Kuoni Travel Holding Ltd. Half-year report 2005 - Kuoni Group

Kuoni Travel Holding Ltd. Half-year report 2005 - Kuoni Group

Kuoni Travel Holding Ltd. Half-year report 2005 - Kuoni Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Kuoni</strong> posts a solid performance in a difficult environment<br />

<strong>Kuoni</strong> <strong>Travel</strong> <strong>Holding</strong> <strong>Ltd</strong>.<br />

<strong>Half</strong>-<strong>year</strong> <strong>report</strong> <strong>2005</strong><br />

<strong>2005</strong> first-half consolidated results<br />

up on prior-<strong>year</strong> levels<br />

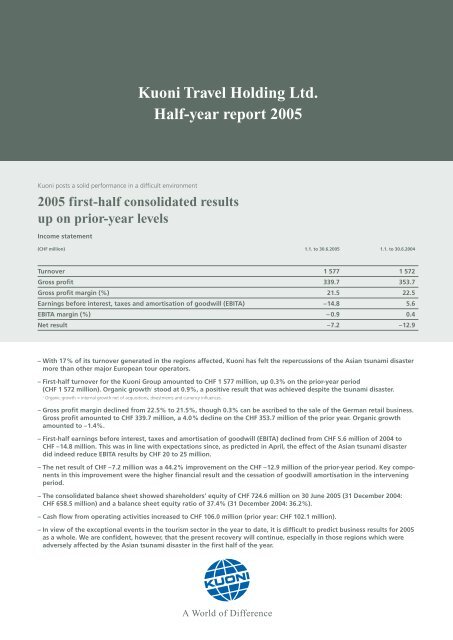

Income statement<br />

(CHF million) 1.1. to 30.6.<strong>2005</strong> 1.1. to 30.6.2004<br />

Turnover 1 577 1 572<br />

Gross profit 339.7 353.7<br />

Gross profit margin (%) 21.5 22.5<br />

Earnings before interest, taxes and amortisation of goodwill (EBITA) –14.8 5.6<br />

EBITA margin (%) – 0.9 0.4<br />

Net result –7.2 –12.9<br />

– With 17% of its turnover generated in the regions affected, <strong>Kuoni</strong> has felt the repercussions of the Asian tsunami disaster<br />

more than other major European tour operators.<br />

– First-half turnover for the <strong>Kuoni</strong> <strong>Group</strong> amounted to CHF 1 577 million, up 0.3% on the prior-<strong>year</strong> period<br />

(CHF 1 572 million). Organic growth 1 stood at 0.9%, a positive result that was achieved despite the tsunami disaster.<br />

1 Organic growth = internal growth net of acquisitions, divestments and currency influences.<br />

– Gross profit margin declined from 22.5% to 21.5%, though 0.3% can be ascribed to the sale of the German retail business.<br />

Gross profit amounted to CHF 339.7 million, a 4.0% decline on the CHF 353.7 million of the prior <strong>year</strong>. Organic growth<br />

amounted to –1.4%.<br />

– First-half earnings before interest, taxes and amortisation of goodwill (EBITA) declined from CHF 5.6 million of 2004 to<br />

CHF –14.8 million. This was in line with expectations since, as predicted in April, the effect of the Asian tsunami disaster<br />

did indeed reduce EBITA results by CHF 20 to 25 million.<br />

– The net result of CHF –7.2 million was a 44.2% improvement on the CHF –12.9 million of the prior-<strong>year</strong> period. Key components<br />

in this improvement were the higher financial result and the cessation of goodwill amortisation in the intervening<br />

period.<br />

– The consolidated balance sheet showed shareholders’ equity of CHF 724.6 million on 30 June <strong>2005</strong> (31 December 2004:<br />

CHF 658.5 million) and a balance sheet equity ratio of 37.4% (31 December 2004: 36.2%).<br />

– Cash flow from operating activities increased to CHF 106.0 million (prior <strong>year</strong>: CHF 102.1 million).<br />

– In view of the exceptional events in the tourism sector in the <strong>year</strong> to date, it is difficult to predict business results for <strong>2005</strong><br />

as a whole. We are confident, however, that the present recovery will continue, especially in those regions which were<br />

adversely affected by the Asian tsunami disaster in the first half of the <strong>year</strong>.

