USER GUIDE FOR HOME EQUITY LENDING - CUNA Mutual Group

USER GUIDE FOR HOME EQUITY LENDING - CUNA Mutual Group

USER GUIDE FOR HOME EQUITY LENDING - CUNA Mutual Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>USER</strong> <strong>GUIDE</strong><strong>FOR</strong><strong>HOME</strong> <strong>EQUITY</strong> <strong>LENDING</strong>EML487

<strong>USER</strong> <strong>GUIDE</strong> <strong>FOR</strong><strong>HOME</strong> <strong>EQUITY</strong> <strong>LENDING</strong>COPYRIGHT © <strong>CUNA</strong> MUTUAL INSURANCE SOCIETY, 1989, 1992, 98, 2003, 04, 06, 07, ALL RIGHTS RESERVED.REPRODUCTION WITHOUT WRITTEN PERMISSION OF <strong>CUNA</strong> MUTUAL INSURANCE SOCIETY IS <strong>FOR</strong>BIDDEN BY LAW.

LOANLINER ® <strong>HOME</strong> <strong>EQUITY</strong> SYSTEMINTRODUCTIONThis LOANLINER ® User Guide for Home Equity Lending is designed to helpyou completely understand the purpose, design and use of the LOANLINER ®Home Equity System. It provides extensive information explaining the useLOANLINER ® documents for home equity loans.To help you use this Guide and efficiently find the information you need,we’ve divided it into the following sections:Section A. User Guide for the LOANLINER ® Home Equity SystemOpen-end Lending DocumentsContains detailed descriptions and examples of the LOANLINER ® documentsyou will use to establish an open-end line of credit home equity account.Includes when and how to use specific documents. A tab for supplementalTexas open-end lending information is included in this section.Section B. User Guide for the LOANLINER ® Home Equity SystemClosed-end Lending DocumentsContains detailed descriptions and examples of the LOANLINER ® documentsyou will use to make closed-end home equity loans. Includes when and how touse specific documents. A tab for supplemental Texas closed-end lendinginformation is included in this section.Section C. User Guide for the LOANLINER ® Home Equity SystemMiscellaneous DocumentsContains detailed descriptions and examples of miscellaneous Home Equitydocuments that are used with the LOANLINER ® Home Equity System.Includes when and how to use each document. A tab for supplemental Texasmiscellaneous information is included in this section.Section D. User Guide for the LOANLINER ® Home Equity SystemMEMBER’S CHOICE TM Payment ProtectionContains an overview of the benefits and enrollment procedures applicable toHome Equity loans insured with <strong>CUNA</strong> <strong>Mutual</strong>’s MEMBER’S CHOICE TMPayment Protection. Includes instructions for both open-end and closed-endHome Equity loans.

LOANLINER ® <strong>HOME</strong> <strong>EQUITY</strong> SYSTEMSection E. Glossary of TermsContains an alphabetical listing of definitions for terms used in this manualand those commonly used with Home Equity lending.Service and SupportOne of the key features of any product you use is the service and support thatgoes with it. You can rely on the <strong>CUNA</strong> <strong>Mutual</strong> <strong>Group</strong> to provide you withexcellent support and service for the LOANLINER ® lending system. You canreceive LOANLINER ® assistance by:• Calling your <strong>CUNA</strong> <strong>Mutual</strong> Account Relationship Manager at:1-800-333-2644• Contacting the LOANLINER Systems Department at:Phone: 1-800-356-5012Fax: 1-608-231-7748E-Mail:Mail:loanliner@cunamutual.comLOANLINER Systems Department<strong>CUNA</strong> <strong>Mutual</strong> <strong>Group</strong>PO Box 2991Madison, WI 53701-2991If you wish to order any of the documents described in this manual, please useany of the methods described above to place your order.CopyrightSubstantial time, effort and money has been spent to develop theLOANLINER ® Home Equity System. The system and the User Guide havebeen copyrighted. The documents and explanatory materials may not bereproduced, either in whole or in part, without written permission from<strong>CUNA</strong> <strong>Mutual</strong>.

<strong>USER</strong> <strong>GUIDE</strong> <strong>FOR</strong> THELOANLINER ®<strong>HOME</strong> <strong>EQUITY</strong> SYSTEMOPEN-END <strong>LENDING</strong> DOCUMENTSCopyright © 1989, 1998, 2003, 04, 06, 07, <strong>CUNA</strong> <strong>Mutual</strong> <strong>Group</strong>, Madison, Wisconsin. ALL RIGHTS RESERVED.

LOANLINER ®<strong>HOME</strong> <strong>EQUITY</strong> SYSTEMOPEN-END <strong>LENDING</strong>ContentsGeneral Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1Definition – Open-End . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Regulation Z – Open-End . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Real Estate Terms Used in Open-End Home Equity Lending . . . . . . . . . . . . . . . . . . . . 4Document Descriptions and Instructions . . . . . . . . . . . . . . . . . . . . . . . . 6Open-End Loan Officer Checklist . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9Brochure – Open-End . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19Early Disclosure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20Document Explanation - Variable Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23Document Explanation - Fixed Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27Credit Agreement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35Addendum . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44Document Explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47Security Instrument (Mortgage, Deed of Trust or Security Deed) . . . 50Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53Notice of Right to Cancel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57Document Explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61Advance Voucher . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

General InformationGeneral InformationIntroductionThis guide is designed to help you completely understand how to use theopen-end LOANLINER ® Home Equity documents you’ve ordered. Rememberthat the documents you are using have been prepared especially for yourcredit union’s home equity plan(s). The documents and samples in this guideare only samples. Your documents may look different but the usage of thedocuments will be the same.Document Descriptions and InstructionsEach open-end LOANLINER ® Home Equity document below is described indetail in this Guide. Instructions for completing each document are included.• Open-End Loan Officer Checklist• Home Equity Brochure• Early Disclosure• Credit Agreement• Addendum• Security Instrument• Notice of Right to CancelAdditional information particular to Texas open-end lending has been addedto the guide.Additional documents may be used in connection with open-end home equityloans. See the LOANLINER ® Home Equity Miscellaneous section for moreinformation.Open-End Sample TransactionsTo show you how the forms can be used to document open-end home equityaccounts, three examples of account transactions are provided.Commonly Asked QuestionsAnswers to commonly asked questions about open-end home equity lendingare provided.Open-End Lending – 1

General InformationDefinition — Open-End Home Equity LoansRegulation Z defines “open-end credit” as “consumer credit” extended by acreditor under a plan which meets all three of the following criteria: 1) thecreditor reasonably contemplates repeated transactions, 2) the creditor mayimpose a finance charge from time to time on an outstanding unpaid balance,and 3) the amount of credit that may be extended to the consumer during theterm of the plan (up to any limit set by the creditor) is generally madeavailable to the extent that any outstanding balance is repaid.Open-end home equity loans are open-end credit plans secured by theconsumer’s dwelling. In this guide we refer to them as open-end home equitylines of credit or open-end home equity plans.Regulation Z – Open-EndThe federal Truth in Lending Act governs all consumer credit transactions.Home equity line of credit plans are covered by the Act. The regulation issuedby the Federal Reserve Board to implement the Act is “Regulation Z”.Open-End Home Equity Plan RestrictionsThe Truth in Lending Act and Regulation Z place certain restrictions on openendhome equity plans, which include:1. The creditor cannot use an internal index (i.e. cost of funds) for avariable interest rate. The index must be out of the control of thecreditor. (Regulation Z Section 226.5b(f)(1))2. The creditor can only terminate the plan and accelerate the balanceunder three circumstances (Regulation Z Section 226.5b(f)(2)):a. the borrower commits fraud or makes a material misrepresentationin connection with the plan;b. the borrower does not meet the repayment terms of the plan; orc. the borrower’s action or inaction adversely affects the collateral orthe lender’s rights in the collateral.3. The creditor can temporarily suspend advances or reduce the creditlimit only for certain reasons as outlined in Regulation ZSection 226.5b(f)(3)(vi). Otherwise, the creditor is obligated to continuemaking advances at the borrower’s request during the “draw period”which is the period of time during which the borrower can takeadvances.4. The creditor cannot change the terms of the plan once it’s opened,except for very specific circumstances. Please refer to Regulation ZSection 226.5b(f)(3) for details.2 – LOANLINER Home Equity System

