October

October

October

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BLUE FUELGazprom Export Global Newsletter

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELAlexander Medvedev: Gazprom's Strategy in AsiaKey notes from the speech at the Sakhalin Oil and Gas 2012 international conference (24 September 2012)As a native of Sakhalin, I am immensely pleased that theGazprom Group has been tasked by the Russian Federationgovernment to implement the Eastern Gas Program, whichwas adopted in September 2007. Our task is to create “aunited system of gas production, transportation and gassupply with the possibility of gas exports to the markets ofChina and other Asia-Pacific countries” as well as in EasternSiberia and the Russian Far East.Progress is well underway. In eastern Russia, gas productioncenters have been established in Krasnoyarsk, Irkutsk,Yakutsk, Sakhalin and Kamchatka, and the first in the Far Eastinterregional gas transmission network "Sakhalin-Khabarovsk-Vladivostok." Construction of major gas pipelines to China andpossibly South Korea (via North Korea) are also planned. Inthe Far East, we are planning to increase production capacityfor producing and exporting LNG, primarily to the Asia-PacificRegion (APR).According to most projections, the average annual growth rateof consumption of natural gas in APR will be 3.3%, and willreach 660 bcm from 2012 to 2035. The main growth will comefrom China and India. The appetite for energy commoditiescould further increase with Japan's plan to phase out nuclearpower generation.Natural gas is expected to become the fuel of choice for Asia.It has a great future as a motor fuel, and as vehicle sales growin the region, so too does the consumption of gasoline anddiesel. We also see great prospects for natural gas in the formof LNG as a fuel for ships, especially with regard to the role ofmaritime transport in the region. This work in Asia, in essence,has not even begun.India is another important market, as it has one of the mostdynamic economies in the world and is home to one-sixthof the world's population! In early August of this year, a largepart of its territory with a population of 600 million people,suffered a series of unprecedented power cuts – “blackouts.”This was caused by overloading of the grid in the face of evergrowingdemand. Although the immediate crisis has subsided,organizations around the Indian capital still must work in anenvironment where, for 80% of the time, they have no energy.Companies are forced to keep large supplies of expensiveoil and other fuel and electricity generators to maintain thehealth of their production. Gasification is the key to solvingthis problem. Gazprom recognizes the potential here and isworking to develop closer fuel-relations with India. Gazpromrecently signed a contract with GAIL, which provides for thedelivery of 2.5 mt of LNG for 20 years in India via GazpromMarketing and Trading Singapore.There will come a time when Gazprom's export strategy willbe equally split between the western and eastern vectors,with comparable profits received from Europe and Asia.Currently, however, Europe accounts for 65% of all Gazpromgas exports, and Asia is far behind. It is in the interests ofGazprom, to accelerate the development in Asia-Pacificbased on the conditions of the regional gas markets.What attracts us to the Asia-Pacific Region (or APR)?It already accounts for over 18% of global natural gasContinues on page 6www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 5ÝÊÑÏÎÐÒ

Alexander Medvedev: Gazprom's Strategy in AsiaContinued from page 5consumption. According to statistics, in2011, the region used more than 600 bcm.Many countries in the APR are forced tosatisfy their energy needs partially andsometimes completely, by imported rawmaterials. The focus group of profitablecustomers are South Korea, China,India, Taiwan, Thailand, Singapore andthe largest importer of natural gas in theworld (in the form of LNG), Japan. Thetotal imports of these countries in 2011amounted to 239 bcm.Already, the APR is a premium marketwhich is willing to pay more for gas than onthe trading floors in the U.S. and Europe.Gas is a substance which, as Gazpromfolklore says, moves from areas of higherpressure to areas of maximum profit.JapanLast year's tragedy at the nuclearFukushima power plant forced theJapanese government to reconsider thepossible directions of energy development.Apparently, the total cessation of nucleargeneration in Japan is being considered.This will have enormous implications for themarket. Japan is the fourth largest countryin the world in terms of energy consumption,while it has few of its own energy resources.Gas consumption in the country is about80 bcm a year. Gas has a 14% share of theenergy consumption in Japan. The countryimports nearly 100% of its gas as LNG,ranking it first in the world for imports.In 2011, Japan was supplied with 8.5 mtof LNG more than in 2010. For the 12months between April 2011 to April 2012,the demand for LNG in Japan increasedby 18% and will likely grow even more.The share of gas in the energy balance ofJapan is also growing. Given the strongdemand for LNG, Japanese partners areinvolved in the feasibility study on theconstruction of LNG plant near Vladivostok.The Japanese market has considerableappeal for us because of both itsgeographical proximity, which reducestransportation costs, and the highsolvency of its consumers. Here you canthink and look beyond the current vectorsof interaction.ChinaChina has a special place in our Asiangrowth strategy. China’s need for naturalgas is projected to exceed 300 bcmper year by 2020. There are ongoingnegotiations between Gazprom and Chinaregarding details of supplies and prices forRussian pipeline gas deliveries of up to 68bcm through two corridors. The variants6

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELof enhanced cooperation, in particular in the field of buildingunderground gas storage facilities in China, as well as thedevelopment of shale gas are being studied – although it istoo early to make decisions on these issues.What hinders the conclusion of an agreement on the supplyof Russian pipeline gas to China? The issue is price. Itshould not be calculated to the detriment of the supplier.Some are urging Gazprom to quickly negotiate a deal underthe concept of “charitable pricing” – yet this would mean thatwe would be essentially granting subsidies to the Chineseeconomy, the second largest economy in the world andthe owner of the largest foreign exchange reserves. Thisstrategy makes no sense.China is counting on the future production of its own shalegas reserves. In our view, the active development of thesereserves will allow the Chinese partners to evaluate the highcost of such production and, consequently, lead to the marketreform of gas pricing. This can speed up agreement withGazprom Group on supply price parameters. In general, theprice increase should not affect the rate of inflation too much:in 2011, the share of natural gas amounted to only 5% ofChina's energy mix; by 2015 it is expected to be 7%.The authors of a recent study by Bank of America Merrill Lynchexpect an increase in gas prices in China by 80%, as thegovernment encourages the production of shale gas. The bankpredicts that by 2016 the price of gas will be up to $11.4 permBtu, while the cost of shale gas to be produced in China willnot fall below $8.5 per mBtu. Following a price adjustment in-linewith the market, Gazprom will have an improved bargainingposition, so the time for China to compromise is approaching.The Korean PeninsulaAbout a year ago a "road map" that will deliver 10 bcm ofnatural gas to the Republic of Korea by pipeline through theterritory of the DPRK was signed. The first deliveries arescheduled to begin in 2017. A joint working group establishedby Gazprom and KOGAS is working on the agreed route.Consultations with technical experts are being held in orderto determine the best solutions for the future union of gastransportation systems between Russia and South Korea.The ideas behind the pipeline look very difficult to implement,especially given the complex political-military contextcontinuing on the Korean peninsula, and the obviouspolitical risks. However, if there is political will and a mutualcommitment, this project could take place, strengtheningnot only energy, but also military and political security in thisrather turbulent region.Apart from the three named countries — China, Japan andSouth Korea — other Pacific Rim countries are alreadyincluded in or are preparing to be included in the numberof buyers of Gazprom gas. We consider as inevitable theincrease in gas consumption in India, Pakistan, Bangladesh,Thailand, and Vietnam. As demand fluctuates in someregions, India and China take in the extra LNG volumescontracted for other markets. In particular, the volume of LNGfrom the Sakhalin-2 project contracted by Gazprom group forsupply to the U.S., was delivered there.We should also mention the use of LNG as motor fuel. Asiancountries are actively involved in this process. In China in2010, 150 thousand vehicles running on natural gas werelaunched. In China, the total number of vehicles using CNGand LNG in 2012 will reach 1.1 million units, and in 2015 it isexpected to increase to 3 million units.The natural gas vehicle revolution could also occur inthe sea and in the future rail and even air transport. Thiscourse of development is both environmentally oriented andeconomically feasible.The evaluation of the economic growth in Asia-Pacificcountries, the structure of energy consumption, and theinterest in the majority of countries in the reduction of CO 2emissions allow us to predict the steady growth in demandfor natural gas. This means that there are opportunities topromote the exports of Gazprom Group on these markets,primarily, LNG and pipeline gas.www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 7ÝÊÑÏÎÐÒ

