapyOut of Network60% covered after deductible is met; limited to 50visits per benefit plan year; in and out-of-networkcombined; subject to Reasonable and Customarylimits; not combined with any other therapyIn Network90% covered after deductible is met; limited to 50visits per benefit plan year; in and out-of-networkcombined; not combined with any other therapyOut of Network60% covered after deductible is met; limited to 50visits per benefit plan year; in and out-of-networkcombined; subject to Reasonable and Customarylimits; not combined with any other therapyIn Network90% covered after deductible is met; limited to 50visits per benefit plan year; in and out-of-networkcombined; not combined with any other therapyOut of Network

60% covered after deductible is met; limited to 50visits per benefit plan year; in and out-of-networkcombined; subject to Reasonable and Customarylimits; not combined with any other therapyNoncustodial home health carePrescribed care in noncustodial skilled nursing facilityIn Network90% covered after deductible is met; limited to 120visits per benefit plan year; in and out-of-networkcombinedOut of Network60% covered after deductible is met; limited to 120visits per benefit plan year; in and out-of-networkcombined; subject to Reasonable and Customary limitsIn Network90% covered after deductible is met; limited to 120days per benefit plan year; in and out-of-networkcombined; limitations apply; check with Plan for detailsOut of Network60% covered after deductible is met; limited to 120days per benefit plan year; in and out-of-networkcombined; subject to Reasonable and Customary limitsHospice careAmbulance servicesProsthetic devicesAccessOut-of-area dependent coverageOut-of-area participant coverageDomestic partner benefitsIn Network90% covered after deductible is met; respite care andbereavement are excludedOut of Network60% covered after deductible is met; respite care andbereavement are excluded; subject to Reasonable andCustomary limits90% covered after deductible is met; in and out-ofnetwork combined; coverage based on medicallynecessary criteria; check with Plan for detailsIn Network90% covered after deductible is metOut of Network60% covered after deductible is met; subject toReasonable and Customary limits<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>YesYesYesEase of UseAbility to self-refer to OB/GYNAbility to self-refer to specialists<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>YesYes

Member Satisfaction<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>Health plan averageNational average 84%Not availableHealth plan averageNational average 96%Not availableHealth plan averageNational average 89%Not availableHealth plan averageNational average 85%Not availableCare Management: Education and Assistance<strong>Anthem</strong> <strong>CDHP</strong> - <strong>ES</strong> Rep <strong>Baltimore</strong>Asthma care managementCancer care managementDiabetes care managementHeart disease care managementHypertension care managementSmoking cessation programWeight control programPrenatal care managementYesYesYesYesYesNoNoYesThe comparison charts are compiled using information that applies to a large number of health plan users andis commonly reported by the health plans. Depending on the chart type, such as charts for dental and visionplans, certain information and/or sections won't appear because the necessary data isn't available. If you havequestions about a topic that isn't covered in the charts, refer to the plan's SPD or contact the health provider'smember services department for additional information. Also, keep in mind that the information on access andquality of care is provided by the health plans. Neither Northrop Grumman nor Hewitt Associates is responsiblefor the accuracy of this information. If there is a discrepancy between the information displayed on thesecharts and the official plan documents, the official plan documents will control. Northrop Grumman reservesthe right to amend, suspend, or terminate the plan(s) or program(s) at any time.