General InformationDisclosure RequirementsRegulation Z requires certain disclosures for open-end home equity planssecured by a dwelling. Each of the following documents must be given to theconsumer for an open-end home equity plan. These documents are:1. Early Disclosure2. Brochure3. Initial Disclosure (referred to as Credit Agreement and Addendum)4. Right of Rescission5. Periodic StatementA creditor must give an Early Disclosure along with a brochure, “What YouShould Know About Home Equity Lines of Credit”, at the time an applicationfor an open-end home equity plan is provided to the member. The EarlyDisclosure provides information on the terms and cost of the open-end homeequity plan(s) offered by the creditor. If a creditor has more than one plan,information about each plan must be disclosed.The LOANLINER ® Open-End Home Equity Plan includes the disclosuresrequired by Regulation Z. The Early Disclosure includes, among other things,the length of the draw and repayment periods, an explanation of how theminimum payment will be determined, the fees that the consumer will have topay to open, use and maintain the plan and a minimum payment exampleshowing the payment and time it would take to repay a $10,000 balance at arecent Annual Percentage Rate.If a variable rate is used with the plan, disclosures about how and when theinterest rate will change, as well as limitations on the change, will bedisclosed. Additionally, the Early Disclosure includes a maximum rate andpayment example which discloses the maximum payment required for a$10,000 balance at the maximum Annual Percentage Rate of the plan, as wellas a statement of the earliest date that maximum rate could be imposed on theplan. All variable rate plans also contain a historical table illustrating how theAnnual Percentage Rate and payments would have been affected by indexvalue changes for the specific terms of your plan in the last 15 years. As part ofour ongoing support, <strong>CUNA</strong> <strong>Mutual</strong> will update the LOANLINER ® EarlyDisclosure annually to provide the most recent 15-year index history. You mustorder new Early Disclosures each year to take advantage of this service.Prior to the first transaction under the plan, Regulation Z Section 226.6 requiresthe creditor to give certain initial disclosures for the plan. The initial disclosuresare given in the Credit Agreement and Addendum to the Credit Agreement.They include information about the circumstances under which a financecharge will be imposed, an explanation of how it will be determined, any othercharges that may be imposed, and the fact that the creditor will take a securityinterest in the dwelling. A billing rights notice is also included along withOpen-End Lending – 3

General Informationseveral other disclosures, such as reasons for terminating the plan, taximplications, etc. The Credit Agreement and Addendum provide alldocumentation necessary to meet Regulation Z requirements.Right to RescindRegulation Z Section 226.15 requires that each consumer giving a securityinterest in his or her principal dwelling must have a right to rescind the plan.The Right of Rescission is the consumer’s right to cancel a transaction withoutpenalty. The Right of Rescission period is for three days. Each person who givesa principal dwelling as security for the Plan must receive two copies of theNotice of Right to Cancel.Security InstrumentsThe legal document used to obtain a security interest in real estate is called aMortgage, Deed of Trust, or Security Deed. The basic differences between thevarious documents concern the way title is held and how foreclosure takesplace. The security instrument is different for every state. The LOANLINER ®Home Equity System provides a security instrument which can be used foropen-end home equity loans. It is available for all states.Periodic StatementRegulation Z Section 226.7 requires that certain disclosures be made on theperiodic statement and it is very important that your data processor meetthese requirements. On all open-end home equity credit plans, the credit unionmust mail or deliver a periodic statement at least quarterly.Real Estate Terms Used in Open-EndHome Equity LendingThis section gives a nontechnical introduction to terms used in home equitylending. The terms are underscored where they first occur.The credit agreement is the legal document which includes the promise to payand all other agreements between the credit union and the borrower. TheAddendum is part of the Credit Agreement. It also gives the Truth in LendingDisclosures. The borrower promises to repay the debt by signing the CreditAgreement. The security instrument (Mortgage, Deed of Trust or SecurityDeed) gives your credit union a security interest in the borrower’s property.The borrower promises to protect your credit union’s rights in the home bysigning the security instrument. In a Mortgage, the borrower can be called amortgagor and the lender a mortgagee. In a Deed of Trust, the borrower canbe called a grantor or a trustor and the lender a beneficiary. In this guide, theborrower is called borrower and the lender is called the lender or the holderof the mortgage.4 – LOANLINER Home Equity System

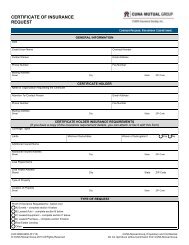

Open-End Loan Officer ChecklistLoan Officer ChecklistOPEN-ENDPLAN NUMBERSHARE/SHARE DRAFT ACCOUNT NUMBERAPPLICANT’S NAMEPHONE NUMBERCO-APPLICANT’S NAMEPHONE NUMBERAPPLICANT’S ADDRESSCO-APPLICANT’S ADDRESS1APPLICATION2PRELIMINARYREVIEW3CREDIT-WORTHINESS4<strong>EQUITY</strong>5APPROVALOR DENIALOF CREDITOR6PREPAREDOCUMENTS–OPENACCOUNTOR(a, b and c given to applicant at this time)a. Applicationb. Early Disclosure/Important Terms of Your Home Equity Planc. Brochure/What You Should Know About Home Equity Lines of Credita. Date application submittedb. Application Fee (if collected)c. Debt/Income Ratiod. Credit Denied and ECOA Notice Given, or Proceed with steps belowa. Verification of Depositb. Verification of Employmentc. Verification of First Mortgaged. Residential Mortgage Credit Reporte. Verification of Debta. Appraisalb. Title Insurance or Opinion of Titlec. Flood Hazard Determinationd. Flood Notice (if applicable)a. Credit Denied and ECOA Notice Givenb. Amount of line of credit approved $____________a. Credit Agreement/Addendumb. Security Instrumentc. Notice of Right to Canceld. Insurance: Hazard Credit Disability Credit Life Floode. Automatic Payment Authorizationf. Voucher for First Advanceg. Additional Credit Union Forms:h. 3-Day Right of Rescission Time Expiredi. Right of Rescission exercisedj. Funds Disbursedk. Payment of Feesl. Security Instrument Recordedm. Letter sent to prior Mortgage Holder©<strong>CUNA</strong> MUTUAL INSURANCE SOCIETY, 1991, 2005, ALL RIGHTS RESERVEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDDATE(OPTIONAL)___ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /___EST4656 – LOANLINER Home Equity System

Open-End Loan Officer ChecklistOpen-End Loan Officer ChecklistDocument DescriptionWhen Used:The credit union may use this Checklist when processingeach open-end home equity plan.Purpose:How Distributed:This document provides a checklist that your loanofficer(s) may use in processing each open-end homeequity plan. It provides a listing of the items that shouldbe considered and the documents that must be given orreceived when processing a standard open-end homeequity plan. It takes the loan officer through eachstandard processing step when opening a home equityplan. It starts at the time the application is given to theapplicant (along with the Brochure and Early Disclosure)and ends with the closing of the plan.This document should be placed in member’s file after itis completed.No. of Parts: 1Imprinting:Special Notes:Optional - Credit union name, address, telephonenumber and logoThis document will help meet the guidelines of NCUALetter No. 124. It should be used by all your loanofficer(s) to achieve consistency and accuracy forprocessing your home equity plans. Your credit union’sloan policies should be written to cover each itemoutlined on this document.Open-End Lending – 7

