Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

kuoni travel holding ltd.<br />

<strong>2008</strong> <strong>Nine</strong>-<strong>Month</strong> <strong>Report</strong>

02 kuoni group <strong>2008</strong> nine-month report<br />

www.kuoni-group.com<br />

<strong>Kuoni</strong> reports further turnover and earnings growth<br />

The <strong>Kuoni</strong> <strong>Group</strong> raised its third-quarter turnover by 4.0% to<br />

CHF 1 547 million in <strong>2008</strong>. Earnings before interest and taxes<br />

(EBIT) for the period were increased by 8.2%, to CHF 105.8<br />

million. As a result, the CHF 3 775 million turnover generated<br />

for the first nine months of <strong>2008</strong> was an improvement of 7.4%<br />

on the prior-year period. <strong>Nine</strong>-month EBIT was increased by<br />

an even higher 15.7% to CHF 119.7 million. Strategic Business<br />

Units (SBUs) Scandinavia, Switzerland and Asia & Destination<br />

income statement 1.1.–30.9.<strong>2008</strong> 1.1.–30.9.2007 change in %<br />

(chF million)<br />

turnover 3 775.0 3 514.8 +7.4<br />

gross profit 800.0 756.6 +5.7<br />

gross profit margin (%) 21.2 21.5<br />

earnings before interest and taxes (eBit) 119.7 103.5 +15.7<br />

eBit margin (%) 3.2 2.9<br />

net result 120.6 99.2 +21.6<br />

cash flow 172.9 242.5 –28.7<br />

results highlights for the first nine months of <strong>2008</strong><br />

► <strong>Group</strong> turnover totalled CHF 3 775 million, a 7.4% improvement<br />

on the CHF 3 515 million of the prior-year period.<br />

Organic growth accounted for 7.2 percentage points of the<br />

increase and acquisitions for 5.9 percentage points, while<br />

currency movements (particularly in the UK) reduced the<br />

increase by a substantial 5.7 percentage points.<br />

► Earnings before interest and taxes (EBIT) saw a sizeable<br />

increase to CHF 119.7 million, 15.7% up on the CHF 103.5<br />

million of 2007.<br />

► Third-quarter turnover increased to CHF 1 547 million,<br />

while EBIT was improved to CHF 105.8 million.<br />

Management were the prime contributors to the encouraging<br />

turnover and earnings rises of the first nine months. At SBU<br />

United Kingdom, by contrast, the already-advanced economic<br />

crisis and the resulting consumer restraint continued to<br />

depress demand. <strong>Kuoni</strong> further pursued its growth strategy,<br />

acquiring Australian Tours Management and UK-based luxury<br />

tour operator Carrier in the third-quarter period.<br />

► <strong>Kuoni</strong>’s growth strategy was further pursued with the<br />

acquisitions of Carrier (of the UK) and Australian Tours<br />

Management. The acquisitions will be included in the scope<br />

of consolidation from 1 October and 1 November <strong>2008</strong><br />

respectively.<br />

► <strong>Kuoni</strong>‘s repositioning as a global travel brand with innovative<br />

product lines, a contemporary-stlye logo and new-look<br />

brochures was successfully launched worldwide with the<br />

Global Launch Event in London in September <strong>2008</strong>.

Results of the <strong>Kuoni</strong> <strong>Group</strong><br />

<strong>Group</strong> TURNOVER for the first nine months of <strong>2008</strong> rose<br />