Russia and Slovakia Celebrate50 Years of Energy CooperationBratislava recently hosted celebrations dedicatedto several different occasions highlightingGazprom’s positive and longstanding relationshipwith Slovakia. This includes the 50th anniversaryof the launch of the Druzhba (Russian for“Friendship”) oil pipeline, the 45th anniversaryof the first blue fuel shipment from the former-USSR to the former-Czechoslovakia and the40th anniversary of the launch of the EustreamA.S. gas transit pipeline system.The festivities were attended by the DeputyChairman of the Gazprom ManagementCommittee and Director General of GazpromExport Alexander Medvedev, the SlovakianMinister of Economy Tomáš Malatinský,the Russian Ambassador to Slovakia PavelKuznetsov, the Vice-President of the EuropeanCommission Responsible for Inter-InstitutionalRelations and Administration Maroš Šefčovič,the Managing Director of the Slovak Oil and GasUnion Ján Klepáč, members of Parliament andCEOs of Slovak companies.The events demonstrated how Gazprom valuesSlovakia as a major partner. Although gasvolumes purchased by the country for domesticconsumption are relatively small, it may surprisesome to learn that Slovakia is the second largesttransit operator of Russian gas after Ukraine.In November 2008, a contract was signedstipulating the shipment of up to 6.5 bcmpaof Russian gas to Slovakia, as well as gasMacedonia: 20 Years of Partnershipand Still Going StrongSome 20 years have passed since Gazpromentered into a mutually beneficial partnershipwith Macedonia.In 1982, we signed a long-term agreement onRussian natural gas deliveries with Makpetrol A.D.for a period of 15 years. After the construction ofa gas pipeline was completed and it was officiallyopened in September 1997, the first blue fuelsupplies started to flow into Macedonia.“We place high importance on the cooperationwith the countries of South East Europe8transit westward of up to 50.0 bcmpa. In 2011,Gazprom provided Slovakia with 5.89 bcm for itsown use and pumped exactly 47.38 bcm acrossits territory.There was an understandable concern onthe part of the Slovak partners regarding whatwould become of these contracts once NordStream begins running at full steam and lateris complemented by South Stream’s deliverysystem. However Medvedev assured Slovakia:“All our contract commitments will be honored.Gas transit across Slovakia is protected by the‘ship-or-pay’ clause. You can feel certain that youwill not be left without the transit fees.”The participants at the celebratory eventsnoted with satisfaction that a mutually beneficialpartnership between Gazprom and Slovakiawas crucial for the security of gas suppliesto European customers and also made animportant contribution to the overall developmentof positive Russian-European relations.“We observe the objective changes in theEuropean gas market and are ready to deal withthem. But at the same time we are confidentthat there are things and principles that must bepreserved intact irrespective of price fluctuationsor the emergence of new gas sources. Theseare principles of free competition, nondiscriminatoryapproach, abidance by legalnorms,” Medvedev emphasized.and in particular with Macedonia,” head ofrepresentative office of Gazprom Export inSkopje Sergei Ikonnikov said. He remindedthe audience that in the time span of 20 yearsMacedonia received more than 1.0 bcm ofRussian natural gas. The volumes of gasdelivered to Macedonia are only set to increaseas the local gas industry grows.New vistas will be opened if a portion of theSouth Stream pipeline links to Macedonia.

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELBlue Corridor Through Europe: NGVs DemonstrateAdvantages of Clean and Affordable FuelFrom 8 to 24 September, Gazprom and its German partnerE.ON Ruhrgas joined forces to promote the sixth BlueCorridor NGV Rally, which featured natural gas vehicles(NGVs) driving across Europe in an effort to expose thepublic to the benefits of natural gas as motor fuel.Some 15 cars, buses and trucks were parading acrossEurope, setting off from Moscow and making brief stays inthe cities of Orsha, Minsk, Brest, Warsaw, Ostrava, Prague,Mannheim, Paris, Brussels, Essen, Berlin and Poznan. Alongthe 6,700 kilometer-long route, the rally organizers held anumber of round table discussions, where rally participantsand invited experts demonstrated to the public whymethane is the most abundant, clean, safe and affordabletransportation fuel.The rally capitalized on the growing number of natural gasrefueling stations, which increased dramatically in the lastseven years – reaching some 4,000 in Europe, with 900 inGermany alone. The network has enabled more than 1.5million vehicles to run on gas in Europe. Experts believe thatfrom the existing 16 million vehicles on the road today, by2020 up to 50 million NGVs will be consuming 200 bcm ofnatural gas annually worldwide.The flagship event was held in Brussels on September 17with European Union officials participating in an open andproactive discussion of the benefits of NGVs. The roundtableand the exhibition event held at Brussels’ iconic Autoworldmuseum hosted over 110 guests in attendance, includingGazprom and E.ON top management, representatives ofthe European Commission, and the leaders of Natural GasVehicles Association (NGVA) Europe and NGVA Russia.Continues on page 10www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 9ÝÊÑÏÎÐÒ

Blue Corridor Through Europe: NGVs DemonstrateAdvantages of Clean and Affordable FuelContinued from page 9All speakers pointed out the challengesfor NGVs, such as the infrastructuredeficit with not enough filling stations sofar in EU. Heinrich Hick from the officeof the European Energy CommissionerOettinger pointed out that the benefitsnatural gas offers would help Europemeet the emissions targets set out in EU’s2050 Energy Roadmap. Director fromDG Move Olivier Onidi noted that naturalgas is definitely among the future fuelsfor transport in Europe and that gas fillinginfrastructure will also be considered inthe new call for proposals of EU energyinfrastructure projects. Participantsalso noted that the perception is stillthat electricity (e-mobility) is a cleanertechnology than gas — although that ismostly due to better PR spinning campaign.Gazprom’s Board member, head of gastransportation, underground storage andutilization department Oleg Aksyutin,presenting the results of NGV developmentin Russia, stressed the importance ofregulation that can serve as game-changerin the NGV development, illustrating itwith the case of Russia. Gazprom is fullycommitted to continue supplying Europewith whatever gas amount is necessaryto further promote the use of gas both intransport and shipping, Aksyutin concluded.The regulation issues were prominent onthe agenda at each roundtable. In Warsaw,the need for Polish government support wasdefined as one of the key factors enablingthe growth of the natural gas vehicles marketin Poland. In Prague, the participants alsocalled for clear rules of the game to be set:although it does not necessarily mitigate thetax burden, it still allows for the predictabilityand long-term planning.In Berlin, Gazprom Germania’s hometown,the key message brought up by allpanelists amounted to the following:framework conditions have to be improved.Existing tax reprieves for natural gas areHow Many Kilometers Can You Drive On 10 Euro?10

