Annual Report & Accounts 2006 - Euromoney Institutional Investor ...

Annual Report & Accounts 2006 - Euromoney Institutional Investor ...

Annual Report & Accounts 2006 - Euromoney Institutional Investor ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

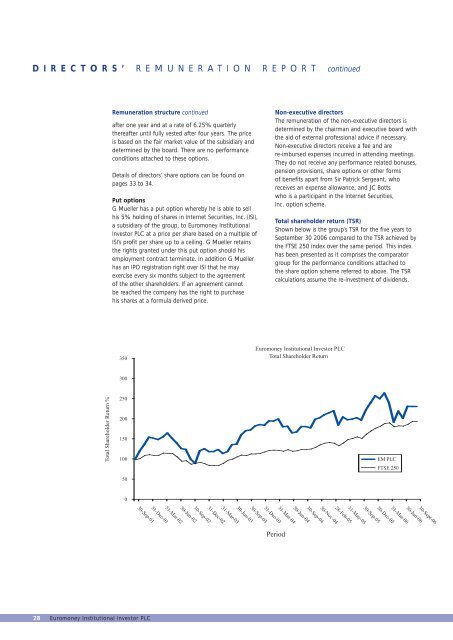

DIRECTORS’REMUNERATION REPORT continuedRemuneration structure continuedafter one year and at a rate of 6.25% quarterlythereafter until fully vested after four years. The priceis based on the fair market value of the subsidiary anddetermined by the board. There are no performanceconditions attached to these options.Details of directors’ share options can be found onpages 33 to 34.Put optionsG Mueller has a put option whereby he is able to sellhis 5% holding of shares in Internet Securities, Inc. (ISI),a subsidiary of the group, to <strong>Euromoney</strong> <strong>Institutional</strong><strong>Investor</strong> PLC at a price per share based on a multiple ofISI’s profit per share up to a ceiling. G Mueller retainsthe rights granted under this put option should hisemployment contract terminate. In addition G Muellerhas an IPO registration right over ISI that he mayexercise every six months subject to the agreementof the other shareholders. If an agreement cannotbe reached the company has the right to purchasehis shares at a formula derived price.Non-executive directorsThe remuneration of the non-executive directors isdetermined by the chairman and executive board withthe aid of external professional advice if necessary.Non-executive directors receive a fee and arere-imbursed expenses incurred in attending meetings.They do not receive any performance related bonuses,pension provisions, share options or other formsof benefits apart from Sir Patrick Sergeant, whoreceives an expense allowance, and JC Bottswho is a participant in the Internet Securities,Inc. option scheme.Total shareholder return (TSR)Shown below is the group’s TSR for the five years toSeptember 30 <strong>2006</strong> compared to the TSR achieved bythe FTSE 250 index over the same period. This indexhas been presented as it comprises the comparatorgroup for the performance conditions attached tothe share option scheme referred to above. The TSRcalculations assume the re-investment of dividends.350<strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLCTotal Shareholder Return300Total Shareholder Return %250200150100EM PLCFTSE 25050030-Sept-0630-Jun-0631-Mar-0630-Dec-0530-Sep-0531-May-0528-Feb-0530-Nov-0430-Sep-0430-Jun-0431-Mar-0431-Dec-0330-Sep-0330-Jun-0331-Mar-0331-Dec-0230-Sep-0230-Jun-0231-Mar-0231-Dec-0130-Sep-01Period28 <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLC