Annual Report & Accounts 2006 - Euromoney Institutional Investor ...

Annual Report & Accounts 2006 - Euromoney Institutional Investor ...

Annual Report & Accounts 2006 - Euromoney Institutional Investor ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

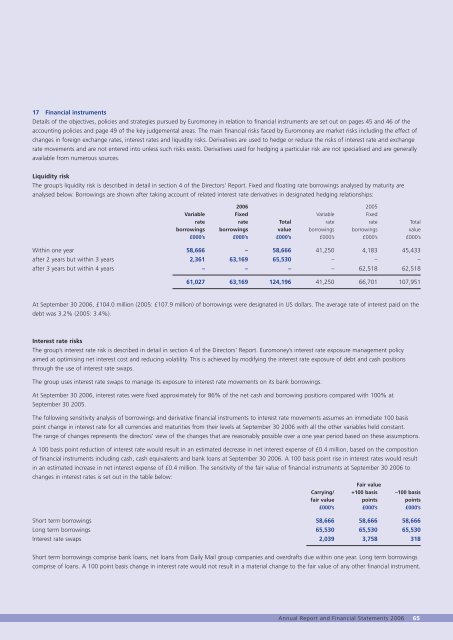

17 Financial instrumentsDetails of the objectives, policies and strategies pursued by <strong>Euromoney</strong> in relation to financial instruments are set out on pages 45 and 46 of theaccounting policies and page 49 of the key judgemental areas. The main financial risks faced by <strong>Euromoney</strong> are market risks including the effect ofchanges in foreign exchange rates, interest rates and liquidity risks. Derivatives are used to hedge or reduce the risks of interest rate and exchangerate movements and are not entered into unless such risks exists. Derivatives used for hedging a particular risk are not specialised and are generallyavailable from numerous sources.Liquidity riskThe group’s liquidity risk is described in detail in section 4 of the Directors‘ <strong>Report</strong>. Fixed and floating rate borrowings analysed by maturity areanalysed below. Borrowings are shown after taking account of related interest rate derivatives in designated hedging relationships:<strong>2006</strong> 2005Variable Fixed Variable Fixedrate rate Total rate rate Totalborrowings borrowings value borrowings borrowings value£000’s £000’s £000’s £000’s £000’s £000’sWithin one year 58,666 – 58,666 41,250 4,183 45,433after 2 years but within 3 years 2,361 63,169 65,530 – – –after 3 years but within 4 years – – – – 62,518 62,51861,027 63,169 124,196 41,250 66,701 107,951At September 30 <strong>2006</strong>, £104.0 million (2005: £107.9 million) of borrowings were designated in US dollars. The average rate of interest paid on thedebt was 3.2% (2005: 3.4%).Interest rate risksThe group’s interest rate risk is described in detail in section 4 of the Directors’ <strong>Report</strong>. <strong>Euromoney</strong>’s interest rate exposure management policyaimed at optimising net interest cost and reducing volatility. This is achieved by modifying the interest rate exposure of debt and cash positionsthrough the use of interest rate swaps.The group uses interest rate swaps to manage its exposure to interest rate movements on its bank borrowings.At September 30 <strong>2006</strong>, interest rates were fixed approximately for 86% of the net cash and borrowing positions compared with 100% atSeptember 30 2005.The following sensitivity analysis of borrowings and derivative financial instruments to interest rate movements assumes an immediate 100 basispoint change in interest rate for all currencies and maturities from their levels at September 30 <strong>2006</strong> with all the other variables held constant.The range of changes represents the directors’ view of the changes that are reasonably possible over a one year period based on these assumptions.A 100 basis point reduction of interest rate would result in an estimated decrease in net interest expense of £0.4 million, based on the compositionof financial instruments including cash, cash equivalents and bank loans at September 30 <strong>2006</strong>. A 100 basis point rise in interest rates would resultin an estimated increase in net interest expense of £0.4 million. The sensitivity of the fair value of financial instruments at September 30 <strong>2006</strong> tochanges in interest rates is set out in the table below:Fair valueCarrying/ +100 basis –100 basisfair value points points£000’s £000’s £000’sShort term borrowings 58,666 58,666 58,666Long term borrowings 65,530 65,530 65,530Interest rate swaps 2,039 3,758 318Short term borrowings comprise bank loans, net loans from Daily Mail group companies and overdrafts due within one year. Long term borrowingscomprise of loans. A 100 point basis change in interest rate would not result in a material change to the fair value of any other financial instrument.<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2006</strong> 65