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELdue to end in 2018 but they should be prolonged until 2025 andbe complemented by additional incentives to ensure the muchneeded investments. The further development of the EuropeanEnergy Taxation Directive should also be considered.Another regulatory solution that could make life easier could bethe introduction of correct labeling: now, consumers buy naturalgas vehicles because they are eco-friendly and natural gas isup to two times more affordable than diesel. But the price fornatural gas at the pump station is dispensed on a cents-perkilogrambasis, which is confusing for consumers and needsto be changed for transparent and uniform labeling scheme fornatural gas as a fuel (in liter-equivalent).Nota bene: natural gas itself is the cheapest carburant it allowsdrivers to save about 30 percent of fuel costs compared to dieseland about 50 percent of petrol costs.The synergy of natural gas with biomethane and otherrenewables as practical transportation fuel is not less worthemphasizing at all levels. Gas industry, for its part, shouldkeep on pioneering the development of on- and off-gridnatural gas filling infrastructure, and provide supportive policyto get positive response from businesses. And from the sideof vehicle manufacturers, more positive engagement policyis expected. Expanding the range of factory-built NGVs inorder to meet more stringent and extensive environmentalregulations, granting them deserved promotion status, andoffering high-quality technical support to customers will bringadditional impulse to the all industries involved.Driving NGVs is good for the planet because natural gaspoweredengines emit 25 percent less carbon dioxidecompared to petrol, produce 95 percent less nitrogen oxide,generate almost no particular matter and do not produce anysoot at all. Recent proposals will mandate manufacturers toreduce average CO 2emissions of their car fleets, providingan incentive for the adoption of low-carbon technology,including NGVs. Euro 6 vehicle standards, applicable from2015 will also strictly cap emissions of nitrogen oxide, whichwill greatly favour natural gas over petrol and diesel and leadto improved air quality. On the other hand, this will contributeto attractiveness of NGVs, imposing higher standards ontraditionally-fueled cars thus making them more expensive,while the price of NGVs remains the same.Blue Corridor rally, hopefully, has inspired European industriesand citizens, demonstrating that running on gas is convenient,cost effective and environmentally beneficial, and encouragingmore and more NGV users to travel on the clean and cheapblue fuel throughout Europe.Learn more about the Blue Corridor Rally:www.bluecorridor.orgThe Golden Age of Methane in Transport is InevitableBy Evgeny Pronin, Executive Director of the National Gas Vehicle AssociationGlobal economic growth can be illustrated by the increasein a number of indicators. According to various internationalinstitutions, the world’s population will increase by 58% (from 6to 9 billion people) between 2000 and 2050; automobilization(the number of cars per 1,000 inhabitants) will increase by50%. Growth in energy consumption, including in the transportsector, could grow by 100%-130%.This economic growth is associated with an increase innegative risk factors, with potential environmental andeconomic consequences that include the following:• global emissions of CO 2could more than double by 2050to about 60 GW;• maintaining the 1% annual growth trend for the price of oilmay lead to its increase to $145 to $150 per barrel.Environmental and economic imperatives are forcing the globaleconomy to engage in a constant search for new alternativesto conventional petroleum-based motor fuels.Substituting petroleum products with alternative energysources can reduce the share of oil in the global fuel mix from32% in 2010 to 24% in 2050, while natural gas is expected toContinues on page 12www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 11ÝÊÑÏÎÐÒ

The Golden Age of Methane in Transport is InevitableContinued from page 11increase from 22% in 2010 to 27% in 2050 –thereby helping to achieve both climate-basedand economically-driven goals.What kind of alternative fuels – specificallyfuel alternatives – and technologies inthe transport sector, can we speak ofwith confidence? They are known: hybridschemes, biofuels, electricity, hydrogen, andgas fuel – LPG and methane. Of course,the list of fuel alternatives for transport isnot limited to vehicles. However, this articleconsiders only this type of use.CH 4– methane (compressed and liquefied),regardless of source of origin: natural gas,shale gas, biomethane, coalbed methane,e-gas (synthetic methane), etc.;Biomethane (compressed and liquefied),regardless of source of origin;Petroleum products – diesel fuel, gasoline,jet and marine fuelsLPG – liquefied petroleum gasElectricity – (batteries and contact wire)Hybrid – hybrid schemesH 2– hydrogen technologiesEach type of motor fuel has a completelydifferent level of market readiness, scopeof application, environmental cleanliness,pricing attractiveness, etc. Assessing selectedcommercial properties of each type of fuelenables their overall evaluation and ranking.What are these properties, what do theyimply, and how does natural gas compare?Applicability – the possibility of using thatfuel for vehicles of different categories andpurposes: natural gas is used in all types andclasses of vehicles.Resources – security of resources for thatfuel: natural gas reserves will meet theworld's needs for another 250 years.Cleanliness – compliance with increasinglystringent environmental requirements:CH4methaneBiomethanePetroleumproductsLPG Electricity Hybrid H 2Applicability 5 5 5 3 1 2 1Resources 5 5 2 2 3 3 5Cleanliness 5 4 3 4 3 3 5Price 5 2 2 3 2 2 1Readiness 5 3 5 5 5 3 1Infrastructure 3 4 5 4 3 5 1Sustainability 4 3 1 1 3 1 5Independence 4 2 4 4 4 2 1Integrated rating 1.0 0.97 0.94 0.92 0.92 0.81 0.751 2 34 5WorseBetter12

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELnatural gas is the most environmentally friendly of all motorfuels available for commercial sale; methane enables a 50%reduction in CO 2emissions and 80% in NOx.Price – the average retail price of compressed natural gas isequal to half the price of petroleum products; natural gas is thecheapest of all motor fuels available for commercial sale.Readiness – the degree and stage of productization; naturalgas is available for commercial sale in more than 80 countriesaround the world.Infrastructure – the level of development of filling stations:methane is available at nearly 21,000 filling stations.Sustainability – the possibility of obtaining this type of fuelfrom other sources or synthetically at affordable prices:methane can be regarded as a renewable energy source sinceit can be produced from biomass or synthetically.Independence – the ability to introduce the fuel into themarket without government support; such support for naturalgas is desirable but not a must, as is the case with other –political – alternatives.The following table reflects a peer assessment of thecommercial attractiveness of each alternative fuel for use in theglobal transportation segment.The conclusion can be presented as follows: At present andin the future, the most optimal kind of motor fuel, from allpoints of view, is methane, the main source of which is andwill remain natural gas.Methane has the unique feature of combining allenvironmental, technical and commercial advantagessimultaneously. No other fuel offers such a combination.It can be argued that the golden age of methane intransport isinevitable. In 2011, world consumption of natural gas by vehicleswas estimated at 35 to 40 billion cubic meters. According tovarious forecasts, by 2035 the global fleet of gas-cylinder carswill range from 30 to 190 million units – from 2% to 10% ofthe world’s total vehicle fleet – with natural gas consumptionbetween 60 and 380 billion cubic meters per year.This in turn allows for adding another criterion to thosepreviously mentioned: investment attractiveness. In thecoming years, it is likely that the market for methane intransport may grow 10 times (!). This is a very significantvolume, considering this fuel’s consumption by water and railtransport. Simple arithmetic shows that, at May 2012 prices,the world gas engine market may reach up to 400 billioneuros on the gas component alone.The time is ripe for investment in the market for gas motor fuels.Gazprom and Summa Group to Develop Global LNG Marketfor Marine Fleet Bunker FuelIn September 2012, Deputy Head of the GazpromManagement Committee Alexander Medvedev and Presidentof Summa Group Alexander Vinokurov signed a Memorandumof Understanding stipulating cooperation in the use of liquefiednatural gas (LNG) as a bunker fuel for marine fleets, includingthose belonging to and operated by Summa Group.Initially, Gazprom and Summa Group will study opportunitiesfor cooperation in the region of the North and Baltic seas.Aside from supplying LNG for the needs of Summa Group, theparties will also consider the possibility of developing bunkeringinfrastructure in the basin of the Baltic and North seas,including LNG storage facilities.Further, the parties will consider the possibility of expandingcooperation into the Black Sea, Mediterranean and Pacific,regions where Summa Group also operates its fleet andpossesses well-developed harbor infrastructure.“The strict mandatory emission limitations that will be imposedafter 2015 for the vessels operating in the Baltic and NorthSeas are a crucial factor in switching to alternative fuel. Onlynatural gas fully complies with the emission limits for marinemotors without need for expensive filters and has priceadvantages over low-sulfur petrochemicals. The vessel, motorand storing technologies for the LNG-fueled fleet are availableand proven. Cooperation with the Summa Group has a strongpotential,” Alexander Medvedev noted.“Due to the joint efforts of Summa Group as an infrastructureoperator and Gazprom as the world’s biggest natural gasproducer, a real breakthrough will be achieved. I am sure itwill provide a long-term positive impact on the environmentaleffects of marine transport, not only in our country but alsoglobally, and will provide a new standard for the wholeindustry,” Alexander Vinokurov said.Summa Group is a Russian-based diversified private holdingjoining assets in port logistics, engineering, construction,telecommunications and the oil and gas sectors. SummaGroup is active in almost 40 regions of Russia and abroad.www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 13ÝÊÑÏÎÐÒ