<strong>Kuoni</strong> half-<strong>year</strong> <strong>report</strong> <strong>2005</strong><br />

Business for the first half of <strong>2005</strong> was strongly influenced by the<br />

continuing effects of the Asian tsunami disaster at the end of the<br />

previous <strong>year</strong>. With 17% of its turnover generated in the regions<br />

affected, <strong>Kuoni</strong> has felt the repercussions of the disaster more<br />

than other major European tour operators. The subsequent cancellations<br />

and booking declines resulted in underutilisation of<br />

both <strong>Kuoni</strong>’s own and bought-in flight capacities. And this – as<br />

predicted at the Annual General Meeting in April <strong>2005</strong> – has<br />

reduced EBITA results by some CHF 20 to 25 million. “In an environment<br />

so marked by unexpected events, the <strong>Kuoni</strong> <strong>Group</strong> delivered<br />

a favourable performance,” comments Armin Meier, Chief<br />

Executive Officer of the <strong>Kuoni</strong> <strong>Group</strong>.<br />

Results of the <strong>Kuoni</strong> <strong>Group</strong><br />

The first-half turnover of CHF 1 577 million was a 0.3% improvement<br />

on the CHF 1 572 million of the prior-<strong>year</strong> period. Organic<br />

growth added 0.9%, the net negative impact of currency movements<br />

reduced turnover by 0.9% and the net effect of acquisitions<br />

and divestments 2 added 0.3% to the overall turnover result.<br />

Gross profit margin slipped from the 22.5% posted for the first<br />

half of 2004 to 21.5%, though 0.3% of this decline is due to the<br />

sale of <strong>Kuoni</strong>’s German retail business. Gross profit margin was<br />

also adversely affected by the turnover declines following the<br />

Asian tsunami disaster. Gross profit fell 4% to CHF 339.7 million<br />

(prior <strong>year</strong>: CHF 353.7 million).<br />

Operating costs rose by CHF 6.4 million. The increase was due in<br />

particular to the expansion of activities in the Asian market. Earnings<br />

before interest, taxes and amortisation of goodwill<br />

(EBITA) were reduced as a result of the adverse effects of the<br />

Asian tsunami disaster to CHF –14.8 million (prior <strong>year</strong>: CHF 5.6<br />

million). The EBITA margin declined from the 0.4% of the prior<strong>year</strong><br />

period to –0.9%.<br />

The net result for the traditionally weaker first six months was<br />

44.2% up, improving from the CHF –12.9 million of first-half<br />

2004 to CHF –7.2 million. Key contributors here included the cessation<br />

of goodwill amortisation in accordance with IFRS accounting<br />

standards and a substantially improved financial result.<br />

The consolidated balance sheet showed shareholders’ equity of<br />

CHF 724.6 million on 30 June <strong>2005</strong> (31 December 2004: CHF<br />

658.5 million) and a solid equity ratio of 37.4% (31 December<br />

2004: 36.2%). The strengthened equity base is the result of net<br />

recognised gains on financial instruments and positive translation<br />

differences. The par value repayment of 8 July <strong>2005</strong> approved by<br />

the <strong>2005</strong> Annual General Meeting will have its balance-sheet<br />

impact in the second half-<strong>year</strong>.<br />

Cash flow from operating activities amounted to an encouraging<br />

CHF 106 million (prior <strong>year</strong>: CHF 102.1 million). Free cash flow<br />

totalled CHF 92 million for the period.<br />

2 Acquisitions and divestments: the purchase of Royal Hansa Cruises Netherlands and the business<br />

activities of CIT-Frantour SA, and the sale of <strong>Kuoni</strong> Reisen GmbH Deutschland and the<br />

Caribbean hotels.