Open-End Loan Officer ChecklistLoan Officer ChecklistOPEN-ENDPLAN NUMBERSHARE/SHARE DRAFT ACCOUNT NUMBERAPPLICANT’S NAMEPHONE NUMBERCO-APPLICANT’S NAMEPHONE NUMBERAPPLICANT’S ADDRESSCO-APPLICANT’S ADDRESS11APPLICATION22PRELIMINARYREVIEW33CREDIT-WORTHINESS44<strong>EQUITY</strong>55APPROVALOR DENIALOF CREDIT OR66PREPAREDOCUMENTS–OPENACCOUNTOR(a, b and c given to applicant at this time)a. Applicationb. Early Disclosure/Important Terms of Your Home Equity Planc. Brochure/What You Should Know About Home Equity Lines of Credita. Date application submittedb. Application Fee (if collected)c. Debt/Income Ratiod. Credit Denied and ECOA Notice Given, or Proceed with steps belowa. Verification of Depositb. Verification of Employmentc. Verification of First Mortgaged. Residential Mortgage Credit Reporte. Verification of Debta. Appraisalb. Title Insurance or Opinion of Titlec. Flood Hazard Determinationd. Flood Notice (if applicable)a. Credit Denied and ECOA Notice Givenb. Amount of line of credit approved $____________a. Credit Agreement/Addendumb. Security Instrumentc. Notice of Right to Canceld. Insurance: Hazard Credit Disability Credit Life Floode. Automatic Payment Authorizationf. Voucher for First Advanceg. Additional Credit Union Forms:h. 3-Day Right of Rescission Time Expiredi. Right of Rescission exercisedj. Funds Disbursedk. Payment of Feesl. Security Instrument Recordedm. Letter sent to prior Mortgage Holder©<strong>CUNA</strong> MUTUAL INSURANCE SOCIETY, 1991, 2005, ALL RIGHTS RESERVEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDCHECKWHEN STEPCOMPLETEDDATE(OPTIONAL)___ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /___DATE(OPTIONAL)___ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /______ /___ /___EST4658 – LOANLINER Home Equity System

Open-End Loan Officer ChecklistCompletion InstructionsThe following information will be helpful to the loan officer whenprocessing applications for open-end home equity plans. The Loan OfficerChecklist takes you through each step usually taken when processing anopen-end home equity plan. This information has been divided into sixsub-headings below to correspond to the checklist headings on thepreceding page.1. Application Picked Up By Applicant – At the time the applicantreceives an application for an open-end home equity plan the membermust receive one copy of each of the following:a. Applicationb. Early Disclosure – “Important Terms of Your Home Equity Plan”required by Regulation Z Section 226.5b(d).c. Brochure – “What You Should Know About Home Equity Lines ofCredit” required by Regulation Z Section 226.5b(e).2. Preliminary Review – This section can be used to screen outapplications clearly ineligible for the LOANLINER ® Home Equity Plan.a. Date Application Submitted – Regulation B Section 202.9 requiresthat the credit union notify the applicant of the credit decisionwithin 30 days after a completed application is received.If the application is incomplete, the credit union has two options.The Official Staff Commentary for Regulation B Section 202.9(a)(1)3states: “When an application is incomplete regarding matters thatthe applicant can complete and the creditor lacks sufficient data fora credit decision, the creditor may deny the application giving as thereason for denial that the application is incomplete. The creditor hasthe option, alternatively, of providing a notice of incompletenessunder Section 202.9(c).”To meet this requirement, an Adverse Action Notice is availablethrough LOANLINER ® Lending Systems. See this Guide for moreinformation on the Adverse Action Notice.b. Application Fee (if collected) – At the time the applicant submits anapplication, your credit union may collect an “application fee”which covers the cost of the appraisal, credit report, etc. However,this fee must be refundable for three business days from the time theapplicant receives the Brochure and Early Disclosure as required byRegulation Z Section 226.5b(h). If the Brochure and Early Disclosureare mailed to the applicant, this fee must be refundable for sixbusiness days after the mailing as required by Regulation ZSection 226.5b(h)(10d).Open-End Lending – 9

Open-End Loan Officer Checklistc. Debt/Income Ratio – Your credit union should initially figure theapplicant’s debt to income ratio. NCUA Letter No. 124 requires adebt to income ratio used to qualify loan applicants be included inyour lending policies.d. Credit Denied and ECOA Notice Given – Based on the abovepreliminary steps, evaluate whether credit will be granted or denied.If credit will be denied send a copy of an Adverse Action Noticecompleted appropriately to meet Regulation B Section 202.9.If credit is not denied proceed with the following steps.3. Creditworthiness – This section will help your loan officer(s) furtherdetermine an applicant’s creditworthiness. This section precedes thesection on equity because if a member is not creditworthy, the creditunion can save the time and expense of appraising the home andconducting a title examination. If a member does not have the ability torepay, a LOANLINER ® Home Equity Plan should not be opened, nomatter how much equity a member may have in the home.a. Verification of Deposit – A “Request for Verification of Deposit”should be obtained from each depository institution the applicant(s)or other persons (co-applicant, spouse or former spouse) indicateson the application. Your credit union should have the applicant(s) orother person sign each verification of deposit before sending to thedepository institution.The “Request for Verification of Deposit” is available throughLOANLINER ® Lending Systems. For further details, please refer tothe Verification of Deposit Completion Instructions section of thisGuide.b. Verification of Employment – A “Request for Verification ofEmployment” should be obtained from each former and currentemployer indicated by the applicant(s) or other person for theperiod of time your credit union had decided you want verified. Thecredit union should have the applicant(s) or other person sign eachverification before sending to the former or current employers.The “Request for Verification of Employment” is available throughLOANLINER ® Lending Systems. For further details, please refer tothe Verification of Employment Completion Instructions section ofthis Guide.c. Verification of First Mortgage – A “Request for Verification ofMortgage” should be used to obtain direct verification of mortgagepayment history from the institution indicated on the application.Many special situations may arise. These must be evaluated by a10 – LOANLINER Home Equity System

Open-End Loan Officer Checklistperson with experience in mortgage lending. Four special situationsare mentioned here:• If the first mortgage has been paid in full and there is no othermortgage, it is not required that you complete a mortgageverification. In this situation, your credit union’s mortgage will bea “first” without being a “purchase money” mortgage. Most statestatutes regulating first mortgages assume that a first mortgage isa purchase money mortgage. Your credit union may want toobtain a mortgage verification, however, for payment historyinformation.• If the existing mortgage contains a future advance clause,amounts not yet advanced under the existing mortgage mayreduce the equity on which your credit union is relying.• If the existing mortgage contains an “escalator” clause, that is, aclause by which monthly payments may increase because of avariable rate or other alternative mortgage provisions, the applicantmay have fewer dollars with which to repay your credit union.• If the existing mortgage prohibits the applicant from taking out asecond mortgage without consent, the written consent of theholder (or servicer) of the first mortgage must be obtained.The “Request for Verification of Mortgage” is available throughLOANLINER ® Lending Systems. For further details refer to theVerification of Mortgage Completion Instructions section of thisGuide.d. Residential Mortgage Credit Report – A detailed “ResidentialMortgage Credit Report” should be obtained on each applicant orother person from a Credit Reporting Agency (Bureau). This reportshould give a detailed account of the credit, employment, andresidence history, as well as public record information, concerningeach applicant or other person.e. Verification of Debt – A “Request for Direct Credit Verification”should be used to verify any debts which do not appear on thecredit report. If there is any doubt that a debt will not be reflected onthe credit report (i.e. local department store charge account), a directcredit verification should be sent to any creditor indicated on theapplication.The “Direct Credit Verification” is available through LOANLINER ®Lending Systems. For further details refer to the Direct CreditVerification Completion Instructions section in this Guide.Open-End Lending – 11

Open-End Loan Officer Checklist4. Equity – This section discusses the steps your credit union should taketo determine the fair market value of the home and measure the equity.a. Appraisal – Obtain an appraisal to verify the value of the propertyand to determine the equity available in the property that is used assecurity. This appraisal should meet the appraisal guidelinesoutlined in the NCUA Letter No. 124 and Part 722 of the NCUARegulations on appraisals.b. Title Insurance or Opinion of Title – Obtain a title examination (titleinsurance or opinion of title) to verify your lien priority. Some titleinsurance companies offer variable rate and revolving creditendorsements to protect the credit union from specified risks.c. Flood Hazard Determination – For every loan made by a creditunion (federally chartered or state chartered, federally insured)which is secured by a building or mobile home, the credit unionmust use a standard Flood Hazard Determination to determinewhether the secured property is or will be located in a special floodhazard area (SFHA). Either the credit union or a vendor maycomplete the document. For further details refer to the StandardFlood Hazard determination Completion Instructions section of thisGuide.d. Flood Insurance Notice – If it is determined that the building ormobile home securing the loan is located in a special flood hazardarea, then this notice must be provided to the borrower/owner. Forfurther details refer to the Flood Insurance Notice CompletionInstructions section of this Guide.5. Approval or Denial of Credit – Based on all the information receivedfrom the above steps evaluate whether credit will be denied orapproved. Notice must be given to the applicant within 30 days ofreceiving a completed application.a. Credit Denied and ECOA Notice Given – If credit will be deniedsend a copy of an Adverse Action Notice completed appropriately tomeet Regulation B Section 202.9.b. Amount of Line of Credit Approved – If credit is approved,determine the amount of the line of credit you will grant theapplicant(s) and notify the applicant(s), by letter or using a voucher,of the approved credit limit within 30 days of receiving thecompleted application.12 – LOANLINER Home Equity System

Open-End Loan Officer ChecklistThe following steps should be completed if a Home Equity Plan isapproved:6. Prepare Documents - Open Account – Once the determination is madeto extend credit to a member, various documents should be preparedfor closing. The member will sign the documents at closing.a. Credit Agreement and Truth in Lending Disclosure/Addendum –The Credit Agreement and Truth in Lending Disclosure (CreditAgreement) and Addendum will serve as the legal obligationbetween the credit union and the borrower(s). Together the CreditAgreement and Addendum include all of the initial disclosuresrequired under Regulation Z Section 226.6 along with thecontractual language necessary to obligate the parties (if it is aprincipal dwelling). If there are joint borrowers, only one borrowerhas to receive the Credit Agreement/Addendum. However,Regulation Z also requires that each person who is entitled torescind the transaction must also receive a copy of the CreditAgreement/Addendum.In preparing the Credit Agreement, the credit union shouldcomplete the credit insurance application. A check should be put inthe election box for each coverage offered in order to signify theborrower does or does not desire such coverage. If credit insuranceis elected, your credit union must make sure to add the premiumfor credit insurance to the principal and interest payment whencalculating the monthly payments.At closing, you should obtain the signature of the borrower(s) on thecredit insurance application. Regulation Z Section 226.4(d)(1)requires the borrower’s signature if credit insurance is elected.While Regulation Z only requires a signature if the borrower electsinsurance we recommend a signature always be obtained whetherinsurance is elected or not to avoid confusion regarding theinsurance election.In preparing the Addendum you will complete the followinginformation:1. Opening date2. Final payment date3. Credit limit4. Account number5. The borrower(s) name and address6. Address of the property securing the account7. Index rate (for variable rate plans)Open-End Lending – 13

Open-End Loan Officer Checklist8. Margin added to the index (for variable rate plans)9. Annual Percentage Rate10. Daily Periodic Rate11. Schedule of closing costs12. Finance charges (if applicable)13. Initial discounted rate (if applicable)a. Annual Percentage Rateb. Daily Periodic Rate14. Monthly renewable credit disability rates (if applicable)At closing, the borrowers will sign and date the Credit Agreement.There is no signature box on the Addendum itself. The CreditAgreement and Addendum is one integrated document. Signing theCredit Agreement signifies agreement with the information containedin the Credit Agreement and Addendum.b. Security Instrument – The security instrument (mortgage, securitydeed or deed of trust) signifies the borrower(s)’ pledge of realproperty as collateral in order to secure the open-end home equityplan.Preparation of the security instrument for closing requires your creditunion to complete applicable information and prepare the signatureand acknowledgment area for the borrower(s) signature at closing.At closing, the credit union will obtain the signature(s) of all personswho have an ownership interest in the property being offered assecurity. Once the security instrument has been executed, the creditunion should take all necessary steps to record the instrument andperfect their interest in the property.For further details refer to the Security Instrument CompletionInstructions section in this Guide.c. Notice of Right to Cancel – It is important to alert borrower(s) thatthey will not receive any funds immediately at closing. By informingthe borrower about the right to rescind, your credit union can avoidany misconception about when funds can be disbursed. Your creditunion should not disburse any funds until the three day right tocancel period has passed. The rescission period will expire atmidnight on the third business day following the opening of theaccount, delivery of the Notice of Right to Cancel or delivery of allmaterial disclosures (the Credit Agreement and Addendum),whichever occurs last.In preparing the Notice of Right to Cancel your credit union shouldprepare a set of two notices for each person having a right to14 – LOANLINER Home Equity System

Open-End Loan Officer Checklistrescind. A person has a right to rescind if they give their principaldwelling as security for the plan.Once the rescission period has passed and you are satisfied that themember has not rescinded, the credit union may disburse fundsunder this account.For further details please refer to the Notice of Right to CancelCompletion Instructions section in this Guide.d. Insurance — Hazard, Credit Disability, Credit Life and Flood – Atclosing, your credit union must receive evidence that adequatehazard insurance is in place and your credit union is named as abeneficiary.Your credit union should determine if the member wants CreditDisability and/or Credit Life insurance. If so, be sure to adjust theloan payment to cover the addition of the premium charges to theloan. For further details refer to the Credit Agreement documentsCompletion Instructions section in this Guide and the MEMBER’SCHOICE TM Payment Protection Guide.Your credit union should determine whether or not the propertybeing offered is located in a special flood hazard area to meet theFlood Disaster Protection Act. It is administered for federallyinsured credit unions by the NCUA (12 C.F.R. Section 760). If it isdetermined that the property is located in such an area, the creditunion must receive documentation that adequate flood insurancehas been purchased.e. Automatic Payment Authorization – If your credit union offersautomatic payments (i.e. monthly payroll deduction), you shouldhave the borrower(s) sign the appropriate documents used by yourcredit union.f. Voucher For First Advance – The voucher is the credit union’s papertrail for the initial and subsequent advances and any paymentchanges.Your credit union should complete the borrower information andpayment terms section of the voucher. The borrower may sign thevoucher at closing. However, no funds can be disbursed at closing.Funds can only be disbursed after the three-day Right of Rescissionperiod has passed. Detailed completion instructions are provided inthis Guide.g. Additional Credit Union Documents – Your credit union mayrequire additional documents in order to complete the open-endhome equity plan. Any additional documents should be preparedfor borrower’s signature at closing.Open-End Lending – 15

Open-End Loan Officer Checklisth. 3-Day Right of Rescission Time Expired – No funds can bedisbursed until the rescission period has expired and the creditunion is reasonably satisfied that the consumers have not rescinded.The right to cancel period expires at midnight on the third businessday following the opening of the account, delivery of the Notice ofRight to Cancel or delivery of the Credit Agreement andAddendum, whichever occurs last.After you’re certain the consumers do not wish to cancel thetransaction, it is recommended (but not required) that you have themreturn and sign the original Notice of Right to Cancel confirmingtheir non-cancellation. When this step occurs, you’re ready todisburse the funds, pay all fees to appropriate parties, record securityinstrument, and notify the first mortgage holder of the new lien.i. Right of Rescission Exercised – If the consumers exercise their rightto cancel, you must take certain steps. First, you must receivewritten notification of the desire to cancel the transaction. Theconsumer can use a copy of the Notice of Right to Cancel you gavethem at closing or any written statement signed and dated by theconsumer stating their intent to cancel. The date by which they mustexercise their right to cancel is stated on the original Notice of Rightto Cancel. When this occurs, you must refund any and all fees(including an application fee) the borrower paid to obtain approvaland open the account. You must return the borrower’s moneyincluding any fees (application, appraisal, etc.) within 20 days ofreceiving the notification of cancellation. You must also release thesecurity instrument if it has been recorded.j. Funds Disbursed – If you did not complete the home equity voucherduring the closing of the account, now would be the time to do so.You can disburse the funds in many ways. You could do so in theform of a check at the credit union, check by mail, or place the fundsdirectly into the borrower’s account.k. Payment of Fees – Now is the time to pay all the fees collected withthis transaction to the appropriate parties (credit reporting agency,appraiser, attorney, etc.).l. Security Instrument Recorded – If you did not already do so, recordthe security instrument (mortgage, deed of trust or security deed)with the government agency responsible for real estate records.You may record the security instrument before the Right ofRescission period is over. However, keep in mind that you must paya fee to record the security instrument. If the consumer chooses tocancel the transaction within the three-day Right of Rescissionperiod, you must refund all fees paid and will have lost the moneypaid to record the mortgage, deed of trust or security deed.16 – LOANLINER Home Equity System

Open-End Loan Officer Checklistm. Letter Sent to Prior Mortgage Holder - A letter should be sentnotifying the holder of any prior mortgage, stating that the creditunion’s security instrument has been recorded. The borrower’s mustsign the bottom of this letter agreeing not to increase the firstmortgage. A sample of this letter is shown below:Sample of Letter to Send AfterOpening of the Open-End Home Equity Plan______________________(Date)Name & Address ofHolder of 1st(Mortgage, Deed of Trust orSecurity Deed)RE: Borrowers’ NamesStreet Address of PropertyCity, State and ZipCredit Union Acct. No.Dear _______________:(Name of credit union) opened a home equity line of credit for the borrowerslisted above. The borrowers agreed not to request or accept any future advanceson the [mortgage or deed of trust] you hold. The borrowers request andauthorize you to notify us if their account with you ever becomes delinquent.The (Mortgage, Deed of Trust, or Security Deed) securing the line of credit wasrecorded on __________ (date) at the _____________________________________(name of recording office) on ______________ page of ________________ book.The maximum principal balance is $_______________.Thank you for your cooperation._______________________________Signature - Credit UnionWe have agreed not to increase the balance of the first (Mortgage, Deed ofTrust, or Security Deed) with you. We authorize you to notify (name of creditunion) if our account becomes delinquent.___________________________Borrower___________________________Borrower____________Date____________DateOpen-End Lending – 17

Brochure — Open-EndWhat YouShould KnowAbout HomeEquity Linesof Credit18 – LOANLINER Home Equity System

Brochure — Open-EndBrochure – Open-EndWhat You Should Know About Home Equity Lines of CreditDocument DescriptionWhen Used:This Brochure is required to be given to a member at thetime the member obtains an open-end home equityapplication as required by Regulation Z Section 226.5b(b)and 226.5b(e).Purpose:How Distributed:The Brochure provides members with a discussion ofgeneral characteristics of home equity plans. TheBrochure describes the home equity lending process andprovides words of caution so the member can be aninformed consumer.The Brochure, along with a copy of the Early Disclosure,is given to the member at the same time the memberobtains an open-end home equity application. TheBrochure does not have to be given again when theaccount is opened.No. of Parts: 1Imprinting:Special Notes:NoneThe Brochure is available for purchase throughLOANLINER ® Lending Systems. Please call1-800-356-5012 to order.Open-End Lending – 19

Early DisclosureEarly DisclosureDocument DescriptionThe terms of the Early Disclosure are individual to each credit union. An EarlyDisclosure is created based on the answers your credit union provides on thehome equity questionnaire.When Used: The Early Disclosure must be given to the member whenreceiving an open-end home equity application asrequired by Regulation Z Section 226.5b(b).Purpose:The Early Disclosure provides the disclosures required byRegulation Z Section 226.5b(d). This disclosure informsthe member about important provisions specific to yourcredit union’s home equity plan.How Distributed: Within three days of the credit union’s receipt of theApplication, the credit union must provide an EarlyDisclosure to the member. (Also, a nonrefundable fee maynot be collected by the credit union until three businessdays after the applicant receives the Brochure and EarlyDisclosures as required by Regulation Z Section 226.5b(h).)If the Brochure and Early Disclosure are mailed to theapplicant, this fee must be refundable for six business daysafter the mailing as required by Regulation Z Section226.5b(h)(10d).No. of Parts: 1Imprinting: Optional - Credit union name and addressSpecial Notes: The Early Disclosure must be updated annually asrequired by Regulation Z for:Fixed Rate Plans – The Annual Percentage Rate (APR)disclosed must be one used within 12 months prior to thedate the Early Disclosure is provided to the member. Thismeans that in order for you to use the same EarlyDisclosure for a full year, the APR disclosed should be theone in effect when the Early Disclosure is prepared. TheEarly Disclosure has to be updated every year to reflectthe current APR. Refer to Regulation Z Section 226.5b(d)(6)footnote 10c.Variable Rate Plans – The index rate for the most recent yearmust be added to the 15-year historical table annually.Data about the index that is more than 15 years old mustbe deleted. This will cause the entire historical example tochange. Also, the minimum and maximum paymentexamples may change. Each year, your credit union needsto order an updated Early Disclosure. Refer to theCommentary to Regulation Z Section 226.5b(d)(12)(xi)-1.Signature – No signature is required for the Early Disclosure.20 – LOANLINER Home Equity System