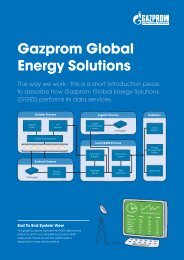

The Face of Gazprom in AsiaBy Serguei Edrenkine, General Director, Gazprom Marketing & Trading SingaporeIn late 2009, when Gazprom Marketing &Trading decided to pursue a commercialopportunity in Asia by dispatching, almostovernight, one member of its staff toSingapore, no one anticipated that the boldmove would result in a successful office inthe city-state being established during ashort span of three years.From one staff member, to three, and now64 employees of 16 nationalities, GazpromMarketing & Trading Singapore (GM&TS)has not only grown its team, but has alsodeveloped a robust business and raised theprofile and brand of its parent company inthe short time it has had a presence in theregion. GM&TS was originally envisioned asan office to market the liquefied natural gas(LNG) cargoes from Sakhalin in Asia Pacific.But it has expanded its initial operations asa platform for LNG trading and shipping tooriginating carbon reduction projects andtrading in liquefied petroleum gas (LPG) andforeign exchange.GM&TS closed its first full year of operationswith a portfolio of 19 Master TradingAgreements, providing access to a largeselection of Asian sellers and buyers. Itexecuted the first direct sale of Russian gasto an Indian energy player, and completedthe sale of a number of cargoes into Taiwan,again marking the first Russian gas sales intothe country – contributing to the final count of27 cargoes delivered by the team that year.Being in the heart of the action, of course,has helped. Demand for LNG in Asia Pacifichas increased steadily during recent yearsand is forecasted to reach 400 million tonnesin the next 10 years. Having a physical officein the region, close to the sources of demand,means GM&TS can respond and optimizecargoes better and faster.Today, GM&TS has 30 Matched Sale-Purchase Agreement (MSPAs) in place andhas firmly established Gazprom’s marketingand trading presence in the premium LNGmarkets of the region. Some of its otherachievements include building a diversifiedportfolio of carbon projects with 140 CleanDevelopment Mechanism (CDM) projectsworldwide, 80 percent of which are inAsia and more than half originated out ofSingapore, as well as Shipping & Logisticsbeing recognized as a center of operationalexcellence with ISO 9001:2008 accreditation.More notable, however, is the fact thatGM&TS has grown the capability of its teamnot just in the front office but across keysupport functions such as finance, risk andlegal. This enables it to be a valuable partof a network – together with the Londonheadquarters and other GM&T offices aroundthe world – that offers global presence,24/7 trading, and a comprehensive suite ofproducts, from gas and electricity marketing,trading and supply to energy managementsolutions and carbon deals.Much of GM&TS’ success has to beattributed to collaboration. It is fortunateto have key members from Gazprom’smanagement on its board of directors– Pavel Oderov, Head of InternationalBusiness Department, OAO Gazprom; ElenaBurmistrova, Deputy Director General for Oil,Petroleum and Petrochemicals, GazpromExport; and Andrey Biryulin, ManagingDirector, Gazprom Germania – who providedirection and leadership and also facilitateconnections within its Moscow headquartersand the wider Gazprom group.Since its early days, GM&TS has fostered arelationship with Gazprom’s representativeoffice in Beijing, which was instrumentalin providing GM&TS introductions tocounterparties in China.14

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELIn addition, its efforts to form mutually beneficial partnershipswithin the group was bolstered early this year with theestablishment of LNG Working Groups to investigateand further opportunities for collaboration with GazpromExploration & Production International.Singapore has proved to be a very advantageous location forGM&T’s first office in the region. With its dynamic businessenvironment, highly supportive government, and a burgeoningLNG trading market – the country is constructing its first LNGterminal due to be completed in 2013 and its energy andbusiness agencies are actively developing the country intoan energy trading hub – GM&TS has found that its arrival asone of the nation’s earliest LNG traders has helped it carvea position as a leading LNG player in the region as well asallowed it to nurture excellent relationships with the governmentand energy agencies.In <strong>October</strong> 2011, GM&TS moved from the serviced offices ithad been operating out of since 2009 into permanent premisesin a brand-new office building – another milestone in theoffice’s young history. With the availability of physical space forthe company’s further expansion, GM&TS is greatly focused onthe future and its continued growth.Diversification will be very much the theme for GM&TS’ nextgoal. In addition to building security of LNG supply through avariety of sources, the management team is also concentratingits efforts on diversifying the scope of its business. While LNGwill always be a major part of its portfolio, GM&TS is alsoconcentrating on developing its other businesses such asClean Energy and moving into other areas of growth for thelong term sustainability of the business.At the heart of GM&TS’ approach is the recognition thatits remit is to create value for the Gazprom group throughinnovative products and solutions for the energy markets, andto be the face of Gazprom in Asia Pacific.This representation of Gazprom is not limited to the commercialrealm only. In May this year, with support from Gazprom,GM&TS organized a concert featuring renowned Russianviolist Yuri Bashmet and world famous chamber orchestra theMoscow Soloists in Singapore. The concert was part of thechamber orchestra’s 20th anniversary world tour, which wassponsored by Gazprom Export.It was well attended by partners from the region’s majorenergy companies, representatives from governmentagencies and members of the Russian diplomatic community,marking a successful brand building and networking event.In line with Gazprom Export’s commitment to supportingsocial and charitable activities for cultural development,education and sport, partial proceeds from tickets sales weredonated to a local charity that offers theatre experiences tounderprivileged children.The event – along with similar concerts in Shanghai, Beijingand Tokyo – generated considerable positive coverage in thelocal and regional media and emphasized Gazprom’s standingas a leading global energy company with a solid commitmentto corporate social responsibility.www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 15ÝÊÑÏÎÐÒ

Gazprom Marketing and Trading Singaporeand Gail Sign 20-Year LNG Supply DealGazprom to supply GAIL 2.5 million tonnes of LNG per annum for 20 yearsUsersuiredo startindustrialom. Soonestting somen the UKergy’sy, nowrcent ofers. Nowping thetion rating.Gazprom Marketing and Trading Singapore(GM&TS), a 100% wholly-owned subsidiaryof Gazprom Marketing & Trading, has signeda legally binding 20-year liquefied naturalgas (LNG) sales and purchase agreement(SPA) with GAIL (India) Limited (GAIL),following the signing of an earlier BasicFramework Agreement (BFA) by the twocompanies on 18 May 2011.Under the terms of the agreement, GAILwill receive 2.5 million tonnes of LNG perannum of LNG (equivalent to approximately130 million MMBtu or 3.5 bcm or 122 bcf perannum) over a period of 20 years.LNG will come from Gazprom’s productionfacilities, optimised and supplementedby GM&T’s global trading portfolio andcapabilities. Under the contract, LNG willbe sustainably priced with an oil-indexedformula and delivered to Dahej, Dabhol andKochi terminals in India.This agreement is a key milestone forboth GAIL and Gazprom, reaffirmingboth their strong corporate partnership indeveloping India as one of the core marketsfor LNG business and the Indo-Russiantrade relationship.Vitaly Vasiliev, CEO of Gazprom Marketing& Trading, said: “We are delighted to havesigned this agreement with GAIL, during aperiod of rising demand for LNG in India.We are looking forward to working togetherwith GAIL to help meet India’s expandinggas demand whilst securing a long-termmarket for Russian gas.” He continued, “Werecognise GAIL’s strength as the major gasplayer within India, enabling flexible accessto a rapidly developing market and areconfident that this SPA will further strengthenour already well-established LNG tradingrelationship.”Commenting on the development, B. C.Tripathi, Chairman & Managing Director,GAIL (India) Limited said, “This long-termLNG supply agreement with Gazprom, whichholds the world’s largest gas reserves,is another milestone in Indian–RussianEnergy Cooperation. The deal with Gazpromreinforces GAIL’s commitment to facilitatethe development of the Indian market forwhich US$6 billion in investments arebeing made by GAIL in creating NaturalGas infrastructure. The deal also marksour efforts to create a well-diversified andsecured supply portfolio to meet the evergrowing energy requirements of the Indianeconomy and enable sustainable long-termgrowth for GAIL.”About GAIL (India) LimitedGAIL (India) Ltd., is India's principal NaturalGas Company with activities rangingfrom Gas Transmission and Marketing toProcessing (for fractionating LPG, Propane,SBP Solvent and Pentane); transmission ofLiquefied Petroleum Gas (LPG); productionand marketing of Petrochemicals likeHDPE and LLDPE and leasing bandwidthin Telecom sector. GAIL has extended itspresence in Power, Liquefied Natural Gas(LNG) re-gasification, City Gas Distributionand Exploration & Production areas throughequity and joint venture participations. GAILregistered a turnover of US$7.9 billion andprofit after tax of US$708 million for the year2011-12.GAIL owns and operates over 9,500 Kmof high pressure cross country naturalgas pipeline network and can handle 175mmscmd. The company is in the process ofsignificantly augmenting its pipeline networkto reach every part of India. Within the nexttwo to three years, GAIL will have a pan-India natural gas pipeline infrastructurespanning over 14,500 km and can handlevolumes over 300 mmscmd. To secureimport of LNG, GAIL is at an advance stageof commissioning 5 MMTPA LNG Terminal16