to CHF 3 775 million, compared to CHF 3 515 million for<br />

the prior-year period. The positive turnover result was<br />

buoyed by above-average organic growth of 7.2%. Acquisitions<br />

added 5.9% to turnover for the period, while the net<br />

impact of currency movements eroded 5.7% from the result.<br />

GROSS PROFIT was increased to CHF 800 million, up 5.7%<br />

on the first nine months of 2007. Gross profit margin<br />

showed a slight decline to 21.2%.<br />

EARNINGS BEFORE INTEREST AND TAXES (EBIT) were<br />

encouragingly improved compared to their prior-year<br />

equivalent, rising from CHF 103.5 million to CHF 119.7<br />

million. The 15.7% increase is attributable largely to<br />

results at SBUs Asia & Destination Management and Scandinavia,<br />

though a sizeable EBIT increase at SBU Switzerland<br />

also made a major contribution. Depreciation no longer<br />

required on Edelweiss Air also added CHF 8.6 million<br />

to the EBIT result. EBIT margin rose encouragingly from<br />

2.9% to 3.2%.<br />

The NET RESULT of CHF 120.6 million for the first nine<br />

months of <strong>2008</strong> was a substantial 21.6% improvement on<br />

the CHF 99.2 million of the prior-year period.<br />

CASH FLOW from operating activities for the first nine<br />

months declined 28.7% to CHF 173 million (prior-year<br />

period: CHF 243 million). The improvement in operational<br />

cash flow amounted to CHF 17 million, this was more than<br />

offset by an increase in accounts receivable (CHF 29 milli-<br />

kuoni group <strong>2008</strong> nine-month report<br />

on, attributable largely to above-average growth in<br />

destina tion management business), a decline in customer<br />

pre payments (CHF 31 million; UK and Scandinavia) and<br />

a decline in other net working capital (CHF 27 million).<br />

While customer prepayments at the end of September<br />

were above their prior-year level in Scandinavia in localcurrency<br />

terms, the decline in the UK reflects the currently-difficult<br />

market environment. Free cash flow stood<br />

at CHF 134 million (prior-year period: CHF 218 million).<br />

The BALANCE SHEET showed equity of CHF 647 million<br />

on 30 September <strong>2008</strong> (compared to CHF 601 million a<br />

year ago) and an equity ratio of 30.2% (which compares to<br />

28.9% on 30 September 2007).<br />

<strong>2008</strong> third-quarter performance<br />

The <strong>Kuoni</strong> <strong>Group</strong> generated turnover of CHF 1 547 million<br />

for the third quarter of <strong>2008</strong>, a 4.0% increase on the CHF<br />

1 488 million of July-to-September 2007. Of this 4.0% increase,<br />

4.1 percentage points were achieved through organic<br />

growth and 5.6 percentage points through acquisitions,<br />

while the net negative impact of currency movements reduced<br />

such growth by 5.7 percentage points.<br />

Gross profit for the quarter showed a slight increase, from<br />

the CHF 330 million of the prior year to CHF 332 million,<br />

while gross profit margin amounted to 21.5%. Third-quarter<br />

earnings before interest and taxes (EBIT) amounted to CHF<br />

105.8 million (compared to CHF 97.8 million for the prioryear<br />

period), while the net result was increased from CHF<br />

95.7 million to CHF 99.3 million.<br />

03

04 kuoni group <strong>2008</strong> nine-month report<br />

www.kuoni-group.com<br />

Third-Quarter <strong>2008</strong> Results by Strategic Business Unit<br />

switzerland<br />

europe<br />

The turnaround achieved at SBU Switzerland in the first half SBU Europe sustained a decline in its third-quarter turn-<br />

of <strong>2008</strong> was further confirmed by the unit’s third-quarter over, from the CHF 262 million of the prior-year period to<br />

results: the CHF 349 million turnover was a 9.4% improve- CHF 233 million. EBIT for the period totalled CHF 16.4 milment<br />

on the CHF 319 million of the same quarter last year. lion (compared to CHF 18.4 million a year ago). The declines<br />

The successful repositioning of the Helvetic Tours inclusive- are due primarily to the relative weakness of the euro and<br />

tour brand and the acquisition of Direkt Reisen both made<br />

substantial contributions to the higher turnover volume.<br />

to the sale of the unit’s Austrian retail operations.<br />

EBIT was also tangibly improved, from CHF 22.0 million to united kingdom<br />

CHF 31.5 million. The EBIT result includes the positive effect While third-quarter turnover at SBU United Kingdom de-<br />

of CHF 2.9 million of depreciation no longer required on clined from CHF 213 million to CHF 167 million, the unit’s<br />