Variable Rate Early Disclosure1 EVERYBODY’S CREDIT UNION12345 Main StreetP.O. Box 1234Anytown, CO 12345-1234<strong>HOME</strong> <strong>EQUITY</strong> EARLY DISCLOSUREIMPORTANT TERMS OF OUR <strong>HOME</strong> <strong>EQUITY</strong> LINE OF CREDIT PLAN23456This disclosure contains important information about our Home Equity Lineof Credit Plan. You should read it carefully and keep a copy for yourrecords.AVAILABILITY OF TERMS: All of the terms described below are subject tochange. If these terms change (other than the annual percentage rate)and you decide, as a result, not to enter into an agreement with us, you areentitled to a refund of any fees that you pay to us or anyone else inconnection with your application.SECURITY INTEREST: We will take a security interest in your home. Youcould lose your home if you do not meet the obligations in your agreementwith us.POSSIBLE ACTIONS: We can terminate your line, require you to pay usthe entire outstanding balance in one payment, and charge you certainfees, if (1) you engage in fraud or material misrepresentation in connectionwith the plan; (2) you do not meet the repayment terms of this plan, or (3)your action or inaction adversely affects the collateral or our rights in thecollateral.We can refuse to make additional extensions of credit or reduce your creditlimit if (1) any reasons mentioned above exist; (2) the value of the dwellingsecuring the line declines significantly below its appraised value forpurposes of the line; (3) we reasonably believe that you will not be able tomeet the repayment requirements due to a material change in yourfinancial circumstances; (4) you are in default of a material obligation of theagreement; (5) government action prevents us from imposing the annualpercentage rate provided for in the agreement; (6) the priority of oursecurity interest is adversely affected by government action to the extentthat the value of the security interest is less than 120 percent of the creditline; (7) a regulatory agency has notified us that continued advances wouldconstitute an unsafe and unsound business practice, or (8) the maximumannual percentage rate is reached.MINIMUM PAYMENT REQUIREMENTS: You can obtain credit advancesfor 10 years. This period is called the "draw period." At our option, wemay renew or extend the draw period. After the draw period ends therepayment period will begin. The length of the repayment period willdepend on the balance at the time of the last advance you obtain beforethe draw period ends. You will be required to make monthly paymentsduring both the draw and repayment periods. At the time of each creditadvance a payoff period will be established. The payoff period may varydepending on the amount of your outstanding credit balance after youobtain an advance. The payoff period is shown in the following table:Range of BalancesPayoff PeriodUp To - $10,000.00 60 Monthly Payments$10,000.01 - $20,000.00 96 Monthly Payments$20,000.01 - $30,000.00 120 Monthly Payments$30,000.01 - $40,000.00 144 Monthly Payments$40,000.01 - And above 180 Monthly PaymentsThe payoff period will always be the shorter of the payoff period for youroutstanding balance or the time remaining to the maturity date. Yourpayment will be set to repay the balance after the advance, at the currentannual percentage rate, within the payoff period. Your payment will berounded up to the nearest dollar. Your payment will remain the sameunless you obtain another credit advance. Your payment may also changeif the annual percentage rate increases or decreases. Each time theannual percentage rate changes, we will adjust your payment to repay thebalance within the original payoff period. Your payment will include anyamounts past due and any amount by which you have exceeded yourcredit limit, and all other charges. Your payment will never be less thanthe smaller of $100.00, or the full amount that you owe.MINIMUM PAYMENT EXAMPLE: If you made only the minimum monthlypayment and took no other credit advances it would take 5 years to pay offa credit advance of $10,000 at an ANNUAL PERCENTAGE RATE of9.25%. During that period, you would make 60 payments of $209.00.FEES AND CHARGES:You must pay certain fees to third parties to open the plan. These feesgenerally total between $300.00 and $750.00. If you ask, we will provideyou with an itemization of the fees you will have to pay third parties.PROPERTY INSURANCE: You must carry insurance on the property thatsecures this plan. If the property is located in a Special Flood Hazard Areawe will require you to obtain flood insurance if it is available.REFUNDABILITY OF FEES: If you decide not to enter into this plan withinthree business days of receiving this disclosure and the home equitybrochure, you are entitled to a refund of any fee you may have alreadypaid.TRANSACTION REQUIREMENTS: The maximum number of advances 11you may obtain per quarter is 6. The minimum credit advance that youcan receive is $2,000.00 for the first advance and $500.00 for eachsubsequent advance.TAX DEDUCTIBILITY: You should consult a tax advisor regarding thedeductibility of interest and charges for the plan.VARIABLE RATE FEATURE: This plan has a variable rate feature and theannual percentage rate (corresponding to the periodic rate) and theminimum payment may change as a result. The annual percentage rateincludes only interest and no other costs.The annual percentage rate is based on the value of an index. The indexis the Prime Rate published in the Money Rates column of the Wall StreetJournal. When a range of rates has been published the highest rate will beused. We will use the most recent index value available to us as of 10days before the date of any annual percentage rate adjustment.789101213©<strong>CUNA</strong> MUTUAL INSURANCE SOCIETY, 1992, 1999 ALL RIGHTS RESERVED EED002 301874 08/14/2007Open-End Lending – 21

Variable Rate Early Disclosure1415To determine the annual percentage rate that will apply to your account,we add a margin to the value of the Index. Ask us for the current indexvalue, margin and annual percentage rate. After you open a plan, rateinformation will be provided on periodic statements that we send you.RATE CHANGES: The annual percentage rate can change quarterly onthe first day of January, April, July and October. There is no limit on theamount by which the annual percentage rate can change during any oneyear period. The maximum ANNUAL PERCENTAGE RATE that canapply is 18.0% or the maximum permitted by law, whichever is less.MAXIMUM RATE AND PAYMENT EXAMPLES: If you had an outstandingbalance of $10,000, the minimum payment at the maximum ANNUALPERCENTAGE RATE of 18.0% would be $254.00. This annualpercentage rate could be reached at the time of the 1st payment.HISTORICAL EXAMPLE: The following table shows how the annualpercentage rate and the minimum payments for a single $10,000 creditadvance would have changed based on changes in the index over the past15 years. The index values are from the last business day of July of eachyear.While only one payment per year is shown, payments may have variedduring each year.The table assumes that no additional credit advances were taken, that onlythe minimum payments were made, and that the rate remained constantduring each year. It does not necessarily indicate how the index or yourpayments will change in the future.16WALL STREET JOURNAL PRIME RATE INDEX TABLEIndexYear (as of the last business day of July)(Percent)Margin (1)(Percent)ANNUALPERCENTAGERATEMonthlyPayment(Dollars)1993 ....................................................................................................................................................... 6.000 1.00 7.000 198.001994 ....................................................................................................................................................... 7.250 1.00 8.250 203.001995 ....................................................................................................................................................... 8.750 1.00 9.750 208.001996 ....................................................................................................................................................... 8.250 1.00 9.250 206.001997 ....................................................................................................................................................... 8.500 1.00 9.500 206.001998 ....................................................................................................................................................... 8.500 1.00 9.5001999 ....................................................................................................................................................... 8.000 1.00 9.0002000 ....................................................................................................................................................... 179.500 1.00 10.5002001 ....................................................................................................................................................... 6.750 1.00 7.7502002 ....................................................................................................................................................... 4.750 1.00 5.7502003 ....................................................................................................................................................... 4.000 1.00 5.0002004 ....................................................................................................................................................... 4.250 1.00 5.2502005 ....................................................................................................................................................... 6.250 1.00 7.2502006 ....................................................................................................................................................... 8.250 1.00 9.2502007 ....................................................................................................................................................... 8.250 1.00 9.250(1) This is a margin we have used recently; your margin may be different.©<strong>CUNA</strong> MUTUAL INSURANCE SOCIETY, 1992, 1999 ALL RIGHTS RESERVED EED002 301875 08/14/200722 – LOANLINER Home Equity System

Variable Rate Early DisclosureVariable Rate Early DisclosureDocument ExplanationPlease refer to the Early Disclosure on the preceding page for thecorresponding numbers. This Early Disclosure is a representative example ofwhat a credit union’s Variable Rate Early Disclosure may look like. Theterms contained in your credit union’s Early Disclosure may differ because ofthe answers your credit union gave on the home equity questionnaire.Many of the provisions in the Early Disclosures are exactly the same as theprovisions in the Addendum to the Credit Agreement. However, the EarlyDisclosures are not transaction-specific for each individual member’s plan.Therefore, you may give the same Early Disclosure to all borrowers interestedin your plan. If you have more than one home equity plan, you must have aseparate Early Disclosure and Addendum for each plan.The first four sections (1-4) precede the other required disclosures as requiredby Regulation Z Section 226.5b(a)(2).1. Credit Union Information – If your credit union name and addresswere not imprinted by <strong>CUNA</strong> <strong>Mutual</strong>, enter the applicable informationhere.2. Introduction – This is standard language required by Regulation ZSection 226.5b(d)(1).3. Availability of Terms – This is standard language required byRegulation Z Section 226.5b(d)(2).4. Security Interest – This is standard language required by Regulation ZSection 226.5b(d)(3).5. Possible Actions – This is standard language required by Regulation ZSection 226.5b(d)(4).6. Minimum Payment Requirements – This language is written to meetthe requirements of Regulation Z Section 226.5b(d)(5) payment terms.The language will vary extensively to reflect the answers given on thequestionnaire by your credit union regarding the payment termsspecific to your credit union’s plan such as:• Length of draw and repayment period• Frequency of payments• How payments are calculated• Whether payments are rounded and by how much• When payments will change and how they will change• The amount of any minimum paymentOpen-End Lending – 23