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELof RGPPL (a JV of GAIL) at Dabhol on the Western Coastof India. GAIL ’s Natural Gas Pipeline from Kochi is atan advanced stage of commissioning its phase-I whichconnects to Kochi LNG Terminal. Recently, GAIL has beenauthorised to lay 1550 km natural gas pipeline from Westernto Eastern Coast – Surat to Paradip Pipeline project.Besides, GAIL has also set up a wholly- owned subsidiarycompany GAIL Global (Singapore) Pte. Ltd. in Singapore forsourcing LNG, and petrochemicals.For further information please visit:www.gailonline.comGazprom Energy Tops Customer Satisfaction Rankings forLarge Gas UsersFor the first time, Gazprom Energy reached the top of theDatamonitor’s Energy Buyer Customer Satisfaction Survey,which is for large gas users.Gazprom Energy, one of the “granddaughters” of GazpromExport and a 100% subsidiary of Gazprom Marketing & Trading,keeps “dislodging” competitors, as Datamonitor phrased it.Datamonitor noted that “independent suppliers in the energymarket are performing extremely well in terms of growing marketshare and maintaining high levels of customer satisfaction.”In 2006, Gazprom Energy acquired Pennine Natural GasLimited to start direct sales to commercial and industrialcustomers in the United Kingdom. Soon after it becamethe second largest supplier in terms of volume, listing someof the largest gas consumers in the UK as its customers.Gazprom Energy’s market share has grown rapidly, nowaccounting for more than 14 percent of gas volume sold toB2B customers. Now it has culminated its rise by toppingthe Datamonitor customer satisfaction rating.Russia, Energy Dialogue with Europe and WTO:A Chance Not to Be MissedBy Dr. Rainer Seele, Chairman of the Board of Directors of WintershallThe Russian parliament recently ratified an agreement onRussia’s accession to the World Trade Organization (WTO) andPresident Vladimir Putin has signed it into law. All the formalitieshave now been completed, and on 22 August Russia became afull-fledged member of the WTO. This event may form the basisfor growth in the Russian economy during the coming years.But first, Russia and the EU should use this opportunity to forgea closer relationship and achieve a higher level of trust in theirchallenging energy dialogue.Russia and Europe already have a long history of cooperationand have reaped economic benefits from this relationship. TheEuropean Union is Russia's main trading partner, and Europeancountries are investing significantly in the Russian economy. Formore than 20 years, I have been observing the development ofrelations between Russian and German businesses, and tradebetween our countries continues to grow: in 2011, it reacheda new peak, as German exports to Russia increased by 40%.Today, more than 6,000 German companies are active in Russia,and Germany is the largest foreign investor in Russia.Businesses in Russia and the EU are well aware of each other'sstrengths and weaknesses. This is reflected in the successfulContinues on page 18www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 17ÝÊÑÏÎÐÒ

Russia, Energy Dialogue with Europe and WTO:A Chance Not to Be MissedContinued from page 17history of our joint projects in the fields ofenergy, engineering, construction, and otherindustries. But there are difficulties as well: arecent example can be cited from the naturalgas industry: it has been announced thatthrough 2015, the tax on mineral extractionin Russia will increase several fold, whichautomatically makes all planned gas projectsless attractive to foreign investors. Therein liesthe main problem that now faces business inRussia: the ever-changing "rules of the game."Each year it becomes increasingly difficult toplan long-term investments in Russia.At the same time, the conditions forinvestment in Russia have never been morefavorable. Russia is one of the top threecountries in the world in terms of gold andcurrency reserves, and it is not burdenedby significant debt, with external borrowingsequivalent to just 10% of GDP. In the currentclimate, this is an extremely favorable fiscalsituation. Russia also boasts significantintellectual resources: over 70% of youngRussians have a college degree, and theynot only understand the need for change buthave the motivation to become the drivingforce behind it.How Russia utilizes these opportunitiesdepends in part on its new, but alreadyvery familiar government, from which realpolitical and economic changes are expected.Accession to the WTO can play a veryuseful role here. By becoming a memberof the WTO, Russia is undertaking a publiccommitment to carry through changesin the socio-political and economic life ofthe country. A reduction in customs dutieswould help counteract customs bureaucracy.Russia's integration into the internationalsystem of regulated trade will reducethe political risks for its foreign partners.And, generally speaking, Russia's WTOmembership will improve the business climateand expand the planning horizon, which canonly serve to attract more investment.Russia’s accession to the WTO will createan organization whose member countriesproduce around 85% of the world’s oil andgas. No other global industry club can boastthis kind of resource base. A significantreinforcement of the energy componentwithin the WTO should help create a betterenvironment for the energy dialogue betweenRussia and the European Union. On the onehand, thanks to unique infrastructure projectssuch as Nord Stream and South Stream andthe joint exploitation of huge fields like Yuzhno-Russkoe, Russia has a stable reputation asa reliable energy supplier. On the other hand,Europe is apprehensive about new energytransit crises and is demanding even moresupply guarantees from Russia. Russia, forits part, is unhappy with restrictive directivessuch as the Third Energy Package. Thesehave an impact on long-term contracts withenergy suppliers and cast doubt on theeconomics of those very same infrastructureprojects. However, these are the only solutionto the transit problems and the sole means ofensuring energy security. Therefore, the WTOcould become the formal structure withinwhich Europe and Russia can synchronizetheir efforts to build an energy dialogue.Priority should be given to joint action in threemain areas: creating a favorable investmentclimate, developing infrastructure andimplementing joint modernization processes.However, no partnership can be a one-waystreet. While counting on change in thebusiness climate in Russia, the EU must beready to reciprocate with measures to bringdown the barriers on its side. As foreigninvestors, we rightly demand guaranteesfor our investments in Russia, but tend toforget that Russian companies are entitledto demand the same for their Europeaninvestments. Europe must ensure equalconditions for all foreign investment partners.And what better way to begin than byreforming the visa regime, which would send aclear signal of openness and trust.Hence, Russia's accession to the WTO isa chance for Europe to start negotiating anew agreement on cooperation between18

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELour countries, which will form the basis of discussion for newarrangements in respect to visas, free trade and partnerships,not only in the field of energy supplies, but also in the exchangeof technology, expertise and project management experience.Growing business cooperation must, in turn, be accompaniedby a strengthening of ties between our societies. Ultimately,Russia and Europe are two parts of one whole: Politically,economically, and culturally.Natural Gas as the Fuel of Choice From the European GasForum PerspectiveBy Philippe Miquel, Chief of Staff of GDF SUEZ, Global Gas & LNGThe European Gas Forum (EGaF) is an informal initiativeof eight major energy companies including Centrica,E.On-Ruhrgas, Eni, Gazprom Export, GDF SUEZ, QatarPetroleum, Shell and Statoil. The organization is designedto exchange views on the promotion of natural gas, with afocus on Europe. Participants do not reflect on any of theirown points of view in particular, as the forum is intendedto be a discussion about various global viewpoints, on thebasis of economic analysis.The forum is composed of major industry players from manycountries, representing each part of the value chain, whilstkeeping the group small enough to be efficient and effective.Since there was no pre-existing place or organization tofoster the exchange of complementary perspectives, theEGaF focuses on specific topics of common interest, suchas the promotion of natural gas, large gas producers (egGazprom, Qatar Petroleum and Statoil) and Europeanenergy suppliers,. Rather than establishing a permanentsecretariat, with the associated bureaucracy and costs,our intention was to take pragmatic and focused actions.Company senior executives were to be directly involvedto address the issues around natural gas targeted at thehighest level of stakeholders.The EGaF was initiated during the summer of 2010 tocontribute to the on-going debate on the EU “Roadmap fora low carbon economy” going forward to the year 2050.Despite its inherent advantages, at the time natural gas wasassessed as being unreasonably ignored in the debate,particularly with respect to the evolution of the energy mixuntil 2050, led by the European Commission.In <strong>October</strong> 2009, the European Council set a clear target interms of greenhouse gas emission reductions. The objectivewas to decarbonize the European economy by 80% to95% by 2050 in comparison to 1990, aiming to limit globalwarming to 2°C. Although there was a political agreementon the objectives and on the need to control global warming,there was no consensus on how to get to this point. Yet, thechoices that Europe was about to make with respect to theenergy mix in the light of 2050 objectives, were to have asignificant impact for years to come and also for the overallcompetitiveness of the European economy as a whole.There was an abundance of alternatives presented at thetime. While meeting the CO 2objectives, these alternativesvaried in vastly different ways. Some of them promotedthe sole use of renewable energy, others insisted on thebenefits and reliance of nuclear energy, and a majority weregeared a higher electrification of the energy mix.Very few of these analyses addressed the issue of costsfor the overall economy and for society as a whole.Furthermore, natural gas was seldom considered as apossible fuel of choice. The benefits of natural gas werelargely ignored by policy makers and EU-leaders. Thefact that natural gas is not only a sound environmentalalternative but also cost-effective was clearly overlooked.For the European Gas Forum, it was important to contributeto the discussions and ensure that the role of natural gaswas correctly reflected or that its potential contributionto meeting the stated EU objectives was, at the least,adequately assessed. It was also important to demonstratethe potential role of natural gas in the construction of aContinues on page 20www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 19ÝÊÑÏÎÐÒ