<strong>Kuoni</strong> half-<strong>year</strong> <strong>report</strong> <strong>2005</strong><br />

Results by business area<br />

Switzerland<br />

In a still difficult market environment, Strategic Business Unit Switzerland<br />

generated turnover of CHF 339 million for the first six<br />

months of <strong>2005</strong>, an 8.6% decline on the CHF 371 million of the<br />

prior-<strong>year</strong> period. While the <strong>Kuoni</strong> brand saw positive trends,<br />

results were less encouraging for Reisen Netto and Helvetic Tours.<br />

EBITA declined 66.7% from the CHF –7.8 million of the prior-<strong>year</strong><br />

period to CHF –13.0 million. The <strong>Kuoni</strong> <strong>Group</strong> acquired all the<br />

business activities of CIT-Frantour SA effective 30 April <strong>2005</strong>.<br />

Scandinavia<br />

Strategic Business Unit Scandinavia <strong>report</strong>ed a positive trend in its<br />

first-half turnover, which, at CHF 300 million, was a 15.8%<br />

improvement on the CHF 259 million of the prior <strong>year</strong>. Sweden<br />

made the biggest contribution, exceeding its prior-<strong>year</strong> turnover<br />

by 11.7%. Norway raised its first-half turnover by as much as<br />

41.4% <strong>year</strong>-on-<strong>year</strong>, while turnover for Denmark was 4.4% above<br />

the prior-<strong>year</strong> period. First-half EBITA for Scandinavia declined<br />

from the CHF –5.4 million of the prior <strong>year</strong> to CHF –7.0 million.<br />

Sweden suffered most from the effects of the Asian tsunami disaster,<br />

while <strong>Kuoni</strong>’s Scandinavian airline incurred extraordinary<br />

expenditure amounting to CHF 4 million.<br />

Europe<br />

First-half results for the country organisations within Strategic<br />

Business Division Europe were largely in line with prior-<strong>year</strong> levels.<br />

Total turnover showed a minimal 0.4% rise to CHF 252 million.<br />

Once again, the greatest turnover contribution came from <strong>Kuoni</strong><br />

France. First-half EBITA for the division declined from the CHF<br />

–3.3 million of the prior-<strong>year</strong> period to CHF –3.9 million. The<br />

<strong>Kuoni</strong> <strong>Group</strong> sold <strong>Kuoni</strong> Reisen GmbH, domiciled in Friedrichshafen<br />

(Germany), effective 1 January <strong>2005</strong>.<br />

United Kingdom & North America<br />

Turnover for Strategic Business Division United Kingdom & North<br />

America amounted to CHF 354 million for the first six months of<br />

<strong>2005</strong>, a 9.2% decline on the CHF 390 million of the prior-<strong>year</strong><br />

period. While operating results were improved in North America,<br />

first-half EBITA for the division declined 32.6% <strong>year</strong>-on-<strong>year</strong> from<br />

CHF 27.6 million to CHF 18.6 million. The reduction is due to the<br />

turnover losses following the Asian tsunami in the Maldives, Sri<br />

Lanka and Thailand, which are all long-established leading <strong>Kuoni</strong><br />

UK destinations.<br />

Incoming & Asia<br />

Strategic Business Division Incoming & Asia increased its first-half<br />

turnover by 9.5% in <strong>2005</strong>, from the CHF 326 million of the prior<strong>year</strong><br />

period to CHF 357 million. In view of the further expansion<br />

of the <strong>Group</strong>’s Asian business, first-half EBITA for the division<br />

declined 30.8% from CHF 2.6 million to CHF 1.8 million.<br />

Second half-<strong>year</strong> developments and outlook<br />

By 14 August <strong>2005</strong>, Swiss-franc booking levels for the <strong>Kuoni</strong><br />

<strong>Group</strong>’s tour operating business were 1% up on their prior-<strong>year</strong><br />

equivalent. Year-on-<strong>year</strong> booking levels for the key business areas<br />

were as follows:<br />

– Switzerland –12%<br />

– United Kingdom –11%<br />

– France +01%<br />

– Scandinavia +21%<br />

<strong>Kuoni</strong> opened its second Chinese representative office – in Shanghai<br />