Variable Rate Early Disclosure7. Minimum Payment Example – The minimum payment example isrequired by Regulation Z Section 226.5b(d)(5)(iii). The language willvary to reflect the answers given on the questionnaire by your creditunion regarding the terms specific to your credit union’s plan for:• The amount of time it will take to pay off a $10,000 advance• The amount of the APR• The number and amount of payments8. Fees and Charges –a. This language is written to meet the requirements of Regulation ZSection 226.5b(d)(7). This paragraph may or may not appear basedon the answers given on the questionnaire completed by your creditunion. This section will reflect any fees and charges imposed byyour credit union to open, use and maintain the home equity planand will indicate when these fees or charges are payable.9. Property Insurance – This paragraph will not vary by your answers onthe questionnaire. It is written to meet the requirement in theCommentary to Regulation Z Section 226.5b(d)(8)-1 regarding propertyinsurance.10. Refundability of Fees – This paragraph will not vary by your answerson the questionnaire. It is written to meet the requirement in theCommentary to Regulation Z Section 226.5b(d)(h)-1 regardingrefundability of fees.11. Transaction Requirements – This paragraph may or may not appearbased on your answers on the questionnaire.12. Tax Deductibility – This language will not vary by your answers on thequestionnaire. It is written to meet the requirement of Regulation ZSection 226.5b(d)(11) regarding tax implications.13. Variable Rate Feature – This paragraph reflects your answers on thequestionnaire. The language and historical table reflect therequirements of Regulation Z Section 226.5b(d)(12)(i) through (xii).14. Rate Changes – This paragraph will vary to reflect the frequency in theAPR change and any limitations on changes in the APR (i.e. minimumand maximums) as it reflects your answers on the questionnaire.15. Maximum Rate and Payment Examples – This paragraph is given tomeet the requirement of Regulation Z Section 226.5b(d)(12)(x). Thisexample will vary to reflect your answer on the questionnaire.24 – LOANLINER Home Equity System

Variable Rate Early Disclosure16. Historical Example – The historical example language and the indextable calculations reflect the terms your credit union chose on thequestionnaire. The language and historical table are written to meet therequirements of Regulation Z Section 226.5b(d)(12)(xi).Open-End Lending – 25

Fixed Rate Early Disclosure<strong>HOME</strong> <strong>EQUITY</strong> EARLY DISCLOSUREIMPORTANT TERMS OF OUR <strong>HOME</strong> <strong>EQUITY</strong> LINE OF CREDIT PLANThis disclosure contains important information about our Home Equity Lineof Credit Plan. You should read it carefully and keep a copy for yourrecords.AVAILABILITY OF TERMS: All of the terms described below are subject tochange. If these terms change (other than the annual percentage rate)and you decide, as a result, not to enter into an agreement with us, you areentitled to a refund of any fees that you pay to us or anyone else inconnection with your application.SECURITY INTEREST: We will take a security interest in your home. Youcould lose your home if you do not meet the obligations in your agreementwith us.POSSIBLE ACTIONS: We can terminate your line, require you to pay usthe entire outstanding balance in one payment, and charge you certainfees, if (1) you engage in fraud or material misrepresentation in connectionwith the plan; (2) you do not meet the repayment terms of this plan, or (3)your action or inaction adversely affects the collateral or our rights in thecollateral.We can refuse to make additional extensions of credit or reduce your creditlimit if (1) any reasons mentioned above exist; (2) the value of the dwellingsecuring the line declines significantly below its appraised value forpurposes of the line; (3) we reasonably believe that you will not be able tomeet the repayment requirements due to a material change in yourfinancial circumstances; (4) you are in default of a material obligation of theagreement; (5) government action prevents us from imposing the annualpercentage rate provided for in the agreement; (6) the priority of oursecurity interest is adversely affected by government action to the extentthat the value of the security interest is less than 120 percent of the creditline; (7) a regulatory agency has notified us that continued advances wouldconstitute an unsafe and unsound business practice, or (8) the maximumannual percentage rate is reached.MINIMUM PAYMENT REQUIREMENTS: You can obtain credit advancesfor 5 years. This period is called the "draw period." At our option, we mayrenew or extend the draw period. After the draw period ends therepayment period will begin. The length of the repayment period willdepend on the balance at the time of the last advance you obtain beforethe draw period ends. You will be required to make monthly paymentsduring both the draw and repayment periods. At the time you obtain acredit advance a payoff period of 120 monthly payments will be used tocalculate your payment.The payoff period will always be the shorter of the payoff period for youroutstanding balance or the time remaining to the maturity date. Yourpayment will be set to repay the balance after the advance within thepayoff period. Your payment will be rounded up to the nearest dollar.EVERYBODY’S CREDIT UNION12345 Main StreetP.O. Box 1234Anytown, CO 12345-1234Your payment will remain the same unless you obtain another creditadvance. Your payment will include any amounts past due and anyamount by which you have exceeded your credit limit, and all othercharges.MINIMUM PAYMENT EXAMPLE: If you made only the minimum monthlypayment and took no other credit advances it would take 9 years 11months to pay off a credit advance of $10,000 at an ANNUALPERCENTAGE RATE of 6.0%. During that period, you would make 119payments of $112.00.FEES AND CHARGES: In order to open, use and maintain a line of creditplan, you must pay the following fees to us:Application Fee: $100.00 (Due at application)Origination Fee: 1.0 % of your credit limit (Due at closing)You must pay certain fees to third parties to open the plan. These feesgenerally total between $300.00 and $750.00. If you ask, we will provideyou with an itemization of the fees you will have to pay third parties.PROPERTY INSURANCE: You must carry insurance on the property thatsecures this plan. If the property is located in a Special Flood Hazard Areawe will require you to obtain flood insurance if it is available.REFUNDABILITY OF FEES: If you decide not to enter into this plan withinthree business days of receiving this disclosure and the home equitybrochure, you are entitled to a refund of any fee you may have alreadypaid.TRANSACTION REQUIREMENTS: The maximum number of advancesyou may obtain per quarter is 6. The minimum credit advance that youcan receive is $2,000.00 for the first advance and $500.00 for eachsubsequent advance.TAX DEDUCTIBILITY: You should consult a tax advisor regarding thedeductibility of interest and charges for the plan.ADDITIONAL <strong>HOME</strong> <strong>EQUITY</strong> PLANS: Please ask us about our otheravailable home equity line of credit plans.ANNUAL PERCENTAGE RATE IN<strong>FOR</strong>MATION: The ANNUALPERCENTAGE RATE under this Plan is not based on an Index. It isbased upon a fixed rate, which will be specified either at the time youreceive a commitment or at closing, and will be based upon the marketconditions at that time. An ANNUAL PERCENTAGE RATE of 6.0% isrepresentative of a fixed rate recently offered by us under this Plan. Theannual percentage rate does not include costs other than interest. Pleaseask us for the current annual percentage rate under this Plan.©<strong>CUNA</strong> MUTUAL INSURANCE SOCIETY, 1992, 1999 ALL RIGHTS RESERVED EED002 202588 08/16/200726 – LOANLINER Home Equity System

Fixed Rate Early DisclosureFixed Rate Early DisclosureDocument ExplanationIf your credit union decided to use a fixed Annual Percentage Rate for yourhome equity plan, your Early Disclosure will appear the same as the variablerate for items 1-13. (Please see previous pages for explanations of these items).1. The only additional disclosure on a fixed rate plan is shown on thepreceding page in the “Annual Percentage Rate Information”paragraph.Unlike a disclosure for a variable rate plan, a fixed rate plan disclosure doesnot include information about how a variable rate will change, the maximumrate, a payment example or the 15-year historical table. This meets therequirements for Regulation Z Section 226.5b(d)(6).Open-End Lending – 27