Edelweiss Air following its sale to Swiss.<br />

EBIT for the period was improved from CHF 8.2 million to<br />

CHF 9.2 million. A severe weakening of the British pound<br />

scandinavia<br />

substantially eroded the earnings result, however; and the<br />

SBU Scandinavia (including New Ventures) achieved a economic downturn and its impact on consumer mood<br />

further sizeable turnover increase for the third quarter of prompted a continued decline in demand that was exacerba-<br />

<strong>2008</strong>: the CHF 420 million turnover for the period was 24.3% ted by the global financial crisis, which has hit the UK parti-<br />

up on the CHF 338 million of July-to-September 2007. EBIT<br />

for the period declined, however, from the CHF 38.3 million<br />

cularly hard.<br />

of the previous year to CHF 31.6 million. Individually, asia & destination management<br />

Scandinavian operations (excluding New Ventures) genera- SBU Asia & Destination Management further improved its<br />

ted third-quarter turnover of CHF 382 million, a 13.0% im- turnover result in the third quarter of <strong>2008</strong>, from the CHF<br />

provement that stems largely from above-average turnover 381 million of the prior-year period to CHF 398 million.<br />

growth in Norway and Denmark. EBIT amounted to CHF EBIT was raised from CHF 22.5 million to CHF 24.9 million.<br />

38.8 million, a 6.1% decline which was due largely to the fact The turnover increase is due to the acquisition of Dubai-<br />

that the comparable results for summer 2007 had been subsbased Desert Adventures Tourism and to the growth in destitantially<br />

boosted by an exceptionally rainy Scandinavian nation management business in Europe and the USA. The<br />

summer that had encouraged outbound travel.<br />

Indian tour operating business and the services provided by<br />

VFS Global (Visa Facilitation Services) also made further<br />

On the New Ventures front, the Shoestring International<br />

operation is to be closed down at the end of <strong>2008</strong> after failing<br />

to achieve sufficient market penetration. The Russian market<br />

also remains very difficult and fiercely contested, putting<br />

pressure on the corresponding margins. Action has already<br />

been initiated to improve results here.<br />

gains, despite sizeable adverse currency movements.

Outlook for <strong>2008</strong> as a whole<br />

BOOKING LEVELS as of 2 November <strong>2008</strong> for the <strong>Kuoni</strong><br />

<strong>Group</strong>’s tour operating business were 3% higher in Swiss-franc<br />

terms than their prior-year equivalents. Organic growth stood<br />

at 3%. Year-on-year booking trends for key business units:<br />

Switzerland +6%<br />

Scandinavia +15%<br />

France +3% (in local EUR terms +6%)<br />

United Kingdom –16% (in local GBP terms –1%)<br />

India –1% (in local INR terms +15%)<br />

zurich, 11 november <strong>2008</strong><br />

Key Dates in 2009<br />

The <strong>Kuoni</strong> <strong>Group</strong> will be reporting on its further business performance<br />