Natural Gas as the Fuel of Choice From the EuropeanGas Forum PerspectiveContinued from page 19balanced European energy mix, alongsideother energy sources, and to highlight theissues of cost and moral hazard in ongoingdebates.As industrialized economies, we alsoneeded to position gas more effectively asan intrinsic part of a longerterm alternative.As a first step, EGaF fielded a study titled“Making the Green Journey Work” thatcovers all sectors of the European economy.The main focus is on power generatorsbut other sectors are also included, albeitcovered in less detail. The study providesa technical analysis of the contributionthat natural gas can make to meeting CO 2emission reductions as targeted by the EU. Itbuilds on scenarios outlined in the EuropeanClimate Foundation (ECF) Roadmap2050 and describes three potential waysto achieve the 80% emissions abatementtargets by 2050.The first conclusion of the study was thatEurope should refrain from mandatingspecific technologies as part of settingCO 2emission targets for the period until2050. The benefits of this strategy wereoutlined to lead to significant cost savings,maintaining European competitiveness,and hence put no restraint on economicgrowth. Two reasons fermented theaforementioned conclusion. First, there isconsiderable predictive uncertainty whichnew technologies will be readily available30-40 years from now, and at what cost.Second, flexibility is needed to deliver alow carbon energy mix which will be costefficient during the period in question.The other conclusion of the study wasthat Europe should rely on existing maturetechnologies at first and gradually move intonew technologies (such as carbon capture& storage and others) at a later stage, oncethe feasibility and their performances werebetter established. This would allow newtechnologies to come to maturity and havea lower impact on costs.Compared to the reference scenario (i.e.,60% RES scenario of the ECF Roadmap2050), the alternatives proposed by EGaFachieve significant cost savings to meetCO 2reduction targets, by using naturalgas in a more balanced energy mix, thatrelies less on coal and less on higher costrenewable technologies. For the period2010-2030, total costs savings in the powersector could be in the vicinity of €250-500 bn. This is about half the investmentneeded in this sector by 2030. Additionalsavings of a similar magnitude are alsopossible for the period between 2030and 2050, although costs are much moreuncertain given the uncertainties in terms ofinvestment costs in that time frame.Natural gas enjoys the lowest cost ofcapital compared to other power generationschemes that are capable of meetingemissions goals. Combined-cycle gas plantsemit half as much CO 2per kilowatt-hour asmodern supercritical coal plants and theyare two-to-three times less capital intensive.While operating costs are low, renewablescan be very expensive both in start-upcapital costs and transmission grid impactcosts. Nevertheless, we do see a significantrole for lower cost renewables as part of acost-efficient future energy generation mix.The study demonstrates that EU emissiongoals could be met by utilizing slightly less ofthe more expensive renewables, comparedto the higher renewable utilization scenario,particularly with respect to the next 20 years.If adopted natural gas-fired generationwill normally be the lowest cost source ofback-up thermal generation required tocomplement intermittent renewables (suchas wind power) and help maintain energysupply security.Hence, adopting alternatives as outlinedby the study between 2010-2030 would20

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELprovide Europe with more time to select and fine-tune itscarbon abatement plans by 2050. Policy support should bereasonably even-handed across a range of low carbon energytechnologies (which include but are not limited to renewables)for providing additional “start-up” support for emergingtechnologies which promise a competitive cost of CO 2abatement in due course.EGaF is exploring the residential and the transportation sectorsin more detail with two additional studies. The residentialstudy was made public on 19 July, while publication of thetransportation study will soon follow. Both studies highlight thepotential cost savings to meet the 2050 CO 2emissions targetsthrough a higher reliance on natural gas technologies.In the residential sector adopting a more diverse technologymix that include gas fuelled heat pumps, gas-fired DistrictHeating and Combined Heat and Power (CHP) could lead tocost savings in the order of €100-120bn compared to a higherelectrification pathway by 2030. In the transportation sector, anincreased reliance on natural gas powered vehicles (particularlyan increased use of LNG as a bunkering and heavy truckingfuel) could also lead to significant savings (in the order of€60-70bn, to 2030) while remaining on track to meet the EUTransport White Paper’s 2050 GHG reduction targets.These two complementary approaches show how a lowercost,lower-risk, and low-carbon energy mix for Europe can beachieved based on cost-effective and technology neutral CO 2mitigation solutions, combining necessary actions on climatechange with secure and affordable access to energy.EGaF has met on several occasions with EU CommissionerOettinger and representatives of DG Energy to presentits results. It also met with other stakeholders of other gasorganizations such as Eurogas, IGU, Gas Naturally, or NGO’ssuch as ECF, Greenpeace, WWF. It has received very positivefeedbacks and gained some significant momentum in thedebate over the future of the energy mix in Europe.In terms of perspectives for natural gas in Europe, it is fair tosay that things have changed significantly over the last twoyears. The impact of Fukushima and the economic downturnhave shed a new light on the energy future of Europe. Leavingoptions open, relying on a balanced energy mix and ensuringthat we avoid unnecessary costs to the economy are now beingaddressed more prominently.Natural gas now has a much brighter future perspective,although a lot remains to be done, particularly with respectto ensuring that natural gas remains a competitive energysource. In the light of abundant due to the unconventionalgas revolution, increased diversity of supply and efficienttechnological solutions, we are confident in the tremendousopportunities of growth that natural gas offers in the short andlong term.At EGaF, we like to think that part of this effort is due to theextensive work done by our members. Yet, challenges remainand EGaF intends to continue to be part of the debate.To learn more, please visit http://europeangasforum.eu/Energy and LeadershipBy Eric Dam, president of the Energy Delta InstituteEnergy plays a crucial role in supporting our modern wayof life. In spite of significant progress in the efficiency of itsuse, energy consumption will continue to rise as incomelevels grow and increased access to energy is guaranteedto an ever growing population. In order to meet growingglobal energy demand, the energy sector has to work hardto overcome numerous challenges. Exploring the unknownarea’s for new gas, energy transition, CO 2reduction,market liberalization, and the need for new and differentinfrastructure services are but a few of the challenges thatlay ahead. It will be up to future executives and leaders ofthe energy industry to meet and resolve these issues. Thiswill require skills, knowledge and expertise in an ever morecomplex industry.To identify what skills and competences are needed tobecome a successful executive in the energy industry,the Energy Delta Institute (EDI) conducted a market surveyContinues on page 22www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 21ÝÊÑÏÎÐÒ

