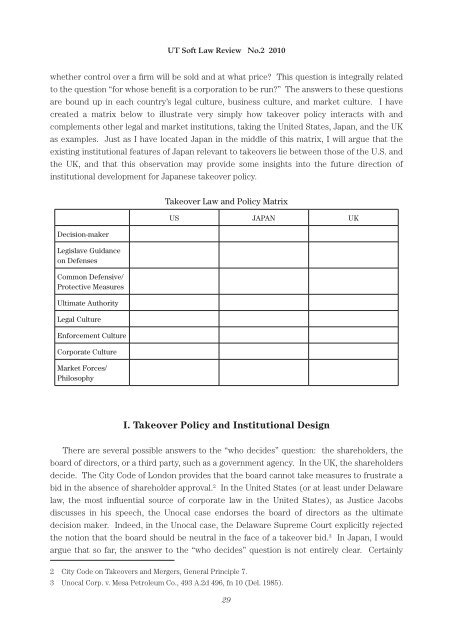

<strong>UT</strong> <strong>Soft</strong> <strong>Law</strong> <strong>Review</strong> No.2 2010whether control over a firm will be sold and at what price? This question is integrally relatedto the question “for whose benefit is a corporation to be run?” The answers to these questionsare bound up in each country’s legal culture, business culture, and market culture. I havecreated a matrix below to illustrate very simply how takeover policy interacts with andcomplements other legal and market institutions, taking the United States, Japan, and the UKas examples. Just as I have located Japan in the middle of this matrix, I will argue that theexisting institutional features of Japan relevant to takeovers lie between those of the U.S. andthe UK, and that this observation may provide some insights into the future direction ofinstitutional development for Japanese takeover policy.Decision-makerLegislave Guidanceon DefensesCommon Defensive/Protective MeasuresUltimate AuthorityLegal CultureEnforcement CultureCorporate CultureMarket Forces/PhilosophyTakeover <strong>Law</strong> and Policy MatrixUS JAPAN UKI. Takeover Policy and Institutional DesignThere are several possible answers to the “who decides” question: the shareholders, theboard of directors, or a third party, such as a government agency. In the UK, the shareholdersdecide. The City Code of London provides that the board cannot take measures to frustrate abid in the absence of shareholder approval. 2 In the United States (or at least under Delawarelaw, the most influential source of corporate law in the United States), as Justice Jacobsdiscusses in his speech, the Unocal case endorses the board of directors as the ultimatedecision maker. Indeed, in the Unocal case, the Delaware Supreme Court explicitly rejectedthe notion that the board should be neutral in the face of a takeover bid. 3 In Japan, I wouldargue that so far, the answer to the “who decides” question is not entirely clear. Certainly2 City Code on Takeovers and Mergers, General Principle 7.3 Unocal Corp. v. Mesa Petroleum Co., 493 A.2d 496, fn 10 (Del. 1985).29

<strong>UT</strong> <strong>Soft</strong> <strong>Law</strong> <strong>Review</strong> No.2 2010Japan’s existing takeover policy places greater emphasis on shareholder approval than doesDelaware law. The METI/MOJ Guidelines indicate that the “will of shareholders” should be acentral consideration in adopting takeover defenses. However, other elements of Japanesetakeover law, including some judicial decisions, appear to indicate that the board of directorshas, at least under certain circumstances, the authority to unilaterally erect defenses to a bidthat the board deems to be harmful to the corporation. The opinions of the Supreme Court ofJapan and the Tokyo High Court in the Bull-Dog Sauce case nicely capture the contrastingemphases of existing Japanese takeover policy. The Supreme Court’s ruling focuses on thefact that the shareholders approved the defensive measure that the board had devised to fendoff Steel Partners, while the High Court’s “abusive acquirer” rationale seems to emphasize theboard’s determination that the private equity fund’s investment motives were harmful to thefirm.Naturally, how a given country answers this key question has major implications forinstitutional design. Even a cursory examination of the main features of takeover institutionsin our three sample jurisdictions illustrates this point. 4 The U.S. institutional landscapefeatures a shareholder rights plan (“poison pill”) adopted unilaterally by the board ofdirectors, policed by courts applying broad principles of fiduciary duty. Virtually all ofDelaware takeover law fits into this simple design, 5 although application of the fiduciary dutydoctrine in a given case may be quite nuanced and complex. In the UK, board neutrality iscoupled with a mandatory bid rule for protection of shareholders, plus a Takeover Panel toprovide guidance to market players, interpret the Takeover Code, resolve disputes, andprovide modest sanctions for violation of the Code. (Notice how different even the two“Anglo-American” common law countries are in their takeover institutions.) The Japaneseinstitutional environment thus far contains features resembling some elements of both the USand the UK institutions—shareholder rights plans and judicial review from the U.S., andTakeover Guidelines and version of a mandatory bid rule from the UK. But also note howrelatively complex the Japanese landscape is in comparison to the other two jurisdictions:some defensive measures are based on “hard law” (e.g. the trust-type rights plan), others arebased on “soft law” (e.g. the pre-warning type rights plan) and still others are based on nonlaw(e.g. cross shareholding). In addition, golden shares are permitted, and rights plans arecoupled with a mandatory bid rule, yet judicial review of takeover defenses is common, andan institution without direct parallel in either the U.S. or the UK—the Corporate Value StudyGroup—has also played an important role in the formation of Japanese takeover policy.4 I am engaged in an empirical research project that attempts to document takeover defenses and theireffects in roughly 30 countries around the world. While I do not yet have statistical results, the summarystatistics indicate that there is tremendous variation around the world in the types of defenses in use, themain enforcement agency for takeover disputes, and the effectiveness of enforcement by the enforcementagency.5 To be sure, there are added complications fin the United States from the use of staggered boards as wellas by-law amendments which seek to give shareholders greater input with respect to the poison pill, as wellas takeover defenses that interfere with the shareholder voting process.30