2012-2013 Verification Form - John Carroll University

2012-2013 Verification Form - John Carroll University

2012-2013 Verification Form - John Carroll University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

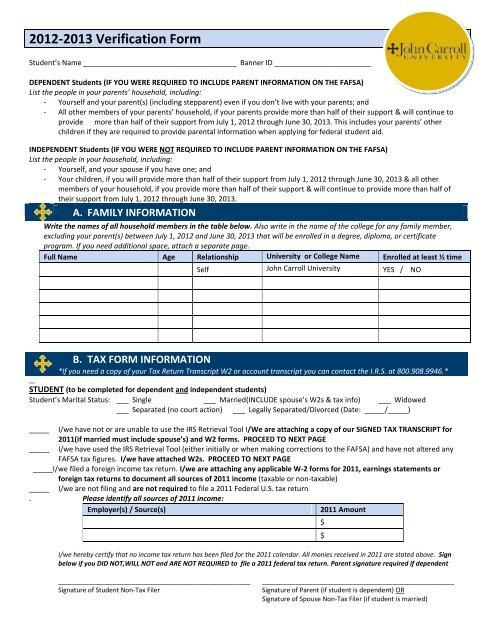

<strong>2012</strong>-<strong>2013</strong> <strong>Verification</strong> <strong>Form</strong>Student’s Name ______________________________________ Banner ID ________________________DEPENDENT Students (IF YOU WERE REQUIRED TO INCLUDE PARENT INFORMATION ON THE FAFSA)List the people in your parents’ household, including:- Yourself and your parent(s) (including stepparent) even if you don’t live with your parents; and- All other members of your parents’ household, if your parents provide more than half of their support & will continue toprovide more than half of their support from July 1, <strong>2012</strong> through June 30, <strong>2013</strong>. This includes your parents’ otherchildren if they are required to provide parental information when applying for federal student aid.INDEPENDENT Students (IF YOU WERE NOT REQUIRED TO INCLUDE PARENT INFORMATION ON THE FAFSA)List the people in your household, including:- Yourself, and your spouse if you have one; and- Your children, if you will provide more than half of their support from July 1, <strong>2012</strong> through June 30, <strong>2013</strong> & all othermembers of your household, if you provide more than half of their support & will continue to provide more than half oftheir support from July 1, <strong>2012</strong> through June 30, <strong>2013</strong>.A. FAMILY INFORMATIONWrite the names of all household members in the table below. Also write in the name of the college for any family member,excluding your parent(s) between July 1, <strong>2012</strong> and June 30, <strong>2013</strong> that will be enrolled in a degree, diploma, or certificateprogram. If you need additional space, attach a separate page.Full Name Age Relationship <strong>University</strong> or College Name Enrolled at least ½ timeSelf <strong>John</strong> <strong>Carroll</strong> <strong>University</strong> YES / NOB. TAX FORM INFORMATION*If you need a copy of your Tax Return Transcript W2 or account transcript you can contact the I.R.S. at 800.908.9946.*__STUDENT (to be completed for dependent and independent students)Student’s Marital Status: ___ Single ___ Married(INCLUDE spouse’s W2s & tax info) ___ Widowed___ Separated (no court action) ___ Legally Separated/Divorced (Date: _____/_____)_____ I/we have not or are unable to use the IRS Retrieval Tool I/We are attaching a copy of our SIGNED TAX TRANSCRIPT for2011(if married must include spouse’s) and W2 forms. PROCEED TO NEXT PAGE_____ I/we have used the IRS Retrieval Tool (either initially or when making corrections to the FAFSA) and have not altered anyFAFSA tax figures. I/we have attached W2s. PROCEED TO NEXT PAGE_____I/we filed a foreign income tax return. I/we are attaching any applicable W-2 forms for 2011, earnings statements orforeign tax returns to document all sources of 2011 income (taxable or non-taxable)_____ I/we are not filing and are not required to file a 2011 Federal U.S. tax return. Please identify all sources of 2011 income:Employer(s) / Source(s)2011 AmountI/we hereby certify that no income tax return has been filed for the 2011 calendar. All monies received in 2011 are stated above. Signbelow if you DID NOT,WILL NOT and ARE NOT REQUIRED to file a 2011 federal tax return. Parent signature required if dependent$$_____________________________________________________Signature of Student Non-Tax Filer_____________________________________________________Signature of Parent (if student is dependent) ORSignature of Spouse Non-Tax Filer (if student is married)