on the following dates:<br />

<strong>2008</strong> Annual Results 19 March 2009<br />

2009 Annual General Meeting of Shareholders 21 April 2009<br />

kuoni group <strong>2008</strong> nine-month report<br />

In view of the global financial crisis and the associated fears of<br />

recession, a slow down in growth can be expected in the<br />

fourth-quarter period.<br />

05

06 kuoni group <strong>2008</strong> nine-month report<br />

www.kuoni-group.com<br />

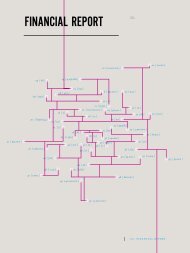

Income Statement (condensed)<br />

chF million 1.1.– 1.1.– CHAnGE 3 rd QUARTER 3 rd QUaRteR change<br />

30.9.<strong>2008</strong> 30.9.2007 in % <strong>2008</strong> 2007 in %<br />

turnover 3 775.0 3 514.8 +7.4 1 546.7 1 487.6 +4.0<br />

Direct costs –2 975.0 –2 758.2 –7.9 –1 214.6 –1 157.6 –4.9<br />

gross profit 800.0 756.6 +5.7 332.1 330.0 +0.6<br />

Personnel expense –373.2 –347.8 –7.3 –124.7 –121.8 –2.4<br />

marketing and advertising expense –102.2 –98.9 –3.3 –33.6 –34.4 +2.3<br />

other operating expense –170.7 –164.6 –3.7 –55.4 –60.9 +9.0<br />

Depreciation –34.2 –41.8 +18.2 –12.6 –15.1 +16.6<br />

earnings before interest<br />

and taxes (eBit) 119.7 103.5 +15.7 105.8 97.8 +8.2<br />

Financial result 20.1 12.2 +64.8 3.6 4.7 –23.4<br />

earnings before taxes 139.8 115.7 +20.9 109.4 102.5 +6.7<br />

income taxes –19.2 –16.5 –16.4 –10.1 –6.8 –48.5<br />

net result<br />

of which:<br />

120.6 99.2 +21.6 99.3 95.7 +3.8<br />

minority interests<br />

net result attributable to share-<br />

–2.0 0.5 –0.8 0.4<br />

holders of <strong>Kuoni</strong> travel holding ltd. 122.6 98.7 100.1 95.3<br />

Basic earnings per registered<br />

share B in chF<br />

Diluted earnings per registered<br />

42.87 33.67<br />

share B in chF 42.87 33.67

Turnover by Strategic Business Unit<br />

kuoni group <strong>2008</strong> nine-month report<br />

chF million 1.1.– 1.1.– CHAnGE 3 rd QUARTER 3 rd QUaRteR change<br />

30.9.<strong>2008</strong> 30.9.2007 in % <strong>2008</strong> 2007 in %<br />

switzerland 775 737 +5.2 349 319 +9.4<br />

scandinavia 944 743 +27.1 420 338 +24.3<br />

europe 544 564 –3.5 233 262 –11.1<br />

United Kingdom 500 573 –12.7 167 213 –22.6<br />

asia & Destination management 1 070 959 +11.6 398 381 +4.5<br />

corporate 10 10 0 4 4 0<br />

less intersegment revenue –68 –71 n.a. –24 –29 n.a.<br />

total 3 775 3 515 +7.4 1 547 1 488 +4.0<br />

EBIT by Strategic Business Unit<br />

chF million 1.1.– 1.1.– CHAnGE 3 rd QUARTER 3 rd QUaRteR change<br />

30.9.<strong>2008</strong> 30.9.2007 in % <strong>2008</strong> 2007 in %<br />

switzerland 24.5 8.6 +184.9 31.5 22.0 +43.2<br />

scandinavia 34.6 41.2 –16.0 31.6 38.3 –17.8<br />

europe 15.3 16.2 –5.6 16.4 18.4 –10.9<br />

United Kingdom 26.6 31.1 –14.5 9.2 8.2 +12.2<br />

asia & Desitnation management 44.7 32.3 +38.4 24.9 22.5 +10.7<br />

corporate –26.0 –25.9 –0.4 –7.7 –11.6 +33.6<br />

total 119.7 103.5 +15.7 105.8 97.8 +8.2<br />

07

disclaimer<br />

If we formulate forecasts or expectations in this announcement or if our statements<br />

relate to the future, these statements may be associated with known and<br />

unknown risks and uncertainties. Actual outcomes and developments may, therefore,<br />

deviate significantly from the expectations and assumptions expressed. The<br />

performance of financial markets and exchange rates as well as national and international<br />

law amendments, particularly with regard to tax regulations, may also<br />

have an influence. Except as required by law, the company assumes no obligation<br />

to update forward-looking statements.<br />

further information<br />

for media representatives<br />

Peter Brun<br />

Head of Corporate Communications<br />

<strong>Kuoni</strong> Travel Holding Ltd.<br />

Neue Hard 7<br />

CH-8010 Zurich<br />

P +41 (0)44 277 48 28<br />

M +41 (0)76 370 24 24<br />

peter.brun@kuoni.com<br />

for analysts and investors<br />

Laurence Bienz<br />

Head of Investor Relations<br />

<strong>Kuoni</strong> Travel Holding Ltd.<br />

Neue Hard 7<br />

CH-8010 Zurich<br />

P +41 (0)44 277 45 29<br />

laurence.bienz@kuoni.com