annual report 2010-11 - Metro Tasmania

annual report 2010-11 - Metro Tasmania

annual report 2010-11 - Metro Tasmania

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

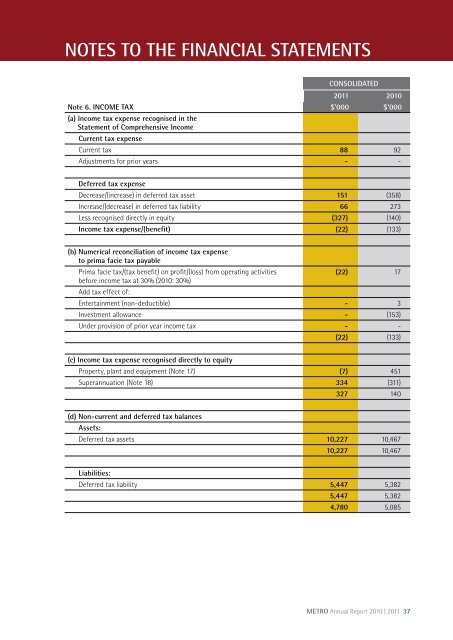

NOTES TO THE FINANCIAL STATEMENTSCONSOLIDATED20<strong>11</strong> <strong>2010</strong>Note 6. INCOME TAX $’000 $’000(a) Income tax expense recognised in theStatement of Comprehensive IncomeCurrent tax expenseCurrent tax 88 92Adjustments for prior years - -Deferred tax expenseDecrease/(increase) in deferred tax asset 151 (358)Increase/(decrease) in deferred tax liability 66 273Less recognised directly in equity (327) (140)Income tax expense/(benefit) (22) (133)(b) Numerical reconciliation of income tax expenseto prima facie tax payablePrima facie tax/(tax benefit) on profit/(loss) from operating activities(22) 17before income tax at 30% (<strong>2010</strong>: 30%)Add tax effect of:Entertainment (non-deductible) - 3Investment allowance - (153)Under provision of prior year income tax - -(22) (133)(c) Income tax expense recognised directly to equityProperty, plant and equipment (Note 17) (7) 451Superannuation (Note 18) 334 (3<strong>11</strong>)327 140(d) Non-current and deferred tax balancesAssets:Deferred tax assets 10,227 10,46710,227 10,467Liabilities:Deferred tax liability 5,447 5,3825,447 5,3824,780 5,085METRO Annual Report <strong>2010</strong> | 20<strong>11</strong> 37