– on 18 August. Having opened its first such office in Beijing<br />

in mid-March <strong>2005</strong>, <strong>Kuoni</strong> thus continues to pursue its growth<br />

strategy in the Asian market.<br />

The strategic reappraisal of Intrav, the <strong>Kuoni</strong> <strong>Group</strong>’s US-based<br />

subsidiary, is continuing according to plan, and should be completed<br />

by <strong>year</strong>-end. All options, including a possible sale, are being<br />

considered in terms of their value-adding potential. This will<br />

enable <strong>Kuoni</strong> to assess the continued value of its investments by<br />

the end of the <strong>year</strong>.<br />

In view of the exceptional events in the tourism sector in the <strong>year</strong><br />

to date, it is difficult to predict business results for <strong>2005</strong> as a<br />

whole. We are confident, however, that the present recovery will<br />

continue, especially in those regions which were adversely affected<br />

by the Asian tsunami disaster in the first half of the <strong>year</strong>. The<br />

fact that July <strong>2005</strong> exceeded our expectations in both turnover<br />

and EBITA terms gives additional cause for confidence in the<br />

weeks and months ahead.<br />

Zurich, 23 August <strong>2005</strong>

<strong>Kuoni</strong> half-<strong>year</strong> <strong>report</strong> <strong>2005</strong><br />

Agenda<br />

The <strong>Kuoni</strong> <strong>Group</strong> will present details of its<br />

further business performance on the following dates:<br />

10 November <strong>2005</strong> Nine-months <strong>2005</strong> Results<br />

16 March 2006 Annual Results <strong>2005</strong><br />

Contact<br />

<strong>Kuoni</strong> <strong>Travel</strong> <strong>Holding</strong> <strong>Ltd</strong>. Phone +41 44 277 45 29<br />

Investor Relations Fax +41 44 277 40 31<br />

Mrs. Laurence Bienz laurence.bienz@kuoni.com<br />

Neue Hard 7<br />

CH-8010 Zurich<br />

www.kuoni.com<br />

This half-<strong>year</strong> <strong>report</strong> is also available in English.<br />

The German original is binding.<br />

Der Halbjahresbericht ist auch in englischer Sprache erhältlich.<br />

Massgebend ist der deutsche Originaltext.

<strong>Kuoni</strong> <strong>Travel</strong> <strong>Holding</strong> <strong>Ltd</strong>.<br />

Interim Consolidated Financial Statements<br />

at 30 June <strong>2005</strong>

Consolidated income statement for the first half of <strong>2005</strong><br />

CHF million 1.1.–30.6.05 1.1.–30.6.04 change in % 1.1.–31.12.04<br />

Turnover 1 577 1 572 0.3 3 581<br />

Direct costs –1 237.2 –1 218.8 –1.5 –2 762.1<br />

Gross profit 339.7 353.7 –4.0 818.9<br />

Personnel expense –192.8 –184.7 –4.4 –373.3<br />

Marketing and advertising expense –52.4 –53.4 1.9 –99.9<br />

Other operating expense –87.0 –87.1 0.1 –172.7<br />

Depreciation –22.3 –22.9 2.6 –45.4<br />

Earnings before interest, taxes<br />

and amortisation of goodwill (EBITA) –14.8 5.6 –364.3 127.6<br />

Amortisation of goodwill 0.0 –16.3 100.0 –32.5<br />

Earnings before interest and<br />

taxes (EBIT) –14.8 –10.7 –38.3 95.1<br />

Financial result 12.7 6.7 89.6 10.9<br />

Result before taxes –2.1 –4.0 47.5 106.0<br />

Income taxes –5.1 –8.9 42.7 –31.9<br />

Net result –7.2 –12.9 44.2 74.1<br />

Of which:<br />

Net result attributable to minority interests 0.2 0.0 100.0 0.3<br />

Net result attributable to<br />

<strong>Kuoni</strong> <strong>Travel</strong> <strong>Holding</strong> <strong>Ltd</strong>. shareholders –7.4 –12.9 42.6 73.8<br />

Pre-goodwill earnings –7.2 3.4 –311.8 106.6<br />

Basic earnings per registered share B in CHF –2.48 –4.37 24.88<br />

Diluted earnings per registered share B in CHF –2.48 –4.37 24.86<br />

Breakdown of Turnover by business area<br />

CHF million 1.1.–30.6.05 1.1.–30.6.04 change in % 1.1.–31.12.04<br />

Switzerland 339 371 –8.6 890<br />

Scandinavia 300 259 15.8 595<br />

Europe 252 251 0.4 597<br />

United Kingdom & North America 354 390 –9.2 827<br />

Incoming & Asia 357 326 9.5 730<br />

Less revenues generated between segments –25 –25 0.0 –58<br />

Total 1 577 1 572 0.3 3 581<br />

Breakdown of EBITA by business area<br />

% of % of % of<br />

CHF million 1.1.–30.6.05 turnover 1.1.–30.6.04 turnover 1.1.–31.12.04 turnover<br />