Energy and LeadershipContinued from page 21amongst a number of industry leaders.40CEO’s and top managers from the industry,a.o. from BP, Chevron, Dong, EON, Eni,Essent, GasTerra, Gasunie, Gazprom,Qatar Gas, Shell, South Stream and Total,participated in this survey and shared theiropinion. In this article, besides highlightingsurvey results, I will also shed some light onmy own vision on strong leadership.Leadership: A definitionIt is evident that we need strong leadershipin order to overcome the challenges we arefacing in the industry. But how do we definecompetent leadership? If we check thedictionary on leadership, it tells us that one ofthe meanings is ‘the capacity or ability to leador give direction.’Before I became president of the EnergyDelta Institute, I was a member of theexecutive board of N.V. Nederlandse Gasunie,where I was also responsible for constructionand maintenance. Being responsible for ofone of the largest departments of Gasunie,I was ‘giving direction’ to a team of severalhundreds of employees.Golden rules in projectmanagement and leadershipFor all department activities both in the pastand in the present, I always apply four ‘goldenrules’. The first one is safety. In our businesssafety is priority number one. The second ruleis budget equals budget. This means alwayssticking to the defined budget. Sticking to thebudget instils confidence by external parties.Rule number three is scope control. It is ofgreat importance to determine the scope,based on what you know today and expectto be true in the future. If and when situationschange, you have to assess the effect ofthese changes on all aspects of the project,like time and budget. Delivering on time is thefourth golden rule I apply as a manager. In mywork I also apply another, not so formal rule,which I think is very important for a great teamatmosphere, which is: work hard and have fun.Strong leadershipIn my opinion, giving direction to a large teamof employees doesn’t automatically mean youare a skilled leader. You can’t judge yourselfwhether you are a good leader or not. Thisis something only others can say about you.Being a good leader means that you are ableto let others excel in everything they do, andthat others respect you for doing so.Some people believe that a good leadershould have the full package of sectorknowledge – both of the entire energy valuechain and in-dept knowledge – and possessexcellent skills, competences and expertise.I disagree. In my opinion, good leadershipmeans you are able to build a good teamaround you. With a fine sense of diversity,you are able to establish a team in which allknowledge and competences needed to getthe job done are covered. When you are ableto surround yourself with such a team, andknow how to inspire them in order to let themexcel, you have proven strong leadership.Of course you should have a soundfundamental knowledge of technology andsector developments, and also develop andexperiment a broad view on different businessprocesses during your career. But establishinga winning team also means being able toidentify personal skills and interests, bothinternally and externally. It means masteringthe art of stakeholder management.‘A great person attracts great people andknows how to hold them together’–Johann Wolfgang Von GoetheDuring the 25th World Gas Conference inKuala Lumpur, Malaysia, the first copy of our‘leadership’ report, written by energy analystMarius Popescu, was handed over to Dr.Datuk Abdul Rahim Hashim, President of theInternational Gas Union, on 4 June, 2012. Theoutcome of the report shall guide the furtherdevelopment of EDI’s educational portfolio.22

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELKey findings reportAccording to several interviewees, a successful executive inthe energy industry will require a solid understanding of theenergy industry as a whole, as well as the function it servesin society. A clear overview of the energy value chain andhow different segments interact with one another is vital forthe leaders of the industry. Besides understanding the energybusiness, being an executive requires a comprehensiveknowledge of the technical aspects of the industry and alsosolid commercial skills. Thus, executives must not onlyunderstand the technical processes behind their productsbut also the commercial mechanisms involved in deliveringtheir products to the market. Ultimately, most executives leadfor-profit organizations and must concentrate on ensuringdesirable financial results. Next to these ‘hard’ skills, anenergy executive must demonstrate good vision andleadership in order to drive energy companies to success.In order to succeed in today’s energy industry, executivesrequire an international orientation. The industry is a globaland multicultural industry, which means that leaders must becomfortable in multicultural environments, accept diversityand leverage on variety.IGU President, Dr Datuk Abdul Rahim Hashim with the first copy of EDI’sreport flanked by Eric Dam (left) and Marius Popescu (right).The development of skills and competenciesIn their own professional development, most executivesregard practical experience as the most important factor.Rotating several jobs within different countries, potentiallydifferent companies and even among various stakeholdersencourages the development of an open mind and a muchneeded overall perspective.Formal education such as professional courses, together withmentoring, mainly had a role of complementing the experiencegained on the job by the interviewees with relevant knowledgeon how the energy industry’s mechanisms interact and how acompany integrates into the overall perspective.Future skills and competenciesThe skill that most interviewees expect to become of greaterimportance in the future is stakeholder management. As theindustry becomes more central in public debate, society’sexpectations towards energy companies regarding their social,health & safety and environmental responsibilities will increasesignificantly and future executives will be required to possessthe necessary skills to manage tighter relationships with allstakeholders. As the energy industry is moving more and moretowards open market conditions, commercial skills and anorientation that places customers at the center of organizationswill become crucial for future energy executives. Future leaderswill require increased flexibility to face the coming trials andrapidly capitalize on future opportunities.Generalists vs. specialistsProfessionals can develop themselves as specialists or as puregeneralists; both routes can lead to top executive positions.There is a ’preferred or natural’ path for professionals in theenergy industry to develop into top level executives namelyto first specialize for a couple of years and afterwards lookto branching out. Several interviewees say that most of theexecutives they know personally in the energy industry aregeneralists with a specialization.Visit our website to read more or contact us to get a copy ofthe report.About EDIEnergy Delta Institute (EDI) is an international energy businessschool, with a primary focus on natural gas. EDI was foundedin 2002 by Nederlandse Gasunie, GasTerra, Gazprom andthe University of Groningen, later joined by Shell, Essent,Dong Energy, EBN, Eneco, Taqa, A.Hak and Tebodin. EDI’smain objective is to contribute to the professional developmentof current and future energy managers. EDI develops andorganizes training programmes and network events with a focuson the economic, management, legal and geopolitical aspects ofthe energy business.www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 23ÝÊÑÏÎÐÒ

Will Shale Gas Disrupt the EuropeanGas Market?By Jacques Percebois, Director, The Center for Research in Energy Economics andLaw, The University of MontpellierIs shale gas a revolution?The supposed unconventional gas revolution –which includes shale, tight and coal-bed gas –has deeply altered the U.S. energy balancein the last five to seven years. This revolution,initiated by directional drilling and hydraulicfracturing, has helped the U.S. become theworld’s largest gas producer, by volume. Gasprices have collapsed on the Henry Hub,replacing coal and nuclear energy in the U.S.For the moment, this directly affects the U.S.only, but indirect impacts can be observed onEuropean and other gas markets. Rememberthat fossil energies still amount to more than80% of global energy consumption, and theirshare will likely remain high through 2030.Will American shale gas impactthe European gas market?The spot market only plays a minor role inAsia and Europe, as long-term contractsprovide Europe’s main source of gassupplies (more than 60% of Europe’s gasconsumption, including 98% for France).These contracts are generally appreciatedbecause they ensure the security of suppliesfor the purchaser. They include an oilindexation,which was created when oil wasthe main energy source. Oil indexation allowsfor balanced risks: the supplier runs the “pricerisk” as it does not know the price at whichits gas will be sold, and the purchaser runsthe “volume risk” since it may not exhaustthe volumes purchased. This indexation candiffer significantly from gas spot prices whenthey are too dissociated from oil prices, as iscurrently the case. Gas prices on the HenryHub fluctuate around $2-3 per MBtu against$10-12 in Europe and $16-18 in Asia. As aresult, the U.S. no longer needs to importLNG, contrary to expectations 5 years ago,and prices have decreased on the Europeanspot market.Can the U.S. become ashale gas exporter?Some wonder if the U.S. could becomea shale gas exporter in the near future,potentially exporting it to Europe andcompeting with Europe’s usual suppliers, suchas Norway, Russia and Algeria. This mightbe possible, but some obstacles should notbe underestimated. Although existing U.S.LNG terminals can easily be converted intoexport units, liquefaction is more expensivethan regasification. Because of the addedexpense, as well as the increasing cost ofusing LNG ships, the price of American LNGwould probably rise to $7-8 per MBtu. It isalso doubtful that the U.S. will be interested insupplying the rest of the world with cheap gas,especially as low hydrocarbons prices therehave fostered the revival and development ofmany energy consuming industries.Should shale gas be exploited inEurope, including in France?According to the International EnergyAgency, shale gas reserves may amount tomore than 25 Tcm in the U.S., 36 Tcm inChina and 22 Tcm in Argentina. Europemay contain 15 Tcm, including 5 Tcm inboth France and Poland. In France, this24

