D.O. Letter relating to Post Budget Changes

D.O. Letter relating to Post Budget Changes

D.O. Letter relating to Post Budget Changes

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

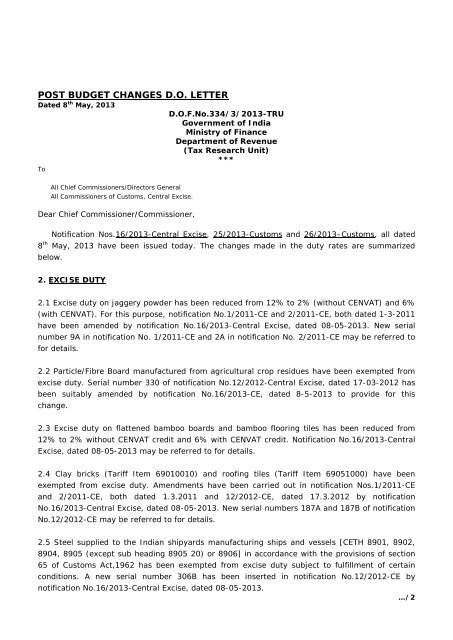

POST BUDGET CHANGES D.O. LETTERDated 8 th May, 2013D.O.F.No.334/3/2013-TRUGovernment of IndiaMinistry of FinanceDepartment of Revenue(Tax Research Unit)***ToAll Chief Commissioners/Direc<strong>to</strong>rs GeneralAll Commissioners of Cus<strong>to</strong>ms, Central Excise.Dear Chief Commissioner/Commissioner,Notification Nos.16/2013-Central Excise, 25/2013-Cus<strong>to</strong>ms and 26/2013–Cus<strong>to</strong>ms, all dated8 th May, 2013 have been issued <strong>to</strong>day. The changes made in the duty rates are summarizedbelow.2. EXCISE DUTY2.1 Excise duty on jaggery powder has been reduced from 12% <strong>to</strong> 2% (without CENVAT) and 6%(with CENVAT). For this purpose, notification No.1/2011-CE and 2/2011-CE, both dated 1-3-2011have been amended by notification No.16/2013-Central Excise, dated 08-05-2013. New serialnumber 9A in notification No. 1/2011-CE and 2A in notification No. 2/2011-CE may be referred <strong>to</strong>for details.2.2 Particle/Fibre Board manufactured from agricultural crop residues have been exempted fromexcise duty. Serial number 330 of notification No.12/2012-Central Excise, dated 17-03-2012 hasbeen suitably amended by notification No.16/2013-CE, dated 8-5-2013 <strong>to</strong> provide for thischange.2.3 Excise duty on flattened bamboo boards and bamboo flooring tiles has been reduced from12% <strong>to</strong> 2% without CENVAT credit and 6% with CENVAT credit. Notification No.16/2013-CentralExcise, dated 08-05-2013 may be referred <strong>to</strong> for details.2.4 Clay bricks (Tariff Item 69010010) and roofing tiles (Tariff Item 69051000) have beenexempted from excise duty. Amendments have been carried out in notification Nos.1/2011-CEand 2/2011-CE, both dated 1.3.2011 and 12/2012-CE, dated 17.3.2012 by notificationNo.16/2013-Central Excise, dated 08-05-2013. New serial numbers 187A and 187B of notificationNo.12/2012-CE may be referred <strong>to</strong> for details.2.5 Steel supplied <strong>to</strong> the Indian shipyards manufacturing ships and vessels [CETH 8901, 8902,8904, 8905 (except sub heading 8905 20) or 8906] in accordance with the provisions of section65 of Cus<strong>to</strong>ms Act,1962 has been exempted from excise duty subject <strong>to</strong> fulfillment of certainconditions. A new serial number 306B has been inserted in notification No.12/2012-CE bynotification No.16/2013-Central Excise, dated 08-05-2013.…/2

3. CUSTOMS DUTY3.1 Exemption from basic cus<strong>to</strong>ms duty (BCD) has been extended <strong>to</strong> Liquefied Natural Gas (LNG)and Natural Gas (NG) imported by 2 PSUs, namely, GAIL NTPC JV and Petronet LNG Ltd. forsupply <strong>to</strong> a generating company as defined in section 2(28) of the Electricity Act, 2003 subject <strong>to</strong>fulfillment of certain conditions. For this purpose, notification No.12/2012-Cus<strong>to</strong>ms, dated17-03-2012 has been amended by notification No.25/2013-Cus<strong>to</strong>ms, dated 08-05-2013. Newserial number 139A of notification No.12/2012-Cus<strong>to</strong>ms, dated 17-3-2012 may be referred <strong>to</strong> fordetails.3.2 The basic cus<strong>to</strong>ms duty (BCD) on titanium dioxide falling under heading 28.23 has beenenhanced from 7.5% <strong>to</strong> 10%. Henceforth, titanium dioxide, regardless of its classification underheading 28.23 or 32.06, will attract a uniform duty at 10%. Serial number 150 of notificationNo.12/2012-Cus<strong>to</strong>ms has been amended by notification No.25/2013-Cus<strong>to</strong>ms, dated 08-05-2013<strong>to</strong> provide for this change.3.3 The basic cus<strong>to</strong>ms duty (BCD) on polymers (CTH 3901, 3902, 3903 and 3904) includingethylene vinyl acetate (EVA) has been increased from 5% <strong>to</strong> 7.5%. Notification No.25/2013-Cus<strong>to</strong>ms, dated 08-05-2013 amending S.Nos.231, 237, 238, 239 and 240 of notificationNo.12/2012-Cu<strong>to</strong>ms may be referred <strong>to</strong> for details.3.4 The basic cus<strong>to</strong>ms duty on iron or steel scrap including stainless steel scrap (CTH 7204) hasbeen increased from Nil <strong>to</strong> 2.5%. Serial numbers 332 & 333 of notification No.12/2012-Cus<strong>to</strong>mshave been amended by notification No.25/2013-Cus<strong>to</strong>ms, dated 08-05-2013 <strong>to</strong> provide for thischange.3.5 The basic cus<strong>to</strong>ms duty on aluminum scrap (CTH 7602) has been increased from Nil <strong>to</strong> 2.5%.Serial number 338 of notification No.12/2012-Cus<strong>to</strong>ms has been amended by notificationNo.25/2013-Cus<strong>to</strong>ms, dated 08-05-2013 <strong>to</strong> provide for this change.3.6 The exemption from special additional duty (Special CVD) on brass scrap has beenwithdrawn. The entry at serial number 80 of notification No.21/2012-Cus<strong>to</strong>ms, dated 17-03-2012has been omitted by notification No.26/2013-Cus<strong>to</strong>ms, dated 08-05-2013 <strong>to</strong> effect this change.4. Notification Nos.16/2013-CE, 25/2013-Cus<strong>to</strong>ms and 26/2013-Cus<strong>to</strong>ms, all dated 08-05-2013may kindly be perused <strong>to</strong> note the changes.With regards,Yours sincerely,** ** **(P.K. Mohanty)