Switzerland –13.0 –3.8 –7.8 –2.1 34.2 3.8<br />

Scandinavia –7.0 –2.3 –5.4 –2.1 16.4 2.8<br />

Europe –3.9 –1.5 –3.3 –1.3 15.3 2.6<br />

United Kingdom &<br />

North America 18.6 5.3 27.6 7.1 63.1 7.6<br />

Incoming & Asia 1.8 0.5 2.6 0.8 17.8 2.4<br />

Corporate –11.3 n.a. –8.1 n.a. –19.2 n.a.<br />

Total –14.8 – 0.9 5.6 0.4 127.6 3.6

Consolidated balance sheet (condensed)<br />

CHF million. 30.06.05 31.12.04 30.06.04<br />

Non-current assets<br />

Tangible fixed assets 321.1 318.0 329.2<br />

Goodwill 323.2 299.9 330.2<br />

Other intangible assets 9.2 6.5 6.8<br />

Financial assets 133.8 165.2 158.5<br />

Current assets<br />

Cash and cash equivalents 685.5 677.1 694.2<br />

Time deposits and securities 34.2 78.9 71.4<br />

Other current assets 429.0 273.0 371.7<br />

Total assets 1 936.0 1 818.6 1 962.0<br />

CHF million 30.06.05 31.12.04 30.06.04<br />

Equity 724.6 658.5 611.9<br />

Long-term liabilities 153.8 143.4 158.3<br />

Advance payments by customers 483.9 305.7 440.0<br />

Other short-term liabilities 573.7 711.0 751.8<br />

Total equity and liabilities 1 936.0 1 818.6 1 962.0<br />

Changes in equity (condensed)<br />

CHF million <strong>2005</strong> 2004<br />

Equity as at 1 January 658.5 614.8<br />

Net result –7.2 –12.9<br />

Profits distributed –0.1 –20.8<br />

Disposal of treasury shares 4.5 2.5<br />

Reduction of minority interests 0.0 –0.7<br />

Recognised gains or losses on financial instruments 40.7 18.4<br />

Translation differences 28.2 10.6<br />

Equity as at 30 June 724.6 611.9<br />

Cash flow statement (condensed)<br />

CHF million 1.1.–30.6.05 1.1.–30.6.04<br />

Net result –7.2 –12.9<br />

Depreciation 22.3 22.9<br />

Amortisation of goodwill 0.0 16.3<br />

Other non-cash expenses and income –7.0 –18.0<br />

Changes in net working capital 97.9 93.8<br />

Cash flow from operating activities 106.0 102.1<br />

Net cash from investing activities 51.8 104.5<br />

Net cash used in financing activities –170.1 –84.8

<strong>Kuoni</strong> half-<strong>year</strong> <strong>report</strong> <strong>2005</strong><br />

Notes to the interim consolidated<br />

financial statements<br />

The unaudited interim consolidated financial statements at 30<br />

June <strong>2005</strong> have been prepared in accordance with the accounting<br />

principles set out in International Accounting Standard 34 (IAS 34)<br />

“Interim Financial Reporting” and, being an updated version of<br />

previously-published information, should be read in connection<br />

with the consolidated financial statements for the business <strong>year</strong><br />