Credit AgreementIMPORTANT! Complete all sections before detaching copiesOpen-End Home Equity Credit Agreementand Truth in Lending DisclosureBORROWER 1 NAME (Please Print)ACCOUNT NUMBERBORROWER 2 NAME (Please Print)ACCOUNT NUMBERBORROWER 1 ADDRESSBORROWER 2 ADDRESSINTRODUCTION. This LOANLINER ® Home Equity Plan Credit Agreement and Truth inLending Disclosure will be referred to as this “Plan”. This Plan consists of thisAgreement and the accompanying Addendum which is incorporated into andbecomes a part of this Credit Agreement and Truth in Lending Disclosure. The words“you,” “your,” and “Borrower” mean each person who signs this Plan. The words“we,” “us,” “our,” “Lender,” and “credit union” mean the credit union whose nameappears above or anyone to whom the credit union transfers its rights under this Plan.1. HOW THIS PLAN WORKS. This Plan establishes a revolving line of creditaccount (“account”). You and the credit union anticipate that you will obtain a seriesof advances under this Plan from time to time. The maximum amount you canborrow (“credit limit”) is disclosed in the Addendum. It is the amount of credit youmay borrow, repay all or a portion and re-borrow subject to the terms of this Plan.2. PROMISE TO PAY. You promise to repay to the credit union, or order, alladvances made to you under this Plan, plus finance charges, other applicablecharges, and costs of voluntary payment protection for which you are responsibleunder this Plan. You agree to pay the Minimum Payment on or before the due date.By signing below you agree that you have read the LOANLINER ® Home Equity PlanCredit Agreement and Truth in Lending Disclosure and Addendum and agree to bebound by the terms of the Agreement. You also acknowledge receipt of a copy ofCREDIT AGREEMENT AND TRUTH IN <strong>LENDING</strong> DISCLOSURE3. JOINT ACCOUNTS. If this is a joint account, each of you must sign this Plan andyou will be individually and jointly responsible for the promises you make in thisAgreement, including paying all amounts owed. This means that the credit union canrequire any one of you to repay all advances plus applicable finance charges, otherapplicable charges, and voluntary payment protection costs. Unless the credit union’swritten policy requires all of you to sign for an advance, each of you authorizes theother(s) to obtain advances individually and agrees to repay advances made to theother(s). The credit union can release one of you from responsibility under this Planwithout releasing the other(s).4. SECURITY INTEREST. This Plan is secured by a mortgage, deed of trust,security deed, or security agreement (the “security instrument”) in your dwellingwhich is described in the Addendum.5. PROMISES IN SECURITY INSTRUMENT. The security instrument you sign thesame day you sign this Plan is incorporated by reference into this Plan. You mustkeep all the promises you made in the security instrument.SIGNATURES(Continued on reverse side.)this Agreement, and the Home Equity Early Disclosure and handbook entitled “WhatYou Should Know About Home Equity Lines of Credit” given to you at the time ofapplication.Notice To Vermont Borrowers: NOTICE TO COSIGNER: YOUR SIGNATURE ON THIS NOTE MEANS THAT YOU ARE EQUALLY LIABLE <strong>FOR</strong> REPAYMENTOF THIS LOAN. IF THE BORROWER DOES NOT PAY, THE LENDER HAS A LEGAL RIGHT TO COLLECT FROM YOU.X(SEAL)X(SEAL)BORROWER 1 SIGNATUREDATEWITNESS SIGNATUREDATEX(SEAL)X(SEAL)BORROWER 2 SIGNATUREDATEWITNESS SIGNATUREDATEENROLLMENT/APPLICATION AND SCHEDULE <strong>FOR</strong> VOLUNTARY PAYMENT PROTECTION<strong>CUNA</strong> <strong>Mutual</strong> Insurance Society • Madison, WI 53701-0391 • Phone: 800/937-2644“You” or “Your” means the member and the joint insured (if applicable). Aco-signor is not eligible for joint coverage.Credit insurance is voluntary and not required in order to obtain this loan. Youmay select any insurer of your choice. You can get this insurance only if youcheck “yes” below and sign your name and write in the date. The rate you arecharged for the insurance is subject to change. You will receive written noticebefore any increase goes into effect. You have the right to stop this insurance bynotifying your credit union in writing. Your signature below means you agree that:• If you elect insurance, you authorize the credit union to add the charges forinsurance to your loan each month.• You are eligible for disability insurance only if you are working for wages orprofit for 25 hours a week or more on the initial loan date. If you are not, youwill not be insured until you return to work. If you are off work because oftemporary layoff, strike or vacation, but soon to resume, you will be consideredat work. Are you working for wages or profit for 25 hours a week or more?Borrower Yes No Co-Borrower Yes No• You are eligible for insurance up to the Maximum Age for Insurance. Insurancewill stop when you reach that age.NOTE: THE LIFE AND DISABILITY INSURANCE CONTAINS CERTAIN BENEFITEXCLUSIONS, INCLUDING A PRE-EXISTING CONDITION EXCLUSION. PLEASEREFER TO YOUR CERTIFICATE <strong>FOR</strong> DETAILS.YOU ELECT THEFOLLOWING INSURANCECOVERAGE(S)SINGLE CREDIT DISABILITYJOINT CREDIT DISABILITYSINGLE CREDIT LIFEJOINT CREDIT LIFEYES NOCOST PER $100OF YOUR MONTHLYLOAN BALANCE$.XX$.XX$.XX$.XXCOVERED MEMBER(please print)If you are totally disabled for more than 30 days, then the disability benefit will begin with the 31st day of disability.ACCOUNT NUMBERINSURANCE MAXIMUMSDISABILITY LIFEGROUP POLICY NUMBERXXX-XXXX-XDATE OF ISSUE OF THE CERTIFICATEMAXIMUM MONTHLY TOTAL DISABILITY BENEFITMAXIMUM INSURABLE BALANCE PER LOAN ACCOUNTMAXIMUM AGE <strong>FOR</strong> INSURANCESECONDARY BENEFICIARY (If you desire to name one)$ XXX$XX,XXXXXN/A$XX,XXXXXDATEMEMBER’S DATE OF BIRTHDATEJOINT INSURED’S DATE OF BIRTHXXSIGNATURE OF MEMBER(Be sure to check one of the boxes above)APP.835-0596IL/RevSIGNATURE OF JOINT INSURED (CO-BORROWER)©<strong>CUNA</strong> MUTUAL GROUP, 1998, 99, 2000, 01, 03, 04, ALL RIGHTS RESERVEDTO ORDER: 1-800-356-5012 CREDIT UNION COPY EST10628 – LOANLINER Home Equity System

Credit AgreementCredit AgreementDocument DescriptionWhen Used:This document is used to open a home equity plan for aborrower(s) and can be used with a fixed or variable rateplan. The Credit Agreement must be completed andsigned before the borrower can receive the first advanceunder the plan.This Credit Agreement should only be completed atthe time the open-end home equity plan is opened. Itshould not be completed again at the time the borrowerobtains subsequent advances.Purpose:How Distributed:The Credit Agreement, along with the Addendumincludes:• the disclosures required by Regulation ZSection 226.6(a)-(e),• the contract between the credit union and theborrower(s) and• the Enrollment/Application and Schedule forVoluntary Payment Protection and Certificate ofInsurance.This Credit Agreement includes the terms of theindividual borrower’s plan at the time the plan is opened.The first copy (labeled Credit Union) is your CreditUnion’s copy of the Credit Agreement. This copy is keptby your credit union in the borrower’s loan file alongwith the Addendum.The second copy (labeled Borrower 1) is the firstborrower’s copy of the Credit Agreement. After theCredit Agreement is completed and signed by allborrowers, the first borrower should receive this copy.The third copy (labeled Borrower 2) is the secondborrower’s copy of the Credit Agreement. If there is morethan one borrower on the plan, only one borrower needsto receive a copy of the Credit Agreement andAddendum. However, any party giving a security interestin the principal dwelling must receive a copy of theCredit Agreement and Addendum. After the CreditAgreement is completed and signed by all borrowers, theOpen-End Lending – 29

Credit Agreementsecond borrower or part owner of the collateral shouldreceive this copy. If there are more than two borrowers ona plan, your credit union may make additionalphotocopies.The last part of the document, Certificate of Insurance, isgiven to the borrower.No. of Parts: 3Components: Credit union copyBorrower 1 copyBorrower 2 copyImprinting: Optional – Credit union name, address, telephonenumber and logoSpecial Notes: Each person entitled to receive the Credit Agreement andTruth in Lending Disclosure must also receive a copy ofthe Addendum to the Credit Agreement. Both documentsmust be given at the same time to each borrower to meetthe “integrated document” requirement ofSection 226.5(a)(1)-2 of the Commentary to Regulation Z.30 – LOANLINER Home Equity System

Open-End Lending – 31