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELwould provide 100 years’ worth of gas consumption at thecurrent rate. Since France’s trade deficit was €70bn in 2011,and energy imports accounted for €61.4bn, the potential ofexploiting a national energy resource should be explored.How to look at shale gas in EuropeShale gas development is a sensitive political issue in Europe.Views are often built on perceptions of dependence on Russia,as well as visceral emotions, rather than on economics. Thereis substantial public support in Poland for shale gas exploration,while France has banned hydraulic fracturing because of itsalleged negative environmental effects, especially involvinggroundwater. Citizen opposition is strong, particularly near Parisand Southeastern France.However, emotions should not get in the way of soundjudgment. We should answer several questions rationally:1. Are hopes linked to the existence of shale gasreserves justified?2. At what cost can shale gas be exploited?3. How do current shale gas drilling techniques affectthe environment??Air pollution ?1 000s of metresShaleShale gas production techniquesand possible environmental hazardsShale gasWastewaterdischarges ?? ?Methane andfracturing fluidin water supply ?1Water table1 High pressure fracturing 2 Fine particles3fluid first cracks the shale(proppant) keepthe fractures openShale gas flows into thepipe and up the wellSource: Adapted Golden from Rules Aldhous for a Golden (2012). Age of Gas – World Energy Outlook Special Report onUnconventional Gas © OECD/IEA, 20122Gas3Energy Policy and the Hungarian EconomyBy Judit Barta, GKI Energy Research and Consulting Ltd. (Hungary)After political changes in the 1990s, the Hungarianeconomy underwent a significant structural change that wascharacterized by the gradual decline of energy-intensiveindustries. As a result, since the middle of the 1990s, totalprimary gross energy consumption has stagnated with theincrease of gross domestic product (GDP). GDP increasedonly from 2000-2005, when economic growth was strongest.Since the most recent economic and financial crisis began,a spectacular decline has occurred, partly due to the declinein GDP and private consumption, as well as the rise inenergy prices. During these years, the wane in domesticenergy production caused an increase in the net import offossil fuels – the majority of which was natural gas – whiletotal energy consumption nearly stagnated.There have been no important changes in the structure ofthe energy sources during the past decade. Natural gasmakes up roughly 38% of total energy sources, havingslightly shrank in recent years depending on the weatherconditions and gas prices.As a result of a wide range of qualitative changes inthe economy and energy sector, the energy intensityof the Hungarian economy – measured by the energyconsumption per GDP (PPP) – is 15% higher than theEU27 average. Measured by current exchange rates, theHungarian economy consumes 90% more than the EUaverage 1 showing the weakness of the Hungarian GDP.In the future, the most important task of the Hungarianenergy policy will be helping improve the competitivenessof the economy. The energy sector can accomplish this featthrough improved efficiency and reductions in energy costsper unit of output (GDP).Energy policyThe Hungarian Parliament adopted resolutions on thecountry's energy policy in 1993, 2008 and 2011 2 . Althoughthey summarized the desired directions and views of thegovernment, they were not used as a guideline. The energyrelateddecisions, laws and regulations were not approvedon the basis of the valid principles, but rather on the gripand constraints of the given economic and political situation.This is especially applicable to the current government, inwhich decisions are made by the “fast-legislation” with noconsultation with stakeholders. Sometimes the decisionsare modified the “very next day.”Continues on page 26www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 25ÝÊÑÏÎÐÒ

Energy Policy and the Hungarian EconomyContinued from page 25The “National Energy Strategy 2030”is based on three commonly acceptedrequirements: efficiency, sustainabilityand security of supply. Its aims arestraightforward:• Increase the effectiveness of theproduction and consumption chain.• Define the energy savingrequirements.• Place a greater emphasis on the use ofrenewable and local energy sources.In this regard, the Hungarian energypolicy goes hand in hand with the EU'scurrent and future ambitions; there is nosignificant difference between the twoenergy policies. They both try to reducedependence on imports and redefine thegovernment's role in energy.The main differences lie in interpretationand the degree to which they are takenseriously. The policies also vary in theirview of the proper role of the market orprivate capital in achieving the objectives.In the last two years, the practical energypolicy preferred both direct and indirectstate ownership instead of marketregulation. Preferences were given to oneoffand administrative state intervention,particularly in residential energyconsumption, where regulated prices aredistorted from actual costs.Companies in the energy sector areburdened with extra crisis taxes due to theeconomic and financial crisis, frequentlycausing large losses. Because of thenegative profit-levels and the unpredictableeconomic conditions in the energy sector,the future is uncertain. It is unknownwhether the necessary investments,including those fulfilling the common EUobjectives, will be implemented.The primary Hungarian energy policydilemma is this: according to the officialassessment, the share of natural gas asa part of overall consumption is too high.Reducing this rate can help the countrylimit import dependence. Indeed, theshare of natural gas in the primary energysources is unique among EU countries.Therefore, the diversification of sources,development of cross-border capacities,and participation in the European regionalgas market ensures Hungarian energysecurity. Depending on market conditions,these steps can stimulate price reductionsTotal primary energy supply and GDP(Volume indices, 1990=100)26

<strong>October</strong> 2012 | Vol. 5 | Issue 3BLUE FUELin imported natural gas. However, there is little emphasisthat it is the final consumer who must cover the costs ofthese investments.The new energy policy often uses the term “energyindependency”or more precisely “seeking ways out of theenergy dependency.” The diversification of natural gas importsupply sources and the development of cross-border transportroutes can help achieve this “independency.”We believe that over the next few years, global energy willbe characterized by large uncertainties, especially in prices.So it is important to develop an energy policy that can adaptto these changing conditions.The aforementioned plans and goals, taking into accountIEA's medium-term gas market forecasts 4 , are a raceagainst time. Over the next 2-3 years, abundant supplyand stagnating demand will characterize the European gasmarkets. Market (hub) prices will not increase, while theprice of oil, which moves long-term gas contract prices, willstagnate at best.The existing gap between the market and contract prices islikely to remain constant in the medium term. By the end ofthe decade, European gas demand is expected to graduallyincrease; however, the evolution of gas prices is also influencedby the development of unconventional gas and LNG.Gazprom has recently amended its contract prices forcertain countries, translating into lower prices for many. Weexpect the Russian-Hungarian long-term gas contract to berenewed in 2015. Hopefully, the above mentioned factorswill play a role in the development of the new prices.Sources:1Source: Eurostat2Source: www.parlament.hu3Source: http://www.parlament.hu/irom39/03839/03839.pdf4Source: Medium-Term Gas MarketReport 2012 IEA 2012Developing a Partnership Between Wind and GasBy Nora Méray, Senior researcher, Clingendael International Energy ProgrammeIn December 2011, the Clingendael International EnergyProgram published a study on the relationship betweenwind power and natural gas in the power generation mix.Since then, this topic has become even more relevantas the profitability of most gas-fired power plants inNorthwest Europe came under pressure due to severalfactors, including higher natural gas prices, cheap coal, lowpenalties for CO 2emissions and falling electricity prices.The EU aims to have CO 2emissions be at least 20% lowerthan they were in 1990 by 2020 and at least 80% lower by2050, which would require CO 2emissions from powergeneration to approach near zero by 2050.Several studies have been published on ways to achievea low-carbon European power generation mix. The role offossil power generation suggested in these studies variesconsiderably, with some even proposing entirely renewableenergy-based mixes. At the same time, the technical andeconomic difficulties of developing and operating a largelyrenewables-based power system are also being recognized.While all studies agree that wind energy will be an essentialpart of a low carbon power generation mix, the variabilityand limited capacity credit of wind power present challengesto power generation.Wind power requires a large amount of back-up powergeneration capacity. Part of this back-up capacity is meantto deal with the short term variability and forecast error ofwind energy. A different type of back-up capacity is neededto address long periods (several hours to days) of low windpower supply.Continues on page 28www.gazpromexport.com | newsletter@gazpromexport.com | +7 (499) 503-61-61 | comm@gazpromexport.com 27ÝÊÑÏÎÐÒ