ended 31 December 2004. These interim consolidated financial<br />

statements were approved for publication by the Board of Directors<br />

on 18 August <strong>2005</strong>.<br />

With the exception of the changes listed below, the accounting<br />

principles applied to and the presentation of these interim consolidated<br />

financial statements are unchanged from those of the consolidated<br />

financial statements for 2004. Comparable figures have<br />

been reclassified or expanded where necessary to reflect changes<br />

in the presentation of the interim consolidated financial statements.<br />

The International Accounting Standards Board (IASB) issued a revised<br />

version of IAS 32 “Financial Instruments: Disclosure and Presentation”,<br />

a revised version of IAS 39 “Financial Instruments:<br />

Recognition and Measurement” and a general revision of its International<br />

Accounting Standards (IAS) which included revisions of<br />

14 existing standards in 2003. In 2004 the IASB published standards<br />

IFRS 2 “Share-based Payment”, IFRS 3 “Business Combinations”,<br />

IFRS 4 “Insurance Contracts”, IFRS 5 “Non-current Assets<br />

Held for Sale and Discontinued Operations”, revised versions of<br />

IAS 36 “Impairment of Assets” and IAS 38 “Intangible Assets”<br />

and further additions to IAS 39. The <strong>Kuoni</strong> <strong>Group</strong> has applied<br />

these standards with effect from 1 January <strong>2005</strong>. The effects of<br />

these changes on the interim consolidated financial statements of<br />

the <strong>Kuoni</strong> <strong>Group</strong> are presented below.<br />

IFRS 3 “Business Combinations”: The new standard requires, inter<br />

alia, the cessation of the systematic straight-line amortisation of<br />

goodwill from 1 January <strong>2005</strong>. Such amortisation of goodwill<br />

amounted to CHF 16.3 million in the first half of 2004. In the case<br />

of new acquisitions, identifiable intangible assets must now be<br />

recognised separately from goodwill and must be amortised over<br />

their expected useful lives.<br />

The <strong>Kuoni</strong> <strong>Group</strong> has assessed the impact of the other revised and<br />

newly-applicable standards, and has concluded that they have no<br />

significant effect on the consolidated financial statements.<br />

The scope of consolidation changed as a result of acquisitions and<br />

disposals in the first six months of <strong>2005</strong>. The most significant of<br />

these are:<br />

– the disposal of <strong>Kuoni</strong> Reisen GmbH, Friedrichshafen,<br />

Germany effective 1 January <strong>2005</strong> and<br />

– the acquisition of the business activities of CIT-Frantour SA,<br />

Geneva effective 30 April <strong>2005</strong>.<br />

<strong>Kuoni</strong> Reisen GmbH, Friedrichshafen, Germany: <strong>Kuoni</strong> <strong>Travel</strong><br />

<strong>Holding</strong> <strong>Ltd</strong>. sold its German-based <strong>Kuoni</strong> Reisen GmbH subsidiary<br />

to Otto Freizeit und Touristik GmbH. Results for of this subsidiary<br />

were previously included within Business Area Europe.<br />

Business activities of CIT-Frantour SA, Geneva: <strong>Kuoni</strong> <strong>Travel</strong> <strong>Holding</strong><br />

<strong>Ltd</strong>. acquired the business activities and the workforce consisting<br />

of around 100 employees of CIT-Frantour SA after the company<br />

sought “Nachlassstundung” administration and protection<br />

from creditors under Swiss law as a result of liquidity problems.<br />

If the creditors’ meeting (scheduled for spring 2006) approves the<br />

proposed brand transfer, the total purchase price will amount to<br />

approximately CHF 9 million. The company’s net assets were<br />

acquired in May <strong>2005</strong>.<br />

The <strong>Kuoni</strong> <strong>Group</strong> repaid the 1% convertible bond with a nominal<br />

value of CHF 178.6 million shown under short-term liabilities in<br />

the first half of <strong>2005</strong>. Although seasonal trends tend to make the<br />

first six months the weaker half of the <strong>year</strong> in business terms, and<br />

despite the negative net result, equity showed a positive trend<br />

thanks to translation differences and net recognised gains on<br />

financial instruments. No dividend was distributed to <strong>Kuoni</strong> shareholders;<br />

but the nominal value of the <strong>Kuoni</strong> share was reduced<br />

with a corresponding repayment to shareholders, as approved by<br />

the <strong>2005</strong> Annual General Meeting. Since this was not effected<br />

until 8 July <strong>2005</strong>, however, the resulting change in equity is not<br />

reflected in the first-half financial statements.<br />

No subsequent events have occurred since 30 June <strong>2005</strong> which<br />

would require adjustments to the carrying amounts of the <strong>Kuoni</strong><br />

<strong>Group</strong>’s assets or liabilities or would have to be disclosed here.