PARENT (only to be completed for DEPENDENT students)Parents’ Marital Status: ___ Married to each other ___ Single, never married ___ One is deceased___ Separated (no court action) ___ Legally Separated/Divorced (Date: _____/_____)_____ I/we have not or are unable to use the IRS Retrieval Tool I/We are attaching a copy of our SIGNED TAX TRANSCRIPT for2011(if married must include spouse’s) and W2 forms. PROCEED TO STEP C_____ I/we have used the IRS Retrieval Tool (either initially or when making corrections to the FAFSA) and have not altered anyFAFSA tax figures. I/we have attached W2s. PROCEED TO STEP C_____I/we filed a foreign income tax return. I/we are attaching any applicable W-2 forms for 2011, earnings statements orforeign tax returns to document all sources of 2011 income (taxable or non-taxable)_____ I/we are not filing and are not required to file a 2011 Federal U.S. tax return. Please identify all sources of 2011 income:Employer(s) / Source(s)2011 AmountI/we hereby certify that no income tax return has been filed for the 2011 calendar year and is not required to be filed. All monies receivedin 2011 are stated above. If parents’ total household income is below $5,000, supplementary information sheet will be sent. Only signbelow if you DID NOT, WILL NOT and ARE NOT REQUIRED to file a 2011 Federal Tax Return.$$_____________________________________________________Signature of Parent/Stepparent Non-Tax Filer_____________________________________________________Signature of Parent/Stepparent Non-Tax FilerC. UNTAXED /OTHER INCOME INFORMATIONPlease indicate how much of each type of income shown below was received. Be sure to enter zeros if no funds were received. Ifentering figure, you must provide DOCUMENTATION FROM THE AGENCY SUPPLYING THE INCOME FOR THE FULL CALENDAR YEAR2011. Failure to complete this section & return the necessary documentation will delay the processing of your financial aid.Student/SpouseType of Untaxed Income / Income Received or PaidEnter amounts that represent the full Calendar Year 2011$ Housing, food, & other living allowances paid to members of military, clergy, etc. $$Veterans non-education benefits such as Disability, Death Pension, Dependencyand Indemnity Compensation (DIC) and/or VA Educational Work-Study allowances.$$ Worker’s Compensation, Disability or Railroad benefits not included in AGI. $Parent(s)/Stepparent$ Other untaxed income. . Identify source_______________________. $$Amount of child support RECEIVED in 2011 for any child in the home. Attachdocumentation from county for full year 2011$$Amount of child support PAID in 2011 for children NOT included in the FAFSAhousehold size List the children for whom this support was paid:_______________ $Attach documentation from county for full year 2011 or END of year 2011 PaystubxxxxxxxxxxxxxxSNAP Food Stamps received in 2010 or 2011? If Yes. attach official SNAPdocumentation stating benefits RECEIVED IN 2010 or 2011 NOT <strong>2012</strong>xxxxxxxxxxxxxxD. CERTIFICATIONBy signing this certification, I/we confirm that all information reported on this <strong>Verification</strong> <strong>Form</strong> in support of the student’sapplication for financial assistance is complete and correct. If dependent, at least one parent must sign.WARNING: If you purposely give false or misleading information on this worksheet, you may be fined, sentenced to jail, or both.________________________________________________________________________________________________________Student Signature Date Parent Signature (dependent students only) Date____________________________________________________Student’s E-mail Address____________________________________________________Parent’s E-mail AddressThis form& documentation should be faxed to 216.397.3098, e-mailed to enrollment@jcu.edu, or mailed to <strong>John</strong> <strong>Carroll</strong> <strong>University</strong>, Office ofFinancial Aid, 20700 North Park Blvd., <strong>University</strong> Heights, OH 44118. If you have questions about completing this form you can call 888-335-6800