Forward-Looking Betas - The University of Chicago Booth School of ...

Forward-Looking Betas - The University of Chicago Booth School of ...

Forward-Looking Betas - The University of Chicago Booth School of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

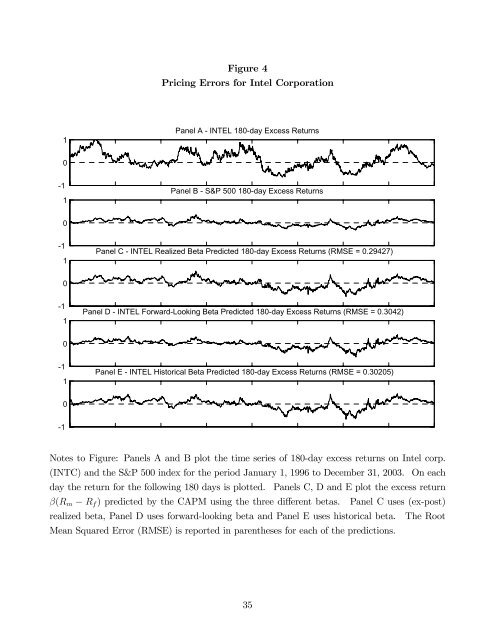

Figure 4Pricing Errors for Intel Corporation1Panel A - INTEL 180-day Excess Returns0-11Panel B - S&P 500 180-day Excess Returns0-11Panel C - INTEL Realized Beta Predicted 180-day Excess Returns (RMSE = 0.29427)0-11Panel D - INTEL <strong>Forward</strong>-<strong>Looking</strong> Beta Predicted 180-day Excess Returns (RMSE = 0.3042)0-11Panel E - INTEL Historical Beta Predicted 180-day Excess Returns (RMSE = 0.30205)0-1Notes to Figure: Panels A and B plot the time series <strong>of</strong> 180-day excess returns on Intel corp.(INTC) and the S&P 500 index for the period January 1, 1996 to December 31, 2003. On eachday the return for the following 180 days is plotted. Panels C, D and E plot the excess returnβ(R m − R f ) predicted by the CAPM using the three different betas. Panel C uses (ex-post)realized beta, Panel D uses forward-looking beta and Panel E uses historical beta. <strong>The</strong> RootMean Squared Error (RMSE) is reported in parentheses for each <strong>of</strong